Copper price down as BHP and workers reach tentative wage deal at Escondida

MINING.COM Staff Writer | August 10, 2021 |

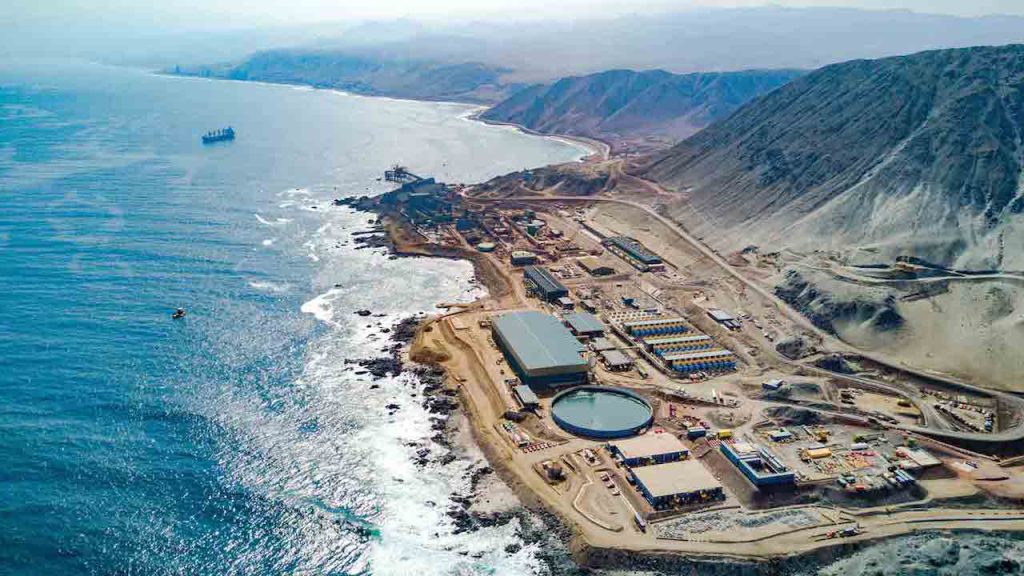

Escondida mine (Image: Wikimedia Commons)

BHP and the union at its Escondida copper mine in Chile said on Tuesday that they had reached a tentative deal for a new contract, although the union will take two more days to submit the new contract to a vote by workers.

The preliminary deal eases fears that the union will call a strike at the world’s biggest copper mine.

Escondida is expected to produce 1.01-1.06 million tonnes of copper in the 2021 financial year. The figure is equivalent to over 5% of the world’s annual mined copper output.

In 2017, a historic 44-day stoppage jolted copper markets and slowed economic growth in Chile, the world’s top copper producer.

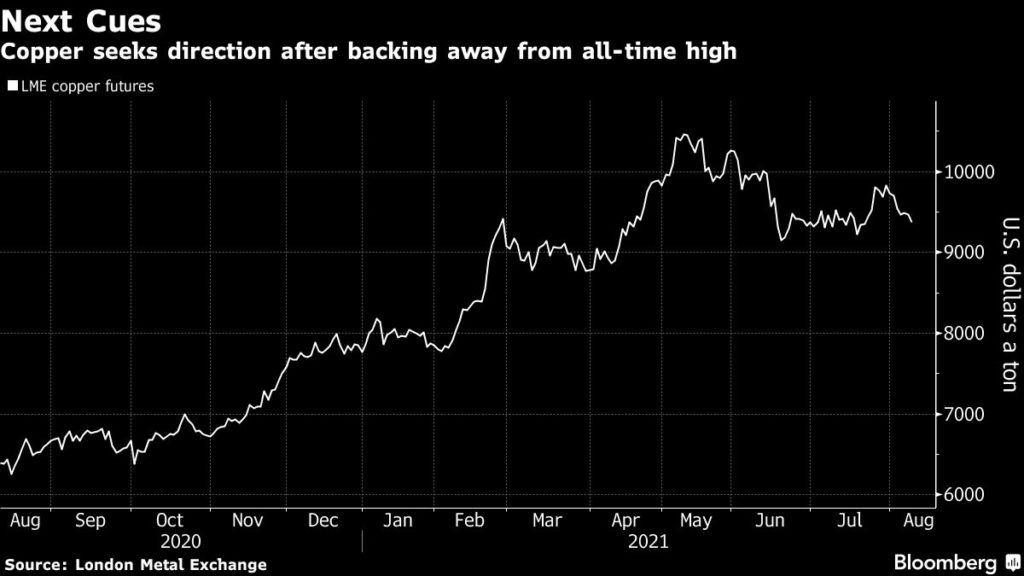

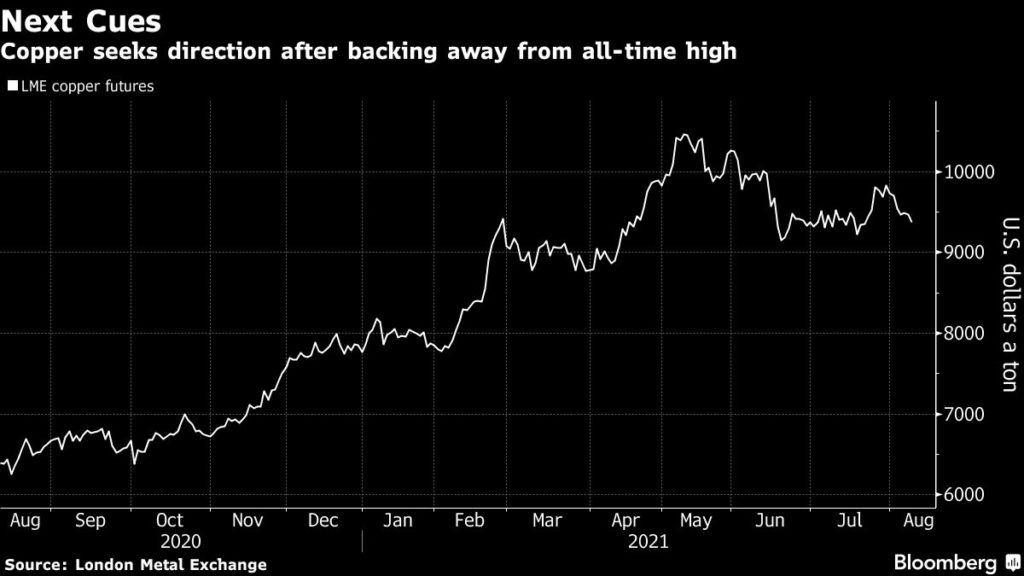

Copper prices fell on Wednesday after the deal was announced.

Click here for an interactive chart of copper prices

Three-month copper on the London Metal Exchange eased 0.4% to $9,485.50 a tonne by 0316 GMT, while the most-traded September copper contract on the Shanghai Futures Exchange tracked overnight gains in London to rise 0.8% to 69,810 yuan ($10,770.82) a tonne

MINING.COM Staff Writer | August 10, 2021 |

Escondida mine (Image: Wikimedia Commons)

BHP and the union at its Escondida copper mine in Chile said on Tuesday that they had reached a tentative deal for a new contract, although the union will take two more days to submit the new contract to a vote by workers.

The preliminary deal eases fears that the union will call a strike at the world’s biggest copper mine.

Escondida is expected to produce 1.01-1.06 million tonnes of copper in the 2021 financial year. The figure is equivalent to over 5% of the world’s annual mined copper output.

In 2017, a historic 44-day stoppage jolted copper markets and slowed economic growth in Chile, the world’s top copper producer.

Copper prices fell on Wednesday after the deal was announced.

Click here for an interactive chart of copper prices

Three-month copper on the London Metal Exchange eased 0.4% to $9,485.50 a tonne by 0316 GMT, while the most-traded September copper contract on the Shanghai Futures Exchange tracked overnight gains in London to rise 0.8% to 69,810 yuan ($10,770.82) a tonne

.

A deal at Escondida would also ease labor tensions in Chile after workers at the Caserones mine owned by JX Nippon Mining & Metals opted to walk off the job Tuesday when their talks with management collapsed.

(With files from Reuters and Bloomberg)

A deal at Escondida would also ease labor tensions in Chile after workers at the Caserones mine owned by JX Nippon Mining & Metals opted to walk off the job Tuesday when their talks with management collapsed.

(With files from Reuters and Bloomberg)

Bloomberg News | August 10, 2021 |

Escondida’s desalination plant. (Image courtesy of BHP.)

BHP Group and union leaders at the Escondida complex in Chile are getting closer to a wage deal that would avert a strike at the world’s biggest copper mine.

Negotiators asked labor authorities for a one-day extension in a mediation process to continue working toward an agreement that could be put to workers Tuesday. According to the union, the breakthrough came after BHP acceded to some demands. On Friday, the Melbourne-based company warned that it wouldn’t improve the offer during a strike.

“During the course of the night, conversations between the parties will continue to close an agreement that will then be presented by Union No. 1 to its members,” BHP said in a statement late Monday.

Avoiding a stoppage at a mine that accounts for about 5% of global copper production would ease tensions over tightening supplies at a time when trillions of dollars in government stimulus fuel demand for industrial metals. In 2017, the same union staged a 44-day stoppage.

A deal at Escondida would also ease labor tensions in Chile after workers at a mine owned by JX Nippon Mining & Metals opted to walk off the job Tuesday when their talks with management collapsed.

At a third copper mine in Chile, Codelco’s Andina, the two sides agreed to extend talks to allow workers to vote on a new proposal, the result of which will be known Wednesday.

Surging producer profits are emboldening mine workers, with host nations also looking at ratcheting up taxes to help resolve inequalities exacerbated by the pandemic. At the same time, companies are striving to keep labor costs in check in a cyclical business and as ore quality deteriorates and input prices start to rise.

(By James Attwood and Alejandra Salgado)

No comments:

Post a Comment