MINING.COM Staff Writer | November 17, 2022 |

Coal. Stock image.

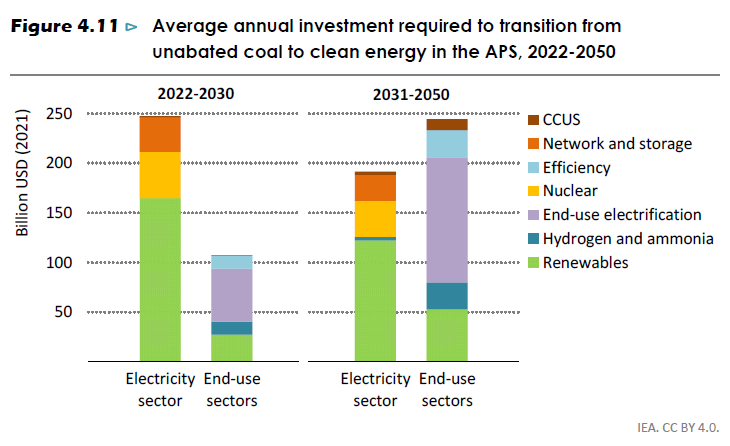

The world needs to invest $380 billion per year in clean energy until 2030 to transition away from coal, according to a new report from the International Energy Agency (IEA).

The amount is around 20% of all clean energy spending in the IEA Announced Pledges Scenario (APS), which assumes that all climate commitments made by governments around the world will be met in full and on time.

“$380 billion to transition away from coal isn’t much. It’s less than the GDP of Austria. It’s 0.4% of global GDP,” Peter Zeniewski, an Energy analyst for the IEA World Energy Outlook, wrote in a tweet.

Until 2030, around $250 billion, about 70% of global investment in the coal transition, will need to be spent in the power sector to replace the use of unabated coal with low emissions sources, primarily wind and solar PV

Coal. Stock image.

The world needs to invest $380 billion per year in clean energy until 2030 to transition away from coal, according to a new report from the International Energy Agency (IEA).

The amount is around 20% of all clean energy spending in the IEA Announced Pledges Scenario (APS), which assumes that all climate commitments made by governments around the world will be met in full and on time.

“$380 billion to transition away from coal isn’t much. It’s less than the GDP of Austria. It’s 0.4% of global GDP,” Peter Zeniewski, an Energy analyst for the IEA World Energy Outlook, wrote in a tweet.

Until 2030, around $250 billion, about 70% of global investment in the coal transition, will need to be spent in the power sector to replace the use of unabated coal with low emissions sources, primarily wind and solar PV

.

Source: IEA

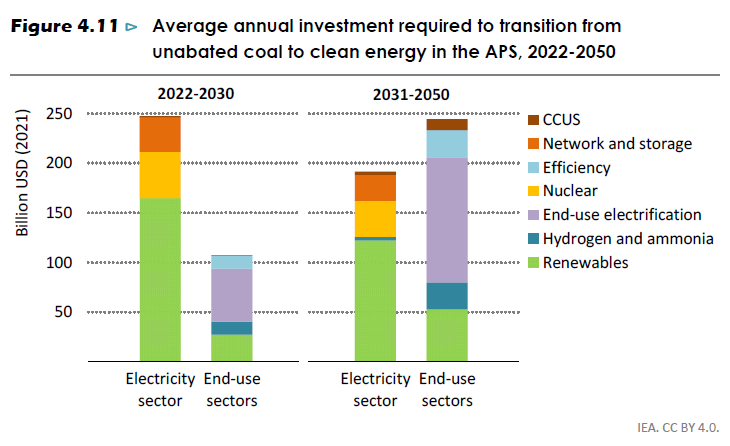

While coal is still the largest source of electricity generation, accounting for 36% of the world total, it is also the largest emitter of energy-related global carbon dioxide (CO2) – 15 gigatonnes (Gt) in 2021.

According to the report, the buck of the investment needs to go into emerging markets and developing economies, where coal emissions are highly concentrated.

While coal is still the largest source of electricity generation, accounting for 36% of the world total, it is also the largest emitter of energy-related global carbon dioxide (CO2) – 15 gigatonnes (Gt) in 2021.

According to the report, the buck of the investment needs to go into emerging markets and developing economies, where coal emissions are highly concentrated.

Source: IEA

This week, US President Joe Biden and Indonesian President Joko Widodo announced a $20 billion package to help the coal-dependent country shift to renewable energy and reach carbon neutrality by 2050.

The deal put forward by the Just Energy Transition Partnership (JETP), which includes the US, Japan, Canada, the UK, and several European countries in the EU and Norway, follows an agreement reached last year in which the United States and Europe pledged to give South Africa $8.5 billion in grants and loans in return for it retiring coal plants, switching to renewable energy, and re-training its workforce.

Similar arrangements are also being discussed with Vietnam, Senegal, and India.

Phasing out coal is essential to achieve the Paris Agreement, which limits global warming to well below 2 degrees Celsius, preferably to 1.5 degrees Celsius, compared to pre-industrial levels.

“The coal transition is affordable, and the challenges aren’t insurmountable. And if we operate the world’s coal assets as they have been in the past, we’ll sail past the 1.5° budget. That will cost the world much more… not just in dollars,” Zeniewski said.

This week, US President Joe Biden and Indonesian President Joko Widodo announced a $20 billion package to help the coal-dependent country shift to renewable energy and reach carbon neutrality by 2050.

The deal put forward by the Just Energy Transition Partnership (JETP), which includes the US, Japan, Canada, the UK, and several European countries in the EU and Norway, follows an agreement reached last year in which the United States and Europe pledged to give South Africa $8.5 billion in grants and loans in return for it retiring coal plants, switching to renewable energy, and re-training its workforce.

Similar arrangements are also being discussed with Vietnam, Senegal, and India.

Phasing out coal is essential to achieve the Paris Agreement, which limits global warming to well below 2 degrees Celsius, preferably to 1.5 degrees Celsius, compared to pre-industrial levels.

“The coal transition is affordable, and the challenges aren’t insurmountable. And if we operate the world’s coal assets as they have been in the past, we’ll sail past the 1.5° budget. That will cost the world much more… not just in dollars,” Zeniewski said.

Coal miners pay highest US dividends as prices soar to records

Bloomberg News | November 16, 2022 |

An open pit coal mine. Credit: AdobeStock

Coal is paying off for investors.

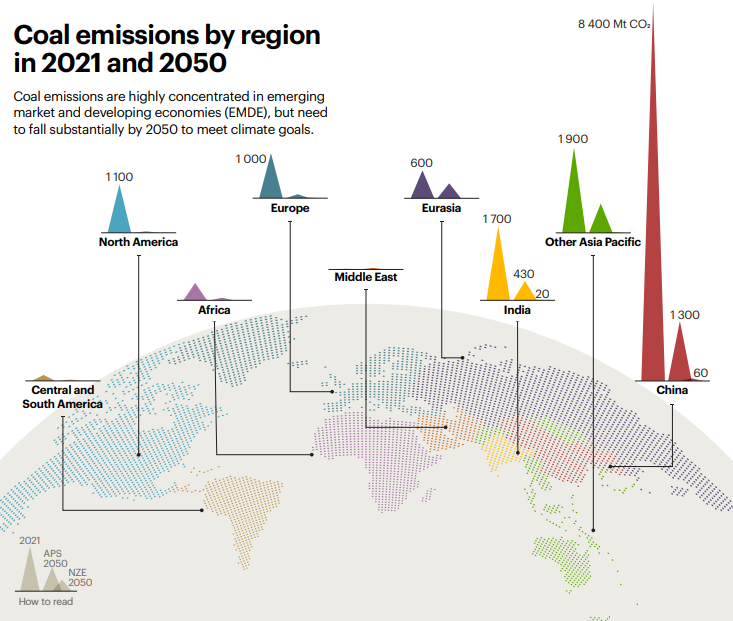

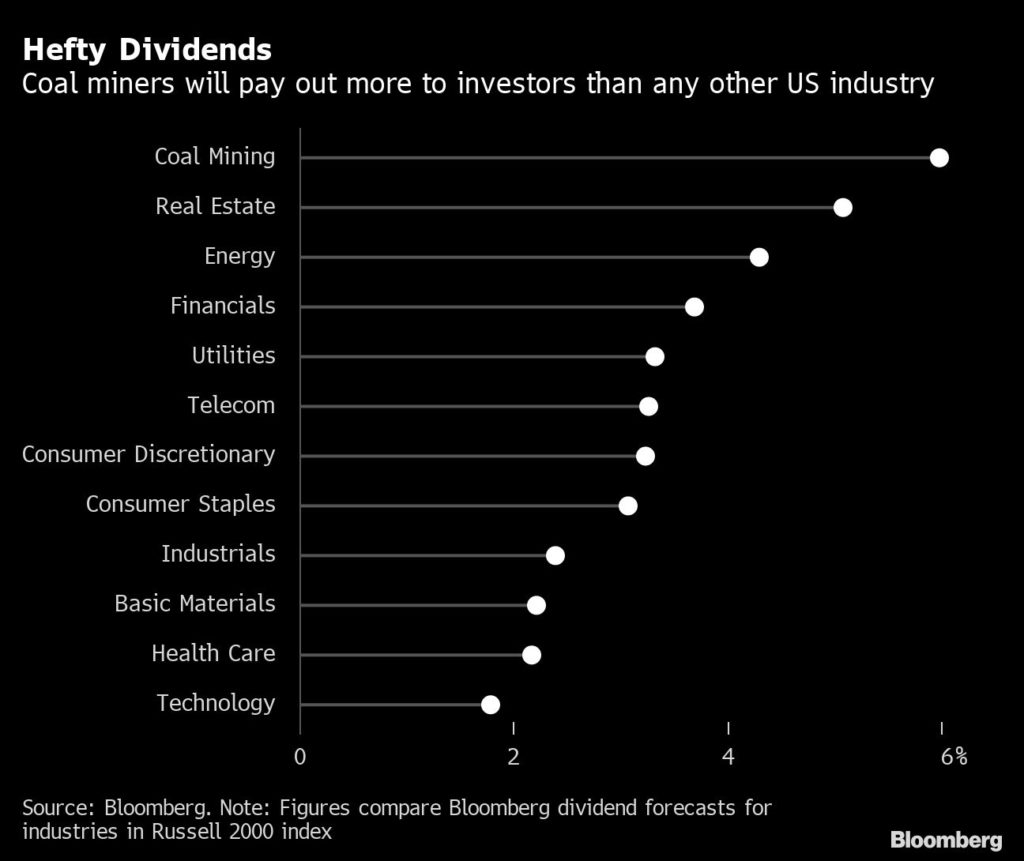

Miners of the fossil fuel are raking in cash and paying out hefty dividends, with shares surging as the global energy crisis boosts coal prices to record highs. US coal producers are projected to offer an average return of about 6% to investors over the next year, more than any other industry. That’s led by Arch Resources Inc., which is about to distribute a substantial $10.75-a-share payout.

It’s a notable turnaround for an industry that experienced waves of bankruptcies in recent years as power producers shift away from the dirtiest fossil fuel. The resurgence comes as Russia’s war in Ukraine roils energy markets, and underscores that the market for coal remains robust even as environmentalists, progressive politicians and many corporations push to abandon the fuel to fight climate change.

Still, coal’s long-term prospects remain bleak, which is why miners enjoying record profits are returning cash to shareholders instead of spending on new projects.

“The name of the game in coal right now is capital returns,” Lucas Pipes, an analyst with B Riley Securities, said in an interview.

Arch’s payout follows a $6-a-share quarterly dividend announced in July and an $8.11 one declared in April. The dividend yield of the second-biggest US coal miner is expected to reach 25% over the next year, the highest on the Russell 2000 Index. Since the company has explicitly pledged to hand half of its cash flow back to shareholders, investors can expect healthy returns for the next several quarters or more, said Andrew Blumenfeld, director of data analytics at McCloskey by Opis.

Other US miners show similar promise, including Alliance Resource Partners LP’s projected 12-month dividend yield of 9.5% and the projected 4.2% yield of Ramaco Resources Inc. Alpha Metallurgical Resources Inc. just raised its regular dividend and announced a special payout of $5 a share.

Coal miners are in a unique position, Blumenfeld said. The market is healthy, for now, as utilities clamor to secure enough fuel to keep the lights on. But the world is inexorably shifting to cleaner sources of power and demand for coal is expected to gradually decline during the next few decades. There’s little reason to spend money on mines to boost output, but offering beefy payouts will make stocks appealing to investors and drive up share prices.

“They’re saying ‘we believe the best place for this cash is back with our investors’,” Blumenfeld said.

(By Will Wade)

Bloomberg News | November 16, 2022 |

An open pit coal mine. Credit: AdobeStock

Coal is paying off for investors.

Miners of the fossil fuel are raking in cash and paying out hefty dividends, with shares surging as the global energy crisis boosts coal prices to record highs. US coal producers are projected to offer an average return of about 6% to investors over the next year, more than any other industry. That’s led by Arch Resources Inc., which is about to distribute a substantial $10.75-a-share payout.

It’s a notable turnaround for an industry that experienced waves of bankruptcies in recent years as power producers shift away from the dirtiest fossil fuel. The resurgence comes as Russia’s war in Ukraine roils energy markets, and underscores that the market for coal remains robust even as environmentalists, progressive politicians and many corporations push to abandon the fuel to fight climate change.

Still, coal’s long-term prospects remain bleak, which is why miners enjoying record profits are returning cash to shareholders instead of spending on new projects.

“The name of the game in coal right now is capital returns,” Lucas Pipes, an analyst with B Riley Securities, said in an interview.

Arch’s payout follows a $6-a-share quarterly dividend announced in July and an $8.11 one declared in April. The dividend yield of the second-biggest US coal miner is expected to reach 25% over the next year, the highest on the Russell 2000 Index. Since the company has explicitly pledged to hand half of its cash flow back to shareholders, investors can expect healthy returns for the next several quarters or more, said Andrew Blumenfeld, director of data analytics at McCloskey by Opis.

Other US miners show similar promise, including Alliance Resource Partners LP’s projected 12-month dividend yield of 9.5% and the projected 4.2% yield of Ramaco Resources Inc. Alpha Metallurgical Resources Inc. just raised its regular dividend and announced a special payout of $5 a share.

Coal miners are in a unique position, Blumenfeld said. The market is healthy, for now, as utilities clamor to secure enough fuel to keep the lights on. But the world is inexorably shifting to cleaner sources of power and demand for coal is expected to gradually decline during the next few decades. There’s little reason to spend money on mines to boost output, but offering beefy payouts will make stocks appealing to investors and drive up share prices.

“They’re saying ‘we believe the best place for this cash is back with our investors’,” Blumenfeld said.

(By Will Wade)

No comments:

Post a Comment