Drivers are skipping car insurance after premiums increase

Ronda Lee

Fri, September 15, 2023

More drivers are going without auto insurance as inflation and higher premiums pressure their budgets.

The number of households that have at least one uninsured vehicle increased to 5.7% in the first half of 2023 from 5.3% in the second half of 2022, according to new data from J.D. Power.

The increase comes after auto insurance premiums grew at an “unprecedented rate” of 7.9% in 2022 and 5.9% in the first six months of this year, the report said. Add to that still high inflation that Americans are swallowing on everyday expenses.

“Consumers are stretched thin after nearly drawing down all their $2.1 trillion of pandemic-related savings, amid still high inflation and slowing income gains,” Kathy Bostjancic, chief economist at Nationwide, said after this Thursday’s release of August retail sales data.

Automobile traffic moves along Interstate 395 on Friday morning September 1, 2023, in Washington, DC.(Drew Angerer/Getty Images)

The cost of auto insurance jumped more than 19% year over year in August and rose 2.4% from July, according to the latest inflation data out this week. That far outpaced the overall inflation rate for the month.

Premiums have gone up to cover rising claims costs associated with repairing and replacing damaged vehicles, medical care, and other expenses.

“In addition to inflation trends, the private passenger auto insurance sector is also experiencing several other trends such as increased frequency and severity of claims cost, riskier driving behavior by the public, cost increases for medical and hospital services, and outsized growth in lawsuit verdicts and legal system abuses, that are negatively impacting and pressuring the industry with increased losses,” Robert Passmore, department vice president for the American Property Casualty Insurance Association (APCIA), said this summer.

And as many Americans brace for the start of student loan repayments next month, more may consider forgoing car insurance to make ends meet.

More than a quarter of Americans with student loan debt say they're not sure how they will be able to repay their loans in October, a recent New York Life survey found. And while another quarter say they have enough money in their budgets to cover the payments, 23% of those said they will need to reduce other spending to make it work.

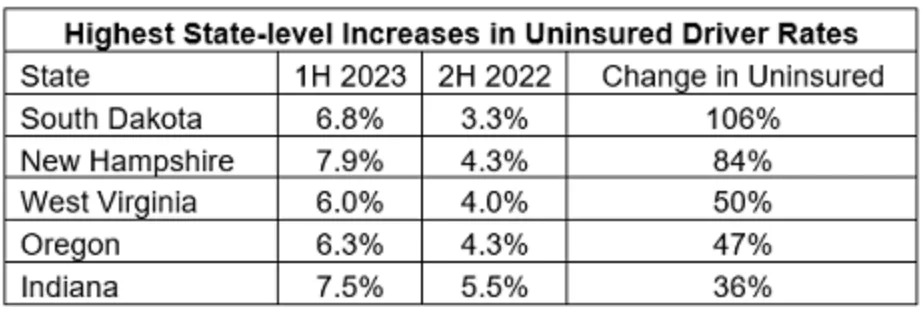

J.D. Power found that certain regions had higher rates of uninsured drivers, with 12 states experiencing a 30% or more increase in the share of uninsured drivers compared with the second half of 2022. The top five states with the most uninsured include South Dakota, New Hampshire, West Virginia, Oregon, and Indiana.

States with the highest level of uninsured driver per J.D. Power

More increases could be on the way because, so far, those higher premiums haven't been enough to cover claims costs.

In 2022, the auto industry spent 12% more on claims and other costs than it collected in premiums, the second straight year such a deficit occurred, the J.D. Power report said.

Similarly, the Insurance Information Institute (Triple-I) told NPR this week that auto insurers paid $1.12 in claims last year for every $1 they received in premiums. This year, that’s down to $1.09, but still more than what’s collected in premiums.

“The industry has not had this poor of a full-year underwriting performance in decades,” Dale Porfilio, chief insurance officer of Triple-I, said in May of this year. “Unless replacement cost trends begin to decrease materially — which is not currently forecast — it will take the industry into at least 2025 to restore personal auto results to underwriting profitability.”

Drivers struggling with higher premiums should contact their insurer to negotiate a lower premium and ask about discounts, especially if they have a clean driving record, J.D. Power recommends. Additionally, consumers should shop around and use independent agents to find competitive quotes.

With more uninsured drivers on the road, those who are insured should also consider increasing their uninsured/underinsured coverage, which reimburses drivers in an accident involving an uninsured, underinsured, or hit-and-run driver.

Ronda is a personal finance senior reporter for Yahoo Finance and attorney with experience in law, insurance, education, and government. Follow her on Twitter @writesronda.

Click here for the latest personal finance news to help you with investing, paying off debt

Ronda Lee

Fri, September 15, 2023

More drivers are going without auto insurance as inflation and higher premiums pressure their budgets.

The number of households that have at least one uninsured vehicle increased to 5.7% in the first half of 2023 from 5.3% in the second half of 2022, according to new data from J.D. Power.

The increase comes after auto insurance premiums grew at an “unprecedented rate” of 7.9% in 2022 and 5.9% in the first six months of this year, the report said. Add to that still high inflation that Americans are swallowing on everyday expenses.

“Consumers are stretched thin after nearly drawing down all their $2.1 trillion of pandemic-related savings, amid still high inflation and slowing income gains,” Kathy Bostjancic, chief economist at Nationwide, said after this Thursday’s release of August retail sales data.

Automobile traffic moves along Interstate 395 on Friday morning September 1, 2023, in Washington, DC.(Drew Angerer/Getty Images)

The cost of auto insurance jumped more than 19% year over year in August and rose 2.4% from July, according to the latest inflation data out this week. That far outpaced the overall inflation rate for the month.

Premiums have gone up to cover rising claims costs associated with repairing and replacing damaged vehicles, medical care, and other expenses.

“In addition to inflation trends, the private passenger auto insurance sector is also experiencing several other trends such as increased frequency and severity of claims cost, riskier driving behavior by the public, cost increases for medical and hospital services, and outsized growth in lawsuit verdicts and legal system abuses, that are negatively impacting and pressuring the industry with increased losses,” Robert Passmore, department vice president for the American Property Casualty Insurance Association (APCIA), said this summer.

And as many Americans brace for the start of student loan repayments next month, more may consider forgoing car insurance to make ends meet.

More than a quarter of Americans with student loan debt say they're not sure how they will be able to repay their loans in October, a recent New York Life survey found. And while another quarter say they have enough money in their budgets to cover the payments, 23% of those said they will need to reduce other spending to make it work.

J.D. Power found that certain regions had higher rates of uninsured drivers, with 12 states experiencing a 30% or more increase in the share of uninsured drivers compared with the second half of 2022. The top five states with the most uninsured include South Dakota, New Hampshire, West Virginia, Oregon, and Indiana.

States with the highest level of uninsured driver per J.D. Power

More increases could be on the way because, so far, those higher premiums haven't been enough to cover claims costs.

In 2022, the auto industry spent 12% more on claims and other costs than it collected in premiums, the second straight year such a deficit occurred, the J.D. Power report said.

Similarly, the Insurance Information Institute (Triple-I) told NPR this week that auto insurers paid $1.12 in claims last year for every $1 they received in premiums. This year, that’s down to $1.09, but still more than what’s collected in premiums.

“The industry has not had this poor of a full-year underwriting performance in decades,” Dale Porfilio, chief insurance officer of Triple-I, said in May of this year. “Unless replacement cost trends begin to decrease materially — which is not currently forecast — it will take the industry into at least 2025 to restore personal auto results to underwriting profitability.”

Drivers struggling with higher premiums should contact their insurer to negotiate a lower premium and ask about discounts, especially if they have a clean driving record, J.D. Power recommends. Additionally, consumers should shop around and use independent agents to find competitive quotes.

With more uninsured drivers on the road, those who are insured should also consider increasing their uninsured/underinsured coverage, which reimburses drivers in an accident involving an uninsured, underinsured, or hit-and-run driver.

Ronda is a personal finance senior reporter for Yahoo Finance and attorney with experience in law, insurance, education, and government. Follow her on Twitter @writesronda.

Click here for the latest personal finance news to help you with investing, paying off debt

No comments:

Post a Comment