Crypto traders turn against each other in a collapsing market

, Bloomberg News

With crypto prices tumbling precipitously, traders have begun increasingly turning against one another to eke out ever-elusive profits.

Many shark traders scour blockchains -- digital ledgers for recording transactions -- seeking information on other traders, particularly those with highly leveraged positions, an anonymous user known as Omakase, a contributor to the Sushi decentralized exchange, said in an interview.

The sharks then attack the positions by trying to push them into liquidation, and earning liquidation bonuses that are common in decentralized finance (DeFi), where people trade, lend and borrow from each other without intermediaries like banks.

Related strategies may have contributed to the collapse of the TerraUSD stablecoin, with shark traders making money off price arbitrage between the Curve decentralized exchange and centralized exchanges, according to Nansen, a blockchain analytics firm.

Recent troubles at crypto lender Celsius Network were exacerbated by arbitragers as well. The price of stETh token that Celsius has a large position in started trading at a large discount from Ether, to which it’s tied.

“As stETH goes down, arbitragers buy stETH and short ETH against it, sending ETH lower, which again lowers collateral values across DeFi,” effectively worsening Celsius’s position, according to a recent Arca note.

As Omakase put it, “In a downtrend environment, where yields are harder to access, what we are going to see is some actors utilize some more aggressive strategies, and that may not be necessarily good for the community.”

“The environment has become more player vs player,” Omakase added.

With crypto prices under pressure, taking on leverage has presented an even greater peril. Last year, Sushi launched a margin-trading and lending platform. Most crypto exchanges offer margin trading, and in the past it has been as high as 100X, meaning that people were able to borrow 100 times what they put down as collateral.

Most DeFi apps require traders to overcollateralize, however -- effectively taking out less in loans than they put in.

DRIVING DOWN THE PRICE

A trader may find out that others could get liquidated when a coin’s price drops to, say, US$100. The trader could then build up a sufficient position in the coin, then sell in order to pull the price below US$100, while also collecting the reward for liquidating the trader that most DeFi apps offer.

“Most protocols offer a 10-15 per cent liquidation fee,” Omakase said. “Triggering enough liquidations would cause a liquidation cascade where a motivated actor could simply hold a short position in order to profit for the subsequent secondary decrease.”

Other traders are simply profiting off liquidations they don’t trigger. Nathan Worsley runs a slew of bots -- software programs -- that search for traders who are about to get liquidated and gets paid a commission for liquidating them.

“Recently the amount of liquidations has been huge,” Worsley said in emails. “However, liquidations is not a continuous strategy, you sometimes go for a week or more without any significant liquidations. However, when liquidations happen there are usually a lot at once. You basically have to work a long time while making US$0 profit, in order to be ready for the big day or two when you might be able to make a million dollars at once.”

His bots continuously scour blockchains, keeping a list of all the borrowers using a particular app and scrutinizing the health of their accounts. Once positions are ready for liquidation, “it’s usually a battle to be the quickest and perform the liquidation,” Worsley explained.

“I would push back on classifying this as an ‘attack,’” he added. “The reason is because without liquidations, you can’t have a lending market. So even though no one enjoys being liquidated, it’s essential that people do get liquidated in order to make the market and protect the protocol from insolvency.”

Liquidations can be triggered after traders borrow from apps like Aave or Compound, and put up collateral -- say, in Ether -- that’s typically greater than what they borrow, perhaps 120 per cent of the borrowed funds. If Ether’s price drops, that collateral may now be worth only 110 per cent of what the trader borrowed.

'PROTECT THE PROTOCOL'

“My job as the liquidator is to protect the protocol by closing your position,” Worsley said. “The protocol gives me a reward for being a liquidator to encourage this activity, because blockchains cannot move by themselves. You have borrowed US$1,000 of Bitcoin, so I repay the US$1,000 of Bitcoin you owe the protocol. In return, the protocol gives me US$1000 of your Ethereum collateral, plus a US$100 ‘liquidation bonus’ from your excess collateral. I have made a profit, you have been liquidated and your position is closed, and the protocol itself has been protected from bad debt.”

With liquidation targets becoming more and more tempting in a tumultuous market, Omakase offers this advice: “Generally everyone should stay safe, everyone should avoid the use of leverage.”

Bloomberg Businessweek: Ethereum mining is about to disappear, miners are not happy

The shift from “Proof of Work” to “Proof of Stake” will drastically reduce power consumption and allow some expensive technology to find new uses.

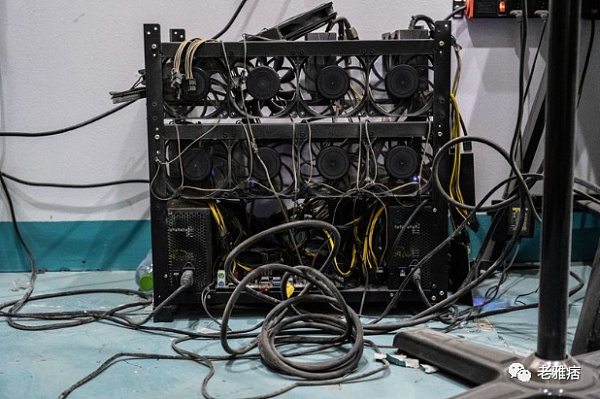

Mikel-Angelo Chalfoun, an ethereum miner, stores his graphics cards in a warehouse in Dubai.

The Ethereum mining community is a diverse group, both geographically and demographically. A 28-year-old translator in Ukraine runs some computing hardware on his balcony to earn cryptocurrency so he can buy clothes and other necessities. In Argentina, a retiree used her gaming computer to double her monthly pension. A college student in Canada has dug up enough money to buy a BMW motorcycle and a modified 2006 Dodge Charger SRT – and pay for gas every month.

Even many outside the blockchain world know that the collapse of the cryptocurrency market has made the past few months quite painful for anyone whose financial situation is tied to a currency. The price of ethereum is down about 70% this year as of June 15. At the same time, a little-known factor (a tectonic shift known as the Ethereum “merger”) will end Ethereum mining entirely, cutting off the income of as many as 1 million people. “It would be a huge economic blow, almost completely depriving the original miners of a good source of income,” the Ukrainian translator said. (He asked to remain anonymous for fear of being robbed.)

Bitcoin and Ethereum, the two largest cryptocurrency networks by market capitalization, both use a procedure known as “proof of work” to record transactions, in which so-called miners use computer resources to solve difficult mathematical problems, converting transactions Blocks are added to the public ledger. Miners receive payment in cryptocurrency as a reward. Bitcoin mining, which usually involves specialized equipment, has been industrialized; as mining has moved to data centers, the participation of ordinary people has largely been eliminated. But Ethereum mining relies on the kind of graphics card found in a typical gaming computer, and many ordinary people can still do it.

Proof-of-work is just a competition to make a computer work hard, which means it uses a lot of energy. The environmental damage it causes is a major criticism of cryptocurrencies by environmentalists. Since the inception of Ethereum, its developers have been preparing to move to an alternative model known as proof-of-stake. Under this system, people would reserve or “stake” a certain amount of ether, the cryptocurrency of the ethereum blockchain, to win rewards for running software that correctly batches transactions into new blocks and checks The work of other validators. Proof of stake can reduce the power consumption of the Ethereum network by about 99%. It would also put miners out of work, which is a major blow given the capital investment to build the business. According to Bitpro Consulting, ethereum miners have already spent about $15 billion on graphics processing units (GPUs), not including ancillary costs such as wiring and transformers.

Prices of Selected Used Graphics Processing Units for Sale on eBay

Average for the previous week??

The ethereum merger is expected to take place in August, although no official date has been given. It has been pushed back many times, and many miners hope this will happen again. “I don’t think they’ll be able to get it done anytime soon,” said Aydin Kilic, chief operating officer of ethereum industrial miner Hive. But others associated with ethereum see a merger as inevitable. “The odds of not happening this year are very low (from 1% to 10%),” said Tim Becco, a computer scientist who coordinates ethereum developers. What I’d like to avoid is someone buys a GPU for mining today, but merges it in Happening this summer, it will make it almost worthless.”

Despite this, miners are actually expanding their operations. GPU prices have more than halved since the start of the year, leading to a surge in purchases. According to data from tracker Etherscan, Ethereum’s hashrate, a measure of the mining power that powers the network, has nearly doubled in the last year. Even with the current depressed cryptocurrency prices, mining Ethereum is more profitable than backing any other major coin, including Bitcoin. “I guess people are trying to get as much as possible before it’s over,” said Slava Karpenko, chief technology officer at 2Miners. The organization helps small miners pool their resources to support Ethereum. The group’s active user count has climbed 70 percent since November, to about 120,000, he said.

However, recovering costs has become more difficult due to the fall in the price of ether. Mike Lam, a 38-year-old engineer from Ontario who has been mining for a year, only made about $5,000 worth of cryptocurrency on his initial $30,000 investment in hardware; he also paid about $650 each. monthly electricity bill. Aaron Petzold, 24, a recent college student who mines ether at his parents’ house in Wisconsin, said he has four months to recoup his investment of more than $28,000. “I want to keep mining until it’s over,” he said. “It’s a big uncertainty. No one really knows what’s going to happen. There’s a lot of people who think I’m obsessed.”

The ethereum merger will likely settle after August.

Miners don’t get nothing. After the merger, their mining rigs will remain powerful computing devices that can be used elsewhere, and some are planning to mine other coins or find other uses for those rigs. After the merger, Petzold is considering using his device as a piece of hardware for digital video production, primarily responsible for rendering, which requires a lot of computing resources. “There are other uses for these cards,” he said. “You can turn it into a render farm, and you can do different machine learning options. They’re just not going to be as profitable as mining.”

Canadian mining pool operator Flexpool is looking to add more tokens for its members to mine and plans to deploy its developers to program other cryptocurrency projects, said a director who asked not to be named for fear of being robbed: “It’s like a company Typewriter companies. When nobody buys typewriters anymore, so you have to use the capital you make on typewriters to move to other businesses.”

Others, like Ivan Zhang, 35, and Karol Przybytkowski, 36, plan to sell their stable of graphics cards and use their facilities in upstate New York to host other miners’ gear for a fee. But GPU prices are expected to drop further as many ethereum miners are likely to rush to sell immediately after the merger. Bitpro plans to stop buying graphics cards within a few weeks, and its CEO Mark D’Aria said: “My view is that no matter how much we pay today, we’re going to make a lot less after this event. We’re just going to sit there and watch Let that happen and pick up the pieces.”

Some miners hope to do better by moving to mining other GPU-requiring coins like Ethereum Classic or Ravencoin. The more miners flocking to any coin, the harder it will be to make a profit. But cryptocurrency breeds optimists, and miners are building for what their business will be a reason to survive. Mikel-Angelo Chalfoun, 30, pays $9,000 a year for a warehouse in Dubai to house and power his 76 graphics cards. He said he would be able to compete with miners at a higher cost. “No matter how cheap crypto gets, no matter how harsh crypto winter gets, I’m fine, I’ll never mine at a loss,” he said.

Other miners just feel betrayed. Canadian engineer Lin said: “They need miners until they merge! It’s a little weird. Ethereum needs us miners until they deprecate us.” (He runs 50 graphics cards in his basement)

Posted by:CoinYuppie,Reprinted with attribution to:https://coinyuppie.com/bloomberg-businessweek-ethereum-mining-is-about-to-disappear-miners-are-not-happy/

Coinyuppie is an open information publishing platform, all information provided is not related to the views and positions of coinyuppie, and does not constitute any investment and financial advice. Users are expected to carefully screen and prevent risks.

No comments:

Post a Comment