Duke Energy (DUK) to Build 150 MW of Solar Sites in Florida

Zacks Equity Research

Fri, March 3, 2023

Duke Energy Corp.’s DUK arm, Duke Energy Florida, recently announced the commencement of the construction of two new solar sites in Florida by the end of March 2023, thus providing a boost to its solar portfolio as it progresses toward the zero carbon emission goal.

With the onset of the construction of these two solar projects, Duke Energy takes a step forward in its community solar program. This underlines the goal of benefiting Florida customers by offering clean energy solutions.

Details of the Solar Sites

The Mule Creek Renewable Energy Center, one of the two solar sites, boasts a capacity of 74.9 megawatts (MW) and will be equipped with 175,000 solar panels. The other facility, the Winquepin Renewable Energy Center, will have a generation capacity of 74.9 MW with 220,000 solar panels.

The construction of the solar sites is expected to reach completion in nine to 12 months and will collectively generate energy that will be enough to power 23,000 homes. Such project additions will strengthen Duke Energy’s position as a supplier of clean and affordable energy for its customers.

Duke Energy’s Clean Energy Connection Program

Duke Energy has taken an initiative to expand the renewable asset base and aims to reach its target of net-zero carbon emissions from electric generation by 2050. With this pledge, the company initiated the Clean Energy Connection program through which it strives to provide the benefits of adopting renewable energy to its customers

Duke Energy Florida customers enjoy the opportunity of getting solar power without having to install any on-site solar panels. Also, by subscribing to solar power, customers can earn credit points on their electricity bill, which is likely to exceed the fee in about five years.

Meanwhile, the monthly subscription fee will contribute to the cost of construction and the operation of renewable energy centers and will be added to a customer's regular electric bill. Such programs by the company are likely to strengthen its customer base while easing the path to attain carbon neutrality.

Peer Moves

Apart from Duke Energy, utilities that have designed various programs to encourage the adoption of renewable energy are as follows:

OGE Energy Corp.’s OGE solar power program provides renewable energy without the upfront cost associated with customer-owned solar.

OGE Energy has a long-term earnings growth rate of 10.2%. The Zacks Consensus Estimate for OGE’s 2024 earnings suggests a growth rate of 5.2% from the prior-year estimated figure.

DTE Energy DTE plans to increase ITS generation from solar by nearly 10 times, producing clean energy from nearly 2.2 million additional solar panels by 2023 end. By 2040, its portfolio may include more than 11 million solar panels.

Its MIGreenPower makes it easy for everyone to benefit from renewable energy. Through the program, DTE plans to generate enough energy from Michigan wind and solar to power more than one million homes by 2025.

DTE Energy has a long-term earnings growth rate of 6%. The Zacks Consensus Estimate for DTE’s 2023 sales suggests a growth rate of 1.8% from the prior-year reported figure.

Ameren AEE is committed to exploring renewable energy options, such as wind, solar, landfill gas, agricultural methane, hydroelectric and other alternative energy sources, to generate electricity. AEE’s community solar program is an easy way for eligible customers to accelerate the expansion of solar energy in Missouri without installing solar panels on their homes or businesses.

Ameren’s long-term earnings growth rate is pegged at 6.9%. The Zacks Consensus Estimate for AEE’s 2023 sales suggests a growth rate of 5.1% from the prior-year reported figure.

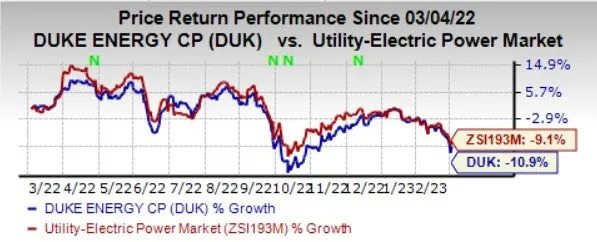

Price Movement

In the past year, Duke Energy’s shares have declined 10.9% compared with the industry’s fall of 9.1%.

Zacks Investment Research

Image Source: Zacks Investment Research

Zacks Rank

Duke Energy currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

No comments:

Post a Comment