Report: U.S. Navy is Feeling Out Ship Construction Options in Turkey

Momentum appears to be building within some corners of the Trump administration to offshore U.S. Navy warship production to yards in U.S. allied nations, where well-developed shipbuilding industries with available capacity can be found. It would require changing U.S. law and longstanding practice, but this has not deterred proponents: South Korea's "Big Three" have openly sought the administration's support for building American warships in Korea, and U.S. officials have recently met with Turkish counterparts to discuss component and frigate construction in Turkey, insiders told Mideast Eye.

"The US shipbuilding industry is in a real crisis, and the Trump administration has talked with Turkey about meeting its needs [for shipbuilding]," an American official told Mideast Eye.

All observers acknowledge that the problem is serious: every U.S. Navy shipbuilding program is behind schedule (as of 2025), according to the Secretary of the Navy, and the Constellation-class frigate was recently scaled back to two hulls over delays and cost overruns. The president himself has acknowledged that "we might have to" begin ordering warships from allied nations in order to make up a domestic capability gap.

In Turkey, the U.S. Navy would have a strong technical partner. Turkish yards are skilled in distributed shipbuilding, series production and short delivery timetables, and they have built export hulls for customers around the world (as well as Turkey's own navy). These experienced builders could ship out blocks and subassemblies for incorporation into American yards' workflows; deliver partially-complete floating hulls; or accept contracts for fully completed vessels.

"The US lacks sufficient manpower, shipyards and dry docks," Turkish defense commentator Kubilay Yildirim told Mideast Eye. "Turkey can help in terms of production volume, timelines, risk sharing and workload distribution."

There are limitations, however. Turkey has cordial relations and certain limited defense contracting ties with Russia. Ankara is still under U.S. sanctions for the purchase of Russian S-400 antiaircraft systems, and it was removed from the F-35 fighter program for this reason during the first Trump administration. Efforts to unwind those sanctions are currently under way.

The second potential speed bump - whether for construction in Turkey or in South Korea - would be the Byrnes-Tollefson Amendment, 10 USC Section 8679, which prohibits construction of U.S. naval vessels and major components in foreign shipyards. The law could be changed, but it would require congressional action to legalize the contract and appropriate funds for a foreign purchase.

After Swift Turnaround for New Deployment, USS Truxton Returns to the Pier

On February 3, the destroyer USS Truxton conducted a fast turnaround from Naval Station Norfolk in order to redeploy to an unknown destination. The next day, she returned to the pier because of an equipment issue, delaying her departure.

Last year, Truxton spent seven months on deployment in the Middle East. She returned to Norfolk in October for maintenance, training and shore leave. On February 3, after about three months in port, she departed again, with speculation pointing to the Caribbean or the Mideast, where a military buildup is under way amidst tensions with Iran.

Three months is a comparatively short time for a destroyer to spend in port between deployments: For repairs and upkeep, U.S. Navy destroyers typically get months of pierside maintenance or a drydocking, followed by six months or more in homeport for training and certification.

"The Navy's kind of asked more for us and our families," Truxton CO Cmdr. James Koffi told local WHRO about the swift deployment. "My crew has done impeccably well during the short turnaround. So I really don't focus on the number of days. . . . I'm very confident of our abilities to execute."

Truxton sailed from Norfolk at about 1000 hours on Tuesday, headed for the York River naval weapons station to take on stores. A harbor webcam spotted her returning to Norfolk on February 4, and USNI confirmed her return to the pier for maintenance purposes on February 5.

A spokesperson for U.S. Second Fleet told USNI that Truxton had to address an "emergent equipment repair," and the extra time at Norfolk would allow the crew to ensure "maximum operational readiness."

Rapid deployment turnarounds are not unheard-of, but when done, they are often a cause for complaint among the crew - especially if the previous deployment was a long one. Destroyer USS The Sullivans deployed five times in the three years ending 2024, though some of her voyages were comparatively brief.

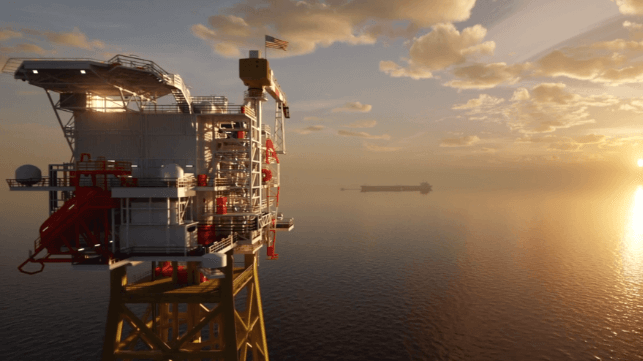

Photos: Future Carrier USS John F. Kennedy Completes Builder's Trials

The future USS John F. Kennedy, the second Ford-class carrier for the U.S. Navy, has completed builder's sea trials at Huntington Ingalls Newport News. It has been 17 years since the initial contract award for Kennedy, and more than 10 years since her keel-laying. The test run was the ship's first outing, and it is a milestone towards the high-tech carrier's long-awaited completion.

Kennedy was affected by the same technological issues facing the first-in-class USS Gerald R. Ford, which faced years of delays in bringing its weapons elevators and its launch & recovery deck gear up to standards. The electromagnetic technology behind these devices had never been to sea before, and Ford delivered without any working weapons elevators. To make the time required for repairs, her first major deployment was deferred until mid-2023, six years after commissioning.

Kennedy also encountered issues with electromagnetic systems, causing delays to the second hull in the series. The Navy also added in additional scope of work pre-delivery to integrate the F-35C fighter into Kennedy's air wing. Certain capabilities are needed aboard to support the stealth fighter jet, and Kennedy will be the first in the class to have them.

The builder's trials started in late January and have now concluded successfully, HII said in a statement. Shipbuilding personnel from HII Newport News were on board, along with Kennedy's crew and other Navy personnel.

Courtesy USN

Kennedy is currently on track to deliver by early 2027, nearly two years later than planned. As first-in-class USS Nimitz is set to retire in May 2026, there will be a brief unplanned gap, and the U.S. Navy's carrier fleet will drop to 10 ships instead of 11 until Kennedy is online. By law, the Navy is required to maintain at least 11 carriers in operational condition.

“Taking Kennedy to sea is a testament to the grit and determination of the world’s finest shipbuilders,” said Derek Murphy, NNS vice president of new construction aircraft carrier programs. “Our nation is depending on us to deliver these critical assets that will protect freedom around the world and we’re proud to see CVN 79 take another step toward joining the fleet.”