Shameless spin can’t excuse the burgeoning boondoggle and ‘global warming machine’ called TMX.

Andrew Nikiforuk

Today

TheTyee.ca

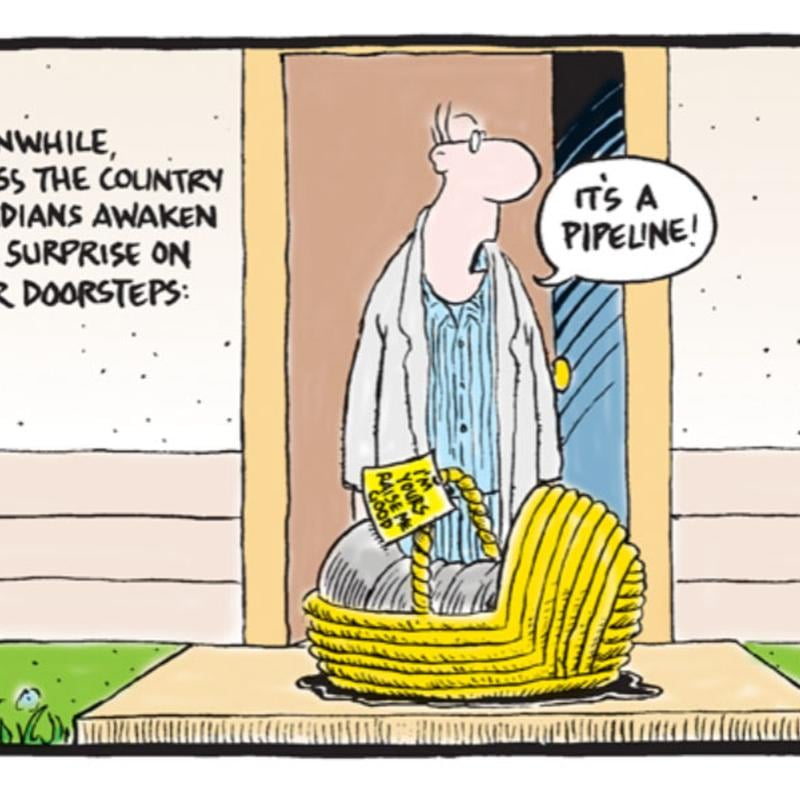

Vancouverites protesting in 2018 after Trudeau pledged $4.5 billion to buy Kinder Morgan’s Trans Mountain pipeline expansion. The public cost has leapt to $30.9 billion.

Photo by Darryl Dyck via the Canadian Press.

Well, the transfer of billions of dollars from ordinary Canadians to wealthy oil companies continues unabated.

The cost of the obscenely over-budget Trans Mountain pipeline expansion, as The Tyee predicted last fall, has increased again by a whopping 44 per cent from $21.4 billion to now $30.9 billion.

Brace yourself. The costs will likely go higher because the twinning of the 980-kilometre-long pipeline, which will transport bitumen from Edmonton to Burnaby, is only 80 per cent complete.

The Trans Mountain Corp., of course, blamed the cost overruns on the usual suspects: global inflation, supply chain challenges and get this, “challenging terrain and geography.”

The Tyee is supported by readers like you Join us and grow independent media in Canada

Back in 2019 even the Canada Investment Development Corp. which oversees the Trans Mountain Corp., recognized that the costs for a highly risky pipeline expansion could be a runaway train due to “difficult terrain” and “risks of cost overruns.”

Robyn Allan, the brilliant independent economist who predicted this sorry debacle, wasn’t impressed by the corporation’s latest revelations:

“This is nothing short of a disaster and it continues to shock me that Ottawa can present a boondoggle as good for the economy, and a global warming machine as something Canadians should be happy to pay for,” said Allan, who headed the Insurance Corp. of British Columbia.

If you’ve lost track of the cost overruns, consider this brief chronology:

In 2013 Kinder Morgan first promised to twin the pipeline for $5.4 billion. When project costs escalated, it bailed and sold to the Canadian government in 2018.

Trudeau then promised to build the project for $7.4 billion. That figure, as Allan warned, soon ballooned to $12.6 billion in 2020. Last year it climbed to $21.4 billion. It now stands at $30.9 billion and counting.

“All the while Alberta’s oil producers capture the financial gain through subsidized tolls without any accountability or apology,” noted Allan.

The Canadian Taxpayer Federation, a group whose financial support and membership are murky but presents itself in the media as defender of the public purse, is supposed to raise hell about such blatant fiascos. Yet is has hardly said boo about this particular hemorrhaging of public funds.

But Allan has spoken doggedly. She repeatedly warned that the controversial mega-project was never financially viable and that’s the real reason why Kinder Morgan, an indebted Texas company, shrewdly sold the project to the Trudeau government which did not do its due diligence.

She also argued that if bitumen companies such as Suncor and Cenovus wanted to expand the pipeline then they should have shouldered the risk and financed it themselves. Where’s free enterprise when you need it?

But why would bitumen miners do that if a gullible government not only buys and constructs the damn expansion for you, but offers to subsidize tolls, setting them so low that no reasonable cost recovery can take place in our lifetimes?

Allan isn’t the only one who has warned about the project’s failings.

The Institute for Energy Economics and Financial Analysis also concluded last year that Canadians would never see a return on their billions because the tolls have been set too low to ever recover costs.

The Office of the Parliamentary Budget Officer was just as blunt in its 2022 report. Given escalating costs, it concluded that “the government’s 2018 decision to acquire, expand, operate and eventually divest of the Trans Mountain assets will result in a net loss for the federal government.”

Last year an exasperated Allan wrote another detailed report on rising losses for taxpayers. It was published by West Coast Environmental Law.

“I knew there would be a further jump in construction costs, and let’s be clear, the main reason for this outrageous increase is gross project mismanagement from Trans Mountain, CDEV and the federal government,” Allan told The Tyee.

“An almost 45 per cent jump is staggering when you consider that the project was well underway and hence costs should have been relatively locked in when Trans Mountain announced last year they had skyrocketed to $21.4 billion,” she said.

In making its bad news announcement on March 10 (a Friday of course), the Trans Mountain Corp. tried to soften the blow by offering “an economic impact assessment” by the accounting firm Ernst & Young LLP.

Before we open the glowing five-page report, readers should know that Ernst & Young is one of the Big Four firms who do accounting for governments and corporations around the world.

You should also know that it was recently the accountant for three major firms: NMC Healthcare, United Arab Emirates’ largest private health-care provider; Luckin Coffee Inc., China’s largest coffee chain; and Wirecard, a German payments company. Despite glowing reports from Ernst & Young, all three companies exploded in major financial scandals.

What’s at Stake with the Trans Mountain Pipeline Expansion?

Well, the transfer of billions of dollars from ordinary Canadians to wealthy oil companies continues unabated.

The cost of the obscenely over-budget Trans Mountain pipeline expansion, as The Tyee predicted last fall, has increased again by a whopping 44 per cent from $21.4 billion to now $30.9 billion.

Brace yourself. The costs will likely go higher because the twinning of the 980-kilometre-long pipeline, which will transport bitumen from Edmonton to Burnaby, is only 80 per cent complete.

The Trans Mountain Corp., of course, blamed the cost overruns on the usual suspects: global inflation, supply chain challenges and get this, “challenging terrain and geography.”

The Tyee is supported by readers like you Join us and grow independent media in Canada

Back in 2019 even the Canada Investment Development Corp. which oversees the Trans Mountain Corp., recognized that the costs for a highly risky pipeline expansion could be a runaway train due to “difficult terrain” and “risks of cost overruns.”

Robyn Allan, the brilliant independent economist who predicted this sorry debacle, wasn’t impressed by the corporation’s latest revelations:

“This is nothing short of a disaster and it continues to shock me that Ottawa can present a boondoggle as good for the economy, and a global warming machine as something Canadians should be happy to pay for,” said Allan, who headed the Insurance Corp. of British Columbia.

If you’ve lost track of the cost overruns, consider this brief chronology:

In 2013 Kinder Morgan first promised to twin the pipeline for $5.4 billion. When project costs escalated, it bailed and sold to the Canadian government in 2018.

Trudeau then promised to build the project for $7.4 billion. That figure, as Allan warned, soon ballooned to $12.6 billion in 2020. Last year it climbed to $21.4 billion. It now stands at $30.9 billion and counting.

“All the while Alberta’s oil producers capture the financial gain through subsidized tolls without any accountability or apology,” noted Allan.

The Canadian Taxpayer Federation, a group whose financial support and membership are murky but presents itself in the media as defender of the public purse, is supposed to raise hell about such blatant fiascos. Yet is has hardly said boo about this particular hemorrhaging of public funds.

But Allan has spoken doggedly. She repeatedly warned that the controversial mega-project was never financially viable and that’s the real reason why Kinder Morgan, an indebted Texas company, shrewdly sold the project to the Trudeau government which did not do its due diligence.

She also argued that if bitumen companies such as Suncor and Cenovus wanted to expand the pipeline then they should have shouldered the risk and financed it themselves. Where’s free enterprise when you need it?

But why would bitumen miners do that if a gullible government not only buys and constructs the damn expansion for you, but offers to subsidize tolls, setting them so low that no reasonable cost recovery can take place in our lifetimes?

Allan isn’t the only one who has warned about the project’s failings.

The Institute for Energy Economics and Financial Analysis also concluded last year that Canadians would never see a return on their billions because the tolls have been set too low to ever recover costs.

The Office of the Parliamentary Budget Officer was just as blunt in its 2022 report. Given escalating costs, it concluded that “the government’s 2018 decision to acquire, expand, operate and eventually divest of the Trans Mountain assets will result in a net loss for the federal government.”

Last year an exasperated Allan wrote another detailed report on rising losses for taxpayers. It was published by West Coast Environmental Law.

“I knew there would be a further jump in construction costs, and let’s be clear, the main reason for this outrageous increase is gross project mismanagement from Trans Mountain, CDEV and the federal government,” Allan told The Tyee.

“An almost 45 per cent jump is staggering when you consider that the project was well underway and hence costs should have been relatively locked in when Trans Mountain announced last year they had skyrocketed to $21.4 billion,” she said.

In making its bad news announcement on March 10 (a Friday of course), the Trans Mountain Corp. tried to soften the blow by offering “an economic impact assessment” by the accounting firm Ernst & Young LLP.

Before we open the glowing five-page report, readers should know that Ernst & Young is one of the Big Four firms who do accounting for governments and corporations around the world.

You should also know that it was recently the accountant for three major firms: NMC Healthcare, United Arab Emirates’ largest private health-care provider; Luckin Coffee Inc., China’s largest coffee chain; and Wirecard, a German payments company. Despite glowing reports from Ernst & Young, all three companies exploded in major financial scandals.

What’s at Stake with the Trans Mountain Pipeline Expansion?

READ MORE

The British High Court of Justice, which awarded $11 million to an Ernst & Young company whistleblower in a related lawsuit in 2020, noted that EY’s conduct put the firm “in breach of the principles of integrity, objectivity and professional behaviour.”

Last year the U.S. Securities and Exchange Commission fined the company $100 million for more fraudulent behaviour.

“It’s simply outrageous that the very professionals responsible for catching cheating by clients cheated on ethics exams of all things,” said the SEC director of the enforcement division, Gurbir S. Grewal. “And it’s equally shocking that Ernst & Young hindered our investigation of this misconduct.”

The U.S. National Whistleblower Center recently concluded that the globe’s Big Four auditors including Ernst & Young had “little incentive to stay competitive by demonstrating effective auditing abilities.”

So that’s a bit of background on the accountant Trans Mountain hired to produce an “independent” report.

The Trans Mountain Boondoggle: Taxpayers Lose Billions, Oil Companies Win

The British High Court of Justice, which awarded $11 million to an Ernst & Young company whistleblower in a related lawsuit in 2020, noted that EY’s conduct put the firm “in breach of the principles of integrity, objectivity and professional behaviour.”

Last year the U.S. Securities and Exchange Commission fined the company $100 million for more fraudulent behaviour.

“It’s simply outrageous that the very professionals responsible for catching cheating by clients cheated on ethics exams of all things,” said the SEC director of the enforcement division, Gurbir S. Grewal. “And it’s equally shocking that Ernst & Young hindered our investigation of this misconduct.”

The U.S. National Whistleblower Center recently concluded that the globe’s Big Four auditors including Ernst & Young had “little incentive to stay competitive by demonstrating effective auditing abilities.”

So that’s a bit of background on the accountant Trans Mountain hired to produce an “independent” report.

The Trans Mountain Boondoggle: Taxpayers Lose Billions, Oil Companies Win

READ MORE

The report defies belief. It tells you that the spending of $30 billion worth of tax dollars has paid for lots of wages, created jobs and contributed to the GDP. Therefore, we should all be happy.

Stunningly, the report does not mention the history of persistent cost overruns or lack of cost controls. Apparently there are no accounting issues when a government promises that it will build a pipeline for $7.4 billion and then ends up spending more than $30 billion on the sucker.

No private firm would consider such shoddy budgeting a glorious achievement for spending on wages and jobs.

Tellingly the EY report makes no mention of multibillion liabilities in Canada bitumen mines.

The pipeline will expand mining in the tarsands and thereby accelerate the production of toxic mining waste stored in more than 300 square kilometres of tailing ponds that have been leaking into groundwater and the Athabasca River for decades.

Cleaning up this deadly waste and other infrastructure will officially cost $33 billion and other credible calculations put the real figure closer to $130 billion. But industry has only set aside $1 billion for the job as of September 2022.

Canada’s Dirty $20-Billion Pipeline Bailout

The report defies belief. It tells you that the spending of $30 billion worth of tax dollars has paid for lots of wages, created jobs and contributed to the GDP. Therefore, we should all be happy.

Stunningly, the report does not mention the history of persistent cost overruns or lack of cost controls. Apparently there are no accounting issues when a government promises that it will build a pipeline for $7.4 billion and then ends up spending more than $30 billion on the sucker.

No private firm would consider such shoddy budgeting a glorious achievement for spending on wages and jobs.

Tellingly the EY report makes no mention of multibillion liabilities in Canada bitumen mines.

The pipeline will expand mining in the tarsands and thereby accelerate the production of toxic mining waste stored in more than 300 square kilometres of tailing ponds that have been leaking into groundwater and the Athabasca River for decades.

Cleaning up this deadly waste and other infrastructure will officially cost $33 billion and other credible calculations put the real figure closer to $130 billion. But industry has only set aside $1 billion for the job as of September 2022.

Canada’s Dirty $20-Billion Pipeline Bailout

READ MORE

Why wouldn’t Ernst & Young mention the pipeline’s connection to that inconvenient liability?

“The EY report is nothing short of silly,” concludes Allan. “It is telling us that if a project goes from $5.4 billion to $30.9 billion somehow this is better for the economy. They should be ashamed.”

The last word, here, should go to Allan. Let’s remember that she warned us that Kinder Morgan wasn’t an honourable player. She warned us that the buyout was scandalous and that the government overpaid for rusty old infrastructure only worth a billion dollars. She also warned us that the tolls had been set too low by so-called regulators. She warned us about rampant cost overruns and other lousy accounting by the Canadian government.

So here’s Allan’s bottom line, and don’t say you weren’t told. “Trans Mountain is not profitable or commercially viable so by definition it cannot have a positive impact and represents a huge taxpayer-funded economic drain.

“It doesn’t matter how many consultants Ottawa pays to spin a different story. The truth is there is no manner by which this project is a benefit to Canadians or the Canadian economy.”

Why wouldn’t Ernst & Young mention the pipeline’s connection to that inconvenient liability?

“The EY report is nothing short of silly,” concludes Allan. “It is telling us that if a project goes from $5.4 billion to $30.9 billion somehow this is better for the economy. They should be ashamed.”

The last word, here, should go to Allan. Let’s remember that she warned us that Kinder Morgan wasn’t an honourable player. She warned us that the buyout was scandalous and that the government overpaid for rusty old infrastructure only worth a billion dollars. She also warned us that the tolls had been set too low by so-called regulators. She warned us about rampant cost overruns and other lousy accounting by the Canadian government.

So here’s Allan’s bottom line, and don’t say you weren’t told. “Trans Mountain is not profitable or commercially viable so by definition it cannot have a positive impact and represents a huge taxpayer-funded economic drain.

“It doesn’t matter how many consultants Ottawa pays to spin a different story. The truth is there is no manner by which this project is a benefit to Canadians or the Canadian economy.”

Tyee contributing editor Andrew Nikiforuk is an award-winning journalist whose books and articles focus on epidemics, the energy industry, nature and more.

No comments:

Post a Comment