Reuters | April 11, 2022 |

Credit: Wikimedia Commons

(The opinions expressed here are those of the author, Andy Home, a columnist for Reuters.)

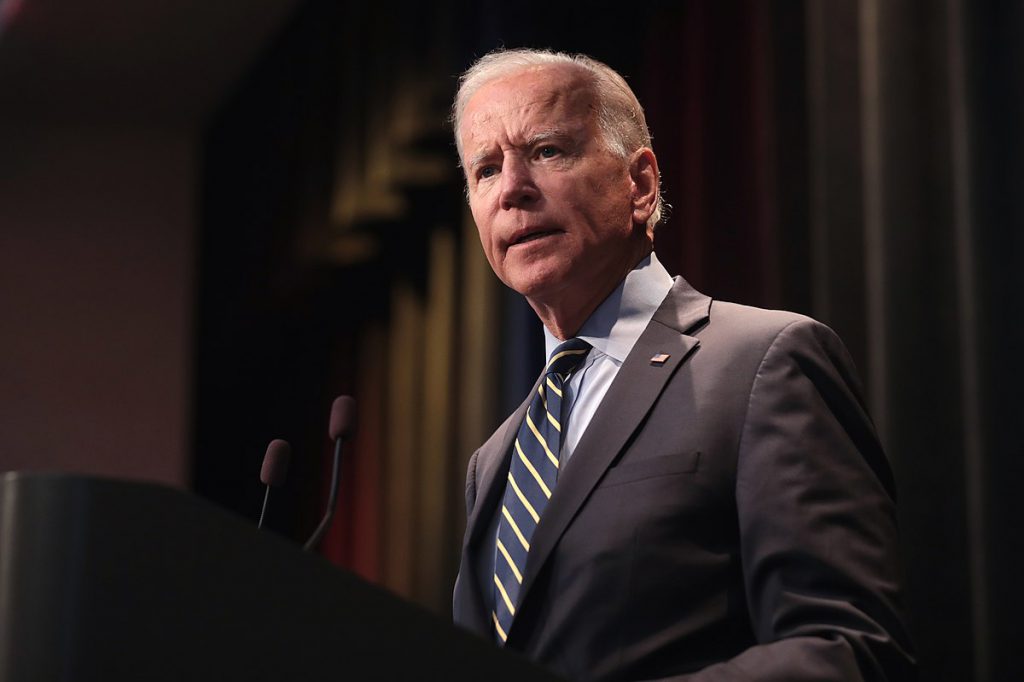

US President Joe Biden has invoked the Defense Production Act (DPA) to accelerate the build-out of a domestic battery materials supply chain.

A measure first used by President Truman to boost US steel production in the Korean War will now be tailored to future energy transition metals such as lithium, cobalt and nickel.

The White House’s March 31 announcement was light on details, specifically the amount of government funding available, and the initial impact is likely to be incremental rather than revolutionary.

Investment in greenfield capacity will be dependent on a planned overhaul of the country’s gold rush-era mining laws, the underlying cause of much of the environmental resistance to new mines.

But it’s still a clear statement of intent and one that reinforces industrial metals’ growing strategic importance in a fast-changing world.

Back to the future

“Our national security and our chances for peace depend on our defense production, (and) our defense production depends on steel,” President Truman told the American people in a radio address in 1952 at the height of the Korean War.

Metals such as steel and aluminum were critical to the war effort, and the Defense Production Act was passed in 1950 to allow the government to stimulate production.

The rise of the oil economy in the second half of the century shifted the strategic focus to energy security, but as energy transitions from fossil fuels to renewables, enabling metals are now back on governments’ priority lists.

“To promote the national defense, the United States must secure a reliable and sustainable supply of such strategic and critical materials,” said President Biden, citing specifically lithium, cobalt, nickel, manganese and graphite.

All are used in batteries, and the United States relies on imports for all of them, often from what Biden termed “unreliable foreign sources”.

Demand for these minerals is set to increase exponentially in the coming years as automakers increase electric vehicle production and build out the required battery capacity.

“Unreliable foreign sources” is usually diplomatic code for China when it comes to strategic metals.

There is obvious concern about China’s dominant position in lithium processing and in the supply of graphite. The United States is totally import dependent for the latter, with around one third of annual imports coming from China.

New urgency

However, Russian metals supply has taken on a new urgency since the invasion of Ukraine.

The United States has limited direct exposure to the potential loss of Russian lithium, manganese or cobalt.

Nickel, however, is much more problematic. Battery production requires high-grade – so-called “Class I” – nickel, and Russia’s Norilsk Nickel accounts for around 17% of global supply, according to Fitch Ratings.

Neither Norilsk nor its oligarch owner Vladimir Potanin have yet been sanctioned, but self-sanctioning is making it ever harder to finance, insure and ship metal from the company’s Arctic base.

Russian metal has suddenly become high-risk supply after the country’s self-styled “special military operation” in Ukraine, tightening an already stretched market. It’s one of the reasons the nickel price turned so wild in March the London Metal Exchange had to suspend its contract.

Western critical metal supply chains were already starting to change in response to the strategic need to loosen dependence on Chinese supply.

Ukraine both opens up new potential mineral hostilities and underlines the need for greater self-sufficiency.

Federal accelerator

The Defense Production Act is intended as a federal government accelerator for a domestic battery metals supply chain that is still in its infancy.

Without presidential action, the United States “cannot reasonably be expected to provide the capability for these needed industrial resources, materials, or critical technology items in a timely manner,” Biden warned.

The initial focus will be on enhancing and expanding existing capacity through funding feasibility studies for by-product and co-product production, mine waste reclamation and value-added modernisation.

New projects will be given a helping hand, both in terms of capital expenditure and winning public acceptance.

Green environmental push-back against green transition metals remains a road-block on the path to a clean energy future, and the Biden Administration is keen to underline that domestic supply must come from “environmentally responsible domestic mining and processing”.

Key to this balancing act will be the planned rewrite of the 1872 General Mining Law, a legal framework that is wholly unfit for 21st century purpose, generating protracted court action and seemingly random outcomes for proposed new mines.

That particular battle lies ahead, which is why it makes sense to channel initial DPA funding into maximising what has already been built. Or, in the case of historic tailings, what has already been built and abandoned.

Critical metals

The real significance of invoking the DPA, however, is that it elevates battery metals to the top of the US critical materials supply list.

Until now the Biden Administration has only used the Act to secure vaccines and enhance testing in its battle to control the covid-19 pandemic.

Securing domestic or “friendly” supplies of lithium and nickel is now in the same top-priority category.

The Administration has already committed up to $3 billion to increase battery metals production thanks to last year’s infrastructure bill.

That was passed with bi-partisan support, and minerals security is one of the few areas of political agreement between Democrats and Republicans, which may open the door on further money being allocated to the sector.

Expect domestic investment to go hand in hand with mineral alliances, particularly with the European Union, Australia and Canada, which itself is preparing a major C$2 billion ($1.6 billion) investment drive into the battery supply chain.

Industrial metals moved out of the geopolitical limelight after the 1970s, when successive oil shocks rocked the global economy.

President Biden’s lithium echo of Truman’s steel warning tells you they’re rapidly returning to centre stage.

(Editing by Jan Harvey)

No comments:

Post a Comment