OCTOBER 12, 2020

Contact:

Jeremy Gaines

Center for Global Development

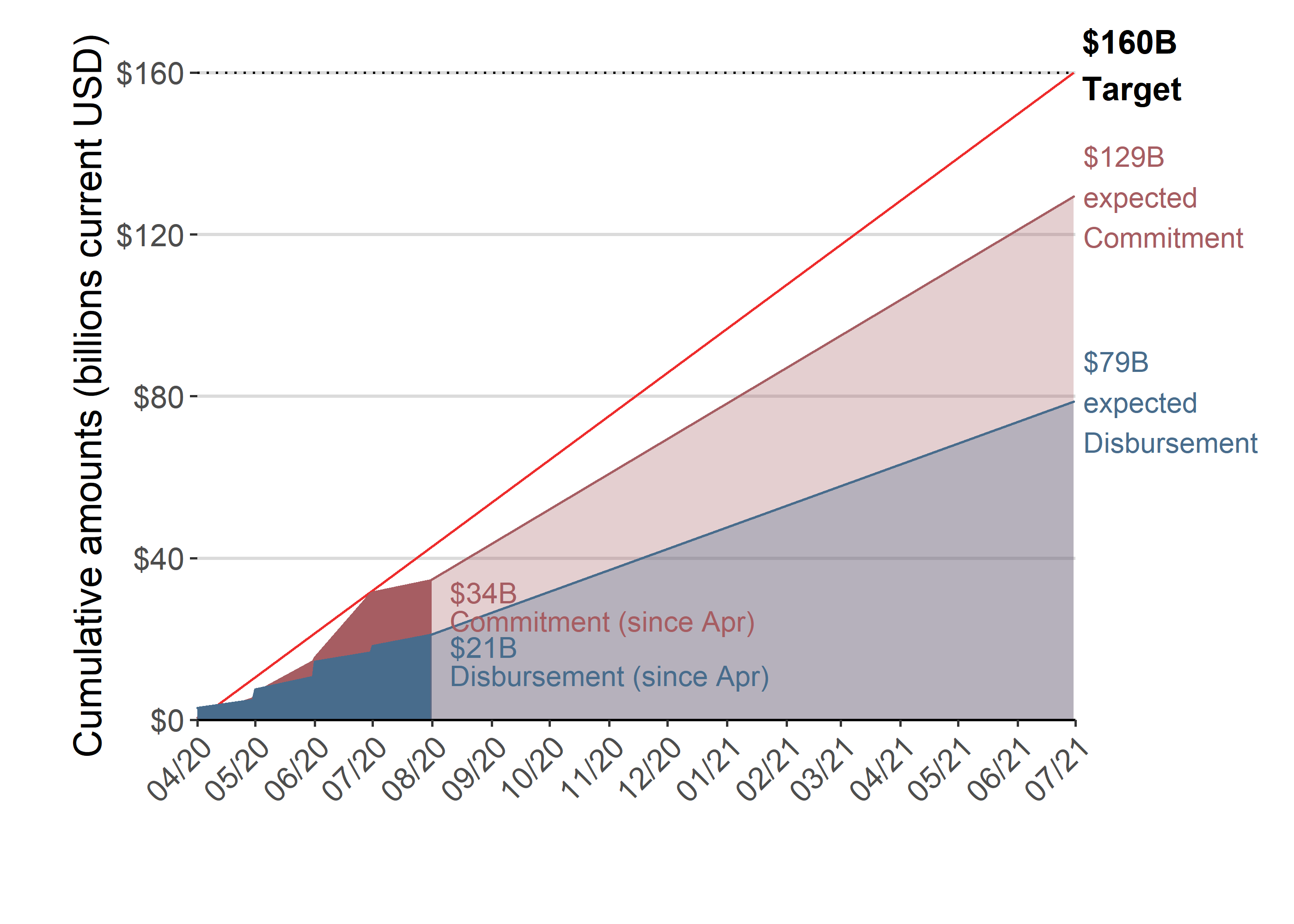

WASHINGTON, DC—At its current pace, the World Bank could fall $81 billion short on its $160 billion target for emergency funding to help developing countries deal with the effects of COVID-19, according to a new study from the Center for Global Development (CGD).

The researchers built a database of the more than 500,000 World Bank transactions since before 2008 to track the Bank’s performance during the current crisis against the norm. They found that the World Bank is lagging both on its rate of new commitments and on the speed it is disbursing loans compared to the bank’s performance during the global financial crisis a decade ago.

The study found:

At its current rate, the Bank’s new commitments will fall $31 billion short of its target of $160 billion by June 2021.

More importantly, they found, the slow rate of disbursements falls far short of that headline target. At the current pace, just $79 billion of the $160 billion target will flow to developing countries by June 2021.

The expected shortfall against the Bank’s lending target

“The World Bank’s own analysis suggests we’re in the midst of a tragic reversal of years of progress in reducing global poverty. So far, the Bank has responded with modest half measures, fretted over its own triple-A credit rating, and talked about conditioning further assistance on structural reforms. The bankers need to get a lot more creative in moving money,” said Justin Sandefur, a senior fellow at CGD and an author of the study.

The researchers also found:

The World Bank has not shifted to providing more direct budgetary support, as it had during the 2008 crisis, which may partially explain the slow rate of disbursement.

Low-income countries have mostly received money faster than middle-income countries, and World Bank financing has met a somewhat larger percentage of financing needs for poorer countries.

Countries like El Salvador, Indonesia, and Yemen are currently paying more to the World Bank to service old debts than they are receiving from the institution in crisis support.

“It’s particularly troubling that World Bank is currently a drag on the ability of some countries to respond this crisis. At a minimum, countries should not be paying more to the bank to service old debts than they are receiving in crisis support,” said Scott Morris, the co-director of CGD’s development finance program and an author of the study.

The full report and dataset are available at https://www.cgdev.org/publication/world-banks-covid-crisis-lending-big-enough-fast-enough-new-evidence-loan-disbursements.

No comments:

Post a Comment