CU

Column: Copper is pricing scarcity at a time of plenty

Don’t panic. The world hasn’t run out of copper, despite the many warnings of imminent shortfall that have accompanied its rally to all-time highs.

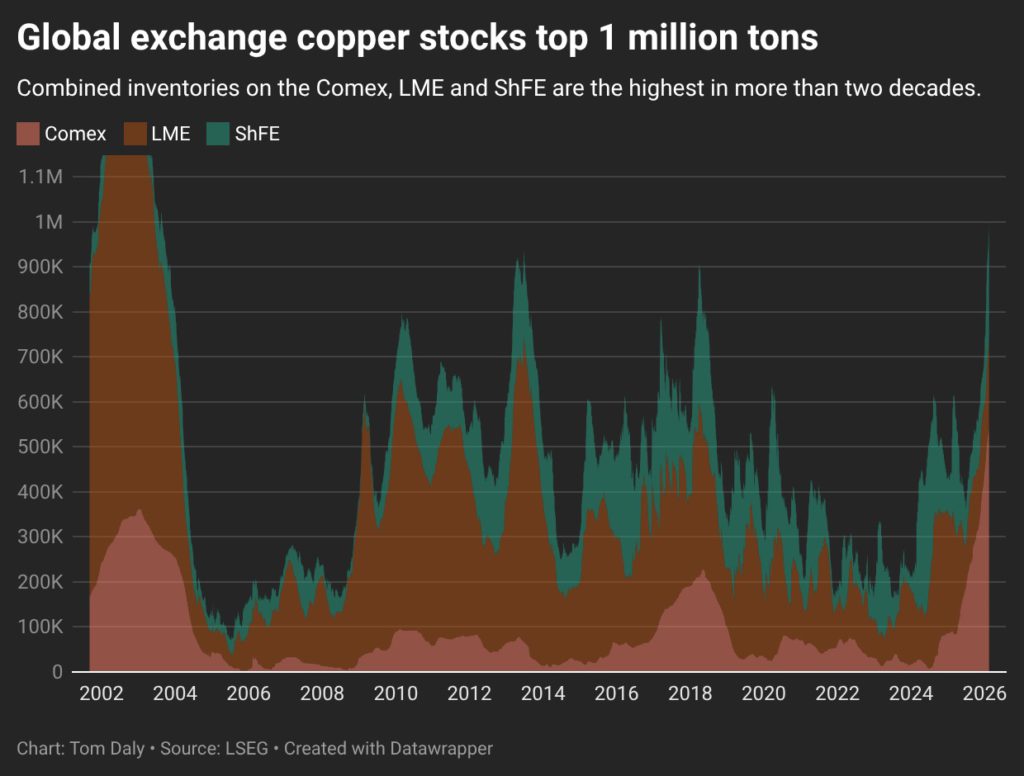

Indeed, the amount of copper held by the world’s big three metal exchanges is above the 1.1 million metric ton mark for the first time since early 2003.

While the tariff trade ensured CME warehouses in the United States accounted for much of the inventory increase last year, both London Metal Exchange and the Shanghai Futures Exchange warehouses are also experiencing accelerated inflows.

Global exchange inventory has surged by 300,000 tons since the start of January, indicating that copper’s super-charged price rally has curbed manufacturing demand.

The gap between speculators’ great expectations and current reality yawns ever wider.

US tariff trade stalls

CME copper stocks registered a net decline on Thursday for the first time since late October in a sign that last year’s relentless build has lost momentum.

The threat of US import tariffs on refined copper, deferred until June, led the CME duty-paid copper price to trade at a wide premium over the LME’s international price at times in 2025.

Traders shipped massive amounts of physical copper to the United States to lock in the easy profits from what was an unprecedented arbitrage opportunity.

US imports of refined copper reached 1.45 million tons in the first eleven months of 2025, a year-on-year increase of over 600,000 tons.

Much of that metal found its way to CME warehouses, lifting exchange stocks from 85,000 tons at the start of 2025 to 536,000 tons today.

The momentum is stalling, however.

The CME premium has evaporated as the market re-assesses the likelihood of US import tariffs. The rationale of US import dependency looks less convincing now the country has so much inventory.

US arrivals continue, but are being redirected to LME warehouses in Baltimore and New Orleans, where registered stocks have risen from zero to 4,950 and 21,075 tons respectively over the last month.

Another 6,450 and 20,665 tons of copper sit in off-warrant LME storage at the two ports.

Shanghai (pre)seasonal surge

The gravitational pull of the US premium last year sucked in 200,000 tons of copper from China’s bonded warehouse zones but no-one seems to have missed it.

Shanghai Futures Exchange stocks have risen by 127,000 tons to 272,475 tons since the start of January. The Yangshan premium , an indicator of import demand assessed by local data provider Shanghai Metal Market, touched an 18-month low of $22 per ton last month.

Sure, rising inventory and weak import appetite are the norm around China’s lunar new year holiday period.

But the Year of the Horse only starts next week and Shanghai exchange stocks are already higher than last year’s seasonal peak.

Moreover, China seems to have enough surplus metal to help replenish LME stocks.

Spreads signal surplus

Chinese brands of copper accounted for 70% of LME-warranted stocks at the end of January and arrivals are taking place daily at LME warehouses in South Korea and Taiwan.

LME-registered stocks are up by 40% so far this year at 203,875 tons with off-warrant tonnage up by 30% at 90,720 tons.

Time-spreads have loosened accordingly. The benchmark LME cash-to-three-months period was in backwardation as recently as November but is now in a comfortable contango of over $100 per ton.

Forward curves on both the CME and Shanghai copper contracts are also in contango, signaling ample availability.

Price signals…?

Rising stocks and loosening spread structures don’t sit well with an outright price that is within touching distance of last month’s record nominal high of $13,618 per ton.

Doctor Copper has caught a dose of the metals fever that first gripped gold, then moved to silver before spreading to base metals.

Chinese and Western investors alike have been buying up copper both as a bet on the metal’s bright energy transition demand narrative and as a hedge in the broader dollar debasement meme.

But the argument for ever higher prices rests on an assumption that at some stage there will not be enough copper to meet global demand.

That time has yet to come. And every daily rise in global inventory pushes it a little further into the future.

(The opinions expressed here are those of the author, Andy Home, a columnist for Reuters.)

(Editing by Barbara Lewis)

Copper price: Global exchange stocks top 1 million tonnes first time in 21 years

Copper rallied through 2025 and despite some sharp pullbacks along the way ended the year more than 40% higher than at the start. This year the price is being pulled into different directions.

In holiday thin trade, copper for March delivery fell nearly 1% in New York to $5.76 a pound or $12,700 a tonne on Monday and is now trading 12% below highs hit just at the end of January.

Copper stocks on the world’s biggest metal exchanges have exceeded 1 million tons for the first time since 2004. Tariff induced stockpiling in the US has been a feature of the market for more than a year and now soft demand in top consumer China is adding to burgeoning global inventories.

Combined copper stocks on the US Comex exchange, London Metal Exchange and the Shanghai Futures Exchange are at 1.012 million tonnes, after the LME and ShFE recorded further inflows on Friday, Reuters reports.

The news comes on the heels of satellite data showing January copper smelter activity was the lowest on record since tracking began nearly a decade ago in a report released last week.

Antofagasta profit jumps 52% on record copper prices

Chilean miner Antofagasta posted a 52% jump in annual core profit on Tuesday, as record copper prices offset slightly weaker output, and said its increased capital spending would support production in the medium term.

Earnings before interest, taxes, depreciation and amortization for 2025 leapt to a record $5.2 billion from $3.43 billion a year earlier, in line with analyst expectations as benchmark copper prices surged more than 40% last year.

Antofagasta’s proposed final dividend for 2025 was 48 cents a share, taking its full-year dividend to 64.6 cents a share and representing a pay-out ratio of 50% of underlying earnings. It has kept its policy of returning at least 35% of net earnings to shareholders for more than a decade.

Capital expenditure rose to $3.7 billion last year, exceeding the $3.6 billion forecast as works at its Centinela concentrator peaked. Capex is seen at $3.4 billion in 2026.

Net debt rose to $2.75 billion at the end of 2025, up 69% from a year earlier.

London-listed Antofagasta’s shares sank 3.1% in mid-morning trading, the top loser on London’s FTSE 100 index, which was up 0.4%. The stock has gained almost 11% this year.

Peel Hunt noted that a final 2025 dividend of 48 cents a share was below analysts’ consensus and the brokerage’s estimate of 56.5 cents.

Expanding Centinela

Antofagasta, which operates four mines in Chile, has long pursued expanding Centinela to meet rising copper demand.

“I think that the progress that we’ve completed by the end of last year is about 70% of construction already at the Centinela second concentrator,” CEO Ivan Arriagada said on an earnings call.

He later told analysts construction was set to finish in 2027, with production ramping up in 2028 and the first year at full capacity coming in 2029. The unit has an annual processing capacity of 95,000 tons.

Arriagada said Antofagasta viewed Chile’s change of government positively, noting that President-elect Jose Antonio Kast plans to ease permitting and to lower corporate taxes.

The CEO was upbeat on prospects for Antofagasta’s Twin Metals copper, nickel and platinum group metals (PGM) project in Minnesota, which had been delayed by a mining ban.

“With the changing landscape and policy environment in the US, we do expect that we will be able to make some progress in Twin Metals in the near term,” Arriagada said.

(By Clara Denina and Tom Daly; Editing by Barbara Lewis and Bernadette Baum)

BHP leans on copper growth, not big deals

BHP (ASX: BHP) will prioritize organic copper growth over major acquisitions, as chief executive Mike Henry says the miner already holds the sector’s strongest development pipeline.

Speaking after the company’s half-year results on Tuesday, Henry said he was not surprised that smaller players were pursuing mergers and acquisitions to bolster copper exposure. He said more companies had recognized copper’s appeal over the past five to seven years and were now seeking growth.

“In our case, we’ve got the luxury of starting from a very strong base,” Henry said. “We are now the largest [copper producer], we’ve grown by 30%, and we’ve got multiple large growth options already in the portfolio, so we don’t feel the need.”

BHP walked away late last year from a potential bid for Anglo American (LON: AAL), a move that paved the way for Anglo to merge with Teck Resources (TSX: TECK) in a $53 billion deal. Earlier this month, Rio Tinto (LON: RIO) and Glencore (LON: GLEN) also abandoned merger talks.

Copper takes the lead

Copper overtook iron ore as BHP’s top earnings driver for the first time, with EBITDA of $8 billion, up 59%. The company aims to lift copper equivalent production to 2.5 million tonnes a year by the 2035 financial year, from 1.9–2 million tonnes this year.

BHP expects to produce about 1.4 million tonnes a year from its Escondida and Pampa Norte assets in Chile and an initial 500,000 tonnes a year from its South Australian portfolio, with potential to reach 1 million tonnes.

At the Vicuña project in Argentina, its joint venture with Lundin Mining (TSX: LUN), released on Monday a new technical report for the project. It estimates the Josemaría and Filo deposits contain about 47 million tonnes of copper, 97 million ounces of gold and 1.8 billion ounces of silver. It means that Vicuña could produce 800,000 tonnes a year of copper equivalent at first-quartile cash costs.

The partners plan to spend about $800 million on the project this year and target a final investment decision on the initial stage by year-end. Henry confirmed they had applied under Argentina’s RIGI scheme, which offers incentives for major foreign investments, and said BHP wanted to move quickly given the project’s advanced stage and attractiveness.

Deal capability

As of the end of 2025, BHP’s net debt stood at $14.7 billion, with gearing of 20.9%. The company has identified up to $10 billion in undervalued capital it could unlock, including $6.3 billion already realized through the sale of Pilbara power infrastructure and a silver streaming deal at Antamina with Wheaton Precious Metals (TSX: WPM).

While that financial capacity gives BHP room to pursue acquisitions, Henry said the strategy does not depend on M&A.

“That’s a dangerous place for a company to be, where they can only unlock growth through M&A,” he said.

Henry also said that focusing on productivity gains and advancing existing projects over the next decade would deliver strong returns for shareholders. Although BHP has the balance sheet and capability to execute deals, he said the pool of large, long-life, low-cost assets that meet its criteria remains limited.

“The real focus is on running our existing business even better and unlocking the organic growth that we have in the portfolio,” Henry said. “For the discrete few opportunities that might come along that fit the very strict criteria that we have, we’ve got the wherewithal to pursue them, but we’re not feeling any burning need to.”

BHP’s Vicuna unveils $18 billion copper investment in Argentina

Miner Vicuna Corp, controlled by Australia’s BHP and Canada’s Lundin Mining, announced on Monday an $18 billion multi-year investment plan to develop copper, gold, and silver mining projects in northern Argentina.

The initial investment in its Josemaria and Filo del Sol projects in the province of San Juan will be $7 billion with capital deployment scheduled from 2027 until production begins in 2030, Vicuna said in a statement.

The project is forecast to average 395,000 tons of copper, 711,000 ounces of gold, and 22.2 million ounces of silver annually over its first 25 years.

Output during the first decade is projected at approximately 2.5 million tons of copper, 5.5 million ounces of gold, and 214 million ounces of silver.

Development of the Josemaria and Filo del Sol mining projects will be carried out in three stages. The first stage will be focused on the Josemaria deposit, with the latter two focused on Filo del Sol.

BHP profit beats forecasts as copper tops iron ore earnings on AI-driven demand

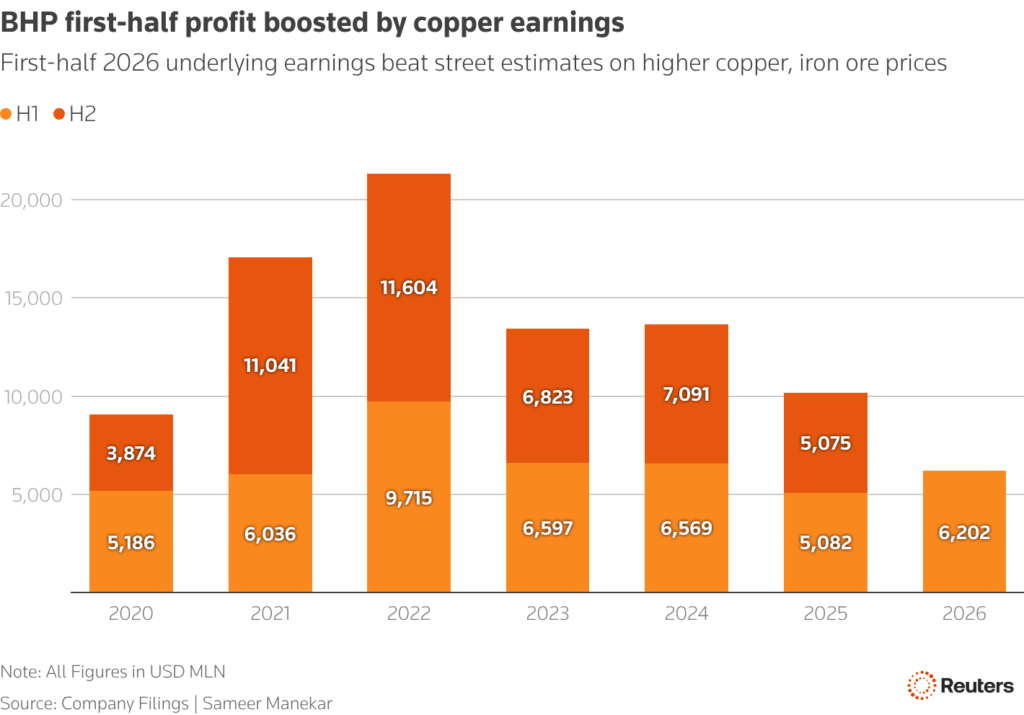

BHP Group reported a stronger-than-expected half-year underlying profit driven by copper, which for the first time surpassed iron ore in the top global miner’s earnings, as prices for the red metal surged on AI-fuelled demand.

BHP’s shares jumped 7% to an all-time high, with investors applauding a much stronger-than-expected dividend and the prospect of sizeable payouts ahead, despite falling iron ore prices.

The strong result comes as demand for copper is soaring driven by rapid growth in power use for artificial intelligence data centres and the shift to cleaner energy, which is spurring competition among mining majors for high‑quality copper assets.

BHP, the world’s top copper producer, highlighted its own copper growth options and played down the need for acquisitions, having walked away last year from an approach to buy Anglo American.

First-half underlying attributable profit rose 22% to $6.20 billion, beating the Visible Alpha consensus of $6.03 billion. BHP declared an interim dividend of 73 cents per share, ahead of market estimates of 63 cents, representing a payout ratio of 60%.

“It was a good result,” said Andy Forster, portfolio manager at Argo Investments, a BHP shareholder. “They smashed everyone’s expectations from a dividend perspective.”

Copper, including byproducts such as gold, contributed $7.95 billion to BHP’s operating earnings in the six months ending December 31, higher than iron ore’s $7.50 billion and making up 51% of the group’s total underlying operating earnings of $15.46 billion.

That was largely driven by a 32% jump in realized prices for copper, along with soaring prices for the precious metals. A record first-half iron ore production alongside higher prices also boosted the miner’s profits.

The push to focus on copper comes amid an expected easing in prices for iron ore as supply grows over the coming years, while inflation is also boosting production costs. Iron ore prices hit a seven-month low this week.

Unit costs for iron ore grew by 7% to $19.41 per metric ton in the half year.

‘No burning need’ for takeovers

BHP chief executive officer Mike Henry said on a media call given its organic growth options, the company did not feel pressure to pursue mergers and acquisitions for copper growth.

“For the discrete few opportunities that might come along that fit the very strict criteria that we have, we’ve got the wherewithal to pursue them, but we’re not feeling any burning need to,” he said.

Rio Tinto, the world’s largest iron ore producer, was in talks to buy Glencore, a deal that would have had major implications for the global copper sector, but walked away earlier this month citing disagreement over valuation.

BHP has been pushing to boost its copper output towards the end of the decade. In January, it lifted the bottom end of its copper production forecast for this year to between 1.9 million and 2 million tons, citing strong operational performance across its copper assets.

On Tuesday it flagged an $18 billion multi-year investment plan to develop copper, gold, and silver mining projects in northern Argentina, at its Vicuna Corp joint venture with Canada’s Lundin Mining. It said the unit has the potential to produce more than 500,000 tons of copper a year at peak production next decade.

Henry said “tough negotiations” with China over iron ore supply continued as the state buyer, CMRG, tries to extract better terms for Chinese steelmakers. He expressed confidence that the issues will be resolved, although it will take time.

BHP flagged it had seen a price impact from CMRG’s ban on its Jimblebar fines product in its quarterly report in January but did not offer further details in its earnings report.

The miner announced a silver streaming agreement with Wheaton Precious Metals for an upfront payment of $4.3 billion at completion, to deliver silver from its share of output at Peru’s Antamina mine.

That payment is part of a targeted $10 billion that BHP aims to raise from existing assets, which could help boost its dividend payout for the full year, Henry said.

(By Sameer Manekar and Rajasik Mukherjee; Editing by Lisa Shumaker and Sonali Paul)

No comments:

Post a Comment