Bloomberg News | March 15, 2021

Child miners as young as 11 in eastern Congo. (Image by Enough Project, Flickr)

The European Union’s efforts to ethically source a key battery metal face headwinds that could make it more expensive for automakers to go electric.

Cobalt is the battery metal at the highest risk of being exploited in ways that damage the health of people and the environment. Most of the world’s supply comes from the Democratic Republic of Congo, with as much as a third of that supplied by small-scale miners who often work in dangerous conditions. Regulators have begun developing rules designed to help industry avoid damaging its reputation.

But those “ambitious requirements might currently be too difficult,” according to an assessment prepared by researchers advising the European Commission. The report, which will be published by Elsevier Ltd.’s Resources Policy journal in June, suggests a tightening market for responsibly-sourced cobalt.

“If, as proposed by the European Commission, due diligence on cobalt supply chain will be mandatory for batteries sold in the EU markets in the near future, the demand for responsibly sourced cobalt will increase rapidly,” the study prepared by the EU’s Joint Research Centre said.

Many downstream companies have been reluctant to purchase hand-dug cobalt because of concerns about child labor. Glencore Plc, which operates two of the world’s biggest industrial cobalt mines in Congo, assures its buyers like Tesla Inc. that only responsibly-sourced cobalt feeds into its products.

But some Chinese companies that sell processed cobalt to Europe mix certified streams of the metal with material sourced from unregulated mines, according to the report. Congo produces some three fifths of the world’s cobalt and as much of a third of that is extracted by hundreds of thousands of freelancers. Miners told the researchers that wages and mineral prices continued to be subjects of dispute.

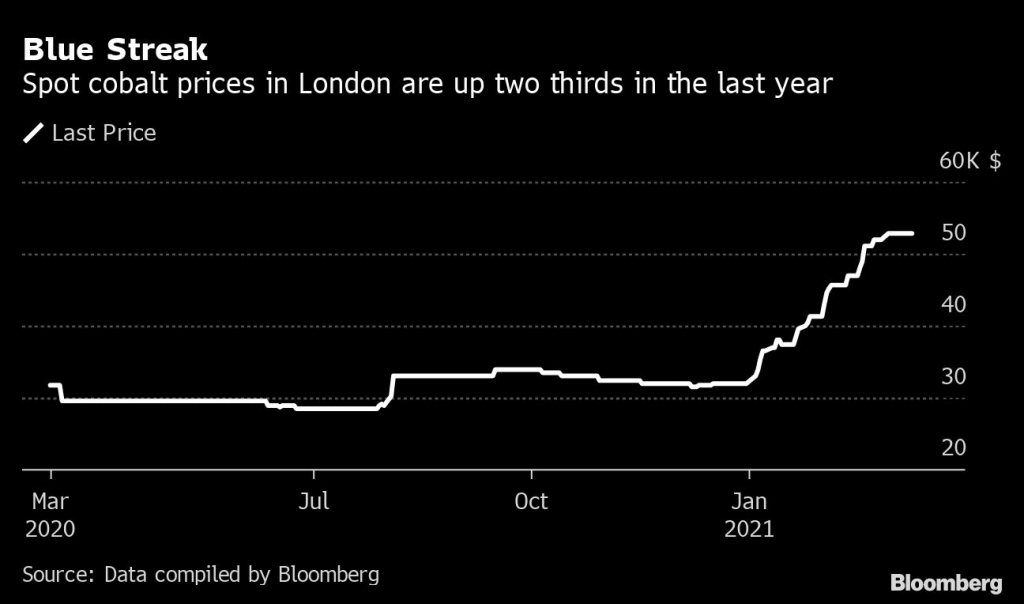

By 2030, EU economies need to secure more than 64,000 tonnes of ethically-sourced cobalt beyond existing supply-chain constraints, a volume of metal worth around $3.2 billion at current prices, to fuel the transition to electric vehicles. The run on the metal’s price is prompting mining companies to seek new reserves from Australia to the deep sea.

(By Jonathan Tirone)

Read more: Cobalt, nickel free electric car batteries are a runaway success

No comments:

Post a Comment