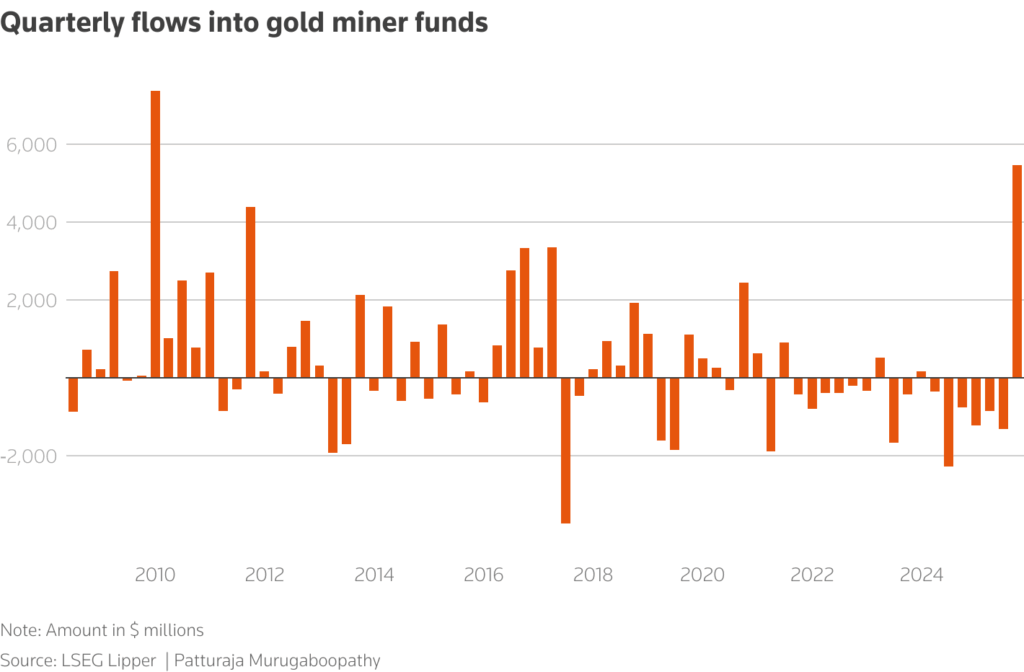

GRAPHIC: Funds investing in gold miners bask in record prices

Mutual funds that invest in gold mining firms are leading 2025 performance, overtaking even high-flying AI and tech funds, as investors bet record gold prices will drive strong margins, cashflows and shareholder returns.

According to LSEG Lipper data, gold mining funds have surged about 114% year-to-date, far outpacing technology funds, which are up 27%, and natural resources funds, which have gained around 23.7%.

The third quarter alone saw inflows of $5.4 billion, the largest quarterly move, into gold miner funds since December 2009, according to the data.

Gold hit a record high on Tuesday as a US government shutdown persisted and expectations for a Fed rate cut this month boosted demand.

While gold miners had lagged the bullion in recent years due to rising costs and operational setbacks, they have outperformed in 2025 as record prices boost profits and cash flows, strengthening balance sheets and offering leveraged exposure to the gold rally.

“Despite the rally, the sector remains widely under-owned, leaving room for new investors to drive further multiple expansion,” said Trevor Yates, senior investment analyst at Global X ETFs.

“We’re particularly constructive on smaller miners and explorers which offer greater leverage to the gold price and are set to be beneficiaries of continued industry consolidation.”

George Cheveley, portfolio manager at investment management firm Ninety One, said strong earnings are reinforcing cost discipline, with some miners accelerating projects funded by cash, a move that supports growth and avoids the need for borrowing.

Gold miner Newmont reported stronger-than-expected second quarter profits and announced a $3 billion share buyback program, while peer Barrick beat profit forecasts and raised its quarterly dividend by 50%.

Some companies are seizing the rally to boost capital through IPOs and share sales. China’s Zijin Gold International raised $3.2 billion in Hong Kong, while Merdeka Gold secured $280 million.

Despite doubling in 2025, the MSCI gold miners index still trades at a forward P/E of 14.3, below its ten-year average of 16.7, suggesting room for valuation expansion.

“At 30% free cash flow (FCF) margins, gold companies have never had it better,” said Adrian Hammond, a research analyst at SBG Securities.

There were opportunities for investors in companies disciplined about cash and keen to reward shareholders, he said.

(By Patturaja Murugaboopathy; Editing by Vidya Ranganathan and Maju Samuel)