Can Brazil Convince the World to Tax

Billionaire Wealth?

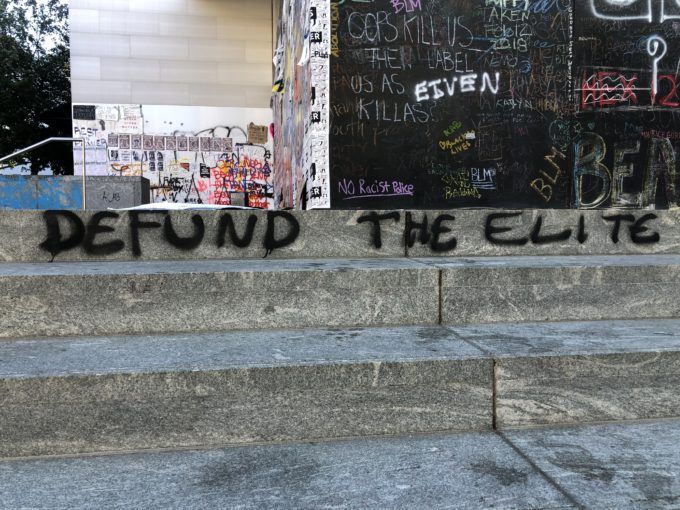

Photograph by Nathaniel St. Clair

Recent weeks have brought three more eye-popping glimpses of our world’s unconscionable concentration of income and wealth . . .

The fabled luxury automaker Lamborghini, for the first time ever, has sold over 10,000 vehicles in a single year. Lamborghini’s current 2024 Revuelto model starts at $608,358 . . .

Google co-founder Larry Page has just expanded his collection of private islands to five. His latest, a isle that sits between Puerto Rico and the British Virgin Islands, sethim back $32 million . . .

The Austrian design firm Motion Code: Blue has released renderings of a new submersible superyacht that can stay underwater for up to four weeks at a time. The 541-foot-long Migaloo M5 also features a built-in swimming pool, a helipad, and a $2-billion price-tag . . .

Why are Austrian designers devoting their talents to fashioning $2-billion baubles for billionaires? Just one reason: Today’s super rich are sitting on mountains of spendable billions.

And what’s raising those mountains of cash? Researchers at Oxfam have a compelling answer to offer in a just-released new analysis.

“The share of national income going to the top 1 percent of earners in G20 countries has increased by 45 percent over the last four decades,” Oxfam notes. “During the same period, the top tax rates on their incomes has fallen by roughly a third.”

In 2022, Oxfam’s researchers add, the top 1 percent of earners in G20 countries pocketed $18 trillion in income.

Oxfam released all these stats on the eve of this week’s inaugural finance track meeting of G20 financial ministers and central bank chiefs. The “G20” actually includes 21 players, 19 of the world’s most powerful nations, plus the European Union and this year, for the first time, the African Union.

Brazil, the G20 chair for 2024, hosted this week’s meeting in São Paulo — and Brazil’s left-led government of Luiz Inácio Lula da Silva vigorously seized this hosting opportunity. His administration’s ambitious goal? To shove the case for taxing the wealth of our world’s wealthiest onto the world’s political stage.

No nation in the world, Brazilian finance minister Fernando Haddad told the newspaper O Globo earlier this week, may now have more credibility on taxing the rich than Brazil. Just last year, Lula da Silva signed into law landmark legislation that subjects the offshore investments of Brazil’s rich to a 15 percent tax. And earlier this year, to prevent Brazil’s rich from avoiding that new levy, the Brazilian government moved to limit the cash the rich can stuff into their pension funds.

The time has come, finance minister Haddad noted in his welcoming address to this week’s São Paulo gathering, for a “new globalization” that addresses the twin threats of climate change and maldistributed wealth.

“We have reached an unsustainable situation, Haddad went on to explain, “where the richest 1 percent own 43 percent of the world’s financial assets and emit the same amount of carbon as the poorest two-thirds of humanity.”

“Hyper-financialization,” he added, has provided the world’s richest “with increasingly elaborate forms of tax evasion.” Nations have made some progress in battling that evasion over recent years, Haddad acknowledged, but “we must admit that we still need to make the world’s billionaires pay their fair share in taxes.”

Just what exactly does Brazil have in mind? Haddad has so far announced no specific details. But he has dropped some serious hints — by inviting to the São Paulo summit one of the world’s top advocates for taxing billionaire fortunes, the French economist Gabriel Zucman.

Zucman and his team at the Paris-based EU Tax Observatory last year called for an annual global minimum tax of 2 percent on the wealth of the world’s wealthiest.

This week’s audience of finance ministers and central bankers in São Paulo has given that proposal its most pivotal audience yet — and given Zucman some real hope that the world’s super rich may actually end up facing a significant tax on their grand fortunes.

What’s driving that hope? Three years ago, negotiators from almost 140 nations actually agreed to set a global 15-percent tax minimum on multinational corporate giants. Not all nations, to be sure, have ratified that global deal. Lawmakers in the United States, for instance, have not yet endorsed the agreement, and the Biden administration has no immediate shot at winning Senate approval.

But economists like Zucman are playing the long game.

“What we have been able to achieve with multinational firms — putting a floor to their effective tax rates — we should do the same for super-rich people,” he notes.

“But it’s hard to know,” Zucman has just told the Guardian, if this is going to take “one year, or five, or 10 or 20.”

The shorter, the better. The more we tolerate grand concentrations of private wealth, as Brazil’s Haddad makes clear, the more intractable our environmental crisis becomes.

We can no longer afford, sums up the Brazilian finance minister, to treat inequality as “a mere corollary of economic policy.” Inequality, as Haddad has told his fellow finance chiefs, needs to become “a fundamental concern of macroeconomic policies.”

Sam Pizzigati writes on inequality for the Institute for Policy Studies. His latest book: The Case for a Maximum Wage (Polity). Among his other books on maldistributed income and wealth: The Rich Don’t Always Win: The Forgotten Triumph over Plutocracy that Created the American Middle Class, 1900-1970 (Seven Stories Press).

LA REVUE GAUCHE - Left Comment: Search results for SAM PIZZIGATI

No comments:

Post a Comment