China, Brazil Lead in Chipping Away at U.S. Economic Power Abroad

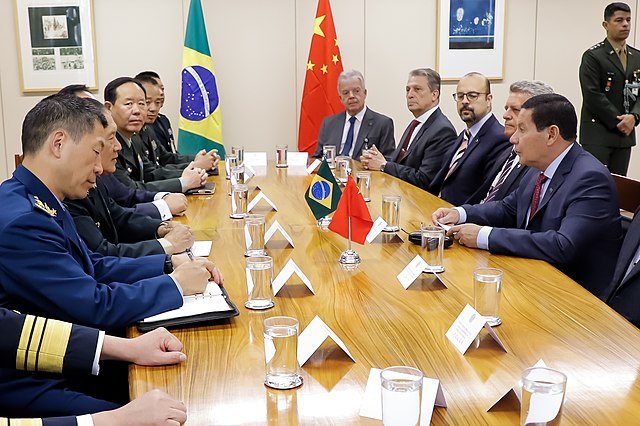

Photograph Source: Palácio do Planalto – CC BY 2.0

The United States proclaimed the Monroe Doctrine 200 years ago and ever since has arranged Latin American and Caribbean affairs to its advantage. Nevertheless, struggles for national and regional independence did continue and the poor and marginalized classes did resist. Eventually there would be indigenous movements, labor mobilizations, and progressive and socialist-inclined governments. Cuba’s revolutionary government has endured for 63 years.

The U.S. political hold may have weakened, but U.S. control over the region’s economies remains strong; after World War II it extended worldwide. Now cracks are showing up. In particular, the U.S. dollar’s role as the world economy’s dominant currency may have run its course.

In 1944, 44 allied nations determined that the value of their various currencies would correlate with the value of the U.S. dollar instead of the value of gold. The nations since then have relied on the U.S. dollar for their reserve currencies, for foreign trade and in banking transactions.

There seemed to be good reason. The United States was supreme in producing and marketing goods and so, presumably, the dollar’s value would remain stable and predictable. The dollar would be readily accessible to bankers and traders and its valuation would be unambiguous. Nations could also build their currency reserves through the dollars they accumulated in the form of bonds sold by an increasingly indebted United States.

The United States has benefited. In currency exchanges involving the dollar, U.S. companies and individuals experience only minor add-on costs. U.S. importers know that the more the dollar strengthens in value, the less expensive will be products they buy abroad. U.S. borrowing costs overseas are relatively low because U.S. bonds, and the investments they represent in dollars, are appealing abroad, for a variety of reasons.

Dollar dominance has caused pain abroad. Exporters to the United States take a hit when the exchange value of the dollar weakens. Importers of U.S. goods are hurt when the dollar strengthens.

Most importantly, the U.S. government gains an opening to punish enemy countries through their use of dollars in international transactions. It imposes economic sanctions requiring that dollars not be used in a targeted country’s overseas transactions. The U.S. Treasury Department penalizes foreign banks and companies that disobey. Sanctioned nations have included Cuba, Iran, North Korea, Syria, Venezuela, Nicaragua, and more recently, China and Russia.

The U.S. government’s frequent resort to economic sanctions has greatly contributed to new stirrings on behalf of a new international currency system. Confiscation of currency reserves deposited in U.S. and European banks that belong to Iran, Venezuela, and Afghanistan have likewise encouraged calls for change.

On March 29 China and Brazil announced they would use their own currencies in trading with each other. China is Brazil’s biggest trade partner. China’s renminbi currency presently constitutes a major share of Brazil’s currency reserves.

Earlier in 2023, Brazil and Argentina proposed cooperation toward creating a common currency for themselves. At the January meeting of the Community of Latin American and Caribbean States (CELAC), Brazilian President Lula da Silva opined that, “If it were up to me, I would promote a single currency for the region.” He would call it the “SUR” (South). The ALBA regional alliance in 2009 proposed an electronic currency called the “Sucre” aimed at reducing dollar dependency.

Former Brazilian President Dilma Rousseff is the recently named head of the New Development Bank which, headquartered in Shanghai, serves the BRICS nations (Brazil, Russia, India, China, and South Africa). The bank represents an alternative to the U.S. -dominated International Monetary Fund and the World Bank.

The shift away from dollar dependency is evident elsewhere.

At a Russian-Indian “Strategic Partnership …Forum” recently, a Russian official announced that the BRICS states would be creating a new currency and that the formal announcement would be made at the BRICS summit meeting in Durban South Africa in August.

The BRICS countries account for “40% of the global population and one-fourth of the global GDP.” According to People’s Dispatch, Iran and Saudi Arabia, having recently signed a peace accord, will soon be joining BRICS. Egypt, Algeria, the UAE, Mexico, Argentina, and Nigeria apparently are giving consideration. The values of new currencies will rest not on another currency but on the value of “products, rare-earth minerals, or soil.”

Iran and Russia in January agreed on methods useful for bypassing the SWIFT banking system, the U.S. tool for servicing its dollar dominance. To evade U.S. sanctions, the two countries reply on their own currencies for most transactions.

At their summit in March, Russian and Chinese leaders reiterated their intention to expand bilateral trade and utilize their own currencies. China increasingly is using its own currency in transactions with Asian, African, and Latin American countries. The yuan “has become the world’s fifth-largest payment currency, third-largest currency in trade settlement and fifth-largest reserve currency,” according to Global Times.

Saudi Arabia is on the verge of selling oil and natural gas in currencies other than the dollar, and China occasionally pays Arabian Gulf nations in yuan for those products.

The finance ministers and governors of the central banks of the member states of the Association of Southeast Asian Nations (ASEAN) met in Indonesia on March 28. At the top of their agenda were “discussions to reduce dependence on the US Dollar, Euro, Yen, and British Pound from financial transactions and move to settlements in local currencies”. The ASEAN nations, an alliance of 10 southeast Asian nations, are developing a digital payment system for member states’ transactions.

Dollar dominance may be losing its appeal closer to home. Former Goldman Sachs chief economist Jim O’Neill claims that, The U. S. dollar plays a far too dominant role in global finance … Whenever the Federal Reserve Board has embarked on periods of monetary tightening, or the opposite, loosening, the consequences on the value of the dollar and the knock-on effects have been dramatic.”

Gillian Tell, chair of the Financial Times’ editorial board notes that, “concerns are afoot that this month’s US banking turmoil, inflation and looming debt ceiling battle is making dollar-based assets less attractive.” Plus, “a multipolar pattern could come as a shock to American policymakers, given how much external financing the US needs.”

There are wider implications. Argentinian economist Julio Gambina bemoans “disorder in the world economy …[and] this attitude of unilateralism represented by the US sanctions.” Interviewed on March 29, Gambina points out that “wealth has a father and a mother: labor and nature.”

He adds that, “Latin America and the Caribbean … where inequality is growing the most … have a highly skilled working class, willing to carry forward the production of wealth. We have the resource of assets held in common for sovereign development through which the interests of our peoples and the reproduction of nature, life and society are defended.”

No comments:

Post a Comment