Even after Sam Bankman-Fried’s arrest, the crypto industry remains full of men acting like boys

Kathleen Breitman

Fri, October 13, 2023

Drew Angerer—Getty Images

When Caroline Ellison strode into court this week to testify against one-time romantic and business partner Sam Bankman-Fried, I felt several things as a woman who has built a company in the same industry. The first was that I had made a mistake on passing on that lovely YSL jacket Ellison was sporting for the trial.

My next thought was a more serious one: Until the collapse of the rotten FTX empire, Ellison—the former CEO of Bankman-Fried’s hedge fund, Alameda Research—had been one of the few, the proud, the women in cryptocurrency with an executive title. My running joke used to be “there are women in crypto—the problem is that I know them all.”

There aren’t many of us around, and the reasons are almost exclusively cultural. Look no further than X (formerly Twitter), where reports about the substance of Ellison’s testimony have been eclipsed by deeply cruel comments about her physical appearance. It left the impression that Ellison had become yet another casualty of the web of lies spun up by her ex-boyfriend and boss.

In theory, crypto has nothing to do with gender—it’s a technology and cultural phenomenon that allows for value transfer on the internet without an intermediary. However, unlike banks or credit card companies, cryptocurrencies began as hobbyist projects and most of their early mythologies came to life on message boards like Reddit or 4Chan. The distinct humor and jargon surrounding crypto mimics that of the almost exclusively male spaces in which it was forged.

Early crypto culture helped sow what would become a massive demographic disparity in the industry. It is not as bad as it used to be. The "women question" in crypto abated in part due to the boom in NFTs, which brought in an infusion of female faces from the art world, and helped make the overall vibe in crypto more pleasant. Or at least tolerable.

But the doyens of cryptocurrencies are still scruffy ragamuffin boyish types who are very online and tweet too much as part of carefully crafted internet personas. In her testimony, Ellison exposed how Bankman-Fried’s disheveled appearance was just an extension of the digital efforts he made to disguise who he really was. All of it fit together to project a fiction: “Too caught up in work and ideas to care about things like hygiene and social graces!”

As for the case of fraud and misappropriation of funds made against SBF, as a businesswoman, it seems straightforward. From its inception, the FTX exchange ran as a passthrough to take customer deposits to fund Alameda. Eventually Ellison was appointed CEO of Alameda and inherited these corporate policies. (To be sure, the same Twitter culture that now makes fun of her appearance once lauded her ability to pump “Sam coins” associated with FTX to their benefit.) The grift caught up with them when the gigantic hole in solubility was pointed out by reporter Ian Allison, who intercepted an Alameda balance sheet.

The final thing that struck me in light of Ellison’s testimony is how unsophisticated the entire FTX/Alameda hustle really was—more like the plot of a Coen brothers film than a swindle designed by geniuses. For instance, how did Ellison enjoy nearly unlimited credit and a close relationship with a kingmaker exchange—and still fail to make Alameda constantly profitable? As her testimony exposed, the entire operation ran on a culture of stealing, yet they still couldn’t balance the books?

Telling still is the fact that Ellison was not the face of the fraud she uniquely facilitated. Once it's all said and done, SBF will go down as a genius for his ability to turn his disheveled appearance into billions—at least temporarily. The man knew his market.

A friend of mine who works for an actor-turned-investor once remarked: "He's usually cast in roles as a dummy, but he's super smart. People don't see it coming, and isn't that better than the other direction?" After this week of testimony in SBF's case, I think it would be hard to disagree.

Women are constantly underestimated in crypto and elsewhere, and one day that will be their strength. In the meantime, the industry’s obsession with schlubs will be its folly.

Kathleen Breitman is a cofounder of Tezos. The opinions expressed in Fortune.com commentary pieces are solely the views of their authors and do not necessarily reflect the opinions and beliefs of Fortune.

This story was originally featured on Fortune.com

At the Sam Bankman-Fried Trial, It’s Clear FTX’s Collapse Was No Accident

Alex Kantrowitz

Fri, October 13, 2023

I’m just back at my desk after spending two days in court at the Sam Bankman-Fried trial. The downtown Manhattan courthouse is just a few stops away on the subway, and I figured I’d stop by to see Caroline Ellison, Alameda Research’s ex-CEO and Bankman-Fried’s ex-girlfriend, testify about his alleged crimes. It was more revelatory than expected.

Bankman-Fried’s empire — which spanned FTX and Alameda — lost billions of customer money without dispute, but there’s a narrative that his simple carelessness might’ve been at fault. It was a whoopsie, you could say, from a guy with good intentions. High-profile writers including Michael Lewis seemed to buy the theory, and Bankman-Fried’s lawyers played off it. Sam was a “math nerd who didn’t drink or party” his legal team said. And well, “some things got overlooked.”

Shocked might not be the right word, but I was astonished to see the delta between that narrative and the reality in court. Speaking clearly, and with devastating precision, Ellison told jurors exactly how she and Bankman-Fried funneled FTX customer funds into Alameda Research, then spent the money even after FTX customers weren’t likely to get it back.

The crimes were no mistake. With everything laid out on spreadsheets, Ellison revealed how she periodically updated Bankman-Fried on how much money Alameda had taken from FTX customers, using the cryptic “FTX Borrows” as the line item. She admitted labeling it such in case the company landed in legal trouble. And even as Alameda drew more than $10 billion from FTX, more than FTX’s total remaining assets, Ellison said Bankman-Fried directed her to pay back loans to crypto lenders, like Genesis, leaving FTX depositors out to dry.

As the crypto market deflated in late 2022, people began losing faith in the system, and FTX needed a miracle to stem an inevitable run on deposits. Much of the money Alamada had taken was either gone or illiquid. It made close to $5 billion in loans to Bankman-Fried and his associates, with little chance of recouping the money. When crypto stayed down, Bankman-Fried floated raising money from Saudi Prince Mohammed bin Salman, Ellison said. But no savior arrived and the operation collapsed. At the courthouse, people laughed and gasped at the brazenness.

Ellison pleaded guilty to seven counts of fraud in exchange for a cooperation agreement from prosecutors, so she had an incentive to build up her case. Much of this story is based on her testimony, an important caveat. But the narrative of a bumbling, likable, and just-a-bit-careless Bankman-Fried is out the door. He lost $8 billion of client money, seemingly with full knowledge of his actions.

How Bankman-Fried manipulated people so fully that the narrative still allows for his good intentions is remarkable. The money is part of it, of course. He and FTX sprayed cash everywhere, naming stadiums, paying off athletes like Tom Brady ($55 million for 20 hours of work?!), funding media companies, wallpapering cities with his face, and donating extravagantly to politicians.

But Bankman-Fried’s save-the-world story, and our desire to believe it, offers a more important lesson. He professed to be an “Effective Altruist,” claiming he was making money to advance the greater good. The public bought his story, even though his business was an exchange for inflated and scam tokens. And behind closed doors, the truth came out. Ellison said Bankman-Fried told her his “utilitarian” views meant he could lie or steal if it justified his ends.

Juries are unpredictable and Bankman-Fried may walk, but we ought not be duped by this form of messaging again. “Visionary” leaders professing to save the world are probably just there to make money. The same applies to the entire Web3 grift, which was so transparently greedy, yet cloaked itself in the language of a better internet. Shortcuts are enticing, but the meaningful stuff often happens bit by bit — not in a flash. If anyone promises you otherwise, it’s worth some serious skepticism.

FTX trial stirs up more chaos as ex Alameda CEO Caroline Ellison testifies on faulty balance sheets, bribes and more

Jacquelyn Melinek

Thu, October 12, 2023

Image Credits: Spencer Platt / Getty Images

Welcome back to Chain Reaction.

It’s week two of the Sam Bankman-Fried trial and I’m writing this live from outside the Southern District of New York courthouse where the case is taking place. (Tip: If you want to get into the main courtroom to sit behind SBF and listen in, you have to line up before 6 am or you'll be sent to the overflow room.)

Tuesday was a slower day filled with technical details, but that changed on Wednesday and Thursday when Caroline Ellison, ex-CEO of Alameda Research, took the stand to testify.

Here’s a refresher on what you may have missed last week. (TC+)

Alameda is a big player in the trial as it’s the crypto hedge fund sister company of FTX. Bankman-Fried started Alameda back in 2017, two years before launching FTX. And in 2021, Ellison took over as co-CEO with Sam Trabucco as Bankman-Fried wanted to step away for optics, but still controlled the firm internally, she testified.

Ellison was the fifth witness for the prosecution and claimed that Bankman-Fried directed her to commit fraud and money laundering crimes. Ellison added that while she ran Alameda, she took several billion dollars from customers to invest in other projects and repay debts to lenders through an “essentially unlimited line of credit.” More details below.

For the latest updates check here

.

The SBF Trial

Former Alameda CEO Caroline Ellison explains how FTX hid losses, sandbagged lenders (TC+)

Alameda Research allegedly paid Chinese officials around $150M to regain $1B worth of exchange accounts

SBF started a $2 billion venture fund using Alameda loans

Crypto is about a lot more than a former golden boy turned villain (TC+)

‘Marked to zero’: Paradigm testimony at SBF trial points to investor fraud

Alameda had a $65B line of credit and ‘unlimited withdrawals’

The SBF Trial

Former Alameda CEO Caroline Ellison explains how FTX hid losses, sandbagged lenders (TC+)

Alameda Research allegedly paid Chinese officials around $150M to regain $1B worth of exchange accounts

SBF started a $2 billion venture fund using Alameda loans

Crypto is about a lot more than a former golden boy turned villain (TC+)

‘Marked to zero’: Paradigm testimony at SBF trial points to investor fraud

Alameda had a $65B line of credit and ‘unlimited withdrawals’

Victoria Bekiempis in New York

Thu, October 12, 2023

Photograph: Peter Foley/EPA

On the third day of Caroline Ellison’s stunning testimony at Sam Bankman-Fried’s trial on billion-dollar fraud charges, his lawyers cast her as the true leader of Alameda Research to make a case that the fallen FTX founder wasn’t responsible for the companies’ collapse.

Ellison, 28, was CEO of the hedge fund Alameda Research and Bankman-Fried’s sometimes-girlfriend. She’s the prosecution’s star witness at his Manhattan federal court trial. Bankman-Fried, 31, faces seven counts on fraud and conspiracy charges relating to his management of the cryptocurrency exchange FTX. He has pleaded not guilty.

Related: Caroline Ellison says she felt ‘relief not to have to lie any more’ after FTX collapse

Defense attorney Mark Cohen suggested that Ellison –Bankman-Fried’s on-again, off-again girlfriend – let heartbreak over their spring 2022 breakup impede business communications in a damaging way.

“After you and Mr Bankman-Fried broke up for the last time, did it affect your ability to communicate with him?” Cohen asked.

“Yes,” Ellison said. “I found it difficult to have in-person, one-on-one conversations with him. I tried to avoid those and avoid much time with him in social settings. I continued to have work communications with him over Signal.”

Cohen intimated during his questioning that Ellison’s business decisions might have been impacted by her emotions toward Bankman-Fried, including her resistance to investing in Modulo, another crypto trading firm. Modulo was run by a woman whom Bankman-Fried had also dated, Lily Zhang, previous court testimony revealed, and Duncan Rheingans-Yoo.

“Didn’t part of you want to crush them?” asked Cohen.

“Yeah, I remember having feelings like that at some points,” Ellison said. Alameda still wound up sending more than $450m to Modulo in spring 2022.

Cohen asked about everything from Ellison’s treatment of risk to accounting techniques, at times implying that Bankman-Fried was a savvy businessman who erred in handing her the reins. In response to Cohen’s questions, Ellison revealed that she had considered resigning from Alameda over concerns of its borrowing.

The day before, Ellison had provided a detailed chronology of Alameda’s shaky inner-workings, deeply intertwined with FTX, both of which came crashing down after crypto dipped in May 2022, weighed down by a $10bn deficit.

While CEO, Ellison testified, she worried that Alameda – largely funded by loans – would be dealt a death blow if the lenders decided to collect, and they did. Alameda found itself billions of dollars short. The hedge fund illegally used funds from FTX customers to repay the debts without notifying them, which was done at Bankman-Fried’s direction, according to Ellison.

In her testimony, Ellison went into detail about her and Bankman-Fried’s relationship, describing how the entanglement saddened her and negatively affected her work.

“I often shared feelings about being unhappy with our relationship” in messages sent to Bankman-Fried via Google Docs, she said. When the crypto crash began, the two had broken up, Ellison said, and she had been avoiding speaking to him in spite of running businesses together.

Bankman-Fried blamed her for Alameda’s downfall, Ellison said Wednesday. In August 2022, months after they had split, she and Bankman-Fried were having a business conversation in the study at their sprawling $40m Bahamas penthouse, which they shared with other FTX and hedge fund employees.

“We initially started by talking about Alameda’s balance sheet, and then Sam started saying … that it was a big mistake, and that it was my fault, and that I was largely responsible for the financial situation Alameda found itself in,” Ellison said. She added, however, that she remembered Bankman-Fried controlled the majority of Alameda’s investment decisions.

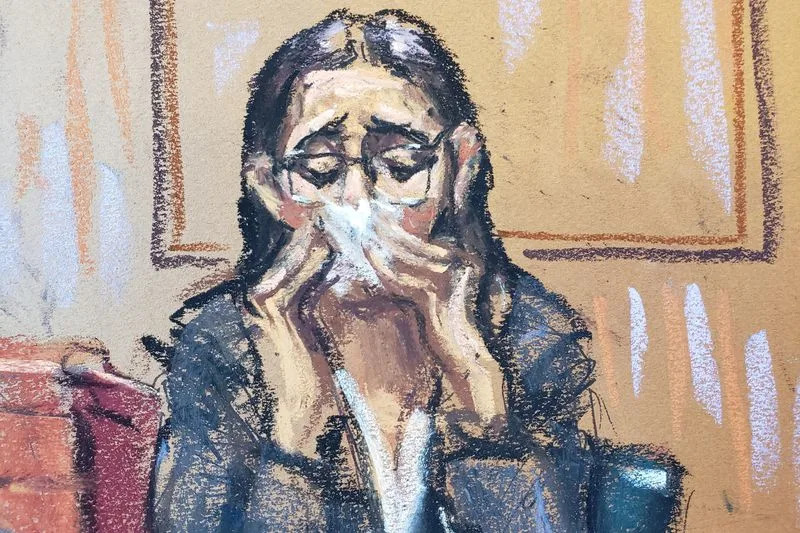

Weeping on the witness stand, she also described how the deception weighed on her as the months wore on – what happened if people found out that FTX customer funds were propping up the ailing Alameda? What happened if too many FTX customers withdrew their money at once – only to find they couldn’t actually collect?

When FTX and Alameda did collapse in November of 2022, she felt relieved, she said Wednesday.

“I had a lot of mood swings during that week and a lot of different feelings, but one of the feelings I had was an overwhelming feeling of relief,” Ellison testified. “This was kind of something I’d been dreading for so long … and I just, I felt a sense of relief that I didn’t have to lie any more ... that I could take responsibility.”

Ellison has pleaded guilty to wire fraud and conspiracy charges for her role in FTX and Alameda’s collapse. FTX co-founder Gary Wang agreed to a similar plea deal and testified against Bankman-Fried last week.

Did Caroline Ellison and SBF Cook Alameda’s Books to Save the World?

Danny Nelson, Nikhilesh De

Thu, October 12, 2023

Before she worked at Alameda Research, Caroline Ellison did not think she’d break the rules of morality and also accounting. Of course, this was also before her ex-boyfriend and boss Sam Bankman-Fried convinced her that such mores were worth bending for the greater good.

The FTX chief’s creative ethics entered his criminal fraud trial during Wednesday’s plodding but emotionally charged direct questioning of Caroline. According to the government’s star witness, Sam was so engrossed in his conception of right and wrong that other people’s base principles (namely, upholding the truth and not stealing) were at best guidelines – if even that.

“The only moral rule that mattered to Sam was whatever maximized utility,” Caroline said. She testified Sam’s goal was to “create the greatest good for the most number of people.”

Therein lies the altruist. Sam styled himself a champion of the “effective altruist” movement, an offshoot of utilitarianism whose proponents seek to make as much money as possible and then give it to causes that might save the world. That was how Sam did it, at least. For a time, his crypto empire appeared to be rocketing the quirky quant toward maximum philanthropic velocity. He’d already started giving massive sums to politicians, charities and pet causes he thought could save humanity from itself.

(It came at the cost of his customers, according to prosecutors as well as “Enron John” Ray III. The crisis-era CEO of now-bankrupt FTX Group has spent the past 11 months on a highly lucrative global treasure hunt to claw back millions of donated dollars to make FTX customers whole.)

You're reading The SBF Trial, a CoinDesk newsletter bringing you daily insights from inside the courtroom where Sam Bankman-Fried will try to stay out of prison. Want to receive it directly? Sign up here.

Regardless … Sam’s maximal utility prompted Caroline to shelve whatever rulebook she’d followed before. “It made me more willing to do things like lie and steal” at Alameda, she testified. Her steady words (they later wavered) captured the jury’s unbroken attention – a rarity on a day mostly spent discussing balance sheets that almost put Judge Kaplan to sleep.

Caroline’s seven-hour long direct questioning delved into how things broke bad for the Empire of Sam. Months before Alameda collapsed, Caroline said she worried the crypto hedge fund’s borrowing of billions of dollars from FTX customers would be both companies’ undoing (she was right). That said, she said she did nothing at the time to stop the lies enabling it. Instead she perpetuated them – she bamboozled Alameda’s lenders with them.

Through a tremendous feat of Grotesquely Atrocious Accounting Principles (G.A.A.P.), Caroline said she cooked up seven flavors of balance sheet to serve lenders like Genesis (a subsidiary of CoinDesk parent Digital Currency Group), who by June 2022 had grown money-hungry in the face of its own possible collapse. Sam chose the seventh. There, Caroline had hidden Alameda’s massive FTX borrows as perhaps more palatable long term loans.

“I didn’t want Genesis or others to know Alameda owed money to FTX,” she said. Throughout Wednesday, she repeated what that really meant: Alameda owed money to FTX’s customers. It had taken their money to help it make money to help make Sam the money he needed to help save the world.

Caroline Ellison pled guilty last December to seven counts stemming from her time running Alameda Research. On Wednesday, she told the jury that she was taking responsibility for her actions. She didn’t really say whether her past failure to do so was a result of her steadfast belief in Sam’s vision – or something else. No matter: She stuck by risk-taking Sam until the castle imploded. This was the man who’d flip a coin that could either destroy the world or make it twice as good, she said Tuesday.

Ultimately the truth did come out, killing FTX, Alameda, their lenders, investors and customers, and sparking criminal investigations into Caroline and the other members of Sam’s inner circle. She said her house was raided by the FBI before she began cooperating with prosecutors – a contrast to the quiet coder Gary Wang, who volunteered himself to the government barely a week after the companies’ demise. Deputy court clerk Andy Mohan slid Caroline a baby blue tissue box as she tearfully called out to “the people that trusted us,” people she said she “betrayed.”

Caroline did not betray Sam’s own state of mind during all this (she isn’t allowed to because of the bothersome rules governing witness questioning. They’re far more rigid than ethical mores). That said, she returned to a favorite topic of this newsletter: The artifice of this alleged fraud.

Caroline told the jury she saw Sam driving one at their home in the Bahamas. He’d switched from an unnamed luxury car to the most normal automobile imaginable because she said he said “it would be better for his image.”

Sitting in the courtroom hearing this, Sam – who was tapping away at his computer when Caroline later broke out in tears – shook at his highest frequency yet.— Danny Nelson

Courtroom scenes

Judge Lewis Kaplan continues to express his respect for the attorneys trying the case – but still wound up almost mocking lead defense counsel Mark Cohen on Wednesday after he objected to Ellison saying she “believes” former FTX executive Nishad Singh told her that offsetting ledger entries in FTX and Alameda’s books were meant for auditors.

“I believe this is Wednesday. I believe this is Wednesday. That’s not speculation. Overruled!” the judge said, getting the ruling in as Cohen said “withdrawn.”

He appeared to be losing his patience with the prosecution as well, chiding Department of Justice attorneys across Tuesday and Wednesday for mislabeled exhibits and seeming exasperated with their extensive focus on spreadsheets.

The overflow room, where most reporters and members of the public are stashed during trial days, burst into laughter after Ellison said “Alameda paid what I believe was a large bribe to Chinese government officials to get some of our exchange accounts unlocked,” and Assistant U.S. Attorney Danielle Sassoon said deadpan, “Well, let’s break that down.”

During a back-and-forth after the jury left the room, Judge Kaplan again took aim at arguments advanced by the defense. Cohen and his team asked for permission to bring up artificial intelligence firm Anthropic’s recent fundraising news (a report said it’s in talks for a juicy valuation), saying it speaks to questions of portfolio investing. Prosecutors objected, saying the current value of Anthropic’s stock is immaterial to whether or not Bankman-Fried misappropriated customer funds, a view Judge Kaplan agreed with.

Judge Lewis Kaplan continues to express his respect for the attorneys trying the case – but still wound up almost mocking lead defense counsel Mark Cohen on Wednesday after he objected to Ellison saying she “believes” former FTX executive Nishad Singh told her that offsetting ledger entries in FTX and Alameda’s books were meant for auditors.

“I believe this is Wednesday. I believe this is Wednesday. That’s not speculation. Overruled!” the judge said, getting the ruling in as Cohen said “withdrawn.”

He appeared to be losing his patience with the prosecution as well, chiding Department of Justice attorneys across Tuesday and Wednesday for mislabeled exhibits and seeming exasperated with their extensive focus on spreadsheets.

The overflow room, where most reporters and members of the public are stashed during trial days, burst into laughter after Ellison said “Alameda paid what I believe was a large bribe to Chinese government officials to get some of our exchange accounts unlocked,” and Assistant U.S. Attorney Danielle Sassoon said deadpan, “Well, let’s break that down.”

During a back-and-forth after the jury left the room, Judge Kaplan again took aim at arguments advanced by the defense. Cohen and his team asked for permission to bring up artificial intelligence firm Anthropic’s recent fundraising news (a report said it’s in talks for a juicy valuation), saying it speaks to questions of portfolio investing. Prosecutors objected, saying the current value of Anthropic’s stock is immaterial to whether or not Bankman-Fried misappropriated customer funds, a view Judge Kaplan agreed with.

“This is like saying if I broke into the Federal Reserve bank, made off with a million dollars, bought Powerball tickets and won big, it’s OK,” he said.— Nikhilesh De

What we're expecting

Caroline Ellison has one more day on the stand, facing defense attorney Mark Cohen as he continues his cross-examination.

He only had a few moments with Ellison on Wednesday, trying to ask a question about FTX’s fiat account and how it tracked its funds – however, after some initial back-and-forth, it was clear he and Ellison were on slightly different pages about how different accounts were referenced, culminating in the best objection I’ve heard so far this trial.

“Objection Your Honor, this is confusing!” Assistant U.S. Attorney Danielle Sassoon said. Judge Lewis Kaplan seemed to agree, cutting the jury loose (it was just around 4 p.m. – 30 minutes early) but keeping attorneys in the room a bit longer to sort out certain issues (see above).

It’s unclear how long Cohen’s planned cross-examination will take. One thought that's striking: While the defense team argued for the right to question prosecution witnesses about recreational drug use, Judge Kaplan said he and the DOJ need prior notice outside the presence of the jury. I haven't seen any filings as of Wednesday early evening, and the topic did not come up at the close of Wednesday's court session.

At any rate, once Cohen is done, prosecutors will have a chance to conduct a redirect. Once that’s done, we’ll likely hear from BlockFi’s Zac Prince.

BlockFi both lent funds to Alameda and was briefly set to be acquired by FTX before it all came crashing down.— Nikhilesh De

EXCLUSIVE: Listen to 1-hour all-hands Alameda Research meeting where Caroline Ellison admitted the crypto firm took FTX customer money

Jacob Shamsian,Katie Balevic

Updated Thu, October 12, 2023

Caroline Ellison held an all-hands meeting with Alameda employees where she admitted to taking FTX customer funds.

A few minutes were played at Sam Bankman-Fried's criminal trial Thursday.

We got our hands on a recording of the entire hour-long meeting.

The news came as a shock.

On November 8, 2022, Sam Bankman-Fried announced that Binance agreed to buy FTX, his competing cryptocurrency exchange, which was in the middle of melting down.

The news sent shockwaves through the office of Alameda Research, the crypto trading firm also owned by Sam Bankman-Fried. It arrived at about 11 p.m. in Hong Kong, where the office was located.

Ellison told the other employees in the office that Alameda would shut down.

The next day, Ellison held an all-hands meeting with the Alameda Research staff in the Hong Kong office. She had just cut short her vacation to Japan to handle a series of crises at the company. About 15 employees attended in person, mostly sitting on a semi-circle couch, with Ellison sitting opposite on a bean bag. Nearly everyone else from the 30-person company attended remotely.

Insider has obtained an audio recording of the hour-long meeting, which it is publishing below.

segray · Caroline Ellison Alameda Research All Hands

The inside view of the meeting was relayed in federal court Thursday by Christian Drappi, a software engineer who had worked at Alameda since May 2021.

Drappi provided an audio recording of the meeting to federal prosecutors, who played a few minutes worth of selected clips as exhibits in court. Insider has obtained a full recording of the meeting.

At the meeting, Ellison initially explained that cryptocurrency prices were cratering, and Alameda didn't have enough liquidity to cover loans that lenders were recalling.

Also, she added, Alameda had taken funds from customers on FTX without their permission.

After Ellison finished her own three-day marathon of testimony, Drappi took the witness stand in the criminal trial against Sam Bankman-Fried, who prosecutors say defrauded FTX customers and Alameda investors and lenders, among other crimes, by stealing FTX customer funds for his own benefit.

"I was utterly shocked," Drappi told jurors Thursday.

At the all-hands meeting, Ellison appeared "sunken, kind of slouching," and "did not display confident body language," Drappi said.

She said Alameda would focus on repaying lenders and creditors, and that employees were welcome to talk to "their own counsel" about moving forward.

"My current hope is that FTX users will have their deposits made whole and so that would include employees," she said. "If that doesn't happen — yeah, TBD I guess."

"I'm sorry. I know that's a very shitty answer and it feels very shitty for employees who relied on trusted FTX to end up getting hurt by that," she added.

Small snippets were played at SBF's criminal trial

Another Alameda coworker, Rick Best, sitting to her left, secretly recorded the meeting, Drappi testified.

"He was an Alameda trader who joined three days before this all went down," Drappi said.

Drappi said Best later gave him a copy, which Drappi then gave to prosecutors.

At the meeting, Drappi asked Ellison whether she was aware that Alameda was taking customer money without their permission.

"I guess," she answered.

When Drappi pressed her on the issue — saying "I'm sure this wasn't just a YOLO thing" to take the money — Ellison admitted she had known since earlier in the year, as did Bankman-Fried, as well as FTX executives Gary Wang and Nashad Singh. (Ellison, Wang, and Singh have all pleaded guilty to charges related to the scheme.)

"FTX basically always allowed Alameda to use user funds," Ellison said.

Drappi asked whether Ellison understood that FTX customers "would be fucked" without their money.

Ellison thought crypto prices would rise again, allowing Alameda to balance things out, but that "did not work out," she responded, before giggling.

Drappi quit within 24 hours of the meeting, he testified Thursday. Binance ultimately did not buy FTX, which declared bankruptcy when Bankman-Fried relinquished control two days after the Alameda all-hands meeting.

Bankman-Fried's lawyers argued Thursday that Ellison's statements at the meeting went far beyond what Bankman-Fried intended to tell Alameda employees.

In a text message screenshot previously shown to jurors, Bankman-Fried advised Ellison to simply tell them that the company was shutting down and it would be appreciated if they stuck around to help wind things down.

Christian Everdell, one of Bankman-Fried's attorneys, said Ellison's confession of crimes was not just a "sober unburdening." She was laughing while giving some answers, he said.

"Thanks, it was a lot of fun," Ellison replied with a giggle after one employer thanked her for being "open and honest."

Drappi testified in court that Ellison was prone to "nervous laughter."

Sam Bankman-Fried trial: scenes from Caroline Ellison's time on the stand

Luc Cohen

Updated Thu, October 12, 2023

Sam Bankman-Fried trial: scenes from Caroline Ellison's time on the stand

Former Alameda Research CEO Ellison arrives for Bankman-Fried trial in New York City

By Luc Cohen

NEW YORK (Reuters) -When star witness Caroline Ellison first took the stand on Tuesday at Sam Bankman-Fried's fraud trial, she needed longer than previous witnesses to point out the 31-year-old former billionaire - her onetime boss and boyfriend - at the defense table.

That may have been because the indicted founder of now-bankrupt cryptocurrency exchange FTX, once known for his mop of unkempt curly locks and trademark shorts and T-shirts, had trimmed his hair and donned a suit for his trial on charges of stealing from FTX customers to prop up his Alameda Research hedge fund.

On Wednesday, Ellison - who ran Alameda - grew emotional in describing why she wrote Bankman-Fried a message on social media in November 2022 as FTX and Alameda were collapsing, saying she was relieved because she did not need to lie anymore. She was handed a box of tissues by U.S. District Judge Lewis Kaplan's deputy.

"I didn't feel like there was anyone else I could talk to about these feelings," Ellison, 28, said. The Stanford University graduate has pleaded guilty to fraud and agreed to cooperate with federal prosecutors.

Bankman-Fried has pleaded not guilty.

Ellison wore a gray blazer and carried a Poland Spring water bottle to and from the witness stand. She did not look at Bankman-Fried in any of the instances when she passed him at the defense table.

Bankman-Fried spent much of Ellison's testimony typing on a laptop or whispering to his defense lawyers. During sidebar discussions with Kaplan where lawyers debated legal issues outside the jury's earshot, Bankman-Fried watched a live transcription feed of their conversation on screens at the defense table.

At one sidebar, prosecutor Danielle Sassoon said Bankman-Fried had "laughed, visibly shaken his head, and scoffed" during Ellison's testimony, according to a transcript. Defense lawyer Mark Cohen called that statement "ridiculous." Kaplan instructed Cohen to "have a word with" Bankman-Fried.

Meanwhile, Bankman-Fried's parents, the Stanford Law School professors Joseph Bankman and Barbara Fried, took notes on legal pads which they occasionally showed to each other. They sat directly behind two courtroom sketch artists drawing their son, and two rows in front of Ellison's lawyers from law firm WilmerHale.

Some of the 12 jurors and six alternate jurors took notes, while others shifted their gaze between Ellison and Sassoon during questioning. Three of the jurors appeared to close their eyes at times as Sassoon quizzed Ellison about spreadsheets showing Alameda's assets and liabilities.

"We'll be out of the spreadsheet thicket soon," Sassoon said during a break.

"I'm just tickled to hear that," Kaplan replied.

(Reporting by Luc Cohen in New York;Editing by Noeleen Walder and Matthew Lewis)

Breaking: Judge Denies Cross-Examination Of Gary Wang And Caroline Ellison By SBF Lawyers

Judge Lewis Kaplan denies the request of Sam Bankman-Fried’s attorneys to cross-examine former FTX CTO Gary Wang.

By Varinder Singh

October 11, 2023

Sam Bankman-Fried’s defense team is continuously seeking requests to cross-examine former FTX CTO Gary Wang and Caroline Ellison, which is turned down by Judge. In the latest development, Judge Kaplan has denied the defense’s request to cross-examine Wang regarding FTX lawyers’ involvement in structuring loans by Alameda Research.

Judge Orders “Denying As Moot” To Cross-Examination of Gary Wang

In a court filing late October 10, Judge Lewis A. Kaplan denied the request of Sam Bankman-Fried’s attorneys to elicit on cross-examination of former FTX chief technology officer Gary Wang evidence regarding the involvement of counsel in structuring the loans issued by Alameda Research.

Caroline Ellison Blamed Sam Bankman-Fried

Caroline Ellison has pleaded guilty and cooperates with the investigators. However, she noted that she did not commit these frauds at her own prerogative, as she was directed to do so by Sam Bankman-Fried. She also pointed out that SBF made decisions on both FTX and Alameda’s operations and had access to both companies’ accounts.

She further added that SBF knew about the risks at Alameda and still decided to use billions of dollars in customer funds toward risky investments.

Judge Lewis Kaplan denies the request of Sam Bankman-Fried’s attorneys to cross-examine former FTX CTO Gary Wang.

By Varinder Singh

October 11, 2023

Sam Bankman-Fried’s defense team is continuously seeking requests to cross-examine former FTX CTO Gary Wang and Caroline Ellison, which is turned down by Judge. In the latest development, Judge Kaplan has denied the defense’s request to cross-examine Wang regarding FTX lawyers’ involvement in structuring loans by Alameda Research.

Judge Orders “Denying As Moot” To Cross-Examination of Gary Wang

In a court filing late October 10, Judge Lewis A. Kaplan denied the request of Sam Bankman-Fried’s attorneys to elicit on cross-examination of former FTX chief technology officer Gary Wang evidence regarding the involvement of counsel in structuring the loans issued by Alameda Research.

The order came after a filing by Sam Bankman-Fried’s lawyers to cross-examine former Alameda Research CEO Caroline Ellison on the same arguments. The defense anticipates prosecutors will seek to elicit from Caroline Ellison that she was directed by Sam Bankman-Fried to set aut0-deletion on certain of her Signal and Slack messaging accounts. However, SBF lawyers assert the involvement of Alameda or FTX lawyers shows good faith and lack of criminal intent.

“The Government has elicited and may continue to elicit testimony on the use of auto-deletion policies at Alameda and FTX, we respectfully request that the Court allow the defense to elicit the above-referenced evidence in its cross-examination of Ms. Ellison.”

Judge Kaplan believes the issue is no longer relevant and too much time has passed as he ordered “denying by moot” to cross-examination of Gary Wang. He is likely to deny the request by SBF’s lawyers to cross-examine Caroline Ellison for the same reason.

Also Read: US SEC Gets Multiple Amicus Curiae Against Coinbase And Ripple

“The Government has elicited and may continue to elicit testimony on the use of auto-deletion policies at Alameda and FTX, we respectfully request that the Court allow the defense to elicit the above-referenced evidence in its cross-examination of Ms. Ellison.”

Judge Kaplan believes the issue is no longer relevant and too much time has passed as he ordered “denying by moot” to cross-examination of Gary Wang. He is likely to deny the request by SBF’s lawyers to cross-examine Caroline Ellison for the same reason.

Also Read: US SEC Gets Multiple Amicus Curiae Against Coinbase And Ripple

Caroline Ellison Blamed Sam Bankman-Fried

Caroline Ellison has pleaded guilty and cooperates with the investigators. However, she noted that she did not commit these frauds at her own prerogative, as she was directed to do so by Sam Bankman-Fried. She also pointed out that SBF made decisions on both FTX and Alameda’s operations and had access to both companies’ accounts.

She further added that SBF knew about the risks at Alameda and still decided to use billions of dollars in customer funds toward risky investments.

SBF Tried to Blame Caroline Ellison for FTX. She Got Revenge on the Stand.

Nitish Pahwa

Tue, October 10, 2023

A courtroom sketch from United States v. Samuel Bankman-Fried shows Judge Lewis Kaplan looking at Caroline Ellison while she stands up and points toward Sam Bankman-Fried. Reuters/Jane Rosenberg

This is part of Slate’s daily coverage of the intricacies and intrigues of the Sam Bankman-Fried trial, from the consequential to the absurd. Sign up for the Slatest to get our latest updates on the trial and the state of the tech industry—and the rest of the day’s top stories—and support our work when you join Slate Plus.

Had Caroline Ellison been anybody other than The United States v. Samuel Bankman-Fried’s single most anticipated witness, she might have entered a Manhattan courthouse attracting far less notice on Tuesday. But she’s Caroline Ellison—SBF’s ex-GF, the former CEO of his Alameda Research crypto hedge fund, one of the first from his inner circle to flip. So, despite masking her gray-coat-and-red-dress fit with a light-blue baseball cap, a pair of shades, and a backpack, Ellison was recognized immediately by the hungry media crews who’ve been encircling the Southern District of New York court all month.

When Ellison took the witness stand in the late morning, following her former colleague Gary Wang, every single reporter in the media overflow room hushed up. Right after she took the oath, the prosecutor asked her personally identify Sam Bankman-Fried; she stood up and spent a dramatic moment gazing across the courtroom, humming and moving her shoulders, yanking on her coat flaps, before finally pinpointing her former compatriot. You couldn’t blame her for taking a beat—SBF looks a lot different these days in that haircut and suit, and it’s likely Ellison hasn’t seen him since that fateful November week that crushed Bankman-Fried’s empire in a matter of days. And so began the Caroline Show.

In case you need a refresher: Caroline Ellison is the Stanford grad who met SBF while interning at Jane Street Capital, a prestigious quant-trading Wall Street firm, in 2017. Early the following year, as Bankman-Fried got Alameda Research off the ground, Ellison reached out, and SBF offered her an Alameda trading gig; she relocated to California for the opportunity. Over the next three years, as SBF & Co. bopped around from Cali to Hong Kong to their infamous Bahamian penthouse, Ellison, aka @CarolineCapital, was present for it all: the launch of the FTX crypto exchange in 2019, the rise of SBF as crypto megainfluencer, the increased prominence of the effective altruism movement to which she and SBF both subscribed, the balance-sheet leak and collapsed Binance-acquisition deal that doomed FTX and Alameda to bankruptcy. Ellison pleaded guilty in December to the charges Bankman-Fried faces now—wire fraud, money laundering, conspiracy counts for securities and commodities fraud—and agreed to cooperate with the Department of Justice’s investigation. All the while, Ellison became a figure of fascination, helping lend the whole affair a tabloid-y gloss. Observers pored over her old Tumblr blogs, her podcast appearances, and her private writings that Bankman-Fried leaked to the New York Times (an act that earned him an early trip to jail from the no-nonsense judge presiding over this case). For how omnipresent Ellison’s been in the saga, it was easy to forget that Tuesday marked her first public appearance all year.

So yeah, was every soul packed into the courthouse glued to Ellison’s testimony, which the prosecution has already predicted will run well into tomorrow? You bet! She admitted to doing crimes at Alameda with SBF and others, to defrauding her hedge fund’s lenders and FTX’s investors, to funneling billions of dollars (I swear I’ve never heard the word billion as often as I have in this trial, and I’m a legit fan of Showtime’s Billions) from FTX customers into Alameda accounts without due permission or disclosure, to making use of those funneled funds for inappropriate purposes, to cooking the Alameda books to cover these transfers, and to committing these misdeeds at the direction of Sam Bankman-Fried. All the while, Ellison’s long-awaited confessions were accompanied by jury displays of bizarrely arranged accounting spreadsheets, Google Docs dense with SBF input, and screenshots of private Signal chats (in which, among other things, Ellison informed an Alameda trader that Bankman-Fried got “upset at me when I spoke too openly” about the sketchy crypto tabulations they were doing).

Not that, unfortunately for her, anything about Ellison is private anymore. She mentioned sleeping with SBF in the fall of 2018, the defendant’s parents in clear earshot, and responded to prosecution queries about how her on-and-off relationship with SBF affected their shared working environment. Ellison spoke clearly and confidently about crimes, passions, and crimes of (dis)passion, yet couldn’t help but to betray some of her (rather understandable) nerves: shifting in her seat, letting out a few long “ummms,” giggling while asking Assistant U.S. Attorney Danielle Sassoon to repeat a question. It’s one thing to have so much of your private life exposed when you’re otherwise preparing to offer witness testimony; it’s another to go over it, in detail, in a room with many important people including your infamous ex, now sitting with arms scrunched at his laptop and wearing a stern expression.

Still, there may have been some quiet catharsis for Ellison on Tuesday. SBF spent much of his post-bankruptcy, pretrial time talking a lot of shit about Ellison specifically, denigrating her Alameda leadership and essentially blaming her for his companies’ implosion. From Day 1, his defense lawyers have echoed that tack. The story Ellison laid out, however, revealed a much different tale, one in which she 1) was not sufficiently warned by SBF, upon joining Alameda Research in 2018, that the place was a dumpster fire in terms of business health and employee retention; 2) was also initially uninformed that Alameda had a sizable credit line that granted it the ability to withdraw customer FTX deposits nonstop; 3) repeatedly expressed concerns about financial holes at FTX/Alameda, only for SBF to insist that she keep using company (read: customer) money for outside investments as well as loan paybacks; 4) was directed by you-know-who to carry out money gimmicks like stuffing Alameda with “Samcoins,” illiquid in-exchange tokens like FTT and Serum that, in her and Gary Wang’s telling, were created by SBF for the purpose of inflating his firms’ net worth to lenders and investors; 5) hesitated to take the top job at Alameda in 2021 before earning reassurance from SBF that “there’s no one better”; 6) was instructed to sign off on Alameda fund withdrawals with nary a clue as to where they were headed; 7) offered insights to Bankman-Fried on how to reduce FTX and Alameda’s gaping liabilities, only to be ignored as he dumped millions, maybe billions, of dollars here and there. (By the way, did you know that even though Ellison was putatively CEO of Alameda, taking over at a time when SBF wanted to separate it further from FTX, she actually directly reported to Bankman-Fried?)

Was Sam Bankman-Fried not such a business pro after all, contra Michael Lewis? If Caroline Ellison is to be believed, it certainly sounds as though the crypto megastar was much more risk-happy, much more impulsive, and much less wealthy than he’d ever let on. Ellison and the prosecution also offered fascinating looks inside the psychology driving the boss man: the FTX CEO’s frequent dismissal of underlings’ advice and worries, his blasé approach to dealing with multibillion-dollar budgetary shortfalls, his earnest belief that the best way to make up for such holes was by throwing more money he didn’t have at startup investments that didn’t pan out, his willingness to keep lieutenants in the dark on details pertinent to their jobs, and his insistence on viewing future financial projections in terms of probabilities. This wasn’t exclusive to, say, the chance that FTX could make customers whole if SBF took out another $3 billion to plow into other companies. He even told Ellison that there was a “5 percent chance he’d become president someday.”

It’s not as though Ellison now comes off as the Good Samaritan; she did carry out SBF’s directives, misrepresent Alameda’s sturdiness to its financial backers, and take bits of customer money for herself, after all. Still, it’s refreshing to hear from a woman who knew Bankman-Fried much more intimately than many, and who had a front-row seat to the non-FTX end of the “Alameda Tree,” as Ellison characterized it. Anyway, she’ll be back on Wednesday to complete her testimony and her cross-examination, which will likely take the entire day. Almost too perfectly, Tuesday’s proceedings ended on a cliffhanger: On May 7, 2022, the first day of the Terra/Luna fiasco that sent crypto into a deep depression, Ellison and Bankman-Fried collaborated on a Google Doc that covered their “worries/questions” over the FTX-Alameda nexus. “Did things get worse?” Sassoon asked. Caroline Ellison all but mic-dropped: “Yes, they did.”

FTX cofounder Gary Wang says he took out $200 million to $300 million in loans from Alameda Research for investments he couldn’t ‘recall’

Ben Weiss

Tue, October 10, 2023

Zixiao (Gary) Wang personally signed for hundreds of millions of dollars in loans when he was chief technology officer at the now-bankrupt crypto exchange FTX. Why? He couldn’t “recall,” he said during his third day of testimony in the blockbuster trial of former crypto mogul Sam Bankman-Fried.

Wang, who signed a cooperation agreement with the government to testify against Bankman-Fried, said that the former CEO of FTX had directed him to take out the loans from Alameda Research, the crypto hedge fund Bankman-Fried also owned. These were for “investments,” Wang said, but he couldn’t remember what most were for, other than some capital allocated for the purchase of LedgerX, which FTX bought in 2021.

Interest payments on the loans became so cumbersome, Wang added, that he took out yet another loan from Alameda Research for $1 million to cover those costs. (He spent $200,000 of that loan on a house in St. Kitts.)

After the defense and prosecution asked him questions about the considerable debt he took on from Alameda, Judge Lewis Kaplan, who is presiding over the trial, intervened. “Why’d you sign a bunch of loan documents when you didn’t know they were for?” he asked.

“Sam told me to, and I trusted him,” Wang responded, in reference to Bankman-Fried, whom he had originally met at a math camp in high school.

Lawyers for the former CEO of FTX drew out the discussion on loans in an apparent attempt to show that previous legal counsel for FTX, specifically Can Sun and Dan Friedberg, gave executives at the exchange unwarranted and risky legal advice, according to a filing Bankman-Fried’s lawyers filed on Monday night. Wang said that both Sun and Friedberg directed him to sign the promissory notes.

This is potentially part of a broader strategy to wage an advice-of-counsel defense, or that Bankman-Fried and his lieutenants acted on allegedly misplaced legal guidance.

In addition to Wang’s willingness to put himself personally on the hook for hundreds of millions of dollars in debt on Bankman-Fried’s behalf, the third and final day of his testimony included the most precise account of his final days at FTX.

He said that he voluntarily met with prosecutors on Nov. 17, less than a week after the crypto exchange filed for bankruptcy. Discussions between Wang, his lawyers, and the government accelerated, and he signed a cooperation agreement with the Justice Department on Dec. 19.

He left the stand on Tuesday afternoon. The next scheduled witness was Caroline Ellison, the former CEO of Alameda Research who also agreed to cooperate with the government.

This story was originally featured on Fortune.com

Ben Weiss

Tue, October 10, 2023

Zixiao (Gary) Wang personally signed for hundreds of millions of dollars in loans when he was chief technology officer at the now-bankrupt crypto exchange FTX. Why? He couldn’t “recall,” he said during his third day of testimony in the blockbuster trial of former crypto mogul Sam Bankman-Fried.

Wang, who signed a cooperation agreement with the government to testify against Bankman-Fried, said that the former CEO of FTX had directed him to take out the loans from Alameda Research, the crypto hedge fund Bankman-Fried also owned. These were for “investments,” Wang said, but he couldn’t remember what most were for, other than some capital allocated for the purchase of LedgerX, which FTX bought in 2021.

Interest payments on the loans became so cumbersome, Wang added, that he took out yet another loan from Alameda Research for $1 million to cover those costs. (He spent $200,000 of that loan on a house in St. Kitts.)

After the defense and prosecution asked him questions about the considerable debt he took on from Alameda, Judge Lewis Kaplan, who is presiding over the trial, intervened. “Why’d you sign a bunch of loan documents when you didn’t know they were for?” he asked.

“Sam told me to, and I trusted him,” Wang responded, in reference to Bankman-Fried, whom he had originally met at a math camp in high school.

Lawyers for the former CEO of FTX drew out the discussion on loans in an apparent attempt to show that previous legal counsel for FTX, specifically Can Sun and Dan Friedberg, gave executives at the exchange unwarranted and risky legal advice, according to a filing Bankman-Fried’s lawyers filed on Monday night. Wang said that both Sun and Friedberg directed him to sign the promissory notes.

This is potentially part of a broader strategy to wage an advice-of-counsel defense, or that Bankman-Fried and his lieutenants acted on allegedly misplaced legal guidance.

In addition to Wang’s willingness to put himself personally on the hook for hundreds of millions of dollars in debt on Bankman-Fried’s behalf, the third and final day of his testimony included the most precise account of his final days at FTX.

He said that he voluntarily met with prosecutors on Nov. 17, less than a week after the crypto exchange filed for bankruptcy. Discussions between Wang, his lawyers, and the government accelerated, and he signed a cooperation agreement with the Justice Department on Dec. 19.

He left the stand on Tuesday afternoon. The next scheduled witness was Caroline Ellison, the former CEO of Alameda Research who also agreed to cooperate with the government.

This story was originally featured on Fortune.com

No comments:

Post a Comment