US mineral supply chains remain exposed to China chokehold: USGS report

A new report by the US Geological Survey reveals that the United States has grown more reliant on foreign imports of minerals over the past year, highlighting the increased urgency to bolster its domestic supply chains.

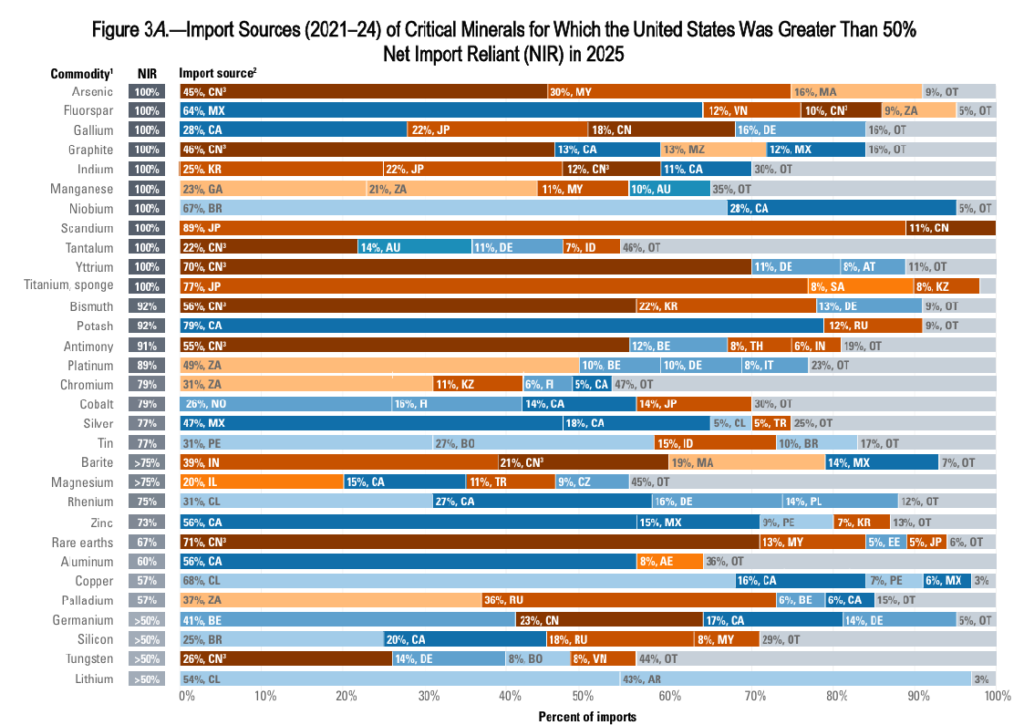

In its annual mineral commodities summary published on Friday, the USGS found that the country was 100% import reliant last year for 16 out of the 90 non-fuel commodities that it tracked. In addition, the US relied more than one-half of its apparent consumption for 54 of the minerals, the report showed.

In comparison, the 2024 data showed 100% import reliance for 15 commodities and more than one-half import reliant for 46 minerals, the USGS said.

As highlighted in the report, the United States is totally reliant on its imports of arsenic (all forms), asbestos, cesium, fluorspar, gallium, graphite (natural), indium, manganese, mica (natural), niobium (columbium), rubidium, scandium, strontium, tantalum, titanium (sponge metal) and yttrium. Most of these are on the USGS critical minerals list, with asbestos, mica and strontium being the only absentees.

An additional 20 critical minerals had a net import reliance of greater than 50%, down from 28 in 2024, USGS noted.

China’s chokehold

For many of the USGS critical minerals, China features prominently as a key supply source, accounting for nearly half of its arsenic and graphite imports, 55% of its antimony, and 70% of rare earths.

“This report underscores just how hard it is to put a dent in China’s decades-long strategy to dominate the world’s minerals markets,” said Rich Nolan, president and CEO of the National Mining Association (NMA), in a press release.

Another leading source of critical minerals is Canada, which supplies the aluminum, gallium, potash and zinc to the US. For copper and silver, which were recently added to the USGS list, Chile and Mexico were the leading import sources respectively.

The USGS report comes at a time when the US government is intensifying efforts to establish a critical minerals supply chain that is independent of China. Earlier this week, the Trump administration unveiled plans for a $12 billion stockpile of critical minerals. Vice President JD Vance followed that up by announcing plans to marshal allies into a preferential trade bloc for critical minerals.

“We have an administration and Congress that have united around the need to de-risk our supply chains and reshore minerals production and processing, but it still takes an average of 29 years to bring a mine online in the US,” Nolan said.

“That’s far too long. Quick action by the administration has been key in jumpstarting domestic mining efforts but we need Congress to act on permitting reform to create the kind of lasting certainty that mining companies need in order to make long-term investments in US projects.”

Argentina trade deals with US do not box out China, minister says

A deal on critical minerals between Argentina and the US signed this week does not rule out Chinese investment in the country’s mining sector, Argentine Foreign Minister Pablo Quirno said on Friday.

“This, as of today, does not imply that China cannot participate or will not participate in investments in Argentina. In fact, it has investments in Argentina, in minerals,” Quirno said in a press conference.

The agreement was announced after a meeting of more than 50 countries in Washington this week where US Vice President JD Vance proposed a trading bloc for critical minerals, with the US establishing a system creating price floors for the commodities.

The two countries also finalized a reciprocal trade and investment agreement on Thursday, with Argentina committing to prioritizing the US as a trading partner for its copper, lithium and other critical minerals over “market manipulating economies or enterprises” – a reference to China.

“What this Argentina-United States agreement does is that it gives greater predictability so that American companies, which are already the leading investor in Argentina, can increase their investments,” Quirno said.

Standing alongside Quirno, Argentina President Javier Milei”s cabinet chief Manuel Adorni did not directly respond to a question about whether Milei had plans to visit China, referring instead to upcoming visits he will make to the US.

Argentina was also seeking more “flexibility” within the Mercosur trade bloc, which also includes Brazil, Paraguay and Uruguay, with Bolivia poised to become a full member, Quirno said. He said that the Mercosur trade bloc doesn’t prohibit Argentina from reaching bilateral agreements, like this one, which he said took just over a year to finalize.

The reciprocal trade and investment agreement will have to be approved by Argentina’s Congress but Quirno said parts could go into effect through a presidential decree.

(By Leila Miller and Brendan O’Boyle; Editing by Cassandra Garrison and Mark Porter)

Brazil’s only rare earth producer offers US stake option for loan deal

Brazil’s only producing rare earth miner has given the US an option to acquire a stake in the company as part of a financing deal.

Serra Verde Group secured a $565 million loan with the US International Development Finance Corporation — an amount 22% more than initially approved by the agency’s board last year. The loan is to help cover upgrades to the company’s Pela Ema operations in Brazil’s Goiás state. The final terms, disclosed by the company, opens the door to US involvement in the closely held firm.

“It is an option for the US government to take a minority stake in the company, with no role in management,” Serra Verde chief operating officer Ricardo Grossi said in an interview.

The Trump administration has been accelerating its backing of companies in the rare earth supply chain to counter China’s dominance in the sector, with the government offering loans and taking equity stakes in companies including MP Materials Corp. and Vulcan Elements. Meteoric Resources NL and Aclara Resources Inc., two developers with Brazilian rare earth projects, have also secured US financing, though at much lower amounts.

Talks between Serra Verde and the DFC have been ongoing for about 18 months, according to Grossi. The company is backed by Denham Capital, Energy and Minerals Group and the UK’s Vision Blue Resources Ltd.

The financing announcement comes after the Trump administration unveiled plans for a strategic critical minerals stockpile to insulate manufacturers from supply shocks as the US works to cut its reliance on Chinese rare earths and other metals. The venture, dubbed Project Vault, sets to marry $1.67 billion in private capital with a $10 billion loan from the US Export-Import Bank to procure and store minerals for automakers, tech firms and other manufacturers.

“It makes complete sense” for Serra Verde to be part of Project Vault, Grossi said, though such participation is still under discussion. “We view the initiative positively, as it could be a way to bring forward revenue for early-stage projects and help buy time until rare earth separation plants outside Asia mature.”

Grossi wouldn’t say whether the DFC funding will be tied to future supply deals, known in the industry as offtake agreements. Serra Verde is renegotiating rare earth supply agreements previously signed with Chinese customers, he said, with contracts expected to conclude by year end — opening the door to contracts with Western companies.

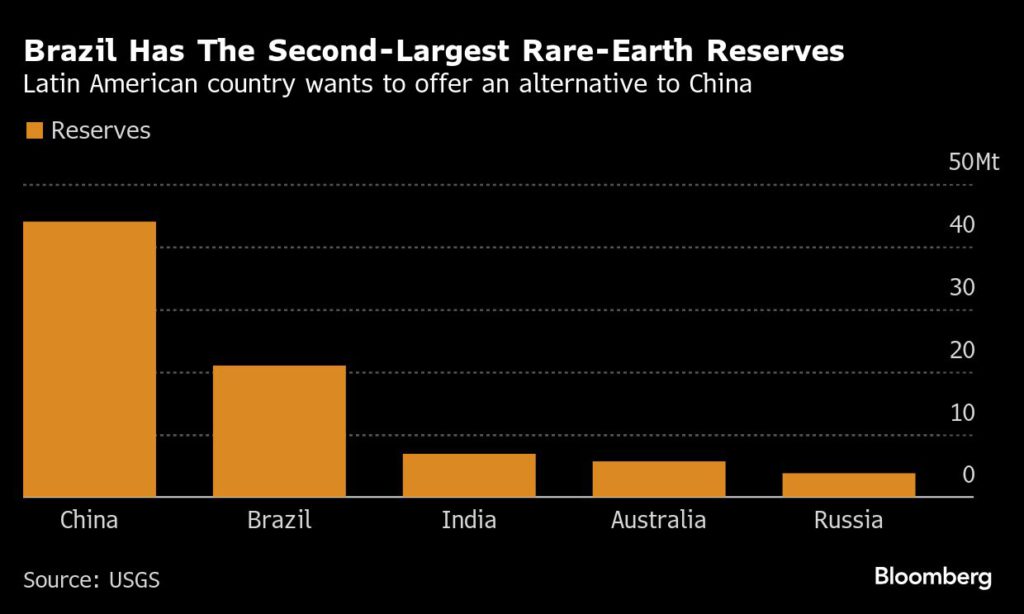

Brazil has the largest rare earth reserves outside China and Serra Verde is the country’s only producer of those metals. Its Pela Ema deposit contains light and heavy rare earth elements — mainly neodymium, praseodymium, terbium and dysprosium – that are key to making magnets used in a wide range of applications.

Serra Verde began commercial output at its mine and processing plant in 2024. The company aims to ramp up annual output to 6,500 metric tons of total rare earth oxides by the end of next year. The company is considering doubling production capacity within the next four years.

(By Mariana Durao)

Vance pitches price floors for key minerals to counter China

The Trump administration hosted 55 countries at a critical minerals summit on Wednesday, pitching price floors and a flood of US private equity in a bid to reduce dependence on China and ensure US manufacturers have stable access to key resources.

The European Union, Japan and Mexico each agreed with the US to set up new policies including price floors to help solve critical mineral supply chain vulnerabilities, according to statements from the US Trade Representative’s office.

Each also pledged to work toward a binding multilateral agreement on trade in critical minerals.

“Today, the international market for critical minerals is failing,” Vice President JD Vance said Wednesday in remarks to open the summit. “Consistent investment is nearly impossible, and it will stay that way so long as prices are erratic and unpredictable.”

Vance called on the audience of foreign officials to help create stable investment conditions. He pitched a “preferential trade center for critical minerals protected from external disruptions,” and made it clear the US is seeking coordinated agreement on price floors.

Price floors have long been discussed among critical minerals industry players as a way to shield non-Chinese companies from the Asian nation flooding markets and depressing Western firms’ profits.

For months, the US and its trading partners have worked toward some sort of cooperation to wean their global supply chains off China. The public statements Wednesday by key US partners, as well as the open discussion of price floors, suggest they’re getting closer to a solution.

The US and EU have committed to concluding a memorandum of understanding within the next 30 days aimed at boosting critical minerals supply chain security.

The US-Mexico arrangement will also include identifying specific critical minerals of interest and exploring price floors for metals imports, according to the USTR. Their agreement comes ahead of a joint review this year of the US-Mexico-Canada free-trade agreement, which could see significant revisions under Trump’s second term.

In his remarks, Vance cast the market for critical minerals as broken, with mining and processing projects abandoned due to volatile prices, and highlighted the administration’s $100 billion lending authority for critical minerals.

His comments built on President Donald Trump’s Monday announcement of plans for a nearly $12 billion critical minerals stockpile, in his latest effort to aid US manufacturers. What the administration has called Project Vault is meant to “ensure that American businesses and workers are never harmed by any shortages,” Trump said at the White House.

The stockpile is set to be financed through $1.67 billion in private capital and a record $10 billion loan from the Export-Import Bank, whose chief executive officer cast the new setup as a “uniquely American” mechanism that relies on a government-led push for private funding.

“We’re crowding in, most importantly, US private equity participation,” Ex-Im CEO John Jovanovic said in a Bloomberg Television interview on Wednesday. The Bank has “an assurance of repayment, we have a fantastic basket of credit risk to look to, and we have physical inventory upon which we’ll earn interest,” he added.

While ending US reliance on China has long been a goal for Washington, it became more urgent last year after Beijing announced export restrictions on so-called rare earths. Trump and Xi Jinping agreed to a trade truce in October that delayed the implementation of the Chinese measures by a year.

Trump spoke with Xi by phone on Wednesday, with the US president saying in in a social media post the two leaders had a “long and thorough call” that included trade. Trump said he looks forward to his April visit to China.

US officials on Wednesday avoided singling out China by name during the summit, with Secretary of State Marco Rubio noting that critical minerals supply “is heavily concentrated in the hands of one country.”

“That lends itself to — at the worst-case scenario — being used as a tool of leverage and geopolitics, but it also lends itself to any sort of disruptions, like a pandemic,” Rubio said in a press conference.

China is home to more than 90% of global rare earths and permanent magnets refining capacity, compared with just 4% for second-place Malaysia, according to the Paris-based International Energy Agency. The rapid expansion of AI is fueling demand for critical minerals used in data centers and high-performance chips.

“Everything is geographically concentrated in China, which really isn’t a value judgment — it’s an objective fact,” said Under Secretary of State for Economic Affairs Jacob Helberg, speaking with reporters on Tuesday to preview the summit. “And so, ultimately, countries want to diversify and de-risk the supply chain, which inherently means de-risking single points of failure.”

The summit and initiative build on years of efforts by prior administrations, including the US Energy Resource Governance Initiative in Trump’s first term and the Biden administration’s Minerals Security Partnership.

Rubio is hosting the talks on Wednesday and the summit is attended mainly by foreign ministers and other diplomats, but Treasury Secretary Scott Bessent and Trade Representative Jamieson Greer have also been involved in the discussions.

(By Eric Martin and Joe Deaux)

No comments:

Post a Comment