Resources - innovative ideas and engaging stories in environmental economics

BEIA SPILLER AND MICHAEL A. TOMAN

NAMLONG NGUYEN / SHUTTERSTOCK

Date

AUG. 30, 2023

Insights for how the United States can approach secure and affordable access to the critical minerals that are needed for electric vehicle production, from a recent workshop held at Resources for the Future.

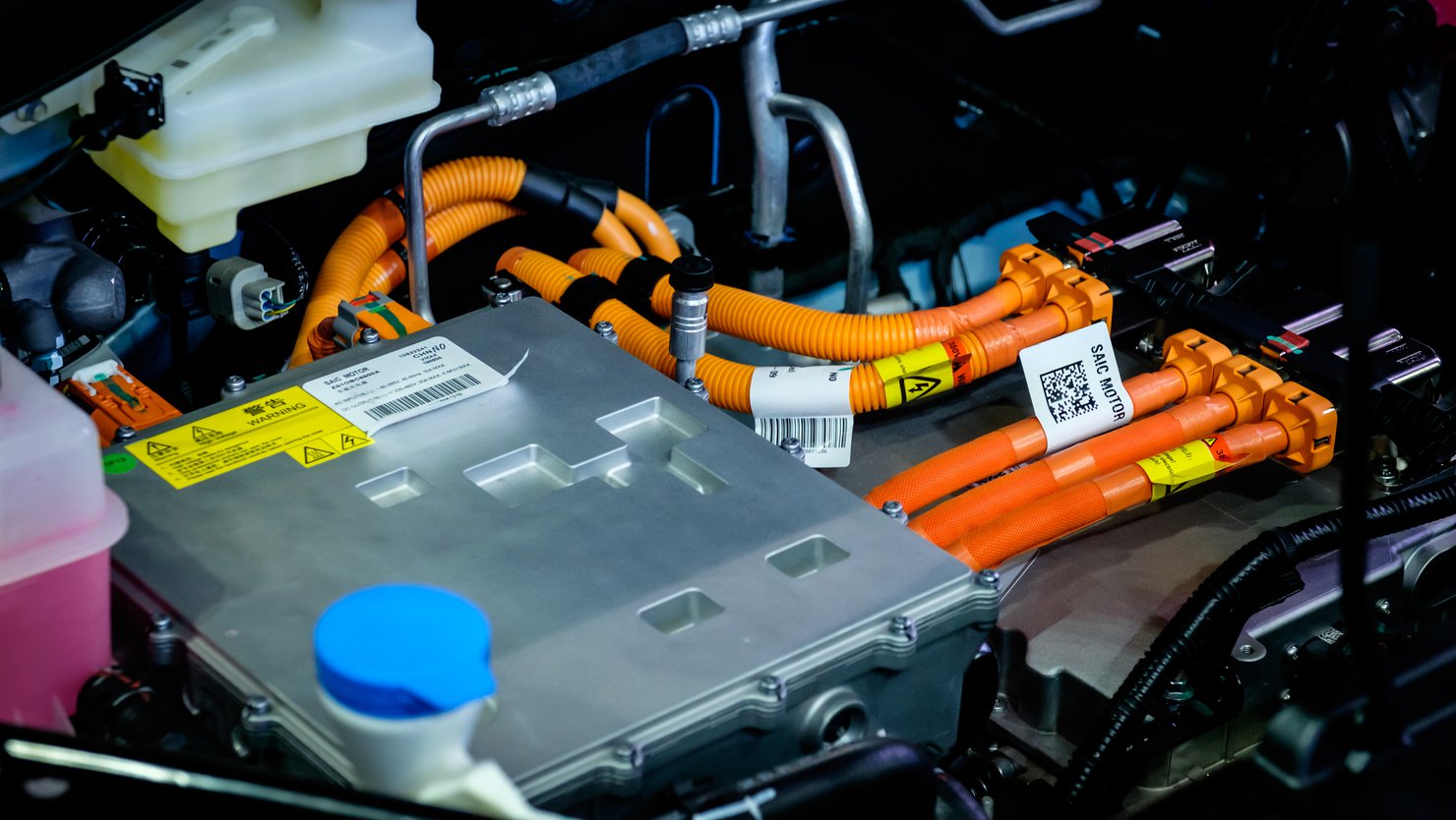

As the move to electrify the vehicle fleet picks up steam, concern has been growing that critical minerals, the key inputs into electric vehicle (EV) batteries, will become a bottleneck. Copper, recently identified as a critical material, also will be needed for the charging infrastructure.

Several questions have moved to the forefront of discussion around vehicle electrification: Will critical mineral shortages restrict battery production? Will the costs of critical minerals rise so much that batteries, and thus EVs, become too expensive? How might environmental, social, and geopolitical concerns associated with these minerals be mitigated?

In July 2023, Resources for the Future held a closed-door workshop with over 20 stakeholders from government, nongovernmental organizations, academia, and the mineral and automotive industries to discuss many of these challenges, uncover areas of agreement and disagreement on these issues, and identify questions that need more research. The workshop covered topics such as supply chains, security, permitting, policies for promoting the supply of domestic critical minerals, and strategies for improving the flexibility of demand for critical minerals. In this blog post, we discuss some high-level takeaways from the meeting.

Data Availability

Data will be necessary for researchers to study these issues, yet data on critical minerals—particularly around their supply chains—are sparse. The US Geological Survey National Minerals Information Center (USGS NMIC) is the most comprehensive and reliable source of publicly available information on non-fuel minerals. For more than 80 different mineral commodities, NMIC publishes domestic and international information on a multitude of issues such as mineral reserves, processing, demand, prices, and ownership. Yet, more information is needed to adequately understand mineral markets and supply chains. To address these needs, past National Research Council committees have recommended that NMIC be organized in a similar way as the US Energy Information Agency, with comparable resources, authority, and autonomy.

Further, although the US government knows and reports the amounts of minerals that are extracted from state lands, an information gap exists for federal lands because royalties are collected from state lands but not federal lands. This knowledge gap limits an understanding of the potential future supply of critical minerals on federal lands—an important consideration for addressing permitting issues.

Ownership of mines and processing facilities worldwide also is important for evaluating the global market power of large suppliers that co-finance and co-own international and domestic sources of critical minerals. As mentioned above, USGS tries to track this information, but ownership changes rapidly, so the data are incomplete.

Sergii Chernov / Shutterstock

The pricing of critical minerals also is difficult to unravel. Although some spot transactions happen, China plays a large role in pricing, given that China is the origin of most of the global supply of processed minerals for EV batteries. Because pricing is not transparent, it is difficult to judge how competitive pricing might be and how changes in supply or demand would affect prices.

Finally, publicly available data on permitting are sparse, which makes it hard to construct and assess policies to improve the permitting process. Workshop participants agreed that long wait times are involved in fully permitting and setting up a mine in the United States, but what proportion of that time is due to the permitting process itself remains unclear. Several agencies at different levels of government are involved in permitting, and comprehensive data on permitting processes have not been compiled. Although anecdotes suggest that the United States takes longer to permit mines than other comparable countries, the data on wait times are too limited for us to draw any firm conclusions. Some participants thought that these permitting issues are not unique to the United States but also arise in other developed countries that enact significant protections for the environment and communities.

Accelerating Domestic Supplies of Critical Minerals

Workshop participants agreed that increasing the domestic capacity for extracting and processing critical minerals is an important goal. However, views differed on the extent to which that ramp-up could significantly increase the availability of cost-competitive supplies. Two key issues underlie the disagreements among participants.

First, the United States currently produces very small amounts of the critical minerals that are needed for EV batteries, and USGS statistics show only limited available quantities of critical mineral reserves. The small supply raises questions about US capability to significantly ramp up production in the near to medium term. Participants who disagreed with that perspective argued that US reserves could be much larger if mining exploration were less impeded by federal land use regulations, a perspective that was contested by other participants.

Second, even if more domestic resources were discovered, many participants thought that existing policies will have only a limited effect on increasing domestic extraction. For example, the EV tax credits in the Inflation Reduction Act require the minerals in the batteries to come from domestic sources or from countries with which the United States has free trade agreements; however, several workshop participants thought that these credits were not a very powerful incentive for new critical mineral exploration and mining in the United States.

The workshop participants agreed that stakeholder opposition has been a major part of the delays in permitting and opening new mines in the United States. Recent research has demonstrated that the majority of domestic reserves are located within 35 miles of Native lands. This observation underscores that any successful ramp-up in critical minerals exploration and extraction will require early, consistent, credible, transparent, and equitable community and stakeholder engagement. Understanding the concerns of local communities and ensuring that community members are part of the planning process will be key to developing plans that reduce impacts and achieve equitable outcomes. Additional objective data on the mining sector’s uptake of best practices for community engagement in advance of new projects also would be useful.

Nontraditional opportunities to increase domestic supplies exist, such as increasing the recovery of critical minerals as byproducts of other mining activity, extracting from existing wastes, and expanding recycling. However, at present, these options are not cost-competitive. Moreover, the volumes of material currently available for recycling are too small relative to the large initial capital costs necessary for setting up recycling. Investments in research and development (R&D) that reduce the costs of accessing these sources would be valuable for increasing domestic capacity.

Insecurity of Critical Mineral Supplies

USGS data show that China currently has a significant market share in extracting and a dominant share in processing the critical minerals that are used in EV batteries. Workshop participants agreed that this market concentration poses risks to the ability of the United States to secure affordable and reliable critical mineral supplies for expanded battery production. For example, China recently withheld graphite exports to Sweden, and workshop participants suggested that this sanction was a geopolitical strategic response to Sweden’s decision to join the North Atlantic Treaty Organization. Officials in China have threatened to withhold or ban exports of rare earth elements to the United States in retaliation against sanctions; China took a similar action in 2010 in response to a territorial dispute with Japan, which caused prices to increase steeply.

A mining facility in Australia. Alf Manciagli / Shutterstock

Workshop participants suggested policies to deal with such insecurity, though each potential solution has its own challenges. For example, the United States and other large importers could jointly limit dependence on imports from “countries of concern.” However, this approach would create a similar upward price pressure as export restrictions. The US government alternatively could subsidize domestic processing, to establish an alternative to Chinese processing of critical minerals. Subsidies likely would be needed to attain cost-competitiveness with China. However, the subsidies might need to continue for an extended period, which would be costly and could stifle technical innovation in the sector. Moreover, the United States faces workforce scarcities for these activities. As noted, nontraditional sources could be tapped for critical minerals, but those options likely will require significant R&D spending to make them cost-competitive.

Given the various obstacles to addressing critical mineral insecurity through supply-side measures, a crucial consideration will be to leverage technological innovation to diversify EV battery designs, especially designs that economize on critical minerals that are more scarce or less reliably supplied. A current example is the increased use of batteries without cobalt (though such batteries have lower range). Having more battery design options increases the flexibility of demand for critical minerals, thus reducing US vulnerability to shortages or high prices. In the short term, flexibility is limited, particularly given the need for vehicle manufacturers to make commitments on vehicle design to accommodate particular battery technologies. However, R&D funding could be used to diversify battery chemistries, thus providing EV and battery manufacturers with additional options for addressing possible disruptions in the supply of specific critical minerals. The cost of the necessary R&D needs to be weighed against the benefits of having a larger number of options available for battery chemistry that depend less, or not at all, on critical minerals that are scarcer or more unreliably supplied.

Implications

Ensuring a smooth transition to an electrified vehicle fleet will require a significant effort to overcome the potential bottlenecks created by critical minerals. As we learned in our recent workshop, these challenges are complex and will require coordinated attention from a variety of stakeholders, including federal and state policymakers, business leaders, academics, and nongovernmental organizations. New policies will need to be developed, and existing policies revisited, to diversify the supply of critical minerals, increase options for EV battery design, reduce risks, keep costs down, and spur innovation.

Another clear conclusion is that the United States can’t do this alone. Overcoming the challenges will require international cooperation. This cooperation can include coordination on R&D policies and on policies for promoting more competitive and transparent markets for critical minerals. In addition, by working to improve environmental and labor outcomes from critical mineral mining and processing in friendly nations (e.g., through the Minerals Security Partnership), and increasing the number of countries with which it has free trade agreements, the United States can promote lower-cost, more secure, and environmentally and socially friendly supply chains for the critical minerals that are used in EV batteries.

RELATED PEOPLE

Beia Spiller

FELLOW; DIRECTOR, TRANSPORTATION PROGRAM

No comments:

Post a Comment