August 29, 2025

President Donald Trump's tariff battle suffered a major defeat Friday when a federal appeals court ruled that his most extensive tariffs were illegal, saying he overstepped his authority. And Nobel Prize-winning economist Paul Krugman expressed "shock."

The court found that the law Trump used to hand down steep tariffs did not grant him the power to enforce them. The ruling's implementation was suspended until Oct. 14, however, to allow the administration to appeal to the Supreme Court.

The ruling challenged Trump's use of emergency powers for trade deficit and other economic concerns.

Writing on his blog, Krugman reacted to the ruling writing, "Holy tariff mess, Batman."

"Wow. An appeals court, backing up the Court of International Trade, has just ruled the majority of Trump’s tariffs illegal. We kind of knew this was coming, but the reality still comes as a shock," he said.

Krugman emphasized that the court didn't find the tariffs were unlawful; rather, the way Trump went about implementing them was, specifically, by claiming an economic emergency.

"But just saying 'I am the Tariff Man, and here are my tariffs' isn’t OK," remarked Krugman.

The former New York Times columnist pointed out that the president is declaring an economic emergency while simultaneously proclaiming the economy has never been stronger.

"So how can things both be terrific and an emergency calling for drastic action?" he asked.

Krugman then mocked the president over his furious reaction on Truth Social, in which he declared the ruling, if upheld, would "literally destroy" America.

"Take away these tariffs, and the county will revert to the blasted wasteland it was on … April 1, just before Trump made his big tariff announcement," he wrote.

Krugman conceded that an "utterly craven" Supreme Court could hand Trump an eventual win — or they could "balk." Either way, Krugman called it a "self-inflicted disaster," since Trump could have just had Republican lawmakers vote on the tariffs.

He concluded that if the tariffs are ultimately declared illegal, it won't embarrass America, as Treasury Secretary Scott Bessent has claimed.

"It will embarrass Trump and Bessent. If anything, it might reassure the rest of the world that some vestige of rule of law yet remains in this nation," he said.

Daniel Hampton

August 29, 2025

A demonstrator holds a placard depicting U.S. President Donald Trump during a protest against tariffs on Brazilian products imposed by U.S. President Donald Trump, outside the U.S. Consulate in Sao Paulo, Brazil August 1, 2025. REUTERS/Amanda Perobelli

President Donald Trump's tariffs suffered a "big blow" in court on Friday, and critics could not hide their satisfaction.

A federal appeals court ruled Trump had no legal right to impose sweeping global tariffs using emergency authority, finding those tariffs unconstitutional. However, the court left the tariffs in place temporarily while the matter is appealed further, likely to the Supreme Court.

The ruling largely upheld a May decision by a specialized federal trade court in New York. It comes as experts warn of "staggering" price hikes that could hit Americans.

CNN's Jake Tapper called it a "big blow" on air to Trump's agenda. New York Times reporter Maggie Haberman told Tapper the same during a brief interview after the ruling dropped.

Reaction was swift across the internet.

Frank Amari, a former public defender, joked on Bluesky, "So much winning!!"

Historian and writer Trent Nelson wrote on Bluesky, "Yea. Obviously."

Economist Justin Wolfers cheered the ruling on Bluesky, but warned the fight isn't over.

"BOOM. The federal appeals court rules Trump's tariffs illegal, because they are. There's no national emergency, and so the power to tariff a country rests with Congress. Trump admin has lost at every stage of the process, but stay tuned for the Supremes to chime in."

He noted, "This won't end all tariffs. This ruling applies to tariffs applied to entire countries (which is most of the tariff agenda). The industry-specific tariffs use a different legal authority, and will remain. The White House has other (more limited) tariff powers it'll dust off."

Dmitry Grozoubinski, author of "Why Politicians Lie About Trade," wrote on Bluesky, "Appeals court says Trump's fentanyl and reciprocal tariffs are unlawful. Looking forward to the 6-3 SCOTUS decision which upholds them anyway because the Constitution clearly states Trump is an omnipotent God-Emperor destined to reign upon the Golden Throne until all is returned to dust."

Analyst and writer Christian Roselund wrote on Bluesky, "This is the second court ruling to affirm that #Trump 's use of the International Emergency Economic Powers Act (IEEPA) to set sweeping, economy-wide tariffs is illegal. The Trump Admin will almost certainly appeal. Not sure what the next stop is."

'Our country would be destroyed': Trump continues attack on judges who blocked his tariffs

Robert DavisAugust 31, 2025

RAW STORY

A court ruling that blocked the president's signature tariff agenda seemed to stick under his skin over the weekend.

In a Truth Social post on Sunday, President Donald Trump raged against the seven appellate judges who ruled on Friday that his tariff policy was illegal. The 7-4 opinion states that Trump's reasoning for the tariffs did not constitute an emergency; therefore, any tariffs that were implemented under the auspices of an emergency were declared null.

Trump responded to the court's decision in a Truth Social post on Sunday.

"Without Tariffs, and all of the TRILLIONS OF DOLLARS we have already taken in, our Country would be completely destroyed, and our military power would be instantly obliterated," Trump wrote on Truth Social.

The president also seemed to congratulate one of the judges who voted to leave the tariffs in place.

" In a 7 to 4 Opinion, a Radical Left group of judges didn’t care, but one Democrat, Obama appointed, actually voted to save our Country," Trump wrote. "I would like to thank him for his Courage! He loves and respects the U.S.A."

Matthew Chapman

August 29, 2025

President Donald Trump released a furious rant on his Truth Social platform after the U.S. Court of Appeals for the Federal Circuit upheld a lower court ruling that his tariff policies are illegal.

The ruling held that the president does not have authority under the International Emergency Economic Powers Act to enact the type of global tariffs he has claimed authority for.

Trump particularly drew attention to the fact that the ruling is delayed from taking effect until October, and vowed to fight the decision at the Supreme Court.

"ALL TARIFFS ARE STILL IN EFFECT!" wrote Trump. "Today a Highly Partisan Appeals Court incorrectly said that our Tariffs should be removed, but they know the United States of America will win in the end. If these Tariffs ever went away, it would be a total disaster for the Country. It would make us financially weak, and we have to be strong."

"The U.S.A. will no longer tolerate enormous Trade Deficits and unfair Tariffs and Non Tariff Trade Barriers imposed by other Countries, friend or foe, that undermine our Manufacturers, Farmers, and everyone else," he continued. "If allowed to stand, this Decision would literally destroy the United States of America. At the start of this Labor Day weekend, we should all remember that TARIFFS are the best tool to help our Workers, and support Companies that produce great MADE IN AMERICA products. For many years, Tariffs were allowed to be used against us by our uncaring and unwise Politicians."

"Now, with the help of the United States Supreme Court, we will use them to the benefit of our Nation, and Make America Rich, Strong, and Powerful Again!" wrote Trump. "Thank you for your attention to this matter."

If the president's policies are struck down, the administration may have to repay billions of dollars in duties, which customs and trade experts warn "would be a logistical nightmare."

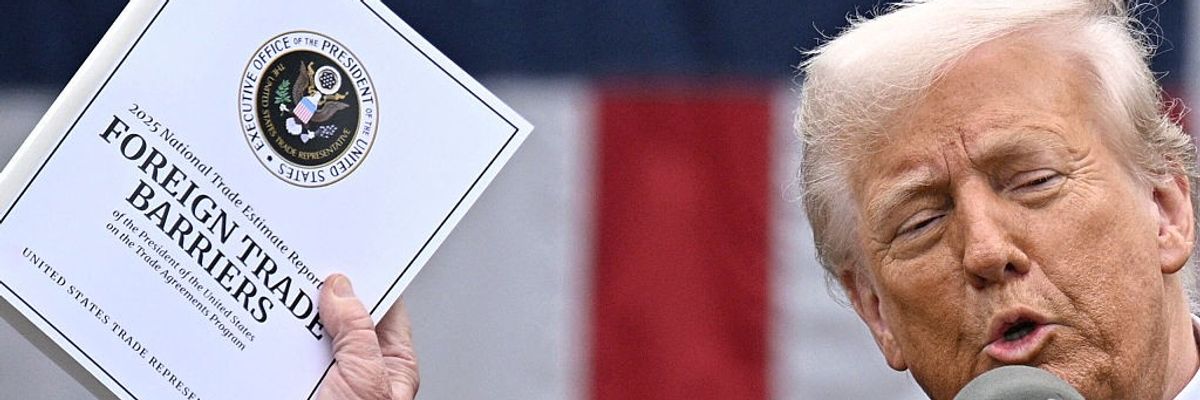

US President Donald Trump delivers remarks on what he claimed are reciprocal tariffs during an event at the White House in Washington, DC, on April 2, 2025.

(Photo by Brendan Smialowski/AFP via Getty Images)

Jessica Corbett

Aug 29, 2025

COMMON DREAMS

As working-class Americans endure the pain from US President Donald Trump's tariff war, the Republican signaled that he plans to keep fighting for the levies after a loss at the US Court of Appeals for the Federal Circuit.

Trump is the first president to impose tariffs by citing the International Emergency Economic Powers Act (IEEPA) of 1977. In a 7-4 ruling, the appellate court's majority found that most of his tariffs are illegal.

Grocery Chains Are Passing Trump Tariff Costs on to US Consumers With Higher Prices: Report

The court said that "tariffs are a core congressional power" and "we discern no clear congressional authorization by IEEPA for tariffs of the magnitude of the reciprocal tariffs and trafficking tariffs."

The decision affirms a May ruling from the US Court of International Trade, which also found that Trump exceeded his authority.

Friday's ruling is paused until October 14, to give the White House time to appeal to the nation's highest court. Trump suggested he would do so in a post on his Truth Social platform, writing:

ALL TARIFFS ARE STILL IN EFFECT! Today a Highly Partisan Appeals Court incorrectly said that our Tariffs should be removed, but they know the United States of America will win in the end. If these Tariffs ever went away, it would be a total disaster for the Country. It would make us financially weak, and we have to be strong. The U.S.A. will no longer tolerate enormous Trade Deficits and unfair Tariffs and Non Tariff Trade Barriers imposed by other Countries, friend or foe, that undermine our Manufacturers, Farmers, and everyone else. If allowed to stand, this Decision would literally destroy the United States of America. At the start of this Labor Day weekend, we should all remember that TARIFFS are the best tool to help our Workers, and support Companies that produce great MADE IN AMERICA products. For many years, Tariffs were allowed to be used against us by our uncaring and unwise Politicians. Now, with the help of the United States Supreme Court, we will use them to the benefit of our Nation, and Make America Rich, Strong, and Powerful Again! Thank you for your attention to this matter.

Politico noted that the Friday decision opens the door "for the administration to potentially have to repay billions worth of duties," and pointed to recent warnings from customs and trade experts "that repayments would be a logistical nightmare, and would likely trigger a wave of legal challenges from other businesses and industry groups seeking reimbursement."

Trump's latest legal loss on the tariff front follows various analyses and polling that show the harm his policies are causing. One Accountable.US report from this month highlights comments from grocery executives about passing costs on to consumers, and a recent survey found that 90% of Americans consider the price of groceries a source of stress.

Democrats on the Joint Economic Committee also released a related report earlier this month. As JEC Ranking Member Maggie Hassan (D-N.H.) said at the time, "While President Trump promised that he would expand our manufacturing sector, this report shows that, instead, the chaos and uncertainty created by his tariffs has placed a burden on American manufacturers that could weigh our country down for years to come."

Another mid-August analysis from the Century Foundation and Groundwork Collaborative details the surging cost of school supplies as American families prepared for the 2025-26 academic year. TCF senior fellow Rachel West said that "from his reckless tariffs to his budget law slashing food assistance and federal student loans, Trump's back-to-school message to America's families is crystal clear: Don't expect help, just expect less."

CNN host Jake Tapper and New York Times White House correspondent Maggie Haberman on CNN on August 29, 2025 (Image: Screengrab via CNN / YouTube)

On Friday, the U.S. Court of Appeals for the Federal Circuit upheld a previous decision by a lower court that the vast bulk of President Donald Trump's tariffs — which he imposed by claiming emergency powers — were unconstitutional. And according to New York Times White House correspondent Maggie Haberman, it's one of the biggest legal setbacks yet for Trump's second administration.

During a segment with CNN host Jake Tapper, Haberman said that the decision was highly anticipated by everyone in the administration who works on trade issues. She added that administration officials had been fearing that it would be "difficult" to defend Trump's assumed emergency powers before the federal judiciary.

"The U.S. is going to end up in a position, if the Supreme Court upholds this ruling, and it's almost certainly going to go to the Supreme Court, the U.S. is now going to be in a position to pay people — countries, excuse me — back, for tariffs. That gets very complicated," she said. "So this is a big blow to the president's agenda. He has sometimes ignored courts. We'll see what this looks like."

Haberman's point that tariffs could have to be paid back to countries affected by them could prove expensive for taxpayers. The Associated Press reported that as of July, total year-over-year tariff revenue exceeded $159 billion. Trump imposed the tariffs by invoking the International Emergency Economic Powers Act (IEEPA) of 1977, which allows a president to assume certain new powers under an economic emergency. But during oral arguments, one of the judges hearing the case pointed out that the IEEPA statute doesn't even mention tariffs.

Moreover, Article I, Section 8 of the U.S. Constitution stipulates that only Congress has the power to levy tariffs, stating that the legislative branch "shall have Power To lay and collect Taxes, Duties, Imposts and Excises, to pay the Debts and provide for the common Defence and general Welfare of the United States; but all Duties, Imposts and Excises shall be uniform throughout the United States."

Shortly after the decision was announced, Trump took to his Truth Social platform to blast the judges (who he deemed "Highly Partisan" in his signature style of oddly-placed capital letters) that struck down his tariffs. He also insisted that "ALL TARIFFS ARE STILL IN EFFECT!"

"If these Tariffs ever went away, it would be a total disaster for the Country. It would make us financially weak, and we have to be strong. The U.S.A. will no longer tolerate enormous Trade Deficits and unfair Tariffs and Non Tariff Trade Barriers imposed by other Countries, friend or foe, that undermine our Manufacturers, Farmers, and everyone else," he wrote. "If allowed to stand, this Decision would literally destroy the United States of America."

Watch Haberman's segment below, or by clicking this link.

By Paul Wallis

August 29, 2025

On April 2, US President Donald Trump, with Commerce Secretary Howard Lutnick beside him, unveiled sweeping tariffs on almost all trading partners - Copyright AFP/File Brendan SMIALOWSKI

The Trump administration’s tariffs are universally unpopular worldwide. American importers have to pay the extra costs, which are passed on to consumers. The increased costs inevitably mean fewer goods are sold. Countries are targeted individually with weaponized tariffs. Global trade is an appalling mess.

These tariffs are raised under the International Emergency Economic Powers Act (IEEPA). The US Court of Appeals for the Federal Circuit in Washington, DC, held in a 7-4 ruling that the statute does not empower the imposition of tariffs. In fact, the Act makes no mention of tariffs.

Meaning that many of the controversial tariffs now imposed also exceed the authority granted by the Act. Therefore, they’re illegal. It’s expected that the administration will appeal to the Supreme Court, and that the Supreme Court will uphold the tariffs.

In the meantime, the administration maintains that the tariffs are legal. It’s a Yes or No situation. If only it were that simple.

But –

The problem with these tariffs and their legalities or lack of legalities is that the US isn’t the only party involved. US importers can fairly say that if the statutory basis of the tariffs is illegal, they shouldn’t have to pay those billions in extra costs. Industry lobbies are likely to put a lot of pressure on the administration as the effects of tariffs become clearer.

That issue’s not likely to go away. The administration has nailed itself to tariffs as an instrument of international economic policy. There’s even a level of “prestige” in sticking to tariffs as the only way to do business. If the tariffs go, the whole house of cards goes with them.

The Supreme Court is in a particularly thankless position. If the Appeals Court is correct in that tariffs are not specifically empowered by the Act, any and all tariffs could be challenged in individual court actions.

Here’s the twist. The Supreme Court would have to make a blanket ruling that all tariffs stand to support the administration. That would lock in added costs for importers and consumers. There would be a lot of pushbacks from the various economic sectors and other countries. Any negotiation with any other country would have to start with trade.

Alternatively, any decision that the tariffs are not empowered by the Act effectively demolishes the entire tariff structure. That means that tariffs as a nominal source of revenue to pay for the ideologically sacred tax cuts would also be scuttled as a budgetary option.

In practice, of course, it’s much worse. A brief overview of the last 200 years of tariffs is hardly encouraging. Tariffs just don’t work. The current range of tariffs are already seen as a major threat to prices. Tariffs are the antithesis of free trade, the supposed basis of modern capitalism.

Nothing can move fast on this subject. As expected by just about everyone, the inherent constipation of the tariffs dogma will prevent movement.

“Sic transit ingloria.” So goes the inglorious.

___________________________________________________________

Disclaimer

The opinions expressed in this Op-Ed are those of the author. They do not purport to reflect the opinions or views of the Digital Journal or its members.

.png)

.jpg)