China’s Budget Spending Drops as Land Sales See Record Fall

Bloomberg News

Mon, 26 Aug 2024,

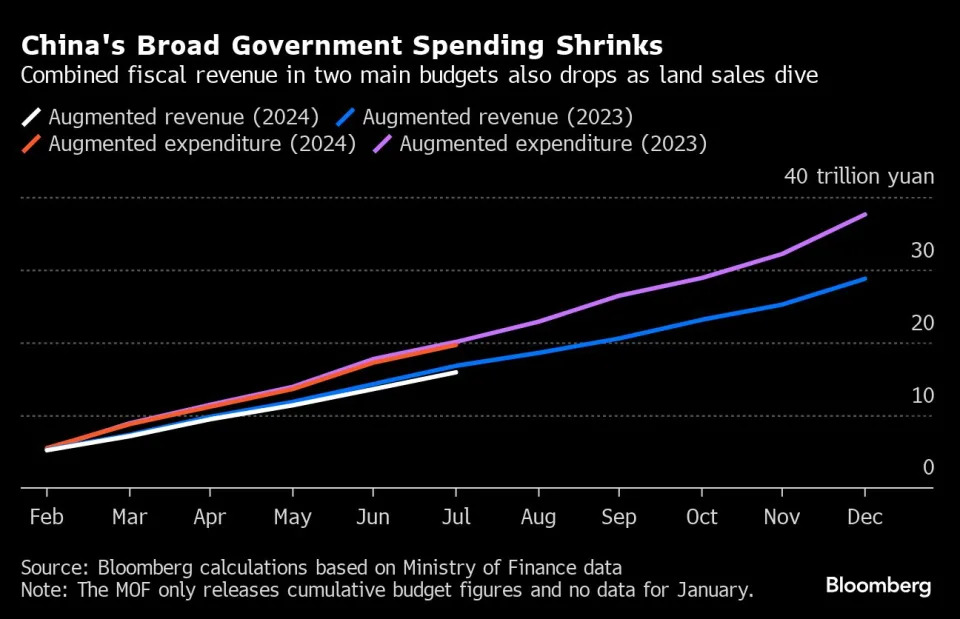

(Bloomberg) -- China’s broad budget expenditure contracted and income from land sales for local governments fell at a record pace, a sign of fiscal weakness that may further increase calls on Beijing to add stimulus to support the $17 trillion economy.

The combined spending in the general public budget and the government fund account was about 19.7 trillion yuan ($2.8 trillion) in the first seven months of the year, down 2% from the same point in 2023, according to Bloomberg calculations based on data released by the Ministry of Finance on Monday.

Behind the decline was a 8.9% decrease in land-related expenditure that includes payments for primary land development and compensation for existing rural infrastructure in preparation for a potential sale. Local governments have been cutting spending as their budgets come under strain from a severe housing downturn that’s made developers reluctant to purchase land.

The property fallout on public finances is becoming increasingly evident on the balance sheets of indebted local governments. Their revenue from land sales in July shrank just over 40% on year to 250 billion yuan, according to Bloomberg calculations, the sharpest fall since comparative data became available in 2016.

Total revenue under the two budgets came in at 15.9 trillion yuan in the first seven months, down 5.3% on year. That translated into an augmented deficit — a broad measure of the fiscal gap — of 3.8 trillion yuan.

“We see significant downward pressure for fiscal funding this year from falling tax and land sales revenue, besides the multi-year” deleveraging by state-owned companies known as local government financing vehicles, Goldman Sachs Group Inc. economists including Lisheng Wang wrote in a note after the data release. It’s a reference to Beijing’s campaign to curb local governments’ exposure to off-balance-sheet debt risks.

On Monday, six government departments including the Ministry of Finance issued measures to strengthen oversight of municipal infrastructure projects to prevent hidden debt. The actions bar local governments from selling bonds to fund projects with zero or little returns.

Policy at Crossroads

The spending contraction came during a month when China’s ruling Communist Party convened for its most important economic policy meetings for the second half of the year. The country’s top leadership pledged to make boosting consumer spending a greater focus but fell short of outlining decisive new measures.

At a regular meeting on July 31, China’s cabinet vowed to study additional steps that would be strong enough to reach companies and households.

The Goldman economists estimate fiscal expenditure growth rebounded in July, citing a broad deficit metric of their own that combines major on- and off-budget channels. They also expect government bond net issuance to increase “notably” in coming months to support fiscal spending and government-led investment.

Calls are meanwhile intensifying for the Chinese authorities to ramp up fiscal stimulus. Domestic demand has struggled to pick up as the persistent real estate crisis, price competition between companies and a gloomy job market weigh on business and consumer confidence.

A growing chorus of state-linked economists has urged Beijing to raise this year’s official deficit ceiling to allow more central government borrowing. Late last year, China lifted the ratio to 3.8% of gross domestic product from the original 3% with the sales of an additional 1 trillion yuan of sovereign bonds.

Among the challenges facing local governments is finding quality infrastructure projects to invest their special bond funds. In response, the economists have proposed using part of the money raised from any additional government borrowing this year to pay for subsidies for less well-off households as well as address the local debt risks and help rescue the property market.

A shift in the use of government bonds has already started. China is tapping some of the 1 trillion yuan of ultra-long special sovereign bonds it’s selling this year to subsidize purchases of new equipment by companies and consumers — Beijing’s key initiative aimed at boosting consumption.

Policymakers are also considering a proposal to let local authorities use these bonds to fund their purchases of unsold homes as part of efforts to prop up the housing market, Bloomberg reported last week.

The issuance of local special bonds — mostly meant for infrastructure investment — accelerated in August after staying slow earlier this year, partly as large amounts of sovereign debt hit the market. Sales of new local special notes have reached 632.7 billion yuan so far this month, already the largest volume since June 2022.

--With assistance from Ailing Tan, Jing Zhao and Lucille Liu.

No comments:

Post a Comment