Staff Writer | October 20, 2022 |

El Soldado copper mine in Chile.

(Image courtesy of Anglo American | Flickr.)

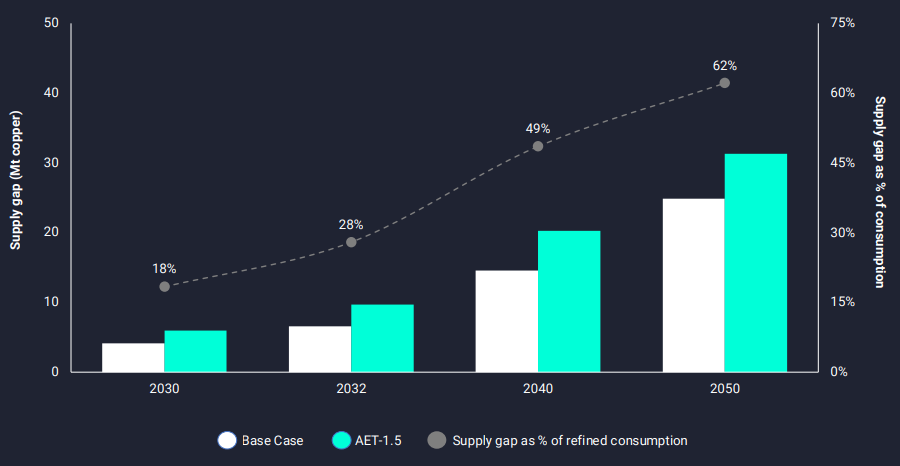

A new report by Wood Mackenzie estimates that 9.7 million tonnes of new copper supply is needed over 10 years from projects that have not attracted sufficient investment, had not been approved by boards or received necessary government and environmental permits, to meet the targets set out in the Paris Climate Agreement.

To put that figure in perspective, 9.7mt is equivalent to nearly a third of current refined consumption, says Woodmac, a Verisk business (Nasdaq:VRSK). That is also the equivalent of putting a new La Escondida, the world’s largest copper mine by a country mile, into production each year.

A new report by Wood Mackenzie estimates that 9.7 million tonnes of new copper supply is needed over 10 years from projects that have not attracted sufficient investment, had not been approved by boards or received necessary government and environmental permits, to meet the targets set out in the Paris Climate Agreement.

To put that figure in perspective, 9.7mt is equivalent to nearly a third of current refined consumption, says Woodmac, a Verisk business (Nasdaq:VRSK). That is also the equivalent of putting a new La Escondida, the world’s largest copper mine by a country mile, into production each year.

Source: Wood Mackenzie

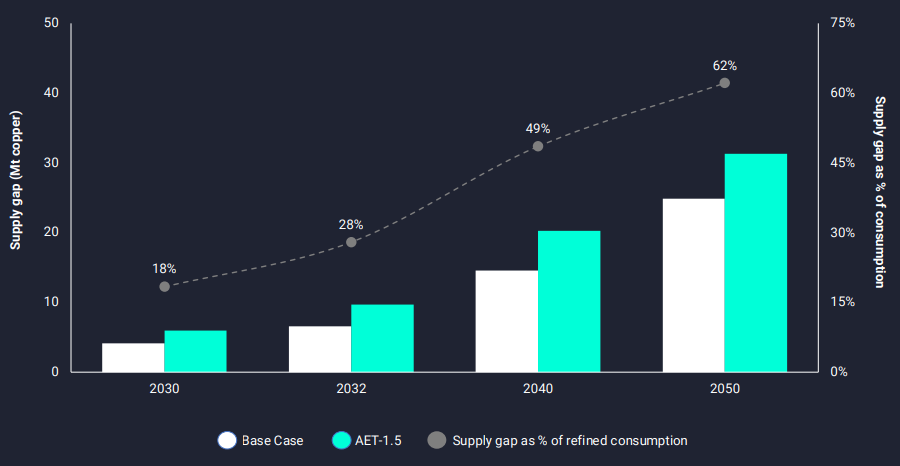

The reality on the ground is far removed from the copper demand created by electric cars and renewable energy generation and storage.

Woodmac figures show despite historically strong copper prices, mining project approval rates have dwindled to cyclical lows. In the first half of 2022, the volume of committed copper projects totalled an average annual production of just 260,000 tonnes per year.

“Copper’s critical role in the energy transition is undisputed. It’s the significant pull on the metal’s existing and potential supplies, and the investment required that needs urgent attention,” said Nick Pickens, research director of copper markets at Wood Mackenzie.

The reality on the ground is far removed from the copper demand created by electric cars and renewable energy generation and storage.

Woodmac figures show despite historically strong copper prices, mining project approval rates have dwindled to cyclical lows. In the first half of 2022, the volume of committed copper projects totalled an average annual production of just 260,000 tonnes per year.

“Copper’s critical role in the energy transition is undisputed. It’s the significant pull on the metal’s existing and potential supplies, and the investment required that needs urgent attention,” said Nick Pickens, research director of copper markets at Wood Mackenzie.

Source: Wood Mackenzie

“To successfully meet zero-carbon targets, the mining industry needs to deliver new projects at a frequency and consistent level of financing never previously accomplished,” Pickens added.

In short, says Woodmac, “the global energy transition presents an almost unattainable mine supply challenge, with significant investment and price incentives required.”

“To successfully meet zero-carbon targets, the mining industry needs to deliver new projects at a frequency and consistent level of financing never previously accomplished,” Pickens added.

In short, says Woodmac, “the global energy transition presents an almost unattainable mine supply challenge, with significant investment and price incentives required.”

Source: Wood Mackenzie

Woodmac estimates that more than $23 billion a year will be needed over 30 years to deliver new projects under the 1.5 degrees Celsius Paris scenario – a level of investment only previously seen for a limited period from 2012 to 2016, following the China-induced commodity super-cycle.

The copper price needed to meet demand rises substantially to $9,370/t ($4.25/lb) in constant 2022 US dollar terms under this scenario. That constitutes a 25% rise from today’s price.

Woodmac estimates that more than $23 billion a year will be needed over 30 years to deliver new projects under the 1.5 degrees Celsius Paris scenario – a level of investment only previously seen for a limited period from 2012 to 2016, following the China-induced commodity super-cycle.

The copper price needed to meet demand rises substantially to $9,370/t ($4.25/lb) in constant 2022 US dollar terms under this scenario. That constitutes a 25% rise from today’s price.

No comments:

Post a Comment