ING: Consumer not ready to change what they eat to help the environment

By wasting less food and eating less meat and dairy, consumers can help to slow down climate change. However, consumers in the EU have barely changed their diets. Emission reduction targets give food companies a reason to encourage consumers to change, but without regulation, the economic incentive to move to a more climate-friendly diet remains weak.

Why changing the way we eat can be a big win for the climate.

According to the Intergovernmental Panel on Climate Change, the food system is responsible for 21% to 37% of total global greenhouse gas emissions. Of course, we all need to eat. But changing the way food is produced and what food is consumed can reduce the negative impact on the climate. Action is clearly needed and at COP28 this year, this subject will be addressed for the first time, with discussions centred on the changes needed to limit the rise in global temperatures to between 1.5 and 2 degrees.

While European consumers are increasingly aware of sustainability issues connected to food, changing actual behaviour remains challenging. That’s why in this article we take a look at how food manufacturers and retailers can influence consumers and what incentives they have to do so.

Consumers and scientists not aligned on most effective ways to make diets more sustainable.

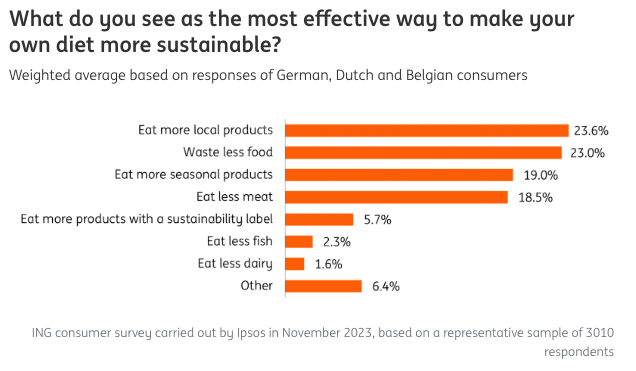

European consumers can do many things to make their diets more sustainable. When we asked about the best approach, German consumers said that ‘eating more local products’ was the most effective route followed by reducing food waste. Dutch and Belgian consumers consider reducing food waste to be the most effective measure. The importance of reducing food waste is also aligned with the view of experts (see for example UN, IPCC). However, consumers tend to give less weight to reducing their consumption of meat and dairy. This is a surprising result since shifting towards a more plant-rich and less animal-rich diet is often considered by scientists and public institutions to be the most effective way for Europeans to reduce the climate impact of their diet.

Meat and dairy consumption largely unchanged.

Meat and dairy are a cornerstone of European diets, providing the majority of our protein and a range of other nutrients. But animal products like beef also account for a disproportionately large share of all food-related greenhouse gas emissions. Meat and dairy companies are very aware of this and are increasingly adopting net zero targets for their own operations and their supply chains in 2050. Yet for the time being, lowering consumption can be another route for consumers to reduce the climate impact of their diet, which also carries health benefits. While there is a certain level of willingness among consumers to reduce meat intake, actual meat consumption per capita in the EU has been fairly stable since the 1990s.

Less beef and pork, more poultry.

Still, there are changes in the type of meat that Europeans eat. Beef and pork consumption in the EU has dropped by 2.5% (beef) and -10% (pork) per capita in the past decade. Poultry consumption is growing (+16.5%) and poultry has a much lower environmental footprint compared to other types of meat. Because of this composition effect, the carbon footprint of a single European person's meat consumption is about 3% lower compared to 10 years ago. Nonetheless, total livestock-related emissions in the EU have been flat since 2010 because improvements in terms of carbon intensity per kilogram have been offset by increases in total production.

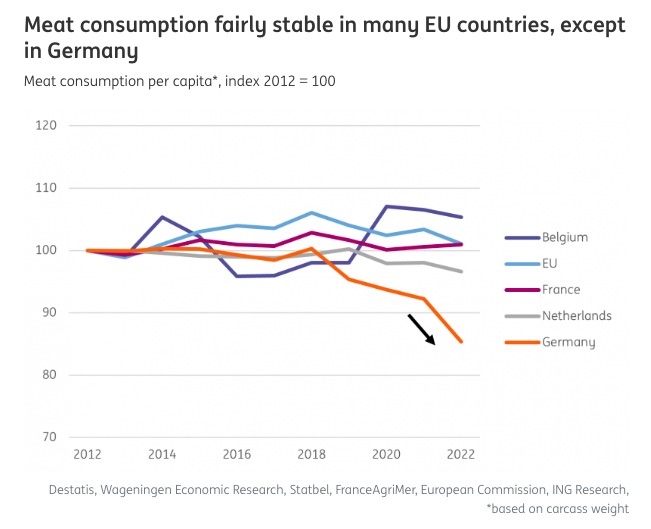

Meat consumption in Germany drops.

Meat consumption data for several countries shows only slight changes during the last decade. The downward trend in Germany since 2018 stands out. This might be explained by a combination of factors such as sustainability considerations, health reasons, inflation, improved availability of alternatives, negative media coverage and demographic changes (meat consumption per capita is generally lower among the elderly and people with a non-western background). However, these factors are not unique to Germany and we should point out that meat remains very popular, including in Germany.

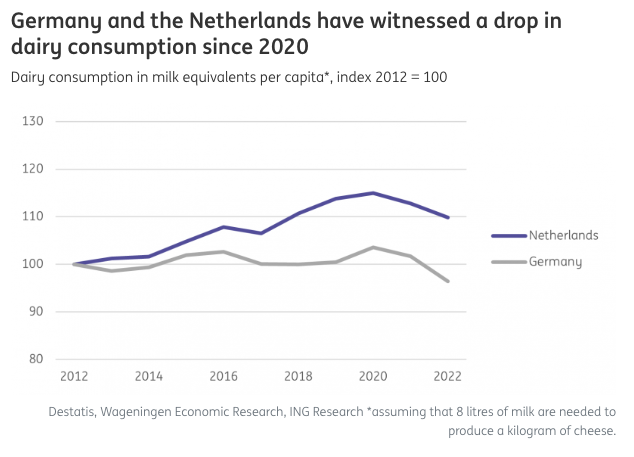

Less milk but more cheese.

EU dairy consumption per capita has gone up during the last decade but seems to have stabilised more recently. Again there are shifts within the category. Consumption of liquid milk has dropped quite significantly in volume terms, for example by 8% in Germany and 12% in the Netherlands over the past 10 years. But at the same time, consumers have started to eat more dairy products, including cheese, which is supportive for milk demand since it requires about eight litres of milk to produce a kilogram of cheese.

For consumers, milk has proven to be one of the easiest animal products to substitute. There are more and more suitable alternatives available and the price gap between milk and plant-based alternatives has become smaller. However, for cheese, which is the favourite animal product for many, substitution has proven to be much harder.

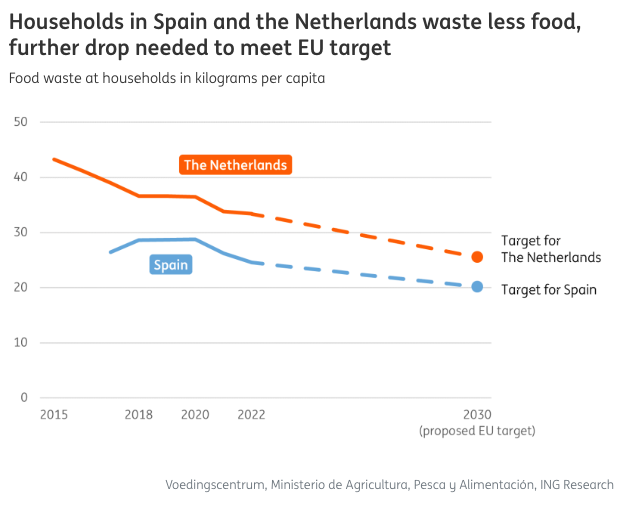

Food waste decreasing, but further declines needed.

Reducing food waste provides another big opportunity to lower the environmental impact of food production and consumption. It’s estimated that almost 60 million tonnes of food waste is generated annually in the EU, with over half occurring within households. Trend data is scarce, but food waste data for Spain and the Netherlands hint at a declining trend. The extraordinary increase in food prices might give households a stronger financial incentive to reduce food waste, but in general, moral considerations (“waste is wrong”) mainly influence our behaviour. Since the EU Commission has proposed that member states should reduce household food waste by 30% in 2030 compared to 2020, it's very likely that additional actions, such as awareness campaigns and tools that enable consumers to change their routines, will be taken. For food companies, a reduction in household food waste aligns with the UN’s sustainable development goals and could help them lower some of their scope 3 greenhouse gas emissions.

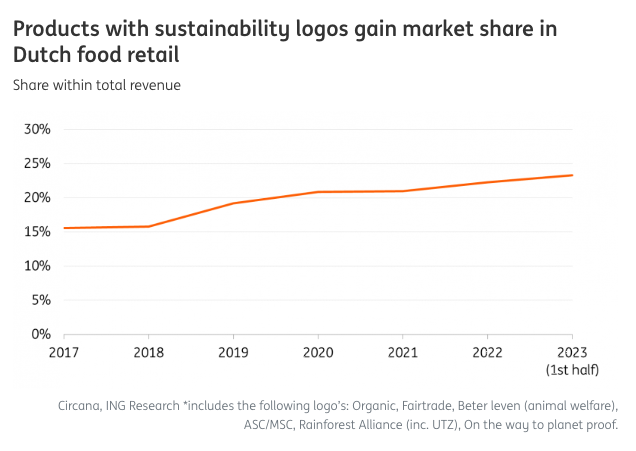

Sales of food products with sustainable logos are booming, Across Europe, the market for food and drink products with sustainable certification is booming. In the Netherlands for example, sales of certified food products have more than doubled in the past five years. They also increased by 50% in the UK between 2016 and 2021. Such certification generally signals that more attention is paid to the environment, labour conditions or animal welfare during production. So it’s not a given that certified products also have a smaller carbon footprint than products without a logo. Certified products are present in every food category, but German, Dutch and Belgian consumers in our survey mainly expressed a higher willingness to pay more for sustainable meat, fruit and vegetables.

But many consumers are not willing to pay a premium.

The sales growth of certified food products indicates that food manufacturers and retailers are succeeding in steering part of consumer spending towards more sustainable products. It is important to note that certified products are not on everyone’s shopping list. For many people, sustainable food needs to be affordable in the first place. Almost one third of all German and half of all Dutch and Belgian consumers in our survey said they were not willing to pay more for sustainable food products in any category. This can be either because they can’t afford to pay extra, don’t trust these claims or don’t see the benefits.

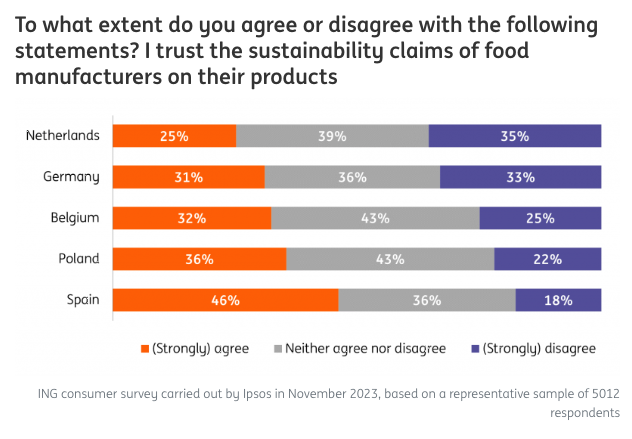

Many consumers tend not to trust sustainability claims on food products.

The increase of (inter)national sustainability-related labels and claims on food products has also attracted criticism. A study from the EU Commission found that 40% of claims on all products, including food, were entirely unsubstantiated. The EU Commission is working on stricter regulation which helps consumers to separate the wheat from the chaff. Our research shows that currently about one in five Spanish and Polish consumers don't trust sustainability claims on food while consumers in Germany and the Netherlands are even more sceptical.

Regulation: tougher on food waste and greenwashing, but hesitant on consumption taxes Because of the share of the food system within total emissions and the far-reaching European ambitions on climate action (the 55% reduction target for the whole economy in 2030 and a recommendation for a 90% reduction target in 2040) it’s very likely that policymakers will closely look at all their instruments to make sure that there is a business case for a rapid reduction in food-related emissions.

Which options do policymakers have? Taxes and levies to deliver external effects These can be targeted at producers or consumers. The EU already has an emission trading system for carbon-intensive sectors and this might be extended to agriculture. Proposals for consumption taxes on certain food products like meat have shown that it can be a challenge to garner public support. Still, it’s not unthinkable that some countries introduce some form of taxation and recent scientific research on meat taxes argues that support can be raised by proper design.

Regulations and norms to raise standards Livestock farmers across the EU face additional (national) environmental regulations that drive up production costs and eventually drive up prices of animal products. The proposed EU targets on food waste and the proposal for the green claims directive are other examples of regulation.

Campaigns to raise awareness among consumers and companies Governments can raise awareness about sustainable diets and the benefits of reducing food waste by initiating campaigns and public-private partnerships.

Subsidies and compensation to stimulate change Governments can provide public funding for R&D, such as research into novel protein sources or carbon sequestration in farmland. For example, Denmark, a large meat and dairy producer and exporter, recently published its national action plan for plant-based foods.

How food manufacturers can take advantage of the need for more sustainable diets.

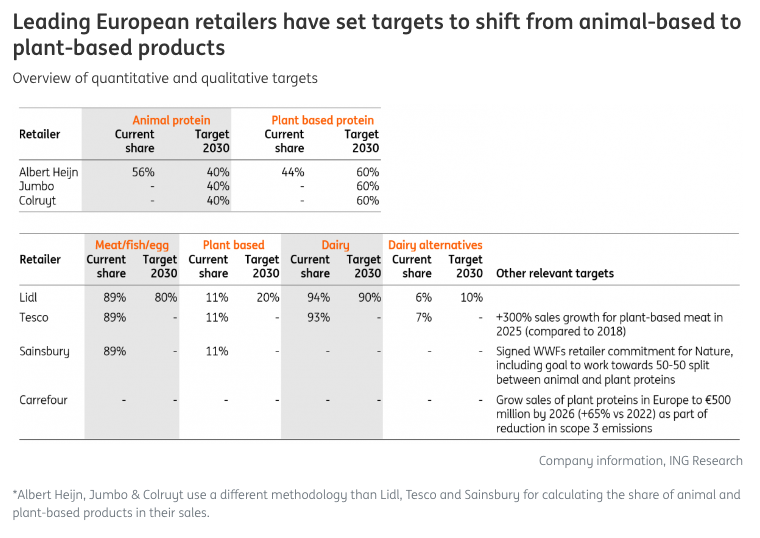

The growth in food products with sustainable logos shows that there are certain aspects of sustainability that consumers value. However, data on meat and dairy consumption shows that consumers often refrain from taking more drastic steps to green their diets. Meanwhile, for retailers, emission reduction targets provide a stronger strategic incentive to get consumers to change. Retailers increasingly consider the carbon footprint of food products an important metric and food manufacturers can do several things to take advantage of this trend.

It starts with establishing the environmental footprint of their products. Besides helping to determine actions to further reduce emissions, this data can also help food makers stand out from their competitors if they do better than the industry average. Furthermore, we expect that calls for a shift between animal- and plant-based categories will continue to influence market dynamics in Europe. Food manufacturers and retailers can do their part by developing and improving plant-based alternatives. But a more profound structural change in the consumption of animal products also depends on the effective use of policy instruments.

Content Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

No comments:

Post a Comment