BLOOD MONEY

A Sununu-linked mining company prepares to exploit resources in a disputed region as ethnic Armenians flee, according to legal docs and other public records.

William Bredderman

Senior Researcher

Published Oct. 02, 2023

Photo Illustration by Thomas Levinson/The Daily Beast/Getty

As thousands of ethnic Armenians swarm toward the border amid Azerbaijan’s attacks on the enclave of Nagorno-Karabakh, a lawsuit filed in D.C. federal court lays out how a leading U.S. political dynasty—one that includes a sitting governor—stands to profit from the humanitarian disaster.

Azerbaijan assaulted the breakaway region earlier this month, after long obstructing the main aid corridor from Armenia, in violation of a Russia-brokered 2020 ceasefire. The Daily Beast provided an exclusive eyewitness account this past week of the unfolding exodus of Nagorno-Karabakh families attempting to escape violence.

The attack marked the latest stage of a long-running Caucasus conflict that dates to the early 20th century and which erupted amid the dissolution of the Soviet Union, when the province declared independence and gained autonomy from Azerbaijan with the help of Armenia. Nonetheless, the international community regards the area as part of Azerbaijan, despite its ethnic Armenian majority.

A lawsuit filed in July describes how, in the intervening years, the Sununu family—led by patriarch John Sununu, the former New Hampshire governor and ex-White House chief-of-staff—held stakes and positions in a U.K.-based firm that secured mining rights within the province from Baku, rights only an Azerbaijani reconquest could guarantee. Public records, news reports, and corporate filings support many of the suit’s factual assertions.

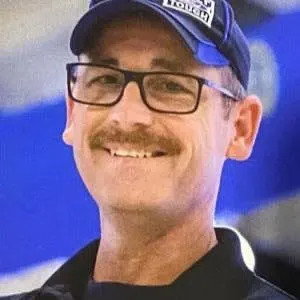

What’s more, according to federal filings that NBC News unearthed while investigating the dynasty’s interests in the Amazon, a family investment vehicle has historically held some of the shares in the U.K. company—a vehicle from which sitting New Hampshire Gov. Chris Sununu still derives income. The Granite State chief executive was the only member of the Sununu family to comment for this story.

“The governor has absolutely no involvement in the operations of Anglo Asian Mining or the operations of Sununu Holdings,” the present governor’s press team wrote to The Daily Beast in answer to questions about both the gold and copper extractor and the clan’s eponymous holding entity.

But the Republican, beloved to some for his criticism of ex-President Donald Trump, did not answer repeated queries about what financial benefits he might derive from Anglo Asian’s activities. His office also would not pledge that the governor would forfeit any potential returns from the company’s prospective business in Nagorno-Karabakh, so as not to profit from Azerbaijan’s alleged ethnic cleansing. Meanwhile, his 84-year-old father controls almost 10 percent of the metal miner, according to the most recently available corporate reports, making him the second largest shareholder in the operation.

New Hampshire Gov. Chris Sununu.

Jemal Countess

The largest is president and CEO Mohammad Reza Vaziri, the defendant in the suit, which a Nagorno-Karabakh resident brought with assistance of an Armenia-aligned U.S. foundation. Neither Vaziri nor his attorneys replied to repeated requests for comment, and Anglo Asian declined to remark other than to point The Daily Beast to the company’s filings with the London Stock Exchange. Although Vaziri is the focus of the litigation, the complaint refers by name not just to John and Chris but to Michael Sununu, brother to the sitting governor and a local New Hampshire politician.

The suit dates the Sununu paterfamilias’ involvement in Vaziri’s Azerbaijani adventures to 1997, when the company first struck a deal with the authoritarian state to gain access to its metal reserves. News reports from that year listed the GOP statesman among Baku’s suitors for extractive opportunities, but the earliest document that The Daily Beast could find of a direct holding in Anglo Asian dates to 2005, when he joined its board of directors. The lawsuit further asserts that Sununu has a stake in at least one of Vaziri’s private companies, which The Daily Beast could not independently confirm.

From the start, the lawsuit notes, Anglo Asian sought and received mining concessions within Nagorno-Karabakh—concessions it could not access due to the territory’s autonomous status. Its interest intensified in January 2016 with the completion of an Armenian-owned copper and molybdenum processing plant in the province’s town of Demirli. An image from the site soon adorned the cover of Azerbaijani government report on Yerevan’s economic presence in “the occupied territories.”

The lawsuit highlights several subsequent events: on March 31 of that year, Azeri President Ilham Aliyev met with John Sununu while he was visiting Washington, D.C., and the next day, Azeri forces attacked Nagorno-Karabakh, an advance the lawsuit suggests aimed at Demirli. After four days of fighting, Aliyev’s forces withdrew.

But Azerbaijan grabbed back some of the territory four and half years later, prompting Anglo Asian to applaud in a statement to stockholders what it described as the “liberation” of one of its mining concession zones. After a month and a half of fighting, Moscow intervened to end the bloodshed, resuming its traditional role as security guarantor in its old imperial dominions.

Weeks later, the lawsuit highlights, Anglo Asian appointed Michael Sununu—founder of Sununu Holdings, the entity from which Chris Sununu draws income—to its board. This means that of the company’s five directors, two today are members of the Sununu family.

Almost exactly one year after the 2020 conflict began, Anglo Asian obtained initial Azerbaijani approvals to exploit two sites within the still-autonomous portions of Nagorno-Karabakh, including the Demirli installation.

“The recent cessation of hostilities with Armenia has presented an opportunity for Anglo Asian to develop its remaining contract areas,” Vaziri told Mining Weekly at the time. “Following extensive negotiations, we are very pleased to have secured two additional highly strategic mining properties.”

In December 2022, Azerbaijan demanded access to one of the mines as a condition for restoring Nagorno-Karabakh’s food, medicine, and fuel route from Armenia. The move came precisely one week after Anglo Asian penned missives to the U.S., U.K, United Nations, and the European Union complaining of “illegal mining” at its concession locations in the disputed region.

Despite these efforts, as of June of this year, Anglo Asian reported it was unable to access these locations, and the blockade of the corridor has persisted despite international condemnation and allegations of genocide.

However, on Sept. 26, Anglo Asian had good news for its shareholders.

“There have been reports in the press that the Azerbaijan Government has taken back control of the Demirli/Kyzlbulag mine, which is located in our contract areas,” an executive wrote in a London Stock Exchange report. “I would like to extend my sincere gratitude to all Anglo Asian employees, partners and the Government of Azerbaijan for their continued support in what continue to be challenging times.”

The lawsuit against the firm has yet to make headway, and Vaziri’s attorneys have so far not filed a response to the complaint. Michael Sununu declined to comment for this story. His father did not respond to repeated calls and emails.

Sununu Family Continues to Support Azerbaijan through Mining in Karabakh Region

JUNE 4, 2021

by Aram Arkun

CONCORD, N.H. – As the Mirror-Spectator reported last November, the Anglo Asian Mining company, in which Republican politician John Henry Sununu, father of current New Hampshire governor Chris Sununu, is the second largest shareholder, plans to resume mining gold in Zangelan province and possibly two other areas that were previously under Armenian control.

John Sununu, a former governor of New Hampshire and former chief of staff to President George H. W. Bush, owns a 9.38 percent stake in the company. After the end of the 2020 Artsakh War, the Sununu family increased its direct involvement in the company, when in December of last year, Anglo Asian Mining welcomed Michael Sununu to its board as a non-executive director. Michael is the son of former governor John Sununu and is a founder and manager of Sununu Enterprises and Sununu Holdings.

Anglo Asian Mining’s predecessor company, controlled by the same CEO, Reza Vaziri, signed an agreement with the Azerbaijani government for rights in 1997 to six mines, including three which were then under Armenian control. As a result of the recent Artsakh war, two of these areas are under full Azerbaijani control. A third area, Sotk/Soyudlu, is on the border between Armenia and Azerbaijani controlled Kelbajar.

In the company’s quarterly report of April 13, 2021, CEO Vaziri states: “A recent visit to the Vejnaly [Kovsakan] contract area in Zangilan has identified some high grade ore stockpiles and the feasibility of transporting this ore to Gedabek for processing is being evaluated.” A May 20, 2021 Anglo Asian Mining report further elaborates: “However, due to safety and security concerns, access to Vejnaly and the other restored areas by company personnel remains somewhat restricted. The determination of their final status continues to be reviewed by the government of Azerbaijan.”

Anglo Asian Mining also has an eye on the Kashen deposit with molybdenum and copper in northern Martakert (Kyzlbulag), part of the territory of the Artsakh Republic, which at present is under the control of Russian peacekeepers. As the company website states, “our access to Kyzlbulag will depend on the final resolution of the status of Nagorno Karabakh.”

Non-executive chairman Khosrov Zamani in the May 20 report concludes, “The restoration of the three contract areas in the formerly occupied territories and Karabakh opens up further opportunities for the Company. The contract areas cover a total of 900 square kilometers and contain existing mines and have exceptional exploration potential. Our production sharing agreement is in good standing and will be reset to ‘year zero’ for each of these contract areas once access has been granted. The political situation is still developing and the Company is closely monitoring events. The Government of Azerbaijan has also commenced building infrastructure in the areas such as roads, railways and airports.” The same report also notes, “Development will commence when the Company receives notice in accordance with its PSA [Production Sharing Agreement] that the Organisation on Security and Cooperation in Europe (‘OSCE’) (or comparable international organisation) has acknowledged a liberation of the previously occupied territories and the Company is satisfied the districts are secure.”

Significantly, the government of Azerbaijan takes a hefty cut of Anglo Asian Mining’s profits due to the existing PSA, while the economic ties of the Sununu family with Azerbaijan naturally lead to political consequences. John Sununu serves as a member of the Honorary Council of Advisors of the United States-Azerbaijan Chamber of Commerce and in 2017 received an award of appreciation from this organization for his “contribution to US-Azerbaijani diplomatic relations.”

Anglo-Asian’s own website attempts to present Azerbaijan in a good light. For example, it glosses over the many problems of Azerbaijan’s undemocratic and authoritarian government with statements like “Azerbaijan is a multiparty democracy and presidential republic with a separation of the executive and legislative bodies. It is among the region’s most stable countries.”

The Azerbaijani connection with the Sununu’s is apparently not one way. BGR Government Affairs, which lobbied for the Republic of Azerbaijan, donated $1000 to Chris Sununu’s campaign for governor in 2017 and hosted a fundraising reception.

A campaign by the Armenian National Committee of America (ANCA) calling on Governor Chris Sununu to divest his family’s shares in this company, calling this investment “blood money,” has not received any response so far, according to the ANCA’s Washington D.C. office. Attempts this May by the Mirror-Spectator to contact Michael and Chris Sununu also received no response and it does not appear that in general Governor Sununu has made any public comments on the Artsakh war.

Mining Company With Ties To Sununu Family Poised To Profit After Peace Deal

New Hampshire Public Radio | By Josh RogersPublished November 10, 2020

Via Steelguru.Com

A mining company with ties to the family of Gov. Chris Sununu is poised to gain financially after a brokered settlement of an armed conflict between the nations of Armenia and Azerbaijan.

The company, Anglo Asian Mining, is partially owned by former Gov. John H. Sununu, father of the current governor.

Anglo Asian has been mining gold, silver and copper in Azerbaijan since 2009.

The peace deal announced this week ends the Armenian-Azerbaijan conflict and clears the way for Anglo Asian to exercise rights to mine in Nagorno-Karabakh, the region under dispute which ethnic Armenians claimed as their own but was internationally recognized as a part of the nation of Azerbaijan.

Armenian groups were angered when Anglo Asian mining recently referenced the “liberation” of the disputed region where it enjoys mining rights.

In a statement published by the website Mining.com, Anglo Asian said it “complies with all international laws and with laws in the countries in which it operates.”

The company has also said it plans to mine in the disputed area only when the government of Azerbaijan confirms all hostilities have ended there.

The settlement has boosted the stock price of Anglo-Asian. Former Gov. Sununu, a director of the company, owns a 9 percent stake in it. That holding is now worth more than $16 million.

Angel Pasuy of the Kamentsá Biya de Sibundoy reservation.Pedro Samper / NBC News

Angel Pasuy of the Kamentsá Biya de Sibundoy reservation.Pedro Samper / NBC News