Bloomberg News | March 24, 2023 |

Credit: Polymetal International Plc

Polymetal International Plc may list in Abu Dhabi, becoming the first company with majority Russian operations to trade in the Middle East, as the gold miner re-domiciles from Jersey to Kazakhstan.

Polymetal is in advanced talks with the Abu Dhabi Securities Exchange as keeping its London listing after re-domiciling is proving difficult, according to people familiar with the situation, who asked not to be identified as the matter is private. “We are studying the listing at ADX, but no decision is yet taken,” a spokesman for Polymetal said by email.

The United Arab Emirates is benefiting from Russian money and trade flows since the invasion of Ukraine, leading to Western concerns that it may be helping to ease the impact of sanctions on Moscow. Polymetal is not sanctioned.

Other companies with Russian roots are also looking at listings in the UAE, although they haven’t taken steps toward doing so, two other people said, without naming any of them.

Polymetal, which has its primary listing in London, is studying moving its domicile to Astana, the capital of Kazakhstan, after the Kremlin banned sales of strategic assets by owners in jurisdictions it considers non-friendly after the invasion of Ukraine. Shifting to a Russia-friendly domicile from Jersey would open the way for Polymetal to pursue a plan it announced last July of splitting its Russian assets — which account for 70% of its sales — from the remainder in Kazakhstan.

Should Polymetal make that change, it would be considered a foreign company in the UK, forcing it to issue depository interest on its shares to keep a London listing. Chief Financial Officer Maxim Nazimok said on March 16 that the miner hadn’t so far managed to find a provider of a depository interest program, and was considering a Middle East bourse as an alternative. It would also have a listing in Kazakhstan.

The trading of shares and depository receipts of Russian companies in London and New York was suspended last year.

(With assistance from Ben Bartenstein)

Russia says gold stash grew during war, lifting veil on reserves

Bloomberg News | March 22, 2023 |

(Image from Vladimir Putin’s website)

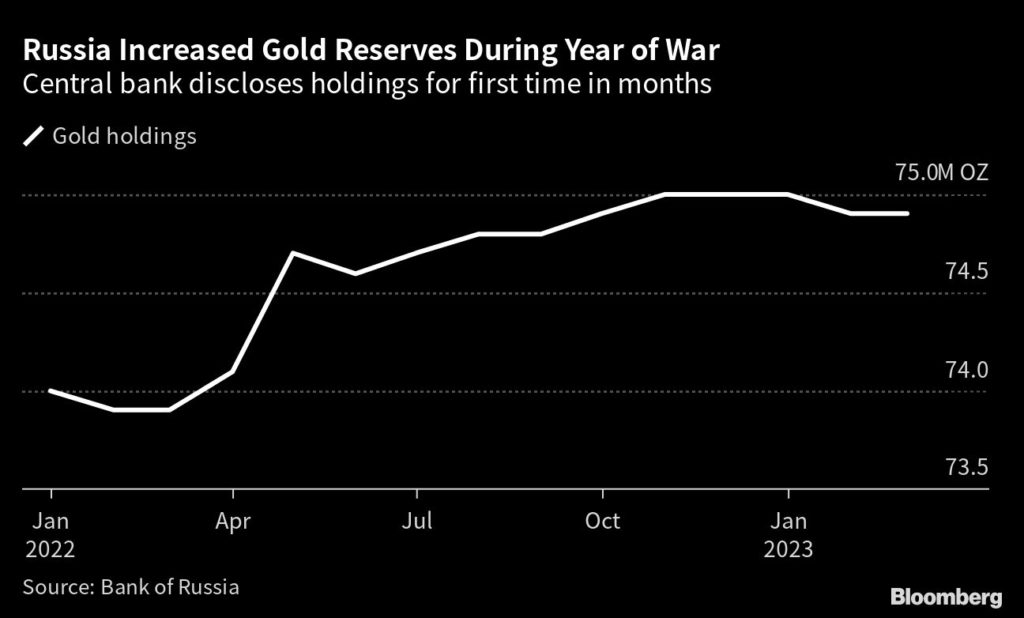

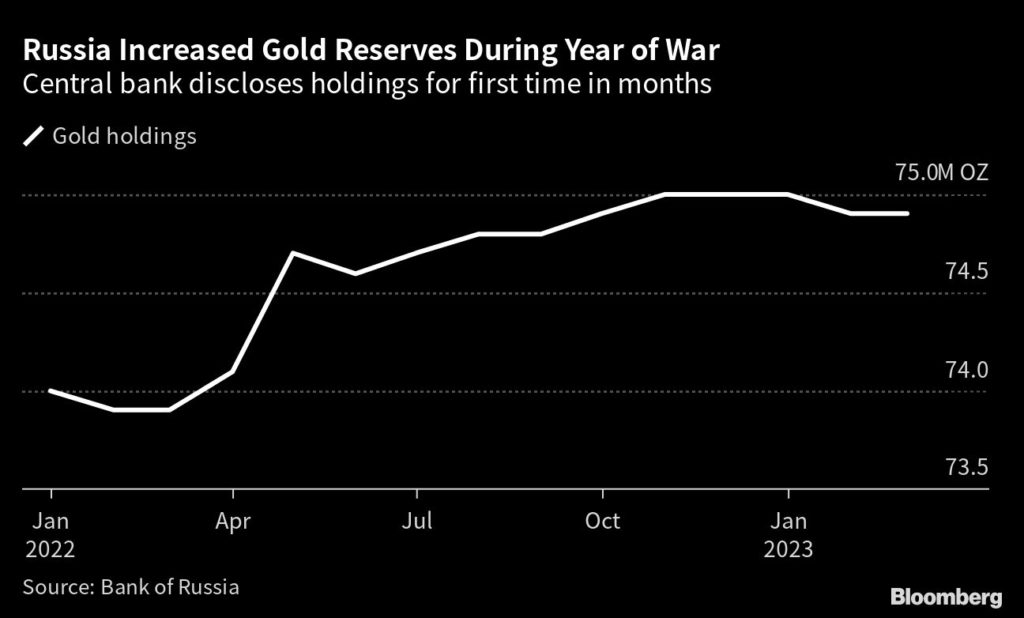

Russia’s gold holdings jumped by 1 million troy ounces over the last year as the central bank bought the metal amid sanctions on its reserves imposed by the US and its allies over the invasion of Ukraine.

The Bank of Russia said it held 74.9 million ounces of gold at the end of February, unchanged from the previous month and up from 73.9 million a year earlier. Over the same period, total holdings of foreign exchange and gold dropped to $574 billion from $617 billion.

The gold hoard was worth $135.6 billion on Feb. 28, 2023, the central bank said.

The disclosure came as Russia has gradually resumed release of some economic indicators it stopped issuing publicly last year in the wake of the sanctions. Russia has the world’s second-highest gold mine output and its central bank has for years been among the biggest buyers globally.

But Russia’s bullion has been shut out of western markets since an import ban in June. Local producers, who previously shipped most of their metal to London, were forced to find new customers in Asia.

Bloomberg News | March 22, 2023 |

(Image from Vladimir Putin’s website)

Russia’s gold holdings jumped by 1 million troy ounces over the last year as the central bank bought the metal amid sanctions on its reserves imposed by the US and its allies over the invasion of Ukraine.

The Bank of Russia said it held 74.9 million ounces of gold at the end of February, unchanged from the previous month and up from 73.9 million a year earlier. Over the same period, total holdings of foreign exchange and gold dropped to $574 billion from $617 billion.

The gold hoard was worth $135.6 billion on Feb. 28, 2023, the central bank said.

The disclosure came as Russia has gradually resumed release of some economic indicators it stopped issuing publicly last year in the wake of the sanctions. Russia has the world’s second-highest gold mine output and its central bank has for years been among the biggest buyers globally.

But Russia’s bullion has been shut out of western markets since an import ban in June. Local producers, who previously shipped most of their metal to London, were forced to find new customers in Asia.

No comments:

Post a Comment