ALBERTA; HOW COLD IS IT

TC Energy says 590,000-bpd Keystone pipeline shut as extreme cold grips

TC Energy’s 590,000-barrels-per-day Keystone oil pipeline was shut down on Tuesday evening for unplanned maintenance, the company said on Wednesday, as parts of Western Canada grappled with frigid winter weather.

TC said efforts to restart the pipeline, which ships crude from the oil sands province of Alberta to the U.S. Midwest, were being challenged by extremely cold temperatures at its Hardisty terminal in central Alberta.

“We are currently working to safely restore service as soon as possible,” TC said in a statement.

The company said the unplanned maintenance on Keystone began at around 8.00 p.m. on Tuesday. TC’s Gulf Coast operations in the United States are uninterrupted.

Deep freeze disrupts crude flows in oil sands and Bakken shale

, Bloomberg News

A deep-freeze in Canada and Northern U.S. is disrupting oil flows, causing a surge in crude prices just as American stockpiles are declining.

With temperatures from North Dakota to Northern Alberta below zero Fahrenheit (-18 Celsius), TC Energy Corp.’s Keystone pipeline was shut on Tuesday before resuming later the next day. In North Dakota’s Bakken shale, production has started to succumb to the freeze, sending local crude prices to their highest since November. Canadian oil has also jumped.

The disruptions mean less supplies at a time when U.S. stockpiles have been shrinking every week since mid-November and getting closer to September’s three-year low. Drillers have been slow to restore output to pre-pandemic levels as they prioritize shareholder returns over growth. This further supports growing predictions that the oil market will return to a deficit this year, with some like Pioneer Natural Resources Co. Chief Executive Officer Scott Sheffield expecting oil to range from US$75 to US$100 a barrel.

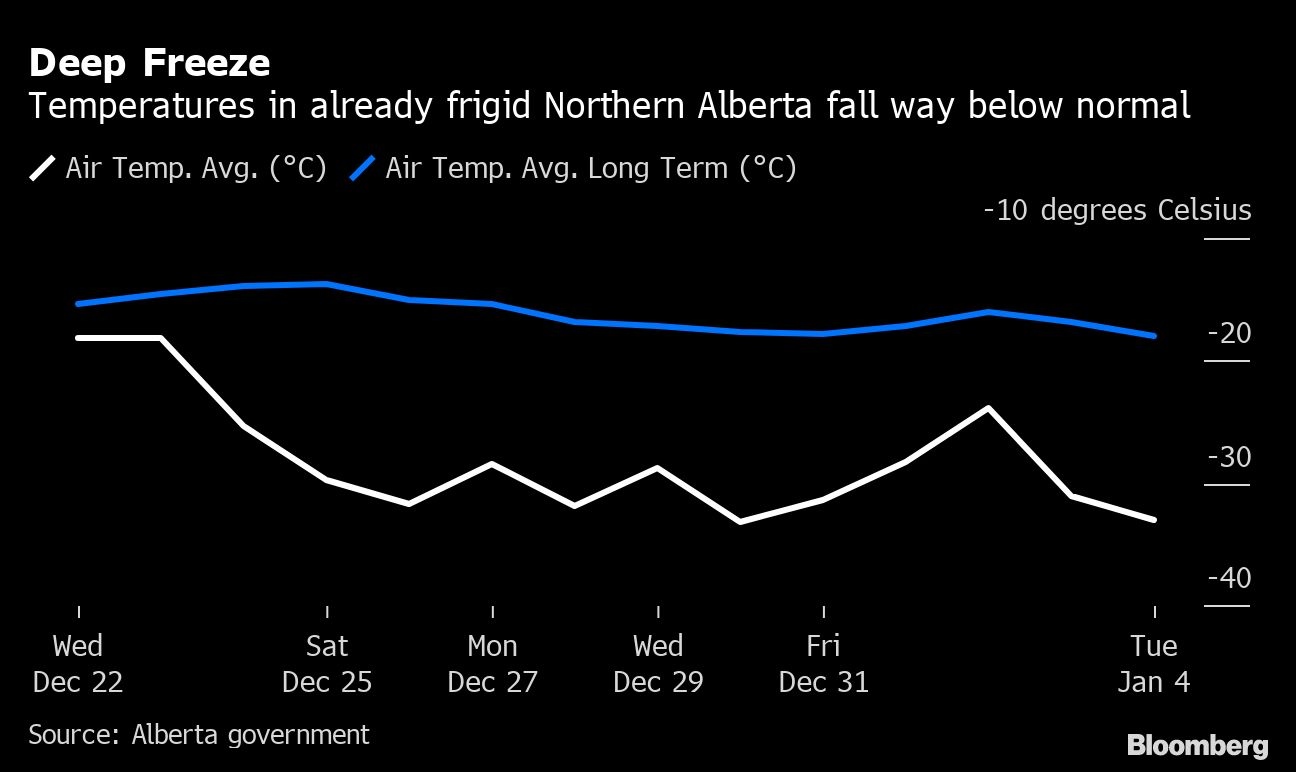

Even though Western Canada and North Dakota are usually cold this time of year, temperatures have been lower than usual.

Western Canadian Select crude’s discount to the U.S. benchmark has shrunk by almost US$3 dollars since Dec. 27, to US$12.10 per barrel on Wednesday.

Bakken crude in the Clearbrook, Minnesota, hub rose 90 cents a barrel in the past two days to reach a US$1.25 premium to Nymex futures Wednesday, a two-month high. The same grade traded this week in Wyoming at a premium to New York futures for the first time since Nov. 18.

Keystone carries 590,000 barrels a day of Canadian oil from Alberta to the U.S. Midwest.

Prior to resuming operations, TC Energy said that its staff have been challenged by extremely cold temperatures impacting the oil flow through its Hardisty terminal. Temperatures there fell to about -24 degrees Celsius (-11 Fahrenheit) on Wednesday afternoon.

Meanwhile, Enbridge Inc. said it was seeking crude supplies for its main pipeline system across Canada and U.S. to keep its pipes running at scheduled rates.

Keystone Pipeline Shuts Down Amid Frigid Weather

TC Energy shut down the Keystone pipeline for several hours for unplanned maintenance as temperatures in the area of the Hardisty terminal were expected to drop to minus 35 Celsius.

Reuters reported that the emergency maintenance began on the evening of Tuesday and lasted until last evening. The Keystone pipeline carries close to 600,000 barrels of Canadian crude daily.

Meanwhile, Bloomberg has reported that frigid weather was disrupting the flow of oil in western Canada and northern U.S. states. Temperatures from Alberta to North Dakota are in deep sub-zero territory, and besides the Keystone pipeline, oil wells are also beginning to get affected.

This is coming at a bad time for U.S. crude oil supply, Bloomberg notes, with inventories recording drawdowns every week for more than two months now, inching closer to the three-year low reported in September.

This will likely have an effect on fuel prices as it will combine with slower supply growth in the United States as well. Drillers have been wary of returning to their pump-at-will strategy from before the pandemic, prioritizing shareholder returns instead.

The price for crude produced in the “colder” states is already reflecting the expectations for tighter supply going forward. According to Bloomberg, the discount of benchmark Canadian crude to WTI has narrowed by $3 from late December to $12.10 per barrel this week.

Meanwhile, the price for Bakken crude sold in Minnesota has gained $0.90 over the past two days, trading at a premium to WTI futures of $1.25 per barrel.

Benchmark prices are also on the rise, despite a decision by OPEC+ to continue adding production in February as concern about spare capacity and the actual ability of OPEC+ members to pump more is called into question. Meanwhile, in the United States, demand for fuels seems to be in decline, with the EIA reporting a gasoline inventory jump of 10 million barrels for the last week of December.

By Irina Slav for Oilprice.com

No comments:

Post a Comment