Complacency and hubris caused economically advanced societies to believe they could easily handle the threat without understanding it fully

The failure of Western leaders to properly prepare has exposed their weaknesses, and could mark a turning point in global history

Tan Tarn How Published: 6 Apr, 2020 SCMP

A woman arrives in an ambulance at a hospital in New York on Sunday. Photo: AFP

The coronavirus story was not supposed to unfold like this. While China has clawed itself out of its self-made pit, most of Europe and the United States remain mired in an escalating crisis, with the prospect of relief not yet in sight.

This unexpected reversal of fortune had happened because the Western world should have learned from China and other countries in East and Southeast Asia – but dithered until it was too late.

How did the West end up being the epicentre of the global pandemic? The main reasons are inexperience, a disunited population and hubris.

Its inexperience is not its own fault. Five of the six places that have been praised for their management of the novel coronavirus – Hong Kong, Taiwan, Vietnam, China (eventually) and my own country Singapore , which is now threatened by a second, graver wave of infections – were some of the worst affected by severe acute respiratory syndrome in 2002 to 2004. The sixth, South Korea, escaped relatively unscathed that time around.

A man has a swab taken at a ‘drive though’ testing centre in South Korea, which has been lauded for its handling of the pandemic. Photo: Reuters

That outbreak, which was similarly caused by a coronavirus thought to have originated in China, killed 774 – or 9.6 per cent – of the 8,098 people it infected. So when the novel coronavirus that causes the Covid-19 disease arrived in January, these places deployed the same strategies that eventually subdued Sars: early detection, contact tracing and social isolation.

The governments and peoples of the West, however, had not seen something like Covid-19 in living memory.

The second reason for the crisis in the West is that their populations are not working together, with many defying attempts to enforce social isolation and quarantines. Governments are partly to blame for a lack of clarity in communications. In the US, for example, official advice has varied wildly. At first, the virus was dismissed as a hoax or no worse than the flu, but now citizens are being told the threat it poses is real and serious.

This has led to “deniers and disbelievers” defying restrictions on movement and travel, according to The New York Times, which said the crisis had “exposed the relationship between individuals and society and our responsibility to others”.

Members of the public walk on a beach in northwest England on Sunday, despite official advise to stay indoors. Photo: AP

To be sure, Asia has also seen its share of people flouting movement controls, but not on the scale seen in the West. Perhaps aware of this, a European embassy in Singapore recently messaged its citizens living in the country reminding them to follow local rules.

Though it should not be overstated in this modern age, it is interesting to note that the six places mentioned above that have been praised for their handling of the pandemic are all to a certain extent Confucian societies, where a greater emphasis is placed on the role of the community than the individual – a trait shared by many Asian societies.

MY BELIEF IS THAT MAO TZE TUNG WAS A CONFUCIAN MORE SO THAN A MARXIST READ HIS TEXTS LIKE "ON CONTRADICTION", THEN READ SOME CONFUCIUS BOTH ARE APHORISTIC TEXTS.

This might be dismissed as meek obedience to authority, but it is not. It is born from the understanding that each individual’s self interest is best taken care of by contributing to the welfare of the community as a whole – pay out to get paid in. So even in Hong Kong, racked by anti-government protests right up to the onset of the pandemic, the population remarkably complied with an administration many see as lacking political legitimacy and as caring more about Beijing than what the people think. They realised the dire threat facing society – and themselves – and that political differences notwithstanding, they had better stick together than face the alternative.

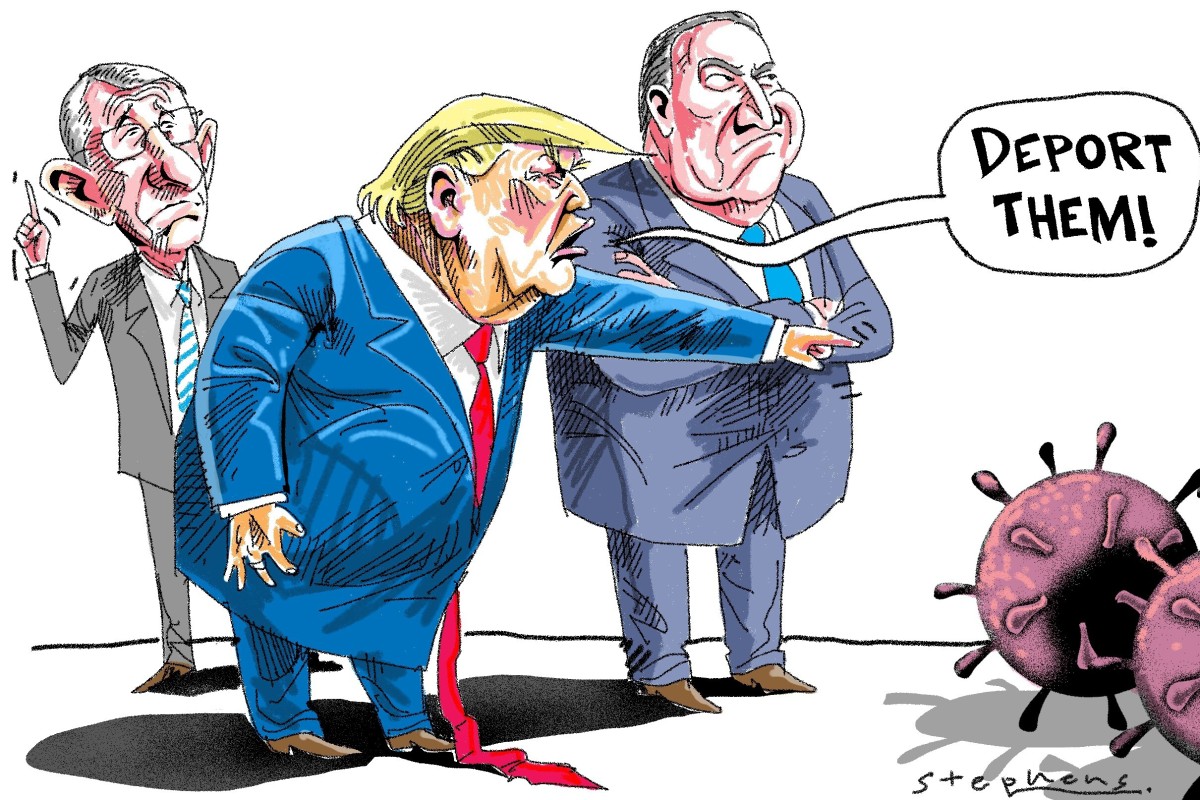

The most important reason that Western societies failed is their complacency, hubris even. They believed that as economically advanced nations, they could easily handle the threat without understanding it fully.

A nurse tends to a coronavirus patient in a hospital’s intensive care unit in Wuhan last month. Photo: Xinhua

This might be dismissed as meek obedience to authority, but it is not. It is born from the understanding that each individual’s self interest is best taken care of by contributing to the welfare of the community as a whole – pay out to get paid in. So even in Hong Kong, racked by anti-government protests right up to the onset of the pandemic, the population remarkably complied with an administration many see as lacking political legitimacy and as caring more about Beijing than what the people think. They realised the dire threat facing society – and themselves – and that political differences notwithstanding, they had better stick together than face the alternative.

The most important reason that Western societies failed is their complacency, hubris even. They believed that as economically advanced nations, they could easily handle the threat without understanding it fully.

A nurse tends to a coronavirus patient in a hospital’s intensive care unit in Wuhan last month. Photo: Xinhua

Clearly, China must take the blame for not snuffing out the outbreak right from the start and hopefully it will learn from its mistakes. But the pandemic in the West would not have happened if countries had not ignored the early warnings of the

World Health Organisation for all to prepare for the deluge.

From January to February, the West sneered at China’s initial missteps: for allowing wildlife markets to operate and for censoring early whistle-blowers and hiding the truth. Later, when Beijing finally woke up to the danger and put in place lockdowns and other measures to contain the escalating outbreak, the West scoffed. Such “draconian” approaches would not work, they said, and could never happen in the “free world”. It was “brutal” when China did it, but has become “necessary” now that the West is doing the same.

The thinking seems to be that China is economically huge but fundamentally part of the Third World. China is communist and can only fumble, which is why it got into trouble in the first place.

This hubris meant that the West – believing itself to know better – squandered the lead time it had to plan, act and learn. The few relatively bright spots in this picture are New Zealand, Iceland and Germany, all with women leaders, which is probably not a coincidence.

The coronavirus has been called an equaliser, which is true to the extent that nations rich or poor, big or small, democratic or authoritarian can be equally ravaged – though the more developed countries are better placed to look after their sick. The other side of the coin is that governments can lessen the blow irrespective of size, wealth and political systems. Hong Kong and Singapore are tiny specks compared to China, Vietnam and South Korea. Hong Kong, Singapore and Taiwan are advanced economies, while Vietnam is a developing country with scant resources that has won kudos for its low-cost but successful strategy. China and Vietnam are communist but Taiwan and South Korea are full-fledged democracies.

The point of this article is not to kick someone when they are down. The rest of the world hopes, for everyone’s sakes, that the pandemic in the West will be over soon. Humanity is in this together. But there is a lesson to be learned. Up until now, much of the West saw itself and was often seen by others – consciously or not – as more advanced, superior to the rest of the world and deserving of its lecturing of others. Its handling of the pandemic has put paid to much of that. Its leaders failed their citizens, and the world. This crisis will perhaps mark an inflection point in global history.

Tan Tarn How is an Adjunct Senior Research Fellow in the National University of Singapore and a Singapore playwright and arts activist.