WHAT GOES FOR GERMANY GOES FOR THE WORLD

Shipping container shortage inflicts pain on German shoppersGermans are finding it hard to lay their hands on a new bike or renovate their homes amid supply disruptions. The scarcity is playing havoc with personal budgets, and the ordeal for consumers may just be getting started.

A shortage of containers is threatening to push prices of consumer goods even higher

Just a cursory glance around sports retailer Decathlon's store in Cologne was enough for me to gauge the severity of the economic fallout from disruptions across global supply chains.

The empty bike racks are a testament to the plight of retailers who are struggling to replenish their stocks, and a warning to consumers of an imminent assault on their pocketbooks.

"The situation is not good. It's been like this since the start of the pandemic due to supply chain disruptions," a salesperson said, as he took out his tablet to help me zero in on a city bike.

"This one is perfect for you, but unfortunately we don't have this model here," he said. Not one to give up easily, he checked the bike's availability on Decathlon's website but was left disappointed. The bike wasn't available online either.

"It should be available in two to three weeks," he said. "I can't promise, though."

A Decathlon spokesperson attributed the shortfall to high demand for bikes over the past 18 months and pandemic-related lockdowns that caused bottlenecks for some of its suppliers.

The retailer is not alone in its predicament. Bike stores across Germany have been struggling to source new bikes and spare parts amid strong demand for personal mobility during the pandemic. This has left frustrated customers who are having to endure monthslong waiting periods just to have their two-wheelers repaired.

Beyond bikes, the supply bottlenecks are hurting sectors from construction to manufacturing, which have been left scrambling for key raw materials.

Bike sellers such as Decathlon are struggling to replenish their stock

Global ocean trade in disarray

A strong recovery in consumer demand, especially in the United States, following the easing of COVID-19 restrictions and a rush by Western companies to replenish their depleted stocks has led to an uneven distribution of shipping containers globally. This has caused widespread shortages of the steel transport boxes.

The paucity has only been made more acute by operational disruptions caused by the Suez Canal blockage in March and bottlenecks at major ports, including China's Yantian port, which have kept ships at sea longer.

"It's the worst I have seen in over 20 years. In the past, you may have some isolated cases of equipment shortages but nothing near this scale," Edward Aldridge from global logistics firm Agility told DW.

"Many vessels are simply bypassing ports around the world, and our market information shows that between 25-30% of available capacity is simply not operating. This means containers are then not moved back to where they are needed because the entire system is not running optimally," he said.

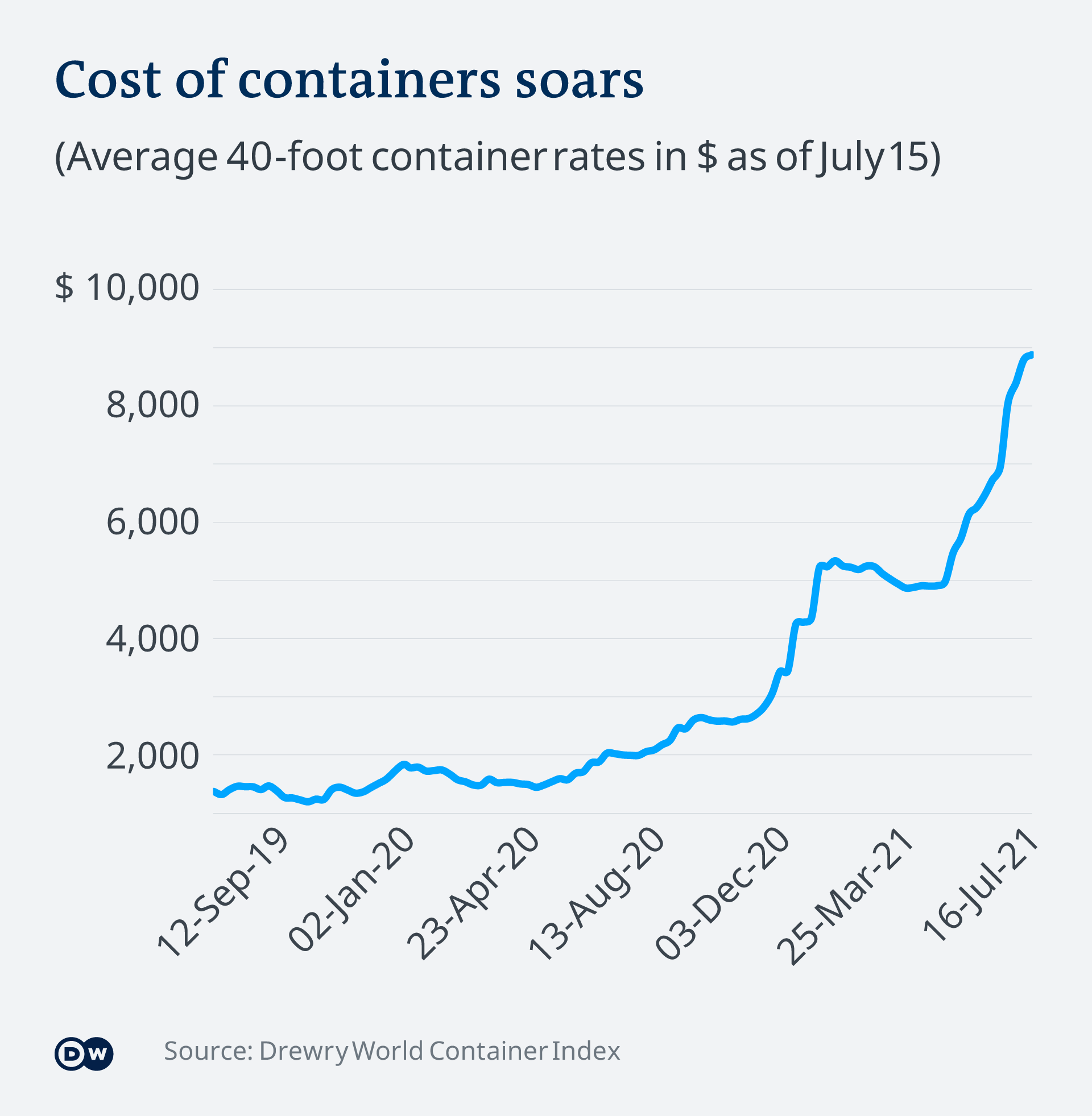

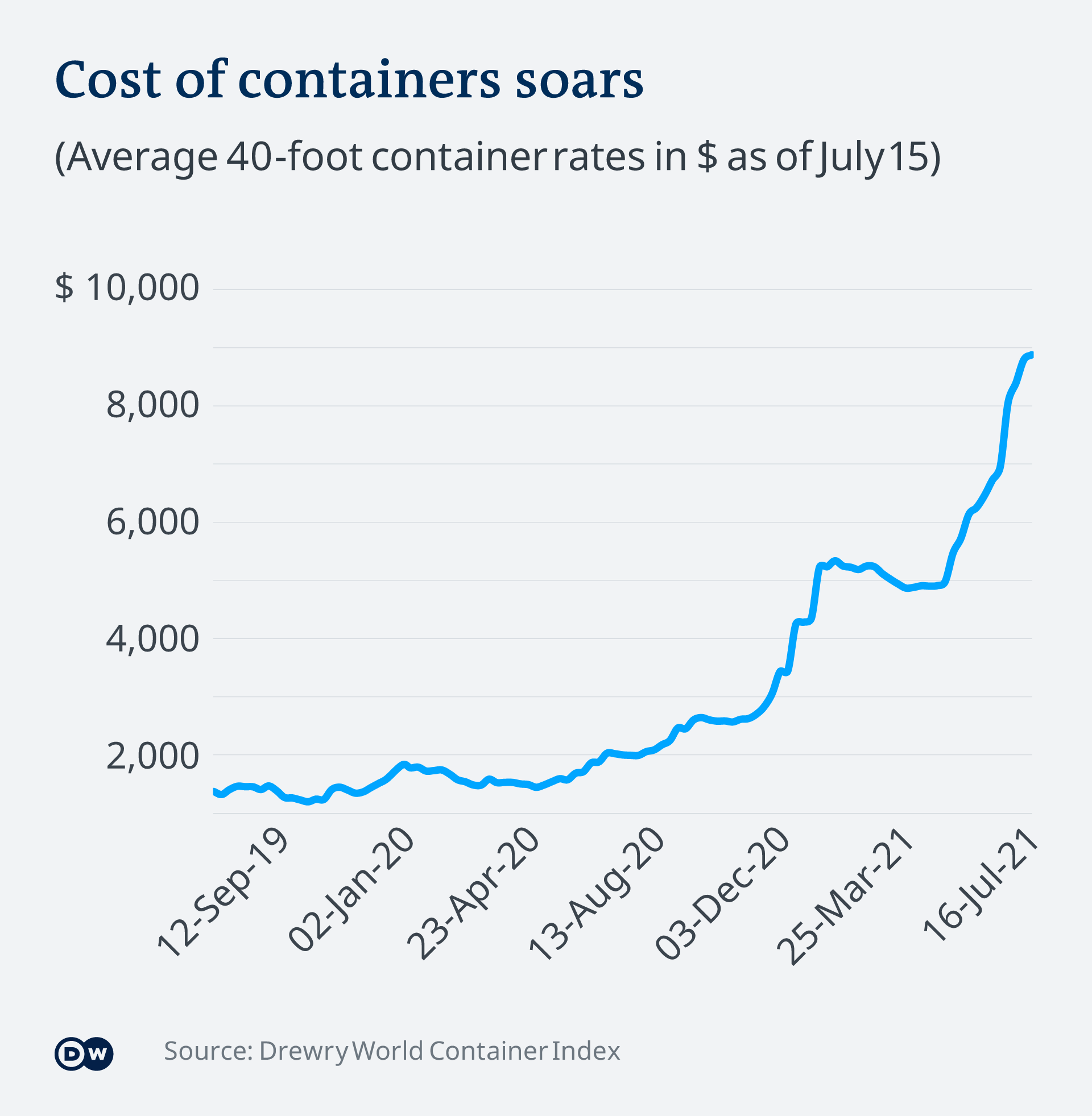

Container prices have soared to record highs as companies race to get their goods on ships. The average cost of transporting a 40-foot steel box of cargo by sea has more than quadrupled from a year ago, to nearly $9,000 (€7,600) as of July 15, according to Drewry Shipping. Sending a similar container from Shanghai to Rotterdam, Europe's largest port, is now setting back shippers about $13,000.

With a large chunk of goods trade moving by sea, the steep rise in transportation costs is either threatening or is already pushing up prices of goods ranging from building materials and auto parts to apparel, furniture and toys.

"Our market information shows that some shippers or importers who were waiting for the market to drop now have no option but to accept premiums over the spot market to move cargo," Aldridge said. "I certainly am seeing a shift from the traditional discussions of 'what's the lowest price to move cargo' to 'what does it take to get access to container equipment and cargo loaded' as a result of the container imbalance."

A strong recovery in consumer demand, especially in the United States, following the easing of COVID-19 restrictions and a rush by Western companies to replenish their depleted stocks has led to an uneven distribution of shipping containers globally. This has caused widespread shortages of the steel transport boxes.

The paucity has only been made more acute by operational disruptions caused by the Suez Canal blockage in March and bottlenecks at major ports, including China's Yantian port, which have kept ships at sea longer.

"It's the worst I have seen in over 20 years. In the past, you may have some isolated cases of equipment shortages but nothing near this scale," Edward Aldridge from global logistics firm Agility told DW.

"Many vessels are simply bypassing ports around the world, and our market information shows that between 25-30% of available capacity is simply not operating. This means containers are then not moved back to where they are needed because the entire system is not running optimally," he said.

Container prices have soared to record highs as companies race to get their goods on ships. The average cost of transporting a 40-foot steel box of cargo by sea has more than quadrupled from a year ago, to nearly $9,000 (€7,600) as of July 15, according to Drewry Shipping. Sending a similar container from Shanghai to Rotterdam, Europe's largest port, is now setting back shippers about $13,000.

With a large chunk of goods trade moving by sea, the steep rise in transportation costs is either threatening or is already pushing up prices of goods ranging from building materials and auto parts to apparel, furniture and toys.

"Our market information shows that some shippers or importers who were waiting for the market to drop now have no option but to accept premiums over the spot market to move cargo," Aldridge said. "I certainly am seeing a shift from the traditional discussions of 'what's the lowest price to move cargo' to 'what does it take to get access to container equipment and cargo loaded' as a result of the container imbalance."

Deferring a dream home

The impact is being most felt in the construction sector, where a shortage of building materials such as lumber, steel and insulating material has already begun to pinch consumers. Construction prices in Germany rose by 6.4% in May from a year ago — the highest year-on-year increase since May 2007, the Federal Statistical Office (Destatis) reported earlier this month.

In June, 95.2% of German construction companies surveyed by the Munich-based ifo Institute reported that purchase prices of building materials had risen in the previous three months.

Rising material costs have pushed up home prices. The offer prices for prefabricated houses rose by 14% in the three months through May, according to the online portal Immoscout24.

The situation has worsened the plight of many first-time buyers, who are already being priced out due to pent-up demand from buyers looking to invest their piles of forced savings.

Bracing for higher prices

German retailers such as drugstore chain Rossmann and discount store Kik, which sources a lot of its goods from Asia, are sounding the alarm.

"We are having great difficulty getting freight capacity for our orders on the ships," Kik CEO Patrick Zahn told the Handelsblatt newspaper this week, adding that "price increases in retail will be unavoidable."

Rossmann boss Raoul Rossmann has also warned about higher freight costs pushing up prices of consumer goods. However, a spokesperson for the retailer sought to play down the impact of the disruptions on the company.

"We are fortunate that only a small proportion of our product range comes from Asia. Therefore, the impact on our customers will not be felt to the extent that the current reports suggest," he told DW.

Discount fashion retailer Primark told DW that while it was not immune to the supply chain disruptions, it had "no intention of increasing prices."

Higher prices of household goods — as businesses pass on some of the burden to consumers — are expected to further push up inflation, which is already hovering above the European Central Bank's 2% target. German inflation is expected to range between 3% and 4% from July onward, before eventually falling next year.

Though with no end in sight for the container chaos at sea and in ports, German consumers may just need to guard their wallets a little while longer.

THE SHIPPING CONTAINER TURNS 65 YEARS OLDA man and his boxes

No comments:

Post a Comment