4 myths about green energy being pushed by GOP candidates

Fact-checking some of what got said last week by Trump and other candidates

Wind generators and solar panels in Sluiskil, Netherlands. Green energy will be a multi-trillion-dollar industry in the coming years. First-movers will lock in vast amounts of wealth, innovation, employment, and other benefits, as they always do. (Getty Images)

Rick Newman / Yahoo Finance senior columnist

When Yahoo Finance interviewed former Vice President Mike Pence on Sept. 26, he referred to President Biden’s energy policies as the “Green New Deal.”

Biden actually opposed the Green New Deal (GND), which was a fanciful plan hatched by liberal Democrats in 2019 to overhaul the energy and transportation sectors and remake much of the US economy. There was never a chance it would become law, but progressives such as Sen. Bernie Sanders (I-Vt.) and Rep. Alexandria Ocasio-Cortez (D-NY) hoped the GND would serve as a vision document for future efforts to combat global warming.

Pence and other Republicans apply the label to Biden because they hope it will tar him with connotations of socialist extremism. Biden has, in fact, signed aggressive green-energy programs into law, but they largely rely on tax breaks meant to trigger private investment, not the mandates and government takeovers contained in the Green New Deal.

Republicans, nonetheless, seem to think Biden’s green-energy agenda is a juicy target as they look for ways to weaken his reelection campaign. Republican front-runner Donald Trump calls the move to green energy a “transition to hell,” while other Republicans blame Biden’s green-energy push for inflation, the autoworkers' strike and assorted other woes.

As ever, embellishments and lies mingle with reality. Here are four myths Republicans are spinning about green energy:

Myth 1: Biden’s policies will force consumers to go green

Trump, for instance, said in Michigan on Sept. 27, that Biden “wants electric vehicle mandates that will spell the death of the American auto industry.” But there are no Biden mandates requiring consumers to do anything. Biden does have a goal, which is to make EVs 50% of all new-car purchases by 2030. But he’s trying to accomplish that through incentives such as tax breaks that make EVs cheaper to buy and federal funding to help build a nationwide charging network. If the market doesn’t hit that 50% EV target by 2030, nothing will happen.

It's possible automakers will retire gas-powered models in favor of electrics and leave some buyers wanting a gas-powered car that no longer exists. But this can only happen if consumers embrace EVs enough to move the market fully away from gasoline. They may not, forcing automakers to keep a blend of EVs and gassers in their fleets. It’s also true that broad consumer trends often leave out buyers who prefer particular features no longer popular. Some drivers love manual transmissions, for instance, but automakers barely make them anymore because the take rate is so low.

[Drop Rick Newman a note, follow him on Twitter, or sign up for his newsletter.]

There are green-energy mandates in some states, where governments are forcing utilities to move away from fossil fuels toward renewables for electricity generation, which can lead to higher prices for retail consumers. Biden has proposed a rule requiring sharp cuts in carbon emissions at power plants nationwide by 2035. The Supreme Court struck down a similar rule the Obama administration tried to impose, and the Biden rule is sure to face litigation if or when a final version goes into effect. Energy consumers who want to stay brown will be able to do so for a long time.

Myth 2: The U.S. auto industry will be driven out of business

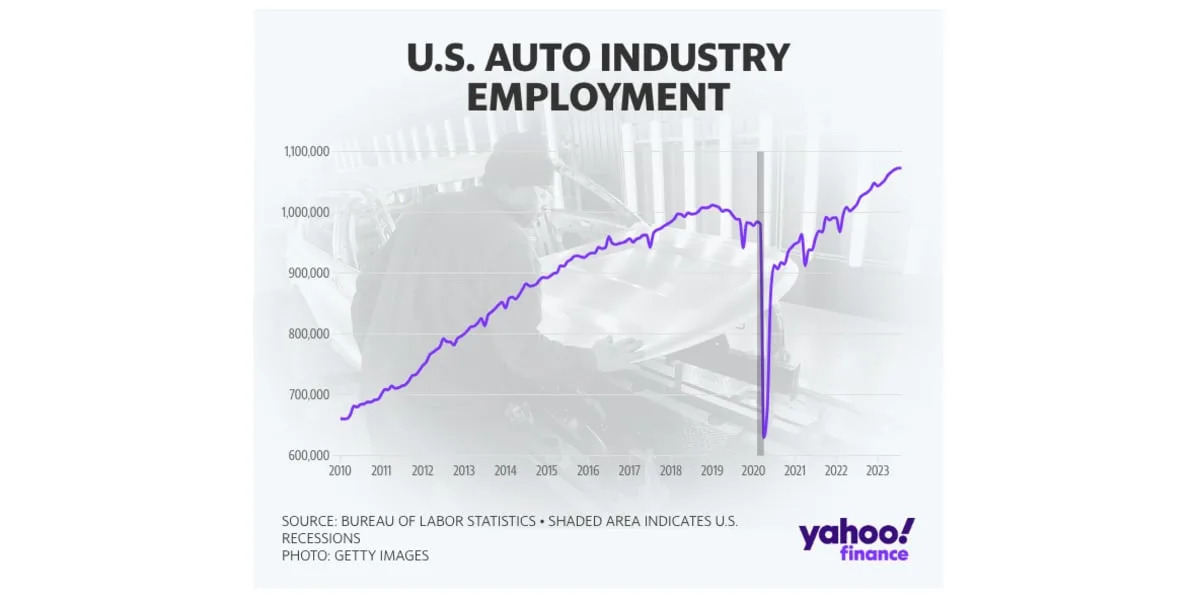

It’s not happening any time soon — especially if you include all the non-unionized workers at Tesla and the many foreign automakers that have factories in the United States. Trump told the workers in Michigan that “they want to go all electric and put you all out of business." He gave it two years. Yet U.S. auto-industry employment has been rising — even as virtually every carmaker has begun shifting to electrics. Since the post-COVID recovery began in mid 2020, the number of automotive jobs has risen to nearly 1.1 million, about 60,000 more than the peak under Trump.

The huge green-energy package Biden signed into law last year includes powerful incentives to build more factories in the United States, not fewer. And there is, in fact, an unprecedented boom in U.S. factory production, which will be followed by even more factory hiring as those plants come online. A new U.S. “battery belt” is forming as factories pop up to supply the new components EVs will need. There could even be new mining operations as companies tap needed minerals, such as lithium from a huge deposit in Nevada.

There’s no guarantee new green-energy jobs will be unionized, and that’s something the striking autoworkers hope to address with General Motors, Ford and Stellantis. But the Biden green-energy laws also contain added incentives for domestic projects that pay union-level wages. Trump gave his Michigan speech at a non-union automotive plant, and Republicans in general don’t support unions. So if it sounds like they’re bashing green energy to show solidarity with the union cause, don’t buy it.

Myth 3: Biden’s policies benefit China

If Biden did require Americans to buy EVs and other types of green-energy products, with no incentives to boost domestic production, then it probably would benefit China, which has a more robust renewable energy supply chain and lower costs than the United States does. But re-shoring green-energy production is one of the main goals of the Biden policy, and the claim about China winning is only plausible if you accept the first two bogus arguments.

Myth 4: We can just go back to oil and gas

Most of the Republican presidential candidates say they’ll trash Biden’s green-energy agenda and reemphasize oil and gas development if they become president. That would be foolish for two reasons, even if you put aside the need to address global warming.

First, the whole developed world is moving away from carbon and developing new green-energy technologies. This is a multi-trillion-dollar opportunity and everybody is not going to participate equally. First-movers will lock in vast amounts of wealth, innovation, employment, and other benefits, as they always do. The race is still on. Biden’s green-energy plan is a counterbalance to government incentives in China, Europe, and elsewhere aimed at keeping the spoils there.

Second, private-sector firms are now investing hundreds of billions of dollars in green energy development in the United States, in part because of the lucrative incentives Biden has signed into law. Would a Republican president really cancel all those incentives and tell green-energy firms to fire their workers and mothball their plants because we’re going back to fossil fuels? That’s basically what Republicans are promising to do. We’ll have oil and gasoline for a long time, but that doesn’t mean we have to be the last ones clinging to it.

Rick Newman is a senior columnist for Yahoo Finance. Follow him on Twitter at @rickjnewman.

Click here for politics news related to business and money

Read the latest financial and business news from Yahoo Finance

Angel Pasuy of the Kamentsá Biya de Sibundoy reservation.Pedro Samper / NBC News

Angel Pasuy of the Kamentsá Biya de Sibundoy reservation.Pedro Samper / NBC News