Howard Schneider

WASHINGTON (Reuters) - U.S. President Donald Trump rolled out an eye-catching statistic in his State of the Union address Tuesday: the wealth held by the poorest half of American households increased three times as fast as the wealth held by the “1%” since he became president.

That’s true, according to Federal Reserve data.

On average, Americans have seen a 17% jump in household wealth since Trump’s election, while wealth at the bottom half has increased 54%.

“This is a blue collar boom,” Trump also said Tuesday. That’s less apparent. The biggest winners on a dollar basis were a familiar group - whites, college graduates, and people born during the “baby boom” between 1946 and 1964.

Since December 2016, President Barack Obama’s last full month in office, aggregate household wealth has increased by $15.8 trillion, but the vast majority went to groups that have tended to accumulate wealth in the past.

Even with a 54% increase in their household wealth under Trump, the poorest half of American households, around 64 million families, still have just 1.6% of household “net worth.”

HALF OF AMERICA

Net worth combines the value of assets like real estate and stocks and subtracts liabilities like mortgage loans and credit card balances.

Because America’s bottom 50% are starting from such a small base, given the enormous disparities in wealth in the United States, even large moves in their fortunes do little to dent the overall distribution. In dollar terms as of the end of September 2019, that latest data available from the Fed, the combined net worth of the poorest half of families was $1.67 trillion out of total U.S. household wealth of $107 trillion.

Here is what the Fed’s Distributional Financial Accounts have to say:

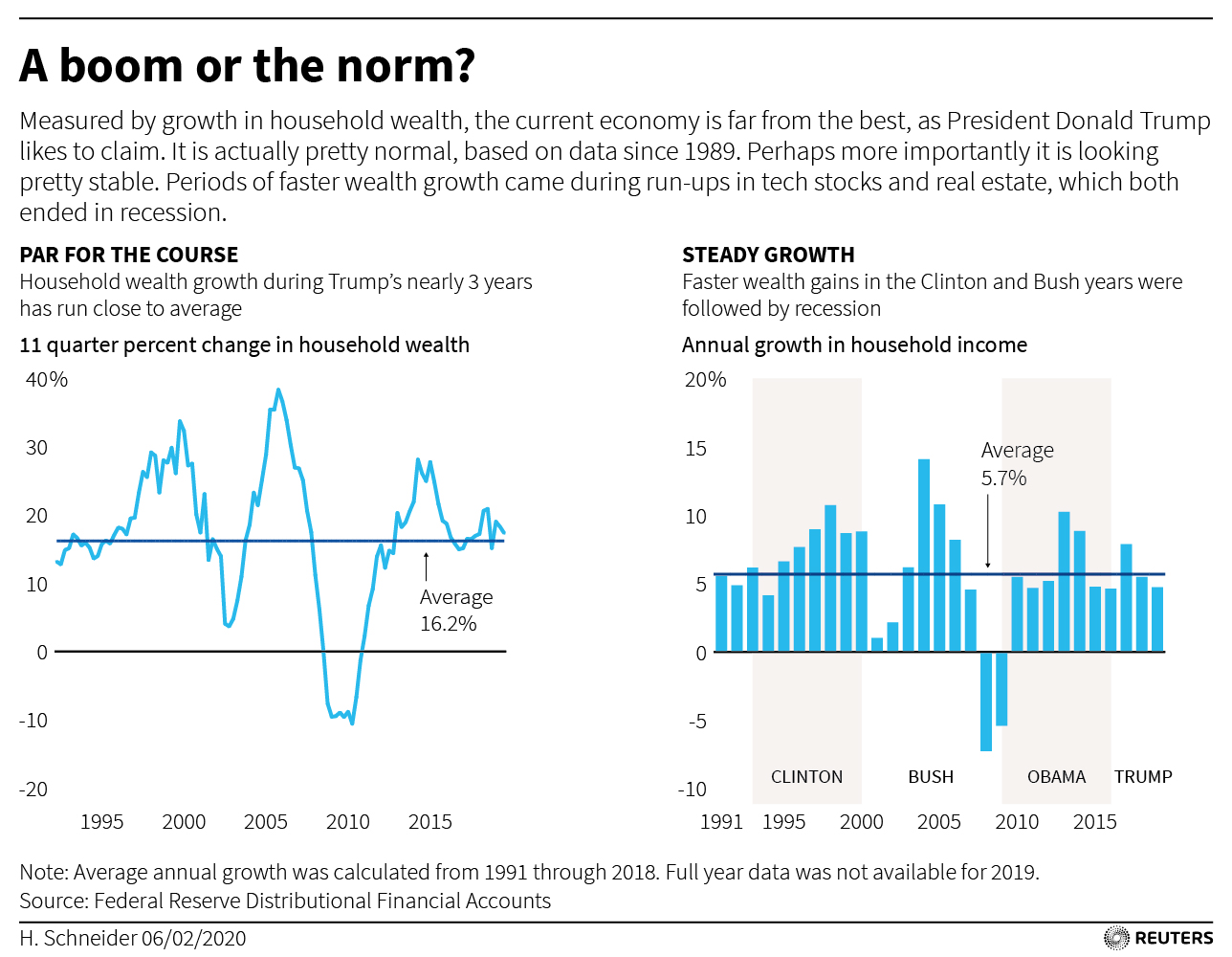

Historically, 17% growth in household wealth over 11 three-month “quarters,” or nearly three years, is pretty standard. There have been 110 such periods since the Fed’s data series begins in mid-1989, and the most recent ranks 55th, squarely in the middle.

On a quarterly basis, compound growth in household wealth since 1989 has averaged 1.39%. Under Trump it is slightly less, at 1.34%.

The bottom half of households saw their net worth rise by 54% under Trump, from $1.08 trillion to $1.67 trillion. That’s compared to an 18% rise for the top 1%, who control roughly a third of the total household wealth in America, or around $34.5 trillion.

Even after those gains, that works out to average net worth of around $26,000 for the bottom half of households versus around $27 million for the ones at the top.

Much of that increase among the bottom half was due to increases in real estate, not stocks, after a resurgence in home ownership rates that began in 2016.

Wages for lower-skilled jobs have of late been rising faster than those for higher-skilled occupations. January non-farm payrolls data show a bigger-than-expected jump in overall employment, bolstered by an increase in construction jobs.

But it takes time for income to be saved and translate into wealth. Since Trump took office, households headed by a college graduate captured 75% of the net worth gains, or around $11.88 trillion.

They represent about a third of all households, according to the Fed survey on which the data series is based.

Overall, households headed by a high school graduate, a group on the front lines of Trump’s pledge to restore blue collar fortunes, lost $0.4 trillion in net worth during his time in office. Those households represent about a fourth of the total.

A BABY BOOMER BOOM

Generationally, households with a head born from 1946 to 1964 did not get fooled again, as the 1971 rock anthem pledged. The title of Trump’s speech was “The Great American Comeback.” It could just as easily have been “OK Boomer, What About the Rest of Us?”

Baby boomers under Trump, himself a member of that generation, captured around $10 trillion of recent wealth gains, or about two-thirds of the total.

The Fed survey’s demographic estimates are as of 2016, and the population would have changed slightly since then. In 2016 about 36% of household heads (in the case of mixed-sex couples the Fed considers the man to be the head, in same-sex couples it is the oldest of the two) were headed by a member of the baby boom.

Wealth accumulates with time, and older people would tend to have a larger base to start with. But for millennials, those born between 1981 and 1996, the last three years of booming markets have meant an extra half trillion dollars only, spread across about 20.6% of households. GenX’ers, born between 1965 and 1980, got about 21% of the gains, and made up roughly 26% of households. The pre-baby boom “Silent Generation” got 16% of the gains, roughly in line with that group’s share of households.

Analyzed by race, the data told a familiar story of inequality. About 84% of recent wealth gains accrued to the 64% of households that self-identified to the Fed as white.

About 4.6% of wealth gains went to the 14.5% of households that identified as black, and 3.8% to the 10.1% of households that identified as Hispanic.

No comments:

Post a Comment