Shell Backs Out Of Yet Another Floating Offshore Wind Project

Shell will exit another floating offshore wind project, the company said on Thursday—adding another to the long list of departures from the offshore wind segment.

Shell will sell its 80% stake in the 1.25 GW MunmuBaram project in South Korea to its JV partner Hexicon, leaving the latter with a 100% stake in the project, Shell said. The compensation to Shell for the remaining stake in the project will be $5 million in cash, plus another $50 million in the form of a profit-sharing agreement spread over three years, commencing when the project starts.

Shell decided last year to scrap its reduce its oil production by 1 to 2% annually. Shell—along with other major oil companies—have found that transitioning to alternative energies such as wind hasn’t lived up to the hype when it comes to expected returns. Meanwhile, oil continues to prove its mettle in the profit department, helped along, of course, by OPEC’s production cuts and geopolitical turmoil.

Nevertheless, Big Oil has profited more than $250 billion since the start of the Russian/Ukraine war. Of course, that comes after a couple of hard covid-induced years. In fact, according to a recent Global Witness report, the five largest oil companies in the world, BP, TotalEnergies, Exxon, Chevron—and yes, Shell—have distributed some $200 billion among their shareholders.

Wind projects, on the other hand, have suffered a significant blow to its profitability thanks to the skyrocketing costs of raw materials and equipment, and developers are backing out around the globe.

In the United States, for example, even after the Department of the Interior approved in November 2023 large-scale offshore wind power project Empire Wind 2, developers just months later scrapped the project, citing its compromised commercial viability. BP and Equinor booked $840 million in impairments associated with the failed wind project, and Orsted—the world’s largest offshore wind developer—recently took impairment charges worth $4 billion after canceling two offshore wind projects planned off the coast of New Jersey.

By Julianne Geiger for Oilprice.com

Equinor's Empire Wind Project Gets Final Federal Permit

Equinor's Empire Wind 1 and Empire Wind 2 offshore wind projects have received their final federal permitting approval. The decision enables developer Equinor to move forward once it secures a new offtake agreement with the State of New York.

The Empire Wind site is located about 12 nautical miles south of Long Island, and has a capacity potential of up to two gigawatts. It is a linchpin in New York State's plan to achieve net-zero emissions by 2050.

To commercialize Empire Wind, Equinor has asked New York State for a new state offtake agreement. Most offshore wind projects on the U.S. East Coast were designed around prepandemic business conditions, including low inflation, low interest rates and a stable supply chain. Those factors have changed over the past four years, and East Coast offshore wind developers have been canceling or rebidding projects accordingly - like Equinor's Ocean Wind project off New Jersey, which was canceled in a multibillion-dollar loss last year.

Empire Wind has not been immune to these headwinds. One-half of the project, Empire Wind 2, has been delayed indefinitely. Joint backers Equinor and BP terminated Empire Wind 2's state offtake agreement in early January, citing the deep changes in the U.S. offshore wind market. (Empire Wind 1's offtake agreement was not canceled.)

Shortly after, BP and Equinor parted ways in the offshore wind market. Equinor kept control of Empire Wind, and in late January, it rebid the still-active Empire Wind 1 project in a special new state auction round.

If New York State accepts Equinor's new strike price bid for Empire Wind 1, the project could begin construction by the end of this year and deliver its first power to market by 2026. The work on Equinor's future wind port project at South Brooklyn Marine Terminal could start even earlier, within months.

"We are ready to get to work," said Molly Morris, President of Equinor Renewables Americas. "Empire Wind is one step closer to delivering renewable power to hundreds of thousands of New York homes."

Shell Exits Wind Investment Selling South Korea Project to Partner Hexicon

Shell has become the latest major to retreat from its earlier plans for investments in offshore wind development agreeing to sell its majority position in one of South Korea’s largest projects. Investing in the project in 2021, Shell said at the time it viewed offshore wind energy as a key part of a net-zero energy system, but more recently it has sold its investments in wind in favor of other portions of the business.

Under the agreement announced today, Shell will sell its 80 percent stake in South Korea’s MunmuBaram project to partner Hexicon, an early project developer in floating wind, based in Sweden. Hexicon reports that the acquisition is being made possible with support from Glennmont Partners, one of Europe’s largest infrastructure funds focused on clean energy. The company will draw on its loan facility with Glennmont initially paying Shell $5 million to take 100 percent ownership of the MunmuBaram joint venture. The agreement also provides for up to $50 million over three years in profit sharing for Shell.

“South Korea continues to be a leading market with good conditions for the development of floating offshore wind. Through this transaction, South Korea remains a core market for Hexicon and strengthens our position as a leading global developer of floating offshore wind,” says Marcus Thor, CEO of Hexicon.

Hexicon has been working on the project since 2018 and in August 2020 began measurements and data collection at the project location. The joint venture with Shell was launched in September 2021 while the project was still at a feasibility assessment stage. At the time, Shell cited its long history in South Korea, the strong potential for wind energy, and the company’s expansion of activities into floating wind.

“Korea’s capabilities in the fabrication of offshore facilities and shipbuilding could play a pivotal role in the development and fabrication of floating offshore wind foundations not only for Korea but also for the region and beyond,” said Joe Nai, Shell’s General Manager, Offshore Wind Asia announcing the 2021 partnership.

The plan for MunmuBaram calls for approximately 1.125 GW of power generation from the wind farm which will be located off the coast of Ulsan City in the southeastern region of South Korea. In 2022, they proposed 84 wind turbines designating Vestas and its 15 MW turbine as the preferred supplier for the project. At a location 40 to 50 miles off the coast, the topography will require float wind turbines. Hexicon has a patented floating wind design for foundations utilizing two turbines on one platform.

The company has made good progress in South Korea, including receiving the power licenses required to develop the wind farm. They also entered into a tentative offtake agreement for an industrial user. Ulsan is one of the industrial bases of South Korea.

Hexicon reports that South Korea will represent approximately 15 percent of its net portfolio in terms of megawatts.

Shell says it has over 2 GW of offshore wind in operation. It had reported its pipeline and the potential for more than 9 GW. While they continue to hold positions in wind energy in Norway and the UK, Shell has also exited projects including in September 2022 two planned Irish windfarms. After acquiring French floating wind specialist Eolfi in 2019, Shell was reported in May 2023 preparing to sell the company after Wael Sawan became CEO and said Shell would be focusing on creating greater value for shareholders.

Dominion Energy Sells Half Virginia Offshore Wind Farm for $3B to Stonepeak

Dominion Energy has agreed to sell half of its planned Coastal Virginia Offshore Wind project in a move the company reports is designed to reduce its risk profile as the giant wind farm moves into construction. The company will sell a 50 percent noncontrolling interest in a newly formed partnership to Stonepeak, one of the leading U.S. private equity firms that is focused on infrastructure.

Under the terms of the agreement, which requires regulatory approval, the companies would be partners in a newly created public utility that would be a subsidiary of Dominion Energy. The company reports it expects to receive approximately $3 billion representing half the construction costs of the wind farm. Dominion Energy will retain full operational control for the construction and operation of the wind firm with the two companies sharing in the costs.

The Coastal Virginia Offshore Wind farm has completed its permitting and is approved to begin construction which is projected to cost approximately $10 billion. Dominion previously reported that the first components of the wind farm were already being staged in Virginia with the major contracts awarded for the project which they report remains on schedule and budget. There are provisions in the agreement for cost overruns above $11.3 billion.

The wind farm, which will be located offshore near Virginia Beach, will be one of the largest completed in the United States. The plan calls for 176 turbines and three offshore substations in a nearly 113,000-acre lease area. When completed in late 2026, it will have the capacity to provide 2.6 GW.

"A competitive partnership process attracted high-quality interest resulting in a compelling partner for CVOW,” said Robert Blue, Dominion Energy chair, president and chief executive officer. “Stonepeak is one of the world's largest infrastructure investors with more than $61 billion in assets under management and an extensive track record of investment in large and complex energy infrastructure projects including offshore wind. Their significant financial participation will benefit both our project and our customers.”

Dominion Energy cited several reasons for pursuing the partnership highlighting that it would improve the risk profile by establishing cost-sharing that provides “meaningful protection for any unforeseen project cost increases.” They also highlighted the attractive, well-capitalized, and high-quality nature of Stonepeak while noting the partnership is expected to be viewed as a “significant credit-positive” development for Dominion by the credit rating agencies.

In addition, by establishing the partnership as a public utility in Virginia it will be entitled to recover its costs of construction and operations. It will operate under the existing Virginia offshore wind rider program established by the regulators.

The deal is the latest in a series of significant investments by the private equity sector into the U.S. offshore wind sector. Last week, Eversource reported it had agreed to sell its 50 percent interest in both the South Fork Wind farm which is nearing completion, and the planned Revolution Wind to Global Infrastructure Partners (GIP) for approximately $1.1 billion. Eversource, which is New England’s largest energy delivery system, is exiting the wind sector with the private equity firm set to become partners with Ørsted in the development and operation of the two wind farms. BlackRock one of the largest private equity management firms is currently seeking to acquire GIP.

Australia Releases Plan for Potentially First Indian Ocean Wind Farm

As Australia seeks to accelerate its plans for offshore wind energy development, the government is seeking public input after releasing a plan for the first wind farm for the western shore of the country. Previously, areas have been designated off the east and southern coasts and now for the first time, the government is detailing the plans for a wind farm in the Indian Ocean.

The Department of Climate Change, Energy, the Environment, and Water released a draft proposal yesterday, February 20 for the proposed area citing the beneficial nature of wind energy and its advantages over other forms of energy generation. They highlighted that just one turn of one offshore wind turbine provides as much energy as an average rooftop solar installation generates in a whole day. They noted that a wind turbine makes around 15 turns per minute.

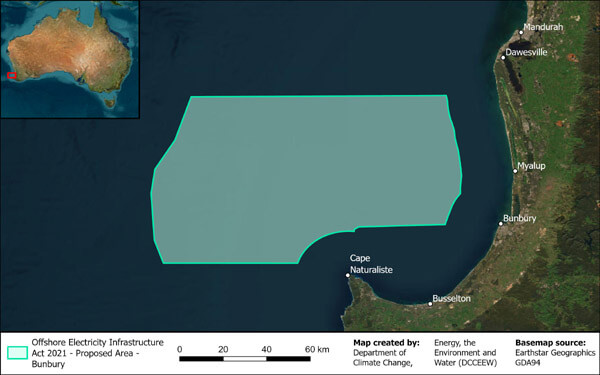

The proposal mapped out an area off the Bunbury region in Western Australia south of Perth and Fremantle. It encompasses nearly 7,700 square kilometers (nearly 3,000 square miles) with the nearest point at least 12.5 miles from the closest point off Cape Naturaliste and the city of Bunbury. It would be more than 22 miles off the coast from Busselton. Initial calculations show it could enable up to 20 GW of offshore wind energy.

Map outlining the proposed area which would be the first in the Indian Ocean (DCCEEW)

They noted that Western Australia is the sixth region to be considered as potentially suitable for future large-scale offshore wind projects in Australia. They said the area is an “ideal location for offshore electricity generation” because of the high-speed winds in the Indian Ocean. Furthermore, they also noted the area's proximity to large energy users and the relatively shallow depth in the area. The Indian Ocean area they said would be located close to the resources and heavy industry heartland of Australia.

Australia declared its first two suitable areas as being off Victoria’s Gippsland coast and the New South Wales Hunter region. The proposals in the Southern Ocean Region off Victoria and South Australia, and the NSW Illawarra region have each completed their initial community consultation phase. The consultation period has closed for the proposal in the Bass Strait region off Northern Tasmania.

Yesterday’s announcement launches the consultation period for the proposed Western Australia area. The first meetings are scheduled for mid-March and will run through May 2024. They said the sessions would provide opportunities to learn about the plans and ask questions as well as express views. Like all the wind areas they seek to ensure the work with other ocean users.

Australia is relatively new to the wind sector having only resolved a little over a year ago its regulatory framework and started the process to declare potential areas. Both domestic and international companies have shown a strong interest as the government works to move forward in the process. The target is to have the first wind farm operational before the end of 2025.

NYK Orders First Domestically-Built CTV Anticipating Offshore Wind Demand

The Japanese shipping industry looks to realize opportunities as the country moves forward with offshore wind energy as one of the government’s pillars of its future energy initiatives. NYK, one of Japan’s oldest shipping companies is moving aggressively into the sector reporting it plans to invest more than $260 million between 2023 and 2026 into the offshore wind power value chain.

One of the elements of NYK’s plan is the building of dedicated vessels to serve the emerging industry. The company reports last month it placed an order for its first crew transfer vessel to be built in Japan in an effort both for the wind industry and to support Japanese shipbuilding. The new CTV will be the third owned by NYK in Japan, following the introduction in April 2023 of the Rera As, a CTV operating in the Ishikari Bay New Port for the offshore wind farm located off Hokkaido, and one of the first in Japan.

Japan so far has mostly developed near-shore wind farms launching the first commercial-scale operations late in 2022 and 2023. While wind energy is a major element of the government’s plans, one of the challenges Japan faces is the water depth and underwater topography. As such, floating wind turbines are likely to play a significant role in Japan’s wind industry. The news outlet NHK reported today that the government is moving forward with the first areas for floating wind farms and is expected in May 2024 to choose the companies to develop the first two sites.

NYK says the construction of offshore wind power facilities in Japan is expected to begin in earnest around 2026. They expect the demand for CTVs to grow as the industry develops. In 2020, NYK formed a partnership with Northern Offshore Services of Sweden, one of the largest operators of CTVs in Europe.

Under the partnership, NYK will domestically produce the hull form for the CTV based on the designs developed by Northern Offshore. The new CTV will be built by Kosaba Shipbuilding Corporation in Kamaishi City. It will be approximately 145 tons and nearly 92 feet with a capacity for 12 people. The shipyard highlights that it is well suited for the work as it manufactures ships with a focus on light aluminum alloy ships. They highlight that currently there are only a few companies in Japan that build aluminum ships.

NYK reports it will seek to continue to build CTVs in Japanese shipyards as part of its strategy to meet anticipated demand as the wind sector ramps up. The company which traces its origins to 1885 and today has a fleet of more than 800 vessels views the wind sector as a strong growth opportunity and aligned with its new value initiatives for low carbon and decarbonization through green businesses.

Chinese Receive ABS AiP for Large WTIV with Dual-Fuel Methanol Power

A new generation of larger and more capable wind turbine installation vessels is planned to meet the challenges as the industry expands. China’s Yantai CIMC Raffles Offshore has been awarded approval in principle (AIP) for the designs of a dual-fuel methanol, heavy-duty, offshore wind turbine installation vessel (WTIV).

“This is an exciting development for the offshore wind market, which is a key player in the global energy evolution,” said Rob Langford, ABS Vice President, Global Offshore Wind. “Support vessels like WTIVs are in short supply, and new builds are being hampered by challenging market dynamics. This design from Yantai promises to meet the need for high-capacity, heavy-duty offshore wind projects.”

CIMC’s design calls for a WTIV capable of transporting and installing the largest wind turbines in the world. China is pushing the envelope with Mingyang Wind Power surprising the industry last fall by announcing it would have a 22 MW turbine completed by 2024 or 2025. Responding to the anticipated growth, CIMC expects growing demand to install wind turbines capable of producing 16 to 20 megawatts of electricity.

At the end of 2023, they reported that the massive Bo Qiang 3060, one of the largest and most capable vessels of its kind, was on sea trials. They highlighted that with upgrades the vessel would be able to handle turbines up to 20 MW.

In the latest designs, CIMC is now adding a dual-fuel methanol propulsion system. The design also features a 3,500-ton leg encircling crane and a strong, sea-keeping dynamic positioning system (DPS) that aligns with ABS class requirements DPS-2.

“The vessel is designed for the European market, with a maximum lifting weight of 3,500 tons and a maximum lifting height of 228 meters above sea level, and can carry seven sets of 14 MW or four sets of 20 MW wind turbine components. This vessel is equipped with a dual-fuel main engine and hybrid battery system, reducing carbon emissions and fuel consumption,” said Fu Qiang, Director of CIMC Raffles Strategy R&D Centre. “Given the complex international market and rising raw material prices, the design offers better economics and stronger competitiveness,” he predicts.

“ABS understands and is deeply involved in supporting clients with alternative fuels as part of their decarbonization journey. Methanol has emerged as a favorite among new designs as it represents a ‘here-now’ technology rather than a ‘hoped-for’,” said Panos Koutsourakis, ABS Vice President of Global Sustainability.

ABS highlights that it developed global standards for offshore wind foundations, both fixed and floating, substations and the unique vessels that support the industry. It certified the first semisubmersible offshore wind turbine WindFloat I, classed the world's largest floating wind turbine Windfloat Atlantic, and classed Kincardine, the world’s largest floating offshore windfarm at its commercial online date (COD). With more than 70 years of experience in the offshore sector, ABS says it understands the needs of owners and operators to enhance operational efficiencies with sustainable energy solutions.

Yantai CIMC Raffles Offshore will be competing against several Europeans that are also moving quickly to develop this new generation of larger and more capable installation vessels

No comments:

Post a Comment