The vast majority of people who trade in shares are already the wealthiest 10% of American households

Who gets a slice of the stock market cake?

Photograph: Mona Chalabi

.png?width=300&quality=85&auto=format&fit=max&s=97e44208508eeb2acc4445777a3dece7)

Mona Chalabi

@MonaChalabi

Tue 16 Feb 2021

Robinhood wants to “democratize finance”, according to its mission statement. And, for a brief period last month, the trading app seemed to be doing just that as small investors appeared to be battering Wall Street investors who had bet on the demise of GameStop, AMC cinemas and other.

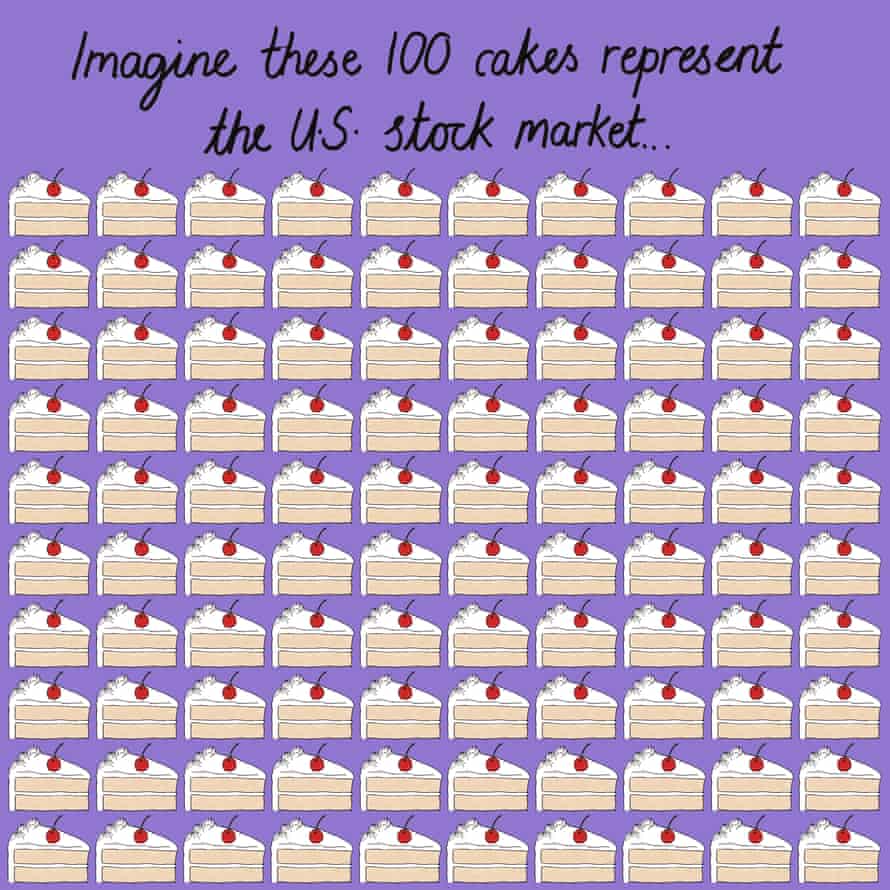

The long-term fallout of a saga that gripped the world is still unknown and regulators are poring over the sudden rise in shares of GameStop and others. But what is true is that share ownership in the US is still anything but democratic – the vast majority of people who trade in shares are already the wealthiest slice of society.

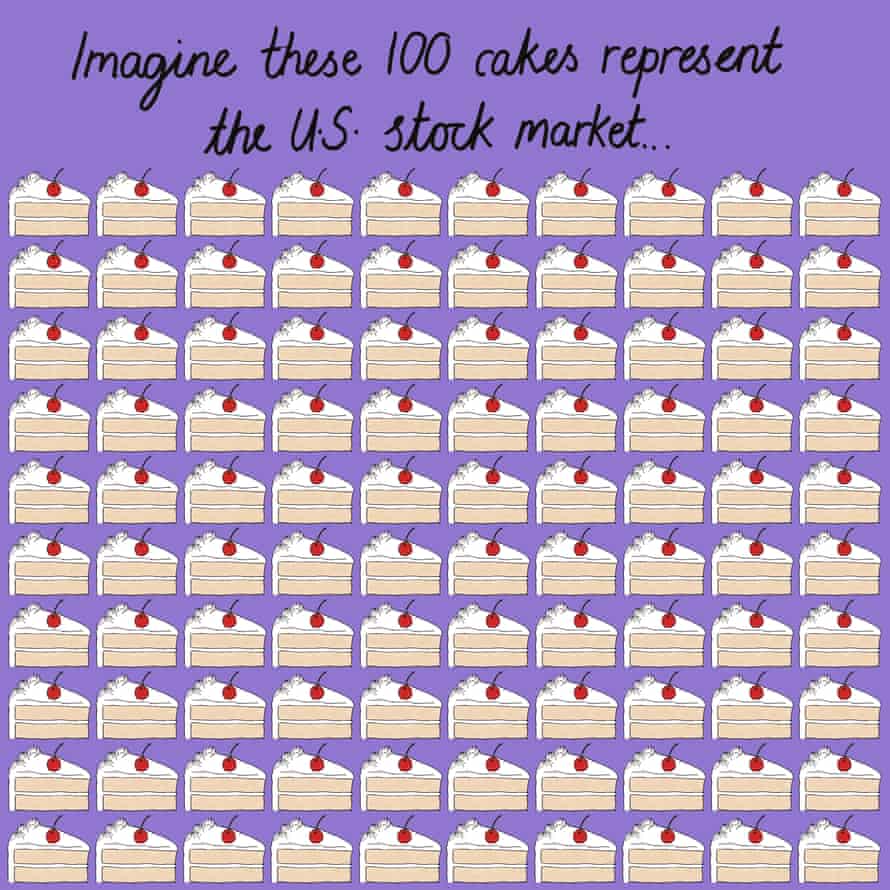

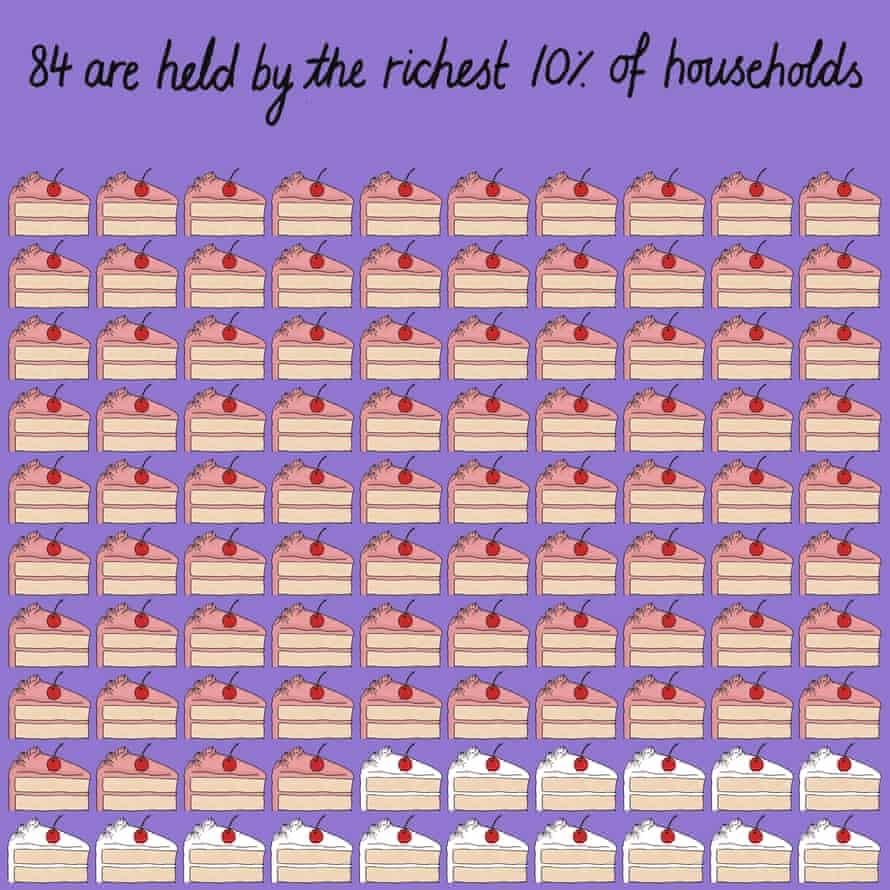

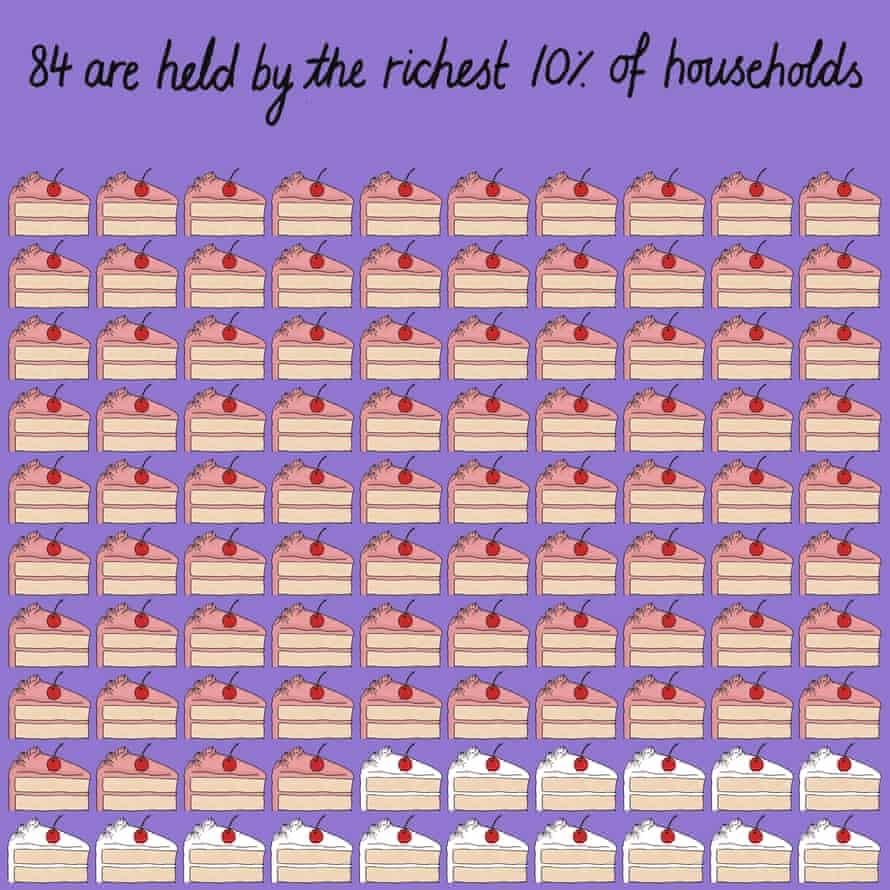

A massive 84% of all shares held by American households are owned by the wealthiest 10%. These figures come from a 2017 study by the economist Edward N Wolff who used data from the Survey of Consumer Finances to reveal just how skewed US stock ownership is.

Wolff notes that the concentration of stocks in the hands of the wealthy has huge consequences for wealth inequality. Rather than owning stock, the wealth of the middle class was largely invested in home ownership, meaning that this slice of American society was deeply affected by the housing price drop that began in 2007. That sting has been even sharper given that real wages have barely risen over the past 40 years.

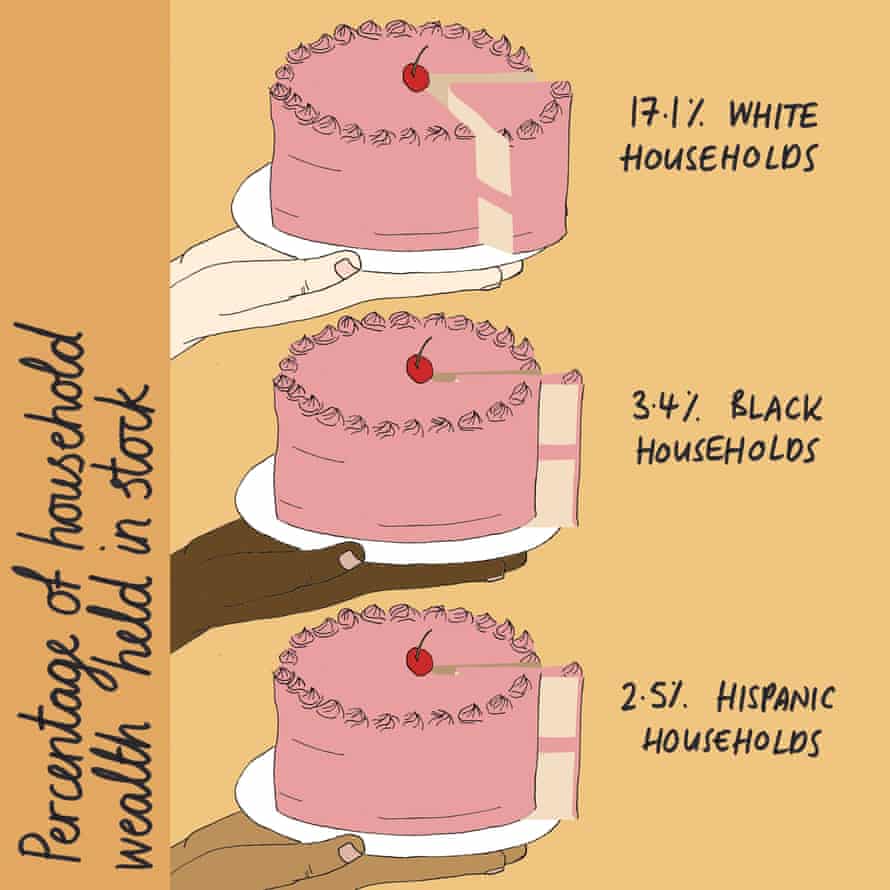

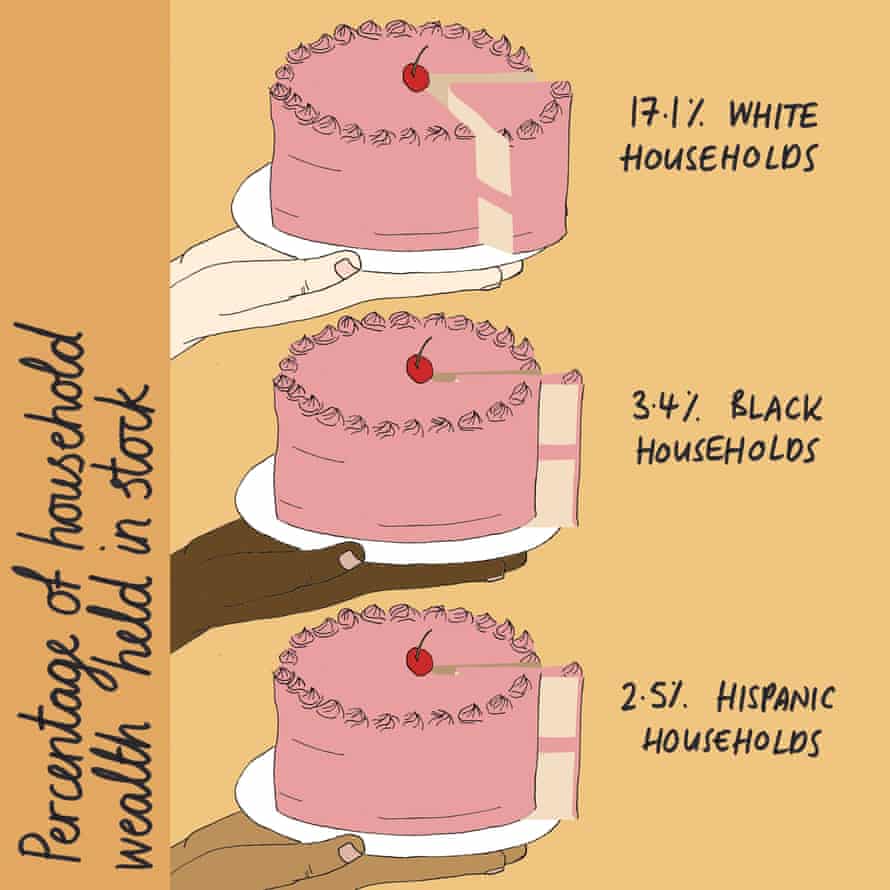

And, since the US is a country where economic inequality overlaps with racial inequality, there are other clear patterns in stock ownership. While stock ownership makes up 17% of white household wealth in the US, it represents just 3% of the wealth in Black and Hispanic households.

.png?width=300&quality=85&auto=format&fit=max&s=97e44208508eeb2acc4445777a3dece7)

Mona Chalabi

@MonaChalabi

Tue 16 Feb 2021

Robinhood wants to “democratize finance”, according to its mission statement. And, for a brief period last month, the trading app seemed to be doing just that as small investors appeared to be battering Wall Street investors who had bet on the demise of GameStop, AMC cinemas and other.

The long-term fallout of a saga that gripped the world is still unknown and regulators are poring over the sudden rise in shares of GameStop and others. But what is true is that share ownership in the US is still anything but democratic – the vast majority of people who trade in shares are already the wealthiest slice of society.

A massive 84% of all shares held by American households are owned by the wealthiest 10%. These figures come from a 2017 study by the economist Edward N Wolff who used data from the Survey of Consumer Finances to reveal just how skewed US stock ownership is.

US stocks can be represented as 100 cake slices, each one representing 1% of the market. Photograph: Mona Chalabi

84% of the US stock market is held by the richest 10% of households. Photograph: Mona Chalabi

Wolff notes that the concentration of stocks in the hands of the wealthy has huge consequences for wealth inequality. Rather than owning stock, the wealth of the middle class was largely invested in home ownership, meaning that this slice of American society was deeply affected by the housing price drop that began in 2007. That sting has been even sharper given that real wages have barely risen over the past 40 years.

And, since the US is a country where economic inequality overlaps with racial inequality, there are other clear patterns in stock ownership. While stock ownership makes up 17% of white household wealth in the US, it represents just 3% of the wealth in Black and Hispanic households.

Household wealth by race. Photograph: Mona Chalabi

No comments:

Post a Comment