ONTARIO

The Ring of Fire: An abundance of metals, few juniors

Northern Ontario Business calls the Ring of Fire “the garden of agony” for mining companies ever since the discovery of nickel and chromite in the James Bay region in 2007-08:

Over the decades, the vast and open-ended mineral potential of the remote Ring of Fire has received its share of passionate lip service from Ottawa and Queen’s Park.

But these two orders of government have also contributed to the lack of Far North development through apathy and inaction, arduous assessment processes, and diverging policies over how — or even if — resource extraction should take place in the James Bay lowlands.

The sclerotic pace of development though could be quickening, thanks to a change of federal government, new initiatives from the Doug Ford-led provincial government, and progress on roadbuilding that is being headed up by local First Nations.

A promise of new mining infrastructure has brought a fresh wave of optimism from resource companies advancing deposits in the region, who see a new “area play” developing. Curiously though, this area play, i.e, mineral exploration that takes on a regional perspective, involves mostly major and mid-tier mining firms rather than junior resource companies that normally create areas plays where one company makes a discovery then begins staking ground, followed by others with similar ambitions.

What is the Ring of Fire?

The Ring of Fire is one of the most promising opportunities for critical minerals development in the Canadian province of Ontario.

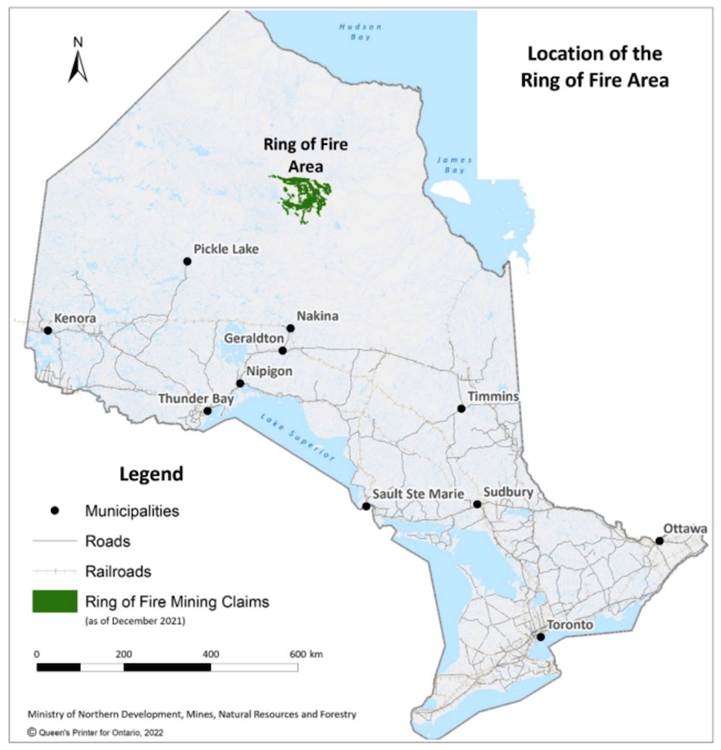

Wikipedia says “The Ring of Fire is a vast, mineral-rich region located in the remote James Bay Lowlands of Northern Ontario Canada. Spanning approximately 5,000 square kilometres (1,900 sq mi), the area is rich in chromite, nickel, copper, platinum group elements, gold, zinc and other valuable minerals. Discovered in the early 21st century, the Ring of Fire is considered one of the most significant mineral deposits in Canada, with the potential to greatly impact the nation’s economy and global mining industry.”

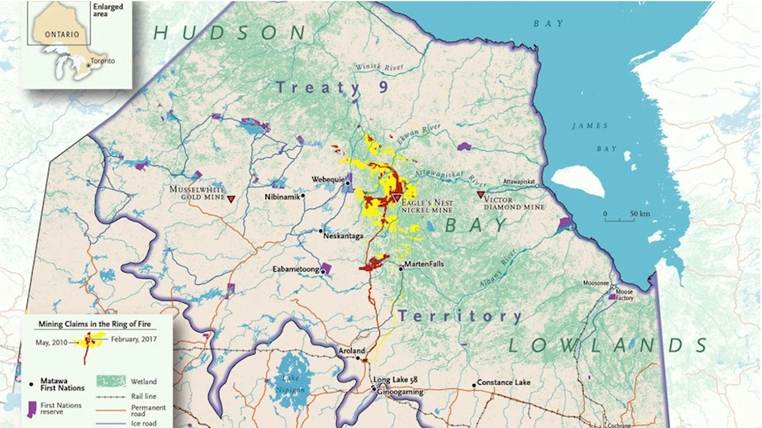

“The region is centred on McFaulds Lake near the Attawapiskat River in Kenora District, approximately 400 kilometres (250 miles) northeast of Thunder Bay, about 70 kilometers (43 miles) east of Webequie, and due north of Marten Falls and Ogoki Post, which is near/on the Albany River in the James Bay Lowlands of Ontario, Canada.”

The Sudbury Star notes the Ring of Fire spans an area of Ontario bigger than Quetico Provincial Park — itself nearly as big as Algonquin Park.

According to the Canadian Mining Journal, the number of mining claims in the Ring of Fire has increased by over 28% since September 2022. The 33,074 claims, as of September 2023, now cover approximately 626,000 hectares, nearly 10 times the size of Toronto.

Privately held Juno Corp currently holds the most claims at 17,000 covering about 333,000 hectares. More on Juno and other companies operating in the ROF below.

Minerals found in the Ring of Fire to date include:

- chromite

- copper

- zinc

- gold

- diamonds

- nickel

- platinum group elements

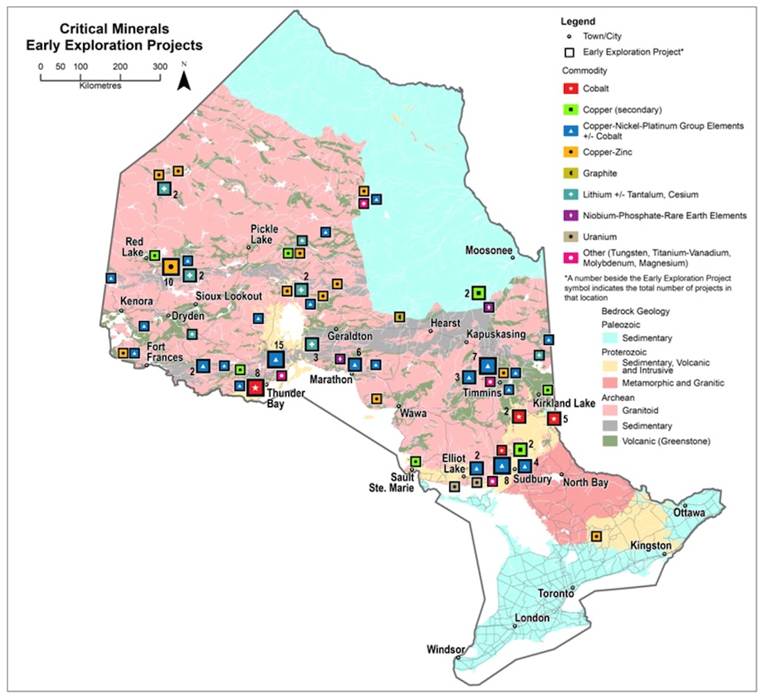

Ontario’s Critical Minerals Strategy is a five-year roadmap that will secure the province’s position as a reliable global supplier of responsibly sourced critical minerals.

According to the provincial government,

Ontario is a globally significant producer of critical minerals including nickel and cobalt and is home to several advanced lithium and graphite development projects. Other critical minerals that have either been produced in the province, or that occur in deposits currently being developed, include barite, chromite, fluorspar, magnesium, molybdenum, niobium, phosphate and tungsten. These minerals are key components of stainless steel and other important building materials that contribute to economic growth.

The global supply chain issues that have taken root over the last couple of years and recent geopolitical conflicts demonstrate that, now more than ever, steps must be taken to ensure that we have the minerals and advanced materials required to continue transitioning to a more connected, cleaner and technology-driven economy. Currently, a great deal of global mine production and important mineral processing and refining capacity for critical minerals, such as those minerals and materials required to produce electric vehicle batteries, is concentrated in only a handful of jurisdictions outside of North America. Where and how critical minerals are mined, processed and refined is important to manufacturers and consumers. Ontario’s exceptional mineral potential, supportive business climate and strong environmental and social governance fundamentals make the province a premier global destination for investment into critical minerals development.

The Ontario government goes on to say the Ring of Fire is “a transformative opportunity for unlocking multi-generational development of critical minerals,” and that “Ontario continues to make progress on the ‘Corridor to Prosperity’ leading to the Ring of Fire region by collaborating with First Nations partners on legacy infrastructure development in Northern Ontario.”

The Ring was discovered in 2007 by late Sudbury prospector Richard Nemis. As mining lore has it, Nemis came upon the first trove of chromite in the region and, being a fan of Johnny Cash, named the area after Cash’s hit song. The Sudbury Star points out that it was actually his financier friend Robert Cudney, however, who suggested the name while dining with Nemis and former mining exec John Harvey at a Toronto restaurant, according to the book ‘Ring of Fire: High-Stakes Mining in a Lowlands Wilderness’.

The name also alludes, however, to the shape and nature of the geological formation that contains the minerals — a crescent of ancient, volcanic rock.

Cash’s song “Ring of Fire,” was written by his 2nd wife June Carter in 1963. Carter wrote the song trying to express what it felt like falling in love with the man in black.

Mineral endowment

The Star quotes Stan Sudol, a Toronto-based analyst and frequent contributor to the newspaper, who called the Ring of Fire “the most important mining discovery in Canadian history,” which could “even exceed the legendary Sudbury Basin” in output someday.

The Ontario mines ministry says the area is rich in chromite, cobalt, nickel, copper and platinum group elements.

The underlying greenstone belt is similar to the world-famous Abitibi Greenstone Belt that runs from Timmins and Kirkland Lake in Ontario to Quebec’s Rouyn-Noranda and Val d’Or.

The Ring of Fire’s metal resources have a wide variety of applications, everything from EV batteries to military equipment, wind turbines and semiconductors. Chromite, found in larger quantities in the ROF than anywhere else in North America, is turned into ferrochrome, a key alloy in the manufacture of stainless steel. (Sudbury Star)

As for how much wealth is trapped in the rock, Ontario Premier Ford’s estimated economic potential of “upwards of a trillion” is likely hyperbole. The more scientific figure is in the tens of billions. The Star notes a decade ago, late geoscientist James Franklin estimated future output at $30-50 billion, while in February 2025, Ricochet Media said Ford’s trillion-dollar figure “is astronomically out of step with actual estimates that go as high as $77 billion, when adjusted for inflation.”

New roads

Extracting the Ring of Fire’s metals however is far from easy. Nothing can happen without a way to transport material in and out. That statement is easier to appreciate when one considers that this vast, isolated area still has no rail or road access — the nearest road apart from ice roads built during the winter is 300 km away.

The area which consists largely of muskeg is also home to multiple First Nations, that by law must be consulted before any mining or mining infrastructure can take place on their territories.

According to the Canadian Mining Journal:

Although chromite, copper, and nickel were discovered in 2007, the area’s remoteness, lack of infrastructure, opposition from some neighbouring First Nations, and bureaucratic red tape have been ongoing issues. The remote location can only be accessed by planes and winter roads (ice roads) only accessible for about two months of the year…

Three permanent roads are planned, connecting two of the communities and proposed mines. The Marten Falls community access road would create a 200-km north-south permanent route from Marten Falls First Nation to the provincial highway. The Webequie supply road is a proposed 107-km road which would provide year-round access from the community’s airport to the Ring of Fire. The proposed 117 km to 164 km northern road link would connect the mines to the two local roads.

According to the Marten Falls First Nation website, “Better access would allow reduced transportation costs for goods and services; meaning more affordable food, fuel, and other vital supplies and services; enhanced access to emergency, health and social services; increased opportunity for training and jobs for First Nation people and businesses during planning and construction; and increased opportunity for local sustainable economic development.”…

Road construction is estimated to take from five to 10 years and will be carried out by the Marten Falls and Webequie First Nations. The roads are estimated to cost approximately two billion dollars.

Northern Ontario Business reported this week that the Webequie released an environmental report on the Webequie supply road — seen as a key step toward opening the region to mining development:

The draft assessment and impact statement outlines possible effects of the proposed two-lane all-season road and other planned and existing projects, including the Eagle’s Nest and Big Daddy mines, as well as the Marten Falls community access road.

Global News said on June 3 that “A road to the mineral-rich Ring of Fire in northern Ontario is at the centre of the Ford government’s economic strategy, relying on mining contracts to create jobs and prosperity in the face of tariffs from the United States.”

“Development of a regional infrastructure corridor providing all-season road access, led by First Nation communities, is key to unlocking the Eagle’s Nest deposit,” Wyloo states on its website.

Plugged In

Last year 16 First Nations received power from the grid in Ontario and all the First Nations in the Ring of Fire are expected to have power by the end of this year.

That’s very positive in that these communities are going to be getting off diesel power, and of course these same communities want to see roads in, because they’re going to benefit from lower costs, better access to housing, energy, schools, health care, and at the same time there’s obviously an interest in developing the mines because of the economic benefits.

Cutting red tape

The Ring of Fire has been under the spotlight recently as both Ontario and the federal government look to counter US trade moves and build domestic mining and energy capacity.

The Ford government, particularly, has grown frustrated with the long timelines for opening mines and completing major projects. This is the justification it offers for tabling Bill 5, the ‘Protect Ontario by Unleashing Our Economy Act’.

Passed by Queen’s Park on June 4, Bill 5 aims to speed up mining projects and other developments in areas deemed to have economic importance. The legislation allows for creation of Special Economic Zones, where Cabinet would be allowed to exempt projects from certain environmental and labor laws.

Ford has said the Ring of Fire will be among the first places that get this designation — cutting the time period for project approvals in half.

His government has committed $1 billion to build out the Ring of Fire.

Prime Minister Mark Carney has pledged to work closely with the Ontario government to rapidly develop the area, in part through a ‘One Window’ approach that will enable companies “to navigate regulations faster and with fewer redundancies.”(Sudbury Star)

In March, Carney staked out his position in calling for an “action-oriented economy” vowing to end the duplicative environmental impact assessment processes for projects deemed nationally significant.

“One project, one review; it’s time to build,” Carney said. (Northern Ontario Business).

Canadian Mining Journal mentions several Ontario government initiatives for developing mineral resources in the province. They include the Junior Exploration Program that helps juniors finance early-exploration projects; the Critical Minerals Innovation Fund that supports Ontario companies in developing new mining technologies; and Bill 71, the Building More Mines Act:

Bill 71 introduced amendments to the Mining Act that include changes to closure plans, recovery of minerals frameworks, and decision making. The minister can issue an order to defer one or more elements of a closure plan to prevent the delay of mining projects. Minor site alterations do not require filing a Notice of Material Change…

According to the minister of mines, “The economic benefits are already starting to accrue. Within the communities, the province has announced a billion-dollar commitment to develop the broadband and facilities, as well as the transmission corridors. There have already been hundreds of millions of dollars put into the Indigenous communities in the area.”

Projects and companies

The two biggest players in the Ring of Fire are Australia-based Wyloo Metals (privately owned), whose parent company is iron ore giant Fortsescue Metals; and unlisted Juno Corp, based in Toronto. As mentioned, Juno is the largest claim holder in the region with claims covering 4,600 square kilometers. According to its website, “Juno has an extensive and diversified list of targets for elements including Ni-Cu-PGE, VMS polymetallic Cu-Zn-Au, Au, Ti-V, and Cr.” Other companies:

- KWG Resources owns the Black Horse chromite project and maintains an interest in other deposits. KWG owns 90% of some chromite resources but the main chromite is owned by Wyloo. The remaining 10% is owned by Bold Ventures.

- PTX Metals (TSXV: PTX) is a junior with a copper-nickel-cobalt-PGE asset. PTX is surrounded by Barrick on the West end of its 250 sq km W2 Project.

Under the Spotlight – Greg Ferron, CEO PTX Metals

- Canterra Minerals (TSXV: CTM) has a 100%-owned Ring of Fire property and has entered into a deal with Teck Resources for Teck’s potential acquisition of the property, subject to a 1.5% NSR royalty.

- Ecora Resources PLC (TSX: ECOR), a royalty and streaming company, has a 1% life-of-mine NSR royalty over a number of claims on the Black Thor, Black Label and Big Daddy chromite deposits owned by Wyloo Metals.

- MacDonald Mines Exploration, acquired by Canuc Mines in May, is developing the SPJ project which spans 19,710 hectares and is situated approximately 40 kilometers northeast of the prolific Sudbury Mining Camp.

- Bold Ventures’ (TSXV: BOL) Koper Lake project consists of four claims comprising approximately 1,024 hectares hosting chromite and massive sulfide occurrences that have yet to be delineated. In 2012 Bold Ventures signed an option agreement with Fancamp Exploration to earn in for up to 60% of the Koper Lake project. Bold’s Ring of Fire project was originally comprised of claims held by Bold Ventures and Rencore Resources. Pursuant to a merger transaction concluded in 2012, Rencore became a subsidiary of Bold Ventures. The Rencore claims were drill-tested in 2012.

- Copper Lake Resources’ (TSXV: CPL) exploration portfolio includes the Marshall Lake VMS copper, zinc and silver property west of Lake Nipigon, and the Ring of Fire Norton Lake nickel, copper, cobalt, palladium and platinum property. Both are in northwestern Ontario and serviced from Thunder Bay.

- Ongold Resources’ (TSXV: ONAU) Ring of Fire property is October Gold, which covers more than 10 km of the prospective Rideout Deformation Zone, with gold endowment estimated at >15m ounces.

Eagle’s Nest

Wyloo acquired Noront Resources in 2022 and now owns the Eagle’s Nest nickel-copper mine. It is touted as the largest high-grade nickel discovery in Canada since Voisey’s Bay.

Wyloo says it hopes to begin construction of its mine in 2027, with production commencing by 2030. (Sudbury Star)

Northern Ontario Business reports Eagle’s Nest contains more than 15.7 million tonnes of high-grade nickel with significant amounts of copper and platinum group metals.

Wyloo has already invested $630 million on the Noront deal plus $25-30 million spent annually on the project, the publication states.

Last May, Wyloo chose Sudbury as the battery mineral host city for a downstream battery mineral processing plant to be fed by Eagle’s Nest. Mine construction would start in 2027, coinciding with the start of road construction.

Wyloo expects to release an updated feasibility study on Eagle’s Nest in a few months, Northern Ontario Business reported in April.

According to its 2012 feasibility study, the mine will last about 11 years and cost approximately $609 million to build, states the Canadian Mining Journal.

Reserves are estimated at 11.1 million tonnes grading 1.68% nickel, 0.87% copper, 0.87 g/t platinum, 3.09 g/t palladium, and 0.18 g/t gold. The company received a $500,000 grant from the Critical Minerals Innovation Fund to test storing tailings as underground backfill in mine workings.

Conclusion

The above-mentioned companies and their shareholders stand to benefit greatly from the road and power infrastructure the Ontario government is promising for the Ring of Fire.

Wyloo has already spent $650 million on Eagle’s Nest which is a feasibility-stage mine. Agnico Eagle has made a substantial investment in the Ring through Juno Corp. Teck Resources and Barrick have both come into the camp.

The First Nations have started to build roads from their communities to the supply roads. As this continues, you’ll see a wave of capital coming in for exploration, and then you’ll see these majors want to make significant investments because they realize the potential of this camp is billions of dollars worth of mineralization.

The Ontario government wants to build a concentrator in the Ring of Fire and then have the refineries in Sudbury finish the product.

As far as investors go, the Ring of Fire is currently an area play driven by major and mid-tier mining companies. It’s hard to invest directly into the ROF because the exposure is mostly to large, diversified mining firms. As you can see from the above list of juniors, quantity is scarce and that limits the number of quality junior vehicles into the play for investors.

Musselwhite, Red Lake, Timmins and Sudbury have something in common, the camps never existed until the infrastructure came in. I believe if the federal and provincial government’s do what they promised, the whole area is going to become a very hot area for the majors to be a part of.

That makes, for me, a junior with a quality land position in the Ring of Fire a must own. Especially a junior with a shallow resource on a massive, under explored mineralized footprint.

Richard does not own shares of PTX Metals (TSXV:PTX). PTX is a paid advertiser on his site aheadoftheherd.com

This article is issued on behalf of PTX.

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.