Analysis: China casts a giant shadow over emerging nations' chase for debt relief

REUTERS

Published: Jul 3, 2022

From a US$360 million project to expand Zambia's international airport in Lusaka to a US$1.4 billion city port in Sri Lanka's capital of Colombo, China is the missing piece in the puzzle of a number of debt talks underway in developing markets.

As the second-largest economy and the biggest bilateral creditor in the world, China is a dominant lender to many smaller, riskier developing nations. But Beijing has kept a low profile, not only on lending conditions but also on how it renegotiates with borrowers in distress.

That became more evident after the Covid-19 pandemic hit. Many economies buckling under economic strain are seeking debt relief.

Now, the pressure is rising on China to take a more active role in helping strained economies overhaul their debt burdens. Leaders of the Group of Seven rich democracies on Tuesday called on China specifically when urging creditors to help countries.

Poorest countries face US$35 billion in debt-service payments to official and private-sector creditors in 2022, with over 40 percent of the total due to China, according to the World Bank.

But analysts say the International Monetary Fund (IMF) and World Bank's premise of fair burden-sharing in debt relief talks could set them on a collision course with China, putting the prospect of comprehensive debt restructurings into question.

"Chinese 'Belt and Road' money is everywhere – so we will see this over and over in sovereign debt restructurings," said Dennis Hranitzky, head of sovereign litigation at law firm Quinn Emanuel.

From a US$360 million project to expand Zambia's international airport in Lusaka to a US$1.4 billion city port in Sri Lanka's capital of Colombo, China is the missing piece in the puzzle of a number of debt talks underway in developing markets.

As the second-largest economy and the biggest bilateral creditor in the world, China is a dominant lender to many smaller, riskier developing nations. But Beijing has kept a low profile, not only on lending conditions but also on how it renegotiates with borrowers in distress.

That became more evident after the Covid-19 pandemic hit. Many economies buckling under economic strain are seeking debt relief.

Now, the pressure is rising on China to take a more active role in helping strained economies overhaul their debt burdens. Leaders of the Group of Seven rich democracies on Tuesday called on China specifically when urging creditors to help countries.

Poorest countries face US$35 billion in debt-service payments to official and private-sector creditors in 2022, with over 40 percent of the total due to China, according to the World Bank.

But analysts say the International Monetary Fund (IMF) and World Bank's premise of fair burden-sharing in debt relief talks could set them on a collision course with China, putting the prospect of comprehensive debt restructurings into question.

"Chinese 'Belt and Road' money is everywhere – so we will see this over and over in sovereign debt restructurings," said Dennis Hranitzky, head of sovereign litigation at law firm Quinn Emanuel.

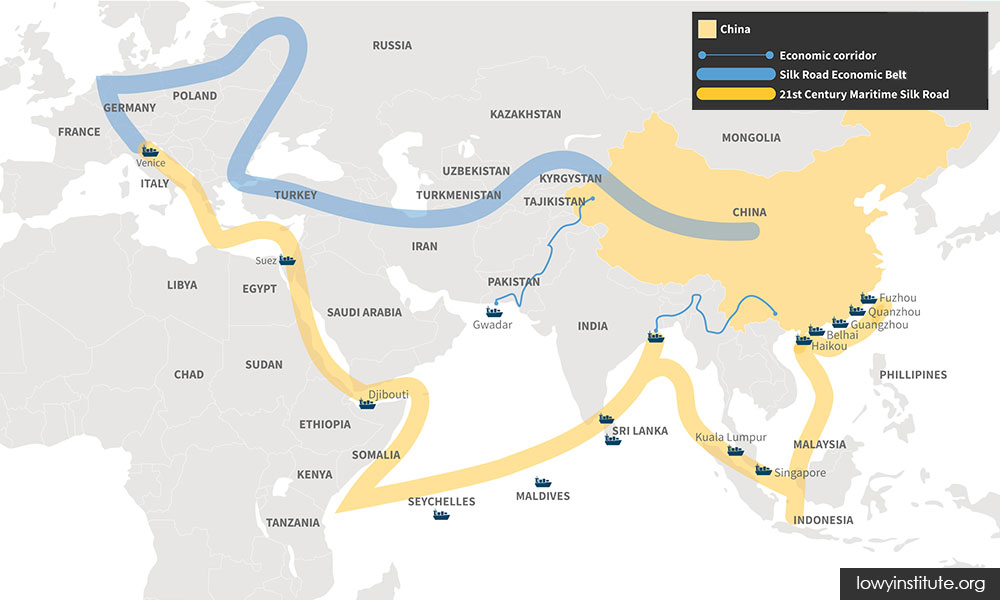

China’s Belt and Road initiative

According to Beijing, the Belt and Road Initiative unveiled in 2013 is a platform for international cooperation in infrastructure, trade, investment and financing linking China with other parts of Asia, the Middle East, Europe and Africa.

China's Foreign Ministry and central bank did not respond to requests for comment.

Zambia and Sri Lanka are test cases on how fast debt talks evolve. Both also need to restructure with overseas bondholders and hammer out IMF programmes.

"China's engagement on debt talks is not in the hands of the IMF nor governments," said Polina Kurdyavko, head of emerging markets at BlueBay Asset Management in London.

"Bringing China to the negotiating table in a timely manner could be the biggest challenge in the upcoming debt restructurings."

Opacity

Chinese lending is mostly extended by state-controlled agencies and policy banks and is often opaque.

A working paper of the National Bureau of Economic Research in the United States found half of the 5,000 loans and grants extended to 152 countries from 1949 to 2017 have not been reported to the IMF or the World Bank, despite China being a member of both multilaterals.

"Opacity is a recurrent problem with some of these Chinese loans," said Matthew Mingey, senior analyst with Rhodium Group, adding that China had stricter confidentiality clauses on its commercial loans.

Data compiled over three years by AidData, a US research lab at the College of William & Mary, found terms of Chinese state-owned banks' loans require borrowers to prioritise them for repayment.

Examinations of 100 Chinese loans with 24 low- and middle-income countries showed - when compared to those of other bilateral, multilateral and commercial creditors - demands for an unusual level of confidentiality, in some cases, "even the fact of the contract's existence", the study led by Georgetown Law professor Anna Gelpern found.

According to Beijing, the Belt and Road Initiative unveiled in 2013 is a platform for international cooperation in infrastructure, trade, investment and financing linking China with other parts of Asia, the Middle East, Europe and Africa.

China's Foreign Ministry and central bank did not respond to requests for comment.

Zambia and Sri Lanka are test cases on how fast debt talks evolve. Both also need to restructure with overseas bondholders and hammer out IMF programmes.

"China's engagement on debt talks is not in the hands of the IMF nor governments," said Polina Kurdyavko, head of emerging markets at BlueBay Asset Management in London.

"Bringing China to the negotiating table in a timely manner could be the biggest challenge in the upcoming debt restructurings."

Opacity

Chinese lending is mostly extended by state-controlled agencies and policy banks and is often opaque.

A working paper of the National Bureau of Economic Research in the United States found half of the 5,000 loans and grants extended to 152 countries from 1949 to 2017 have not been reported to the IMF or the World Bank, despite China being a member of both multilaterals.

"Opacity is a recurrent problem with some of these Chinese loans," said Matthew Mingey, senior analyst with Rhodium Group, adding that China had stricter confidentiality clauses on its commercial loans.

Data compiled over three years by AidData, a US research lab at the College of William & Mary, found terms of Chinese state-owned banks' loans require borrowers to prioritise them for repayment.

Examinations of 100 Chinese loans with 24 low- and middle-income countries showed - when compared to those of other bilateral, multilateral and commercial creditors - demands for an unusual level of confidentiality, in some cases, "even the fact of the contract's existence", the study led by Georgetown Law professor Anna Gelpern found.

Headquarters of China’s central bank, the Peoples Bank of China, in Beijing

Where China has agreed to ease debt burdens, details are often unclear.

The plethora of Chinese lenders also adds to the complexity, though the Export-Import Bank of China and the China Development Bank feature most heavily.

"When it comes time to renegotiate, individual Chinese banks may not necessarily have an idea of what other Chinese banks are doing," said Mingey.

Glacial

Progress has often been slow.

Zambia is seeking relief on US$17 billion of external debt after becoming the first Covid pandemic-era default more than two years ago. Some of the slow progress is due to China's lack of experience with tricky debt restructurings, people familiar with the matter say.

Sri Lanka's talks are moving faster, with the IMF confirming it is on track for a new programme. China's approach, though, is not yet clear.

Meanwhile, some 60 percent of low-income countries are in, or at high risk of, debt distress, according to the IMF.

Seventeen smaller emerging economies have seen premium investors demand to hold their debt soar to levels effectively shutting them out of international markets. That number is higher than during peak-Covid-19 or the 2008 global financial crisis.

In late 2020, the Group of 20 launched a Common Framework to bring creditors such as China and India to the negotiation table along with the IMF, Paris Club and private creditors. Along with Zambia, Chad and Ethiopia have applied to restructure under this new, yet-to-be tested mechanism.

But the framework also "has added a bureaucratic layer to the already complex debt restructuring process" that could discourage other countries from joining, said Patrick Curran, senior economist at Tellimer.

- Reuters

Where China has agreed to ease debt burdens, details are often unclear.

The plethora of Chinese lenders also adds to the complexity, though the Export-Import Bank of China and the China Development Bank feature most heavily.

"When it comes time to renegotiate, individual Chinese banks may not necessarily have an idea of what other Chinese banks are doing," said Mingey.

Glacial

Progress has often been slow.

Zambia is seeking relief on US$17 billion of external debt after becoming the first Covid pandemic-era default more than two years ago. Some of the slow progress is due to China's lack of experience with tricky debt restructurings, people familiar with the matter say.

Sri Lanka's talks are moving faster, with the IMF confirming it is on track for a new programme. China's approach, though, is not yet clear.

Meanwhile, some 60 percent of low-income countries are in, or at high risk of, debt distress, according to the IMF.

Seventeen smaller emerging economies have seen premium investors demand to hold their debt soar to levels effectively shutting them out of international markets. That number is higher than during peak-Covid-19 or the 2008 global financial crisis.

In late 2020, the Group of 20 launched a Common Framework to bring creditors such as China and India to the negotiation table along with the IMF, Paris Club and private creditors. Along with Zambia, Chad and Ethiopia have applied to restructure under this new, yet-to-be tested mechanism.

But the framework also "has added a bureaucratic layer to the already complex debt restructuring process" that could discourage other countries from joining, said Patrick Curran, senior economist at Tellimer.

- Reuters

No comments:

Post a Comment