China’s steel exports, iron ore imports hit record highs

China’s steel exports hit a record monthly high in December, fueled by front-loading driven by Beijing’s announcement of an export licence requirement for shipments from 2026.

The world’s largest steel producer shipped 11.3 million metric tons of the metal used in construction and manufacturing last month, the highest for a single month, data from the country’s General Administration of Customs showed on Wednesday.

Beijing has plans to roll out a licence system from 2026 to regulate steel exports, as robust shipments have sparked a growing protectionist backlash worldwide.

Some exporters rushed to ramp up shipments before January on fears that the export licence requirement might impact shipments, analysts said.

Despite surprisingly high exports, China’s prolonged property market woes have remained a drag on steel consumption.

China’s steel demand is projected to slide by 1% this year after an annual fall of 5.4% in 2025, according to a forecast from a state-backed research agency.

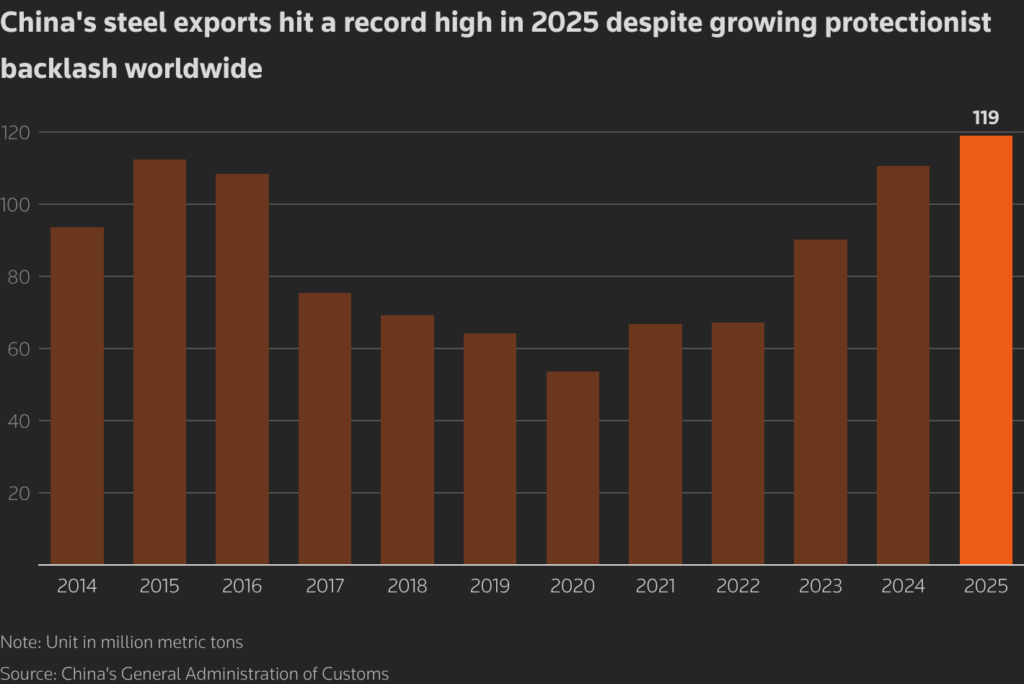

Steel exports for the whole year rose by 7.5% from the year before to an all-time high of 119.02 million tons despite an increasing number of countries throwing up trade barriers on Chinese steel arguing that domestic manufacturing has been hurt.

Iron ore imports at record

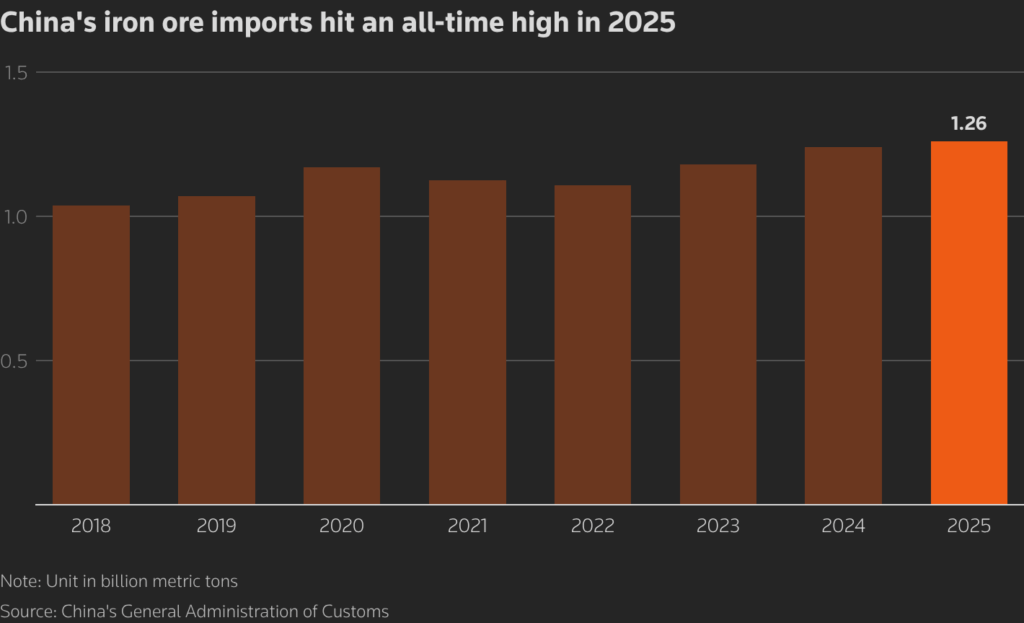

Iron ore imports in the world’s largest consumer hit a record high last year as low in-plant inventories and improved steel margins encouraged mills to book more cargoes.

Chinese steelmakers have kept low inventories at plants since late 2022 as a demand slump caused by the crisis-hit property market strained their cash flow.

Moreover, robust steel exports underpinned resilient demand for the key steelmaking ingredient, analysts said.

Imports in December rose 8.2% from the month before to 119.65 million tons, the highest for a month, bringing the total in 2025 to a record high of 1.26 billion tons with a rise of 1.8% from 2024.

Global iron ore supply is forecast to grow by 2.5% in 2026, and shipments to China are expected to increase by between 36 million and 38 million tons, piling pressure on prices this year, said Bai Xin, an analyst at consultancy Horizon Insights.

(By Amy Lv and Lewis Jackson; Editing by Jacqueline Wong and Tomasz Janowski)

Congo pitches new $29 billion iron ore and logistics project

The Democratic Republic of Congo, one of the world’s biggest producers of copper and cobalt, wants to add a $29 billion iron ore project to its mineral portfolio.

The country’s government has created a project called Mines de Fer de la Grande Orientale, or MIFOR, to develop a particularly rich seam of ore in the remote north of the country, Mines Minister Louis Watum told the council of ministers Friday, according to minutes published on the website of the office of the prime minister. The deposit has an estimated 20 billion tons of resources at an average grade of 60%, he said.

The first phase of the project would require the construction of heavy rail and transport on the Congo River to the deep-water port of Banana on the Atlantic Ocean and cost $28.9 billion, Watum said. Initial production capacity would be approximately 50 million tons per year, expandable to 300 million tons, Watum told the council.

“After more than 100 years of mining primarily focused on copper and cobalt, the MIFOR project marks a major strategic shift in the Democratic Republic of Congo’s extractive model,” Watum said, according to the minutes.

The project has already attracted institutional investors, he told the council, which agreed to create an inter-ministerial commission dedicated to the project.

(By Michael J. Kavanagh)

Radiant unloads BHP iron ore in China as trader tests curbs

A bulk carrier laden with BHP Group’s Jimblebar iron ore has discharged in China after weeks idling offshore, in a rare case of a trader pressing ahead with restricted cargoes despite an ongoing pricing dispute.

The Berge Mawson unloaded its cargo, owned by trading firm Radiant World, at the northern port of Caofeidian in the first week of January and has now left the country, Bloomberg ship tracking data show. The vessel saw lengthy delays after port storage constraints led to a backlog of ships waiting to offload cargoes.

The Jimblebar Fines blend is one of the BHP products subject to curbs imposed by China’s state-run iron ore trader. The nation is the world’s largest buyer of the steelmaking staple and BHP one of its biggest suppliers. As such, the fate of the cargo has become a focal point for traders wanting to gauge whether restricted material can ultimately be sold in the country, according to people familiar with the matter.

Radiant World is a private trading company that has grown rapidly in recent years to become one of the largest players in the market. The Berge Mawson had been anchored off the coast since early December before finally docking on Dec. 31.

It isn’t clear whether Radiant has found a buyer, or whether the ore is stacked up at the port and yet to clear customs. Prolonged delays to shipments threaten to tie up vessels and raise demurrage and storage costs.

BHP is locked in a dispute with China Mineral Resources Group Co., the state-run firm set up in 2022 to consolidate iron ore purchases and wrest pricing power away from foreign miners. Although CMRG told steelmakers in September to stop purchasing Jimblebar, there may be mills that aren’t linked to the state-owned firm willing to take the product. Others might seek special approval from CMRG.

Radiant World and BHP both declined to comment. CMRG didn’t respond to a request for comment. Another vessel loaded with BHP ore that’s being closely watched by traders, the Ever Shine, has been idling off the port of Qingdao since early December

CMRG is also in talks with BHP’s Australian peers, Rio Tinto Group and Fortescue Ltd., for long-term supply deals in 2026. Meanwhile, Chinese customs has been stepping up checks to screen for cargoes of BHP ore, said two of the people, who declined to be named discussing a sensitive matter.

China’s customs administration didn’t immediately respond to a fax seeking comment.

No comments:

Post a Comment