Advanced Nuclear Power Could Transform U.S. Maritime Industry

The US maritime sector has suffered a steep decline since its peak in the immediate post-WWII era with the number of American flagged and constructed vessels plummeting.

The advent of marinized nuclear power offers an opportunity for the reversal of this decline and a new era for American shipping. The US can use its experience in both the nuclear energy and marine sectors to drive forward the decarbonisation of shipping and gain a first-mover advantage for its national economy. Advanced nuclear vessels will need to be both built and flagged in nuclear energy states i.e., those with existing nuclear energy regulators and with a well-developed nuclear ecosystem. This provides the opportunity for massive growth in market share for the US shipbuilding and operating industries as well as providing new opportunities for the next generation of US seafarers.

The US now has the ideal opportunity to demonstrate the benefits of marinized nuclear power in its own internal maritime market. The number of vessels trading within US waters has been continuously decreasing with goods being transported by road or rail increasing while the total volume on ships plateaued. A new fleet of advanced nuclear vessels could reduce shipping costs and create a new high-tech industry while fully decarbonising US shipping.

The US would be in a prime position to become an exporter of this technology to trusted partner nations like the UK, allowing the US to create a valuable export market for technology built by highly skilled American workers.

This report discusses how deployment of advanced marinised nuclear reactors can transform the US maritime industry.

Advanced nuclear for maritime

The US has a long record of using nuclear power in its Navy with an exemplary safety record. This has led to increased interest in the use of nuclear power for civilian vessels, including by US Special Envoy for Climate John Kerry reflecting on his own Naval career during COP26. Naval reactors are not suited for use in civilian applications as they run on highly enriched uranium fuels which is not allowed in commercial applications. Running current naval reactors on low enriched uranium would require large reactors, and would require frequent refuelling, posing a major challenge in managing both supply of fresh fuel and handling of spent fuels. Developments in advanced reactor technology mean that new reactors are being developed which can use low enriched fuel that would be available for deployment within a reasonable timeframe.

The optimum solutions for advanced marine reactors are those which fulfil the three main criteria for success in the maritime industry.

Superior fuel efficiency. Advanced reactors must be extremely fuel-efficient allowing ships to sail for a lifetime without refuelling. This avoids handling of fresh and spent fuels required during operation, and therefore mitigates proliferation concerns.

Minimal Emergency Preparedness Readiness Zone in port. Advanced reactors operating at ambient pressure, require only a tiny Emergency Preparedness Readiness Zone (EPRZ), not extending outside the boundary of the ship. This allows simple and easy port calls, removing a major barrier to adoption.

Small, advanced reactors can be mass-assembled at the highest quality assurance levels, in dedicated facilities or specialist shipyards, making them affordable. This is a major departure from conventional nuclear building techniques.

The two new reactor types which meet these criteria and offer the optimum solution for marine deployment are the Molten Salt Reactor (MSR) and the micro-Heat Pipe Reactor (HPR).

Molten Salt Reactor

A Molten Salt Reactor (MSR) is an advanced nuclear reactor that is fuelled by liquid molten fuel salts rather than solid fuel elements assembled in fuel rods, like those in conventional PWR reactors. The MSR operates at ambient pressure and runs at a very high temperature between 500°C – 700°C.

The fuel salt contains the nuclear fuel and is therefore both the fuel that produces the heat and the coolant which transports the heat to the power conversion system producing electric power. Because MSRs operate at ambient pressure there is no force to expel radio toxins into the environment in the case of an accident. This allows for a small EPRZ which should not extend beyond the boundary of the ship’s hull, making port calls and narrow waterways transits possible without requiring extended safe zones around the ship.

If the reactor stops and the fuel salt is cooled, it would solidify and be entombed in the reactor. This means no fuel can escape. This passive safety feature of the MSR is highly desirable for the marine environment.

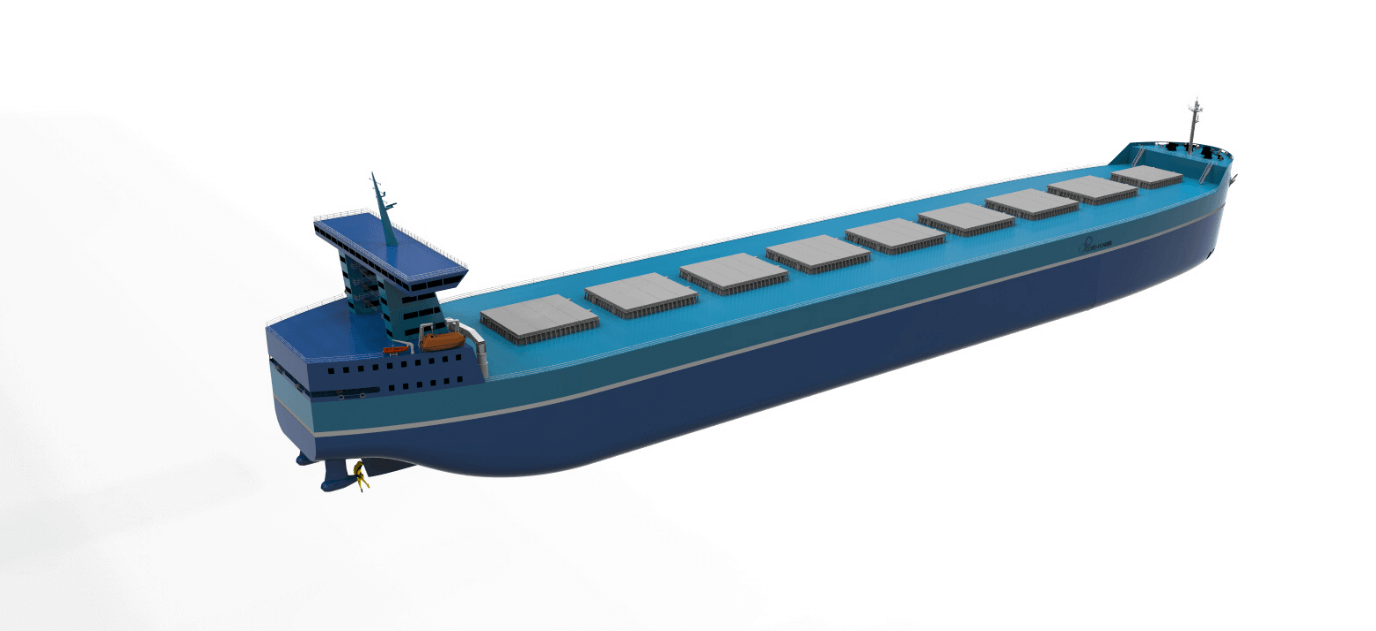

Figure 1: Concept design of a large bulk carrier powered by a molten salt reactor

Figure 1: Concept design of a large bulk carrier powered by a molten salt reactor

The MSR is small and could therefore be mass-assembled, bringing the cost of construction and assembly down to very competitive levels.

A modular marinized MSR could deliver 30MW for 20 full power years. With a maximum continuous rating (MCR) required for marine propulsion of around 65%, this would allow a large ship to sail a full design service speed for 30 years or more.

Heat Pipe Reactor (HPR)

The HPR is an innovative advanced reactor design combining space reactor technologies and over half a century of commercial nuclear systems design, engineering, and innovation. The HPR is designed to provide small scale competitive and resilient power with superior reliability and minimal maintenance, particularly for energy consumers in remote locations. Its small size allows for rapid installation and deployment.

Figure 2: Concept design of a small containership powered by the HPR.

Figure 2: Concept design of a small containership powered by the HPR.

The heat pipes make the HPR a “solid-state” reactor with minimal moving parts, allowing for autonomous operation and inherent load following capabilities. The HPR also operates at ambient pressure. Being fully factory-built, fuelled, and assembled, current HPR designs promise a 10–15-year refuelling interval, a near-zero EPRZ and a very small footprint.

The HPR is not as fuel-efficient as the MSR but would still perform very well for smaller marine deployment over long periods. The HPR could run on a variety of fuel types in solid form and is currently being constructed to use ‘TRi-structural ISOtropic’ (TRISO) uranium fuels. The HPR would cover the segment of deployments requiring 5-20MW with between one and four power units installed dependent on requirements.

Building reactors of this size also opens the possibility of modular shipyard construction. Mass-manufacturing of small modular machines would substantially bring down costs and complexity while maintaining the highest quality.

Current US maritime trade

The US maritime trade sector is a $50 billion market transporting goods on the Great Lakes, up and down the three coasts as well as transporting goods on the major US inland waterways.

The inland fleet plays a vital role in the US economy providing one of the most economically efficient ways to move goods and commodities around the country as well as major US exports to the coast.

The fleet is a key component in facilitating the export of US grain, coal, oil and increasingly steel. The internal waterways employ around 150,000 people.

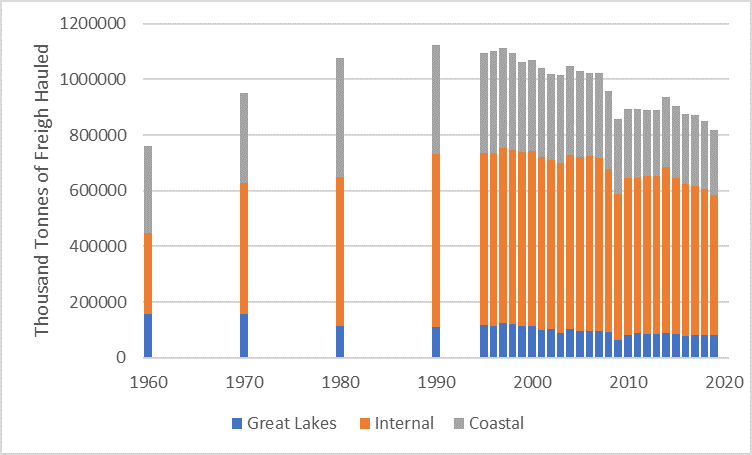

Figure 3: Thousand Tonnes of freight hauled on US internal waterways.[i]

As can be seen in figure 3 above, the amount of cargo transported on the US waterways peaked in 1990 and has been in steady decline ever since almost returning to levels seen in 1960. The sector averaged a 10% decline in total volumes while overall freight levels were increasing.

A decarbonised nuclear powered US internal fleet would provide a highly cost-efficient way to transport goods around the US with more cargo being carried faster where possible. All would be true-zero emission vessels, decarbonising US maritime transportation.

US coastal trade

Trade between US mainland ports as well as between the US mainland and outside US territories like Puerto Rico is governed by the Jones Act, discussed below. The coastal trading US fleet is dominated by tankers for the transport of crude oil as well as refined oil products.

Due to the increased competition of land-based trade routes, the coastal fleet is now almost entirely used for trade where land-based options are not possible like Alaska, Hawaii, and Puerto Rico. The ocean-going fleet of vessels has decreased from more than 400 in 1950 to just 100 in 2018, albeit the DWT of the vessels engaged in this trade has remained broadly flat as ships have become larger.

MSR and HPR powered tankers, ro/ros, container ships and bulkers operating between US ports would carry more cargo at a higher speed and would do so for longer than the current fleet is capable. As each ship would produce its own electric power, these ships could provide electric power to operate loading and discharging gear during port calls, decarbonising US ports and substantially improving the environment for those communities that live and work near ports.

A new generation of vessels capable of competing with land-based transport options would stimulate economic growth in coastal communities while reducing emissions and providing cheaper transportation costs to offshore US territories.

The Great Lakes

The Great Lakes link several large population and manufacturing areas including Chicago and Detroit and provide access to the Canadian cities of Toronto and Montreal. Over 160 million tonnes of cargo valued at $77 billion is transported on the Great Lakes each year, including agricultural, mining and energy commodities. This fleet of vessels is of special importance to the US steel sector who rely on a fleet of steel-carrying barges to move finished products.[ii]

The vessels undertaking this trade are normally below 300 m length overall (LOA) and capable of carrying up to 80,000 metric tonnes of cargo. Vessels can leave and enter the Great Lakes though their size is limited by the design constraints of the St Lawrence Seaway which has a max vessel size of 257m LOA and 24m beam. This means that the largest vessels on the Great Lakes spend their entire operating lives there. Smaller vessels can leave and pass through the seaway and move goods to international ports around the world.[iii]

Inland Waterways

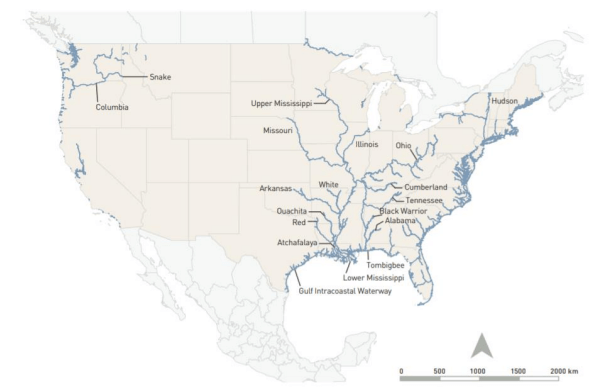

The US has approximately 12,000 miles of commercially navigable waterways. These are traversed by flat-bottom barges transporting a wide range of goods. Moving goods on the US waterways is one of the most economically efficient ways to transport energy, commodities, industrial components and building materials across the US with transport costs 50% lower than rail and as much as 95% lower than trucks.

Figure 4: Map Showing the navigable Inland and Intracoastal waterways of the US.[iv]

In 2019 the Mississippi river system, transported 630 million tonnes of goods.[v] The US waterways have a high amount of spare capacity. A low-cost true-zero emission power option for US river barges would boost the volume of goods transported on the rivers and reduce pollution from road haulage as fast, efficient green river transport becomes available.[vi]

The Jones Act

Current vessels in the US fleet are ageing and rely on heavy fuel oil for propulsion power. For domestic costal shipping to compete with road haulage as the preferred freight carrier of goods in bulk, a new generation of ships will have to be built providing cleaner and greener transport.

The Jones Act is a federal law that regulates maritime commerce in the United States. The Jones Act requires goods shipped between US ports to be transported on ships that are built, owned, and operated by United States citizens or permanent residents. The Jones Act is Section 27 of the Merchant Marine Act of 1920, which provided for the maintenance of the American merchant marine. The Jones Act therefore regulates all transit of goods between US ports, preventing foreign flagged, owned, or operated ships to carry out cabotage business in the US.

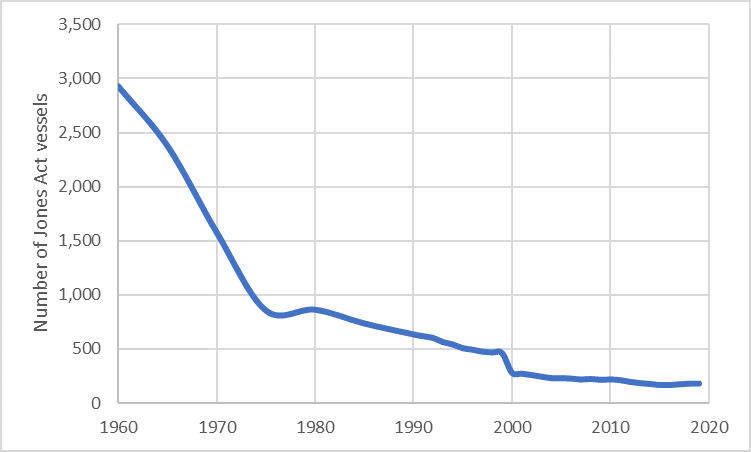

The initial intention of the Act was to protect US shipyards from competition ensuring that the US maintained shipyard capacity for naval purposes. As these vessels must be crewed by American sailors it would also provide a pool of seafarers for potential naval recruits. Whilst partially successful as a protectionist measure, the number of Jones Act vessels has continued to fall in recent decades.[vii],[viii],[ix]

Figure 5: Number of registered vessels in the Jones Act fleet larger than 1,000 gross tonnes .xi

Turning the tide

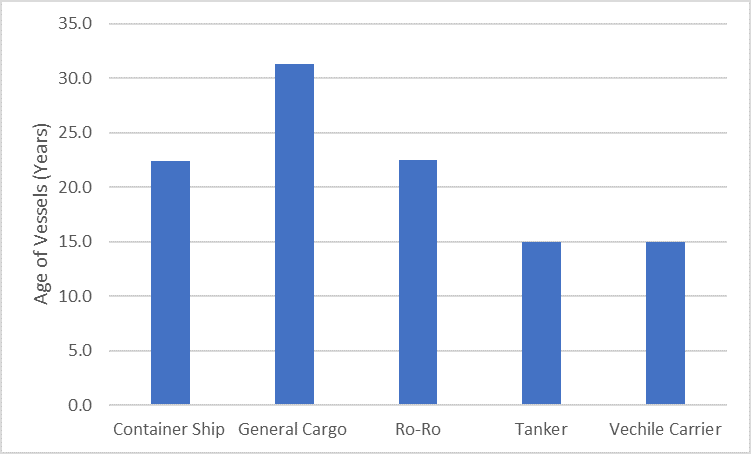

The Jones Act fleet has a considerably older age profile than the global fleet. As of 2021 the average age of Jones Act vessel was 18 years with the oldest vessel being 54. Only a quarter of the fleet is under 10 years old. A typical lifespan of a vessel in the international deep-sea fleet is 20-25 years.[x]

Figure 6: The average age of the Jones Act fleet vessels over 1,000 GT in years by vessel type[xi]

The ageing of the fleet is in part due to the high capital expenditure (CAPEX) resulting from the Jones Act’s requirement to build ships in domestic yards. It is also part due to the uncertainty of owners in selecting the required propulsion method that will be needed to comply with environmental regulations.

This is having the unintended consequence of keeping in service older, more polluting vessels. The order book for Jones Act vessels is currently small, providing little hope of fleet renewal and the overall fleet is expected to age further in the coming years.

Showing the world how to decarbonising shipping

Currently, emissions from the US domestic shipping stand at approximately 60 million tonnes of CO2 per year from the burning of Heavy Fuel Oil as well Liquefied Natural Gas (LNG) and marine gas oil (MGO). The emissions goal for the maritime sector is set by the International Maritime Organisation (IMO) which has mandated that a 50% reduction of emission by 2050 compared to 2008 levels is required to stay in line with the Paris Agreement of 2015.

For these reductions to happen there will have to be a significant change to the way vessels are fuelled. While some small vessels for port operations have the potential to be electrified larger vessels, such as those used in US rivers, Great Lakes and coastal transport may require different and alternative paths to decarbonisation.[xii]

For these goals to be met, most current Jones Act vessels will need to be replaced. By embracing marine-appropriate advanced nuclear power for both propulsion and the production of low-carbon fuels, CO2 emissions from the sector could be reduced by as much as 90%.

Building a new competitive advantage

Different segments of the US fleet would benefit from marinised advanced nuclear power in different ways depending on the power requirement of vessels and their operating conditions.

The US coastal fleet is likely to find the best value in the use of advanced nuclear power for direct propulsion using both the MSR and the HPR. For the largest vessels, those with a power requirement more than 15 MW the MSR offers the best technology, and for those with lower power requirements of between 2-15 MW, the HPR would perform well. The HPR is also a promising option for the propulsion of the Great Lakes fleet where most of the current vessels sit in the sub-15 MW power range.[xiii] The vessels would also be capable of providing power when docked, reducing the emissions both from ships at berth and from energy required to operate loading and discharging gear in ports

The move to advanced nuclear propulsion would see a fundamental shift in the way these vessels are managed and operated throughout their lifecycle. Advanced nuclear vessels would require no refuelling, substantially reducing operating expenditure (OPEX). The higher CAPEX of reactors that are fuelled for the life of a ship, would be mitigated through a leasing structure, where the initial outlay, depreciation and interest rate are combined into a flat monthly payment by the operator. Removing volatility from the OPEX and cost of propulsion would allow for longer, more economically predictable transportation contracts, which in turn would be easier to finance.

Advanced nuclear ships would be true-zero emission vessels and be immune to carbon pricing as it is introduced to fossil fuels. One ton of heavy bunker fuel oil produces 3.2 tons of CO2. Large ships consume 70 metric tons of bunker fuel per day, or close to 500,000 tons over a lifetime, therefore emit in excess of 1.5 million tons of CO2 in service. With a carbon levy of $200 per ton, these ships would see an increased OPEX of $300 million over a lifecycle. Advanced nuclear-powered ships would save this cost, making them economically more viable.

The US inland waterway fleet is comprised of vessels that are often too small for advanced nuclear propulsion. This fleet of smaller river-tractors could still benefit from the development of marinised nuclear power. As discussed in CORE POWER’s January 2022 report on the production of low-carbon synthetic fuels from hydrogen, marinised nuclear power is the ideal power source for ‘green’ fuels. Producing green ammonia as a marine fuel onboard a floating production plant at the mouth of major rivers would convert water and air into fuels that contain little or no carbon. These production facilities could act as refuelling points for barges before returning upriver and could even be stationed along the largest rivers and in the Great lakes. Tank barges could be used to ship green ammonia fuel upriver both to be used by returning vessels as well as potentially the production of fertiliser in the US farm belt.

The use of marinised nuclear power offers the best route to decarbonisation. It is truly green, does not have to rely on complex carbon capture and storage and has the benefit of the extreme reliability of nuclear energy.

By embracing a new generation of fit-for-purpose advanced nuclear reactors, the US Jones Act fleet would be able to fully decarbonise while gaining a new competitive advantages compared to land-based transport.

A resurgent shipbuilding industry

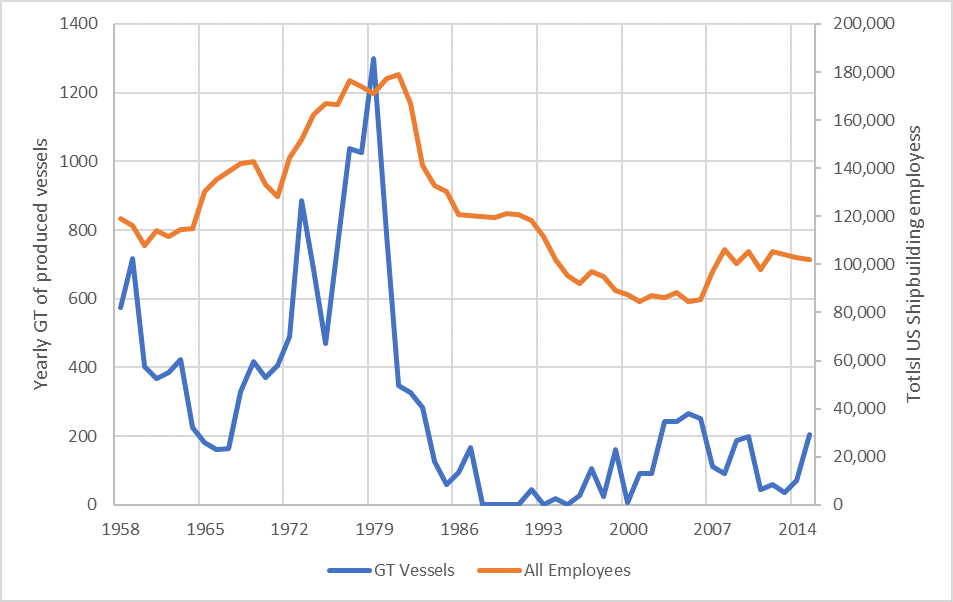

The US shipbuilding industry has been in decline since the 1980s with the total gross tonnage built and the total number of workers in the industry, declining steadily. The yards that remain are mostly focused on US defence contracts and building vessels for the Jones Act fleet, though as stated before, the orderbook is small.

The construction of vessels for international sea freight is now primarily concentrated in East Asia in countries such as Japan, China, and South Korea accounting for around 95% of ships launched each year.

Nuclear powered ships will have to be built in countries with advanced nuclear expertise and a highly skilled workforce. The US fits that bill.

This is an opportunity for a dramatic renaissance of US commercial shipbuilding either as a standalone domestic industry or in collaboration with yards from overseas. In the global fleet of over 100,000 ships larger than 100 gross register tons (GRT) those vessels most suited for advanced nuclear-electric propulsion account for just 17,000 vessels. If construction of a new fleet was spread over a period of 30 years between 2030 and 2060, the US shipbuilding industry could launch up to 570 vessels of these vessels each year. All US yards combined now only build around ten commercial vessels a year.

The advent of nuclear shipping could therefore be transformational for the sector. The value to US GDP of the US private shipping industry is currently $12.2 Billion and the advent of US nuclear shipping could vastly increase this.[xiv] This could allow the US to compete internationally with the largest shipbuilding nations including China which currently dwarves US production.

Figure 7 Summary of the GRT of commercial ships built yearly and the total number of employees engaged in the US shipbuilding industry[xv]

As of 2020 shipbuilding is a $126 Billion a year market and is expected to reach a value of $167 billion by 2026. By embracing nuclear shipping, the US could catalyse exponential growth in US shipbuilding creating a substantial new industry driving employment and economic growth.[xvi]

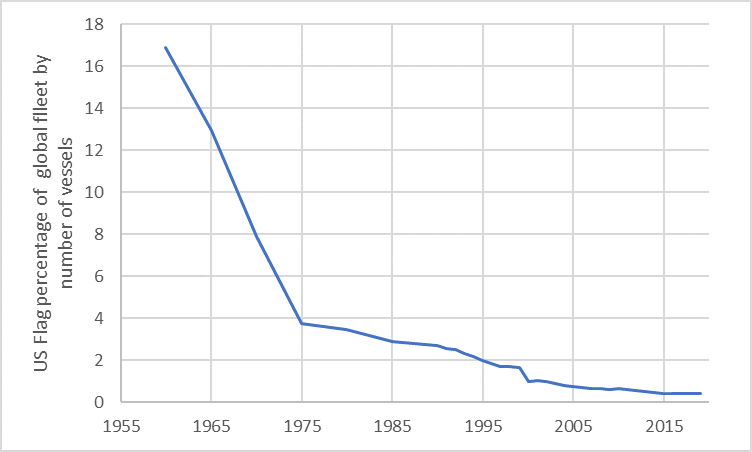

Benefit to the US flag

Just like the US shipbuilding industry, the volume of US flagged vessels has declined in the last few decades. Owners have moved ships to specific low tax low designations, also known as flags-of-convenience. The current US flagged fleet now only accounts for 182 vessels over 1,000 GRT of which around half are Jones Act vessels which are legally required to be flagged in the US.

The US flag is currently ranked just 20th in the world. Compared to other flag states its size is dwarfed by the largest flag states of Panama, Liberia and the Marshall Islands which are between 20 and 30 times larger.[xvii],[xviii]

Figure 8. American flagged vessels as a percentage of the global fleet by number of vessels[xix]

Advanced atomic ships will require a step-change in the way commercial vessels are flagged. These vessels will only be able to be flagged in nations that have both a mature nuclear and maritime regulator and to which export control restrictions allow transfer of stewardship.

The superior economic and environmental benefit of advanced nuclear ships would encourage ship operators to seek the US flag as a high-quality jurisdiction instead of the current race to the cheapest flag of convenience. Partnering with the UK and allowing advanced nuclear power to sail under the UK flag, would help share the burden of oversight and regulation with the US’s closest ally.

For both countries, this would mean more, and better vessels are available if required in for naval support, as well as vastly increasing the revenue via tonnage tax. This tax calculable on all US and UK flagged ships would rise at the same rate as the number of vessels in the register.

The US should look to share the responsibility for regulating and inspecting advanced nuclear ships with allies such as the UK which has equally mature nuclear and maritime regulators, and whose domestic fleet is suffering the same fate as that of the US.

Benefit to ports

The US has some of the world’s busiest ports. Long Beach in California and New York Harbour handle vast amounts of both inbound and outbound cargoes, serving ships from all over the world. The movement towards advanced nuclear power for ships has several key advantages for US ports.

Providing green electricity to port facilities allows for the decarbonisation of port operations. Furthermore since these vessels don’t require bunkering they would help reduce port congestion, in turn allowing port capacity to increase without the need for additional capital investment.

With global trade expected to continue to increase and the ports requiring viable decarbonisation plans, marinised advanced nuclear power provides an ideal solution.

More jobs and seafarers

The advent of nuclear-powered shipping will lead to a paradigm shift in the staffing and crewing of international vessels. Officers on nuclear-powered ships will require a much higher degree of training than those on conventional vessels.

This will be an entirely new career path for both STEM college graduates as well as a career path for veterans of the US nuclear navy. It is not just seafarer jobs that will be created.

The development and flagging of these vessels within the US will create downstream jobs in fuelling, maintenance as well the insurance, broking, and finance industries.

Floating production of green fuels

As discussed in the CORE POWER January 2022 report, a solution for those vessels not suitable for direct nuclear propulsion is the use of green e-fuels from nuclear powered floating facilities. The deployment of reactors on offshore production platform as well as allowing the decarbonisation of smaller vessels such as those trading on US internal waterways, would provide a mixture of electricity, desalinated water, hydrogen, and ammonia to local off-takers.

The US has committed to developing several hydrogen hubs across the country, one of which is specified to be powered by nuclear energy. These facilities could benefit the decarbonisation of other difficult to abate sectors such as aviation and heavy industry by the provision of low-carbon fuelling options, as well as the potential provision of reliably priced water and electricity to American consumers.

Marinised nuclear power offers the opportunity to provide dependable consistently priced power options to not just the maritime industry but to the whole US industrial sector. This will allow the USA to lead the way on decarbonisation while increasing economic competitiveness.

Seizing the opportunity

The US offers a unique blend of experience in the advanced nuclear and marine industries to be among the best placed nations to exploit the developing field of marinised nuclear power.

At a base level, the US is home to companies developing the types of reactors that will be suitable for marine deployment. CORE POWER is partnering with leading US nuclear innovation companies to develop a marinised version of appropriate marine reactors that will be suitable for deployment.

At a deeper level, the US has a wealth of research and development facilities for nuclear technology. The network of US national laboratories leads the world in nuclear reactor innovation as well as the development of nuclear fuel. The US has experience both in the private and public sector in managing nuclear waste as well as reactor fuel, meaning it is ideally located for the modular manufacture and servicing of marinised nuclear reactors.

The US has a well-respected regulator in the Nuclear regulatory Commission (NRC). Current nuclear regulations are light on marine deployment and will need to be updated and improved as the new security requirements and passive safety features of the next generations of advanced reactors, come to market Once licensed, these reactors can be deployed within national waters with high confidence from both the government and the public.

The US also has a highly developed maritime infrastructure not just for shipbuilding, but for ship classification, financing and insurance.

CORE POWER is working with leading classification societies on developing new class rules for advanced nuclear-powered vessels which will be appropriate for the US fleet. Vessels designed, built, and operated to the high standards set by these rules will be properly certified which allows for a solid insurance framework, making advanced nuclear vessels commercially viable.

The US is a leader in international finance. The unique proposition of nuclear-powered vessels with very low OPEX and guaranteed performance over an entire lifetime, allows the development of new financial products to fund the development of the next generation of zero-emissions vessels.

The US also has the benefit of being home to the largest pool of nuclear qualified mariners in the world. The US nuclear navy has operated for almost 70 years without incident and have the best-trained seafarers in the world. The deployment of commercial nuclear vessels would offer an entirely new career path for these seafarers once they leave the Navy. STEM qualified students from the US college system seeking well paid careers in an exciting industry could also be recruited to supplement the skills of the highly trained ex-US Navy personnel.

This is not just a one-way relationship. While the US is ideal for nuclear shipping, nuclear shipping is ideal for US long term goals. By taking the lead in nuclear shipping, the US can develop new high-quality manufacturing jobs reshoring a key industry from the far east. The increase in US-flagged vessels will give the US a ready source of US vessels for use by US Navy if required while ensuring that maritime transport in the US is fast, efficient, and fully decarbonised.

How the US can lead the way

Deployment of marinised nuclear power requires a concerted effort by both nuclear and maritime regulators to establish an exceptional standard for nuclear powered ships that will be acceptable to stakeholders in maritime communities and in government.

The current chapter of IMO’s Safety of Life at Sea Convention (SOLAS) that concerns nuclear commercial vessels was passed in 1981, and specifies conventional PWR feeding a steam cycle which directly drives the propellors.

Advanced nuclear-powered ships will be nuclear- electric where the reactors are used to drive turbines that generate electricity to power the vessel. For SOLAS to be updated, an alliance of key nations such as the US and the UK need to develop new terms and propose a modernisation of the rules to reflect 40 years of advancement in both nuclear and maritime safety standards.

Regulatory development will also have to be supported on the nuclear side for the next generation of nuclear reactors to be fully marinised. The MSR and HP both have essential design characteristics that enable walk away safety and so will not require the same wide EPRZ and active reactivity management which traditional PWRs need.

This action to lead to regulatory change in this area would place the US at the forefront of a new industry allowing the transformation of the US maritime industry.

Conclusion

The US maritime Industry stands at a crossroads. The need to decarbonise has opened new paths and opportunities. If the industry commits to taking the lead on nuclear shipping first by fully decarbonising the US merchant fleet and going on to develop an exportable product, a dramatic renaissance of the US maritime industry is possible. This will lead to substantial jobs growth and a cleaner more efficient domestic transportation sector driving economic competitiveness.

The US maritime industry has been in a process of continuous decline since the 1950s with the number of vessels built, registered, and crewed in the US continuously falling. The shipbuilding industry now is primarily centred in east Asia in Korea Japan and China.

The nuclear vessel industry would offer a unique opportunity to secure the private investments from the shipping sector to re-shore these jobs, driving economic growth and employment.

The first step of this process is the decarbonisation of the US internal maritime market. The transport of goods on the US Coast, Great Lakes and US internal waterways offers amazing proof of concept for nuclear powered decarbonisation, without the complex regulatory hurdles of moving reactors between nation-states.

Taking the lead on this process by updating SOLAS, engaging the NRC with its maritime counterparts and supporting reactor innovation will allow the US to profit from its existing expertise in maritime and nuclear to both decarbonise one of the trickiest industries while providing a long-term boost to the US the economy.

Mikal Bøe is a senior maritime executive with three decades of experience from floor to board level in shipping, finance and technology. As Chairman and CEO of CORE POWER, Mikal today plays a key role in the development and deployment of a new generation of reactor technologies as the solution for ocean transportation to meet its emission reduction targets.

References

[i] Water Transport Profile , US Bureau of Transportation Statistics, 2021

[ii] The Great Lakes Seaway Partnership , Shipping on the Great Lakes-Seaway – Efficient. Green. Sustainable , 2018

[iii] Martin Associates , Economic Impactsof Maritime Shipping In The Great Lakes - St. Lawrence Region , 2018

[iv] American Society of Civil Engineers , Failure to Act: Ports and Inland Waterways Anchoring the U.S. Economy , 2021

[v] US Army Corp of Engineers , 2019 - Mississippi River System , 2020

[vi] HIS Markit , The River Barg Still Plays a Role in U.S Transportation , 2009

[vii] US Department of Transportation, The state of the U.S, Flag Maritime Industry , 2018

[viii] Congressional Research Service , Shipping Under the Jones Act: Legislative an Regulatory Background , John Frittelli , 2019

[ix] CATO Institute , Old Ships Still Abundant in the Jones Act Fleet , 2019

[x] Equasis , The 2020 World Merchant Fleet , 2020

[xi] US Department of Transportation , Oceangoing, Self?Propelled Vessels of 1,000 Gross Tons and Above that Carry Cargo from Port to Port , 2019

[xii] National Transportation Statistics , US Bureau of Transport Statistics , 2021

[xiii] Man , Propulsion Trends in Bulk Carriers , 2015

[xiv] UNCTADSTAT , https://unctadstat.unctad.org/wds/TableViewer/tableView.aspx , Accessed 15/02/2022

[xv] Shipbuilding History , https://www.shipbuildinghistory.com/ , Accessed 15/02/2022

[xvi] Mordor Intelligence , Ship Building Market Growth, Trends, Covid-19 Impact, And Forecasts (2022 - 2027) , 2021

[xvii] What is a ship registry or ship register? , Shipping and Freight Resource, Hariesh Manaadiar , 2018

[xviii] UNCTAD e-Handbook of Statistics 2021 , 2021

[xix] Number and Size of the U.S. Flag Merchant Fleet and Its Share of the World Fleet , US Bureau of Transportation , 2021

The opinions expressed herein are the author's and not necessarily those of The Maritime Executive.

Cameron Livingstone MNI is the secretary of the

Cameron Livingstone MNI is the secretary of the