POTASH

The vital fertilizer that’s driving multibillion-dollar betsBloomberg News | August 17, 2021 |

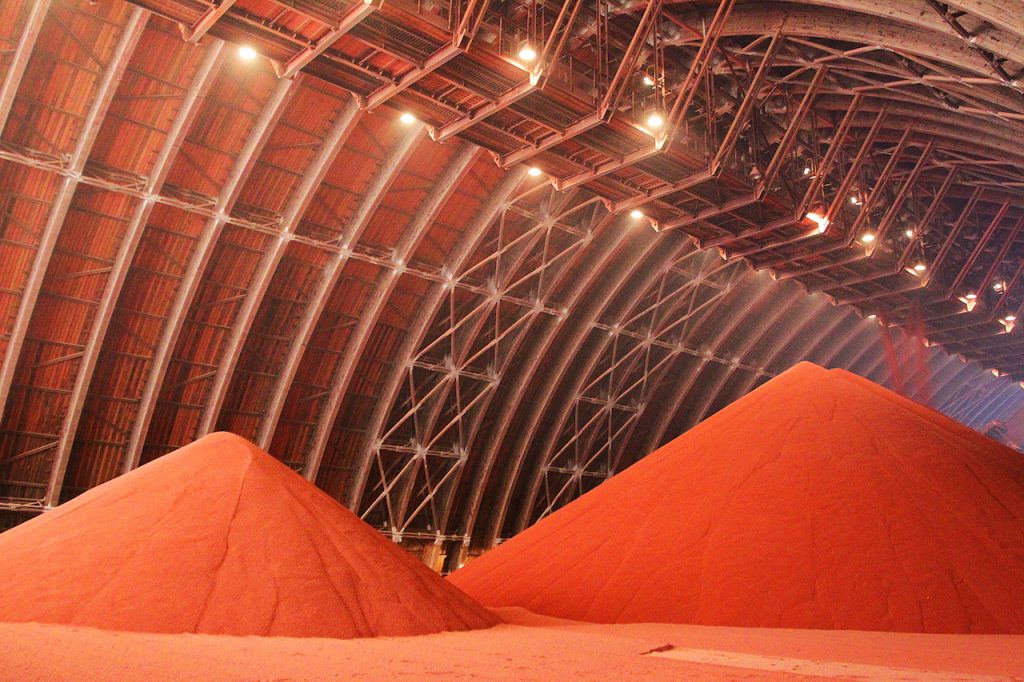

(Image courtesy of BPC.)

BHP Group’s go-ahead to spend $5.7 billion on a giant Canadian potash mine is shining a spotlight on a commodity vital to feeding the world.

Prices of the nutrient essential to producing food for growing populations soared after a crop rally helped farmers boost fertilizer purchases. Unlike oil or most metals and grains, potash trade is focused on annual contracts or in the spot market, rather than on a futures exchange — and supplies are mostly controlled by just a handful of producers.

The fertilizer is part of mining giant BHP’s shift toward commodities of the future as it exits fossil fuels, though production won’t start for another six years. For now, much of the focus will be on how U.S. sanctions on Belarus’s state-owned producer affect supply.

Here’s why potash is important and what’s driving the market:

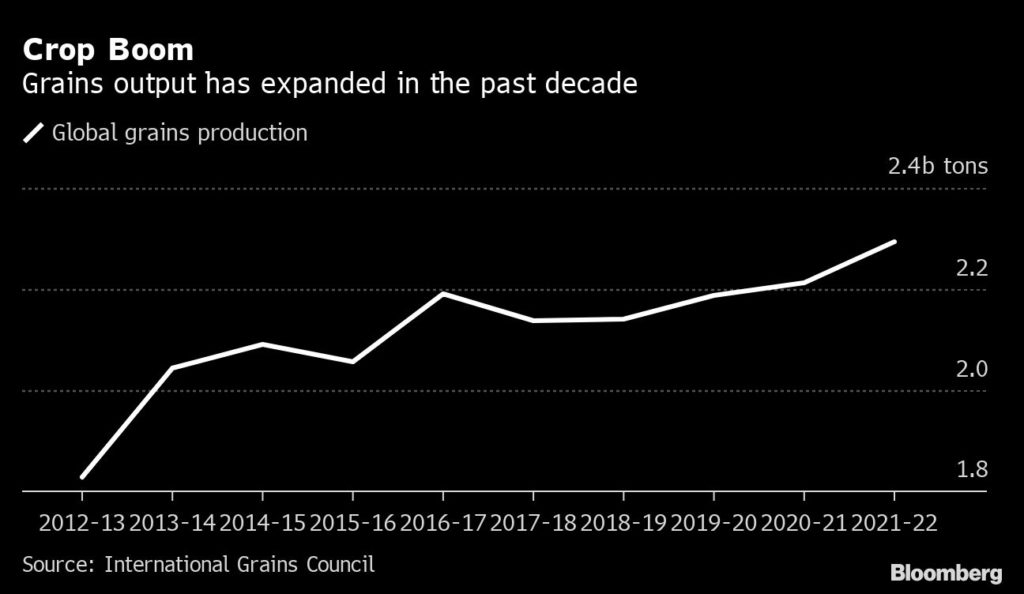

Market rally

Grains output jumped about 25% in almost a decade on rising global food demand, while a crop rally in the past year encouraged farmers to expand planting and use more fertilizers. That’s seen spot potash prices in Brazil and the U.S. hit the highest in at least eight years.

Nutrien Ltd., the biggest fertilizer company, earlier this year said it will raise potash production amid a tightening market. Last week, the Canadian company revised its forecast for global potash shipments to a record on strong demand.

Miners join party

BHP on Tuesday finally approved spending on the Jansen potash mine in Canada, after years of wavering over the huge cost. Potash offers the world’s top mining company a long-term future profit driver as it retreats from fossil fuels and focuses on commodities that should benefit from rising populations or the green-energy transition.

Jansen could operate for a century, and is a scalable business that could grow to rival BHP’s Pilbara iron ore operations and its copper mines in Chile in importance, Ragnar Udd, president of BHP’s Minerals Americas business, said on a media call on Wednesday. BHP isn’t the only miner moving into fertilizers — Anglo American Plc took over a $4 billion U.K. mine in 2020 as it shifts from coal to more environmentally-friendly commodities.

There are other big projects in the works. Russia’s Acron Group is speeding up construction of Talitsky potash mine and targets the first supplies in 2025. In Belarus, Slavkali plans to start a 2 million tons-a-year mine in 2023.

Supply uncertainty

Output is mostly concentrated in North America and former Soviet nations like Russia and Belarus, from underground deposits formed by evaporated sea beds millions of years ago. Nutrien, Mosaic Co., Belaruskali OAO and Uralkali PJSC are among the main producers.

The U.S. last week sanctioned Belaruskali as it targeted companies with ties to President Alexander Lukashenko, though it’s not clear how that will affect supply. Counterparts have until December to wind down transactions with Belaruskali, while Belarusian Potash Co., which handles all of the country’s potash exports, wasn’t itself sanctioned.

Still, BPC told RIA Novosti the sanctions will lead to higher potash prices and less availability on the world market.

Potash trade

Unlike say crude, copper or wheat, benchmark prices are largely derived from annual deals between producers and buyers, rather than on a futures exchange. The nutrient is also traded in spot markets.

Prices at multiyear highs “revived projects like Jensen or Talitsky in Russia, even as the market is still in oversupply,” said VTB Capital analyst Elena Sakhnova. “It’s not clear how long potash price dynamics will sustain, as it is driven by speculative factors and uncertainty over Belarusian shipments.”

BHP’s Udd said he was confident the market could absorb the extra supply from Jansen, with first production targeted for 2027. “The feedback we’re getting from customers at this point is that they will really relish the competition this will induce in the market.”

(By Nicholas Larkin, Thomas Biesheuvel and Yuliya Fedorinova, with assistance from James Thornhill)

Nutrien confident in potash demand even with BHP’s project

Reuters | August 17, 2021 |

Patience Lake potash mine. Credit: Nutrien Ltd.

Canada’s largest potash producer Nutrien Ltd said on Tuesday it is confident in growing global demand for the crop fertiliser, shrugging off BHP Group’s decision to press on with its massive Jansen project in Saskatchewan that will add millions of tonnes a year of potash supply.

BHP announced it is going ahead with its Jansen potash project, which is expected to cost $5.7 billion in the first phase.

The mine will produce 4.35 million tonnes of potash per year from 2027, BHP said. Potash is a key element in plant nutrition that also makes crops more drought resistant.

Canada produced 21 million tonnes in 2019, accounting for more than 31% of global supply.

“It will take another decade for Jansen to have significant production,” Ken Seitz, chief executive of Nutrien Potash said in a statement.

Nutrien expects global demand to grow by 2-3% per year until close to 2030. The company is also seen as an ideal partner to dilute BHP’s risk and development costs. BHP says it is open to but not in need of a partner, while Nutrien has said that any tie-up with BHP is not its focus.

Global potash demand by 2030 is likely to be more than sufficient to absorb additional supply from Jansen, said Morningstar analyst Seth Goldstein, as farmers in Asia use more of the crop nutrient.

“Potash has one of the best demand outlooks of any fertiliser out there,” Goldstein said.

This month Washington imposed sanctions on Belaruskali OAO, one of Belarus’ largest state-owned enterprises and among the world’s biggest producers of potash. Belarus Potash Company (BPC), the exporting arm Belaruskali, warned the move would lead to global potash price increases.

Jansen is expected to create 3,500 jobs annually during construction and employ 600 permanent operating staff.

Premier Scott Moe said the mine is the largest private economic investment in the province’s history.

(By Nia Williams; Editing by Marguerita Choy)

BHP on Tuesday finally approved spending on the Jansen potash mine in Canada, after years of wavering over the huge cost. Potash offers the world’s top mining company a long-term future profit driver as it retreats from fossil fuels and focuses on commodities that should benefit from rising populations or the green-energy transition.

Jansen could operate for a century, and is a scalable business that could grow to rival BHP’s Pilbara iron ore operations and its copper mines in Chile in importance, Ragnar Udd, president of BHP’s Minerals Americas business, said on a media call on Wednesday. BHP isn’t the only miner moving into fertilizers — Anglo American Plc took over a $4 billion U.K. mine in 2020 as it shifts from coal to more environmentally-friendly commodities.

There are other big projects in the works. Russia’s Acron Group is speeding up construction of Talitsky potash mine and targets the first supplies in 2025. In Belarus, Slavkali plans to start a 2 million tons-a-year mine in 2023.

Supply uncertainty

Output is mostly concentrated in North America and former Soviet nations like Russia and Belarus, from underground deposits formed by evaporated sea beds millions of years ago. Nutrien, Mosaic Co., Belaruskali OAO and Uralkali PJSC are among the main producers.

The U.S. last week sanctioned Belaruskali as it targeted companies with ties to President Alexander Lukashenko, though it’s not clear how that will affect supply. Counterparts have until December to wind down transactions with Belaruskali, while Belarusian Potash Co., which handles all of the country’s potash exports, wasn’t itself sanctioned.

Still, BPC told RIA Novosti the sanctions will lead to higher potash prices and less availability on the world market.

Potash trade

Unlike say crude, copper or wheat, benchmark prices are largely derived from annual deals between producers and buyers, rather than on a futures exchange. The nutrient is also traded in spot markets.

Prices at multiyear highs “revived projects like Jensen or Talitsky in Russia, even as the market is still in oversupply,” said VTB Capital analyst Elena Sakhnova. “It’s not clear how long potash price dynamics will sustain, as it is driven by speculative factors and uncertainty over Belarusian shipments.”

BHP’s Udd said he was confident the market could absorb the extra supply from Jansen, with first production targeted for 2027. “The feedback we’re getting from customers at this point is that they will really relish the competition this will induce in the market.”

(By Nicholas Larkin, Thomas Biesheuvel and Yuliya Fedorinova, with assistance from James Thornhill)

Nutrien confident in potash demand even with BHP’s project

Reuters | August 17, 2021 |

Patience Lake potash mine. Credit: Nutrien Ltd.

Canada’s largest potash producer Nutrien Ltd said on Tuesday it is confident in growing global demand for the crop fertiliser, shrugging off BHP Group’s decision to press on with its massive Jansen project in Saskatchewan that will add millions of tonnes a year of potash supply.

BHP announced it is going ahead with its Jansen potash project, which is expected to cost $5.7 billion in the first phase.

The mine will produce 4.35 million tonnes of potash per year from 2027, BHP said. Potash is a key element in plant nutrition that also makes crops more drought resistant.

Canada produced 21 million tonnes in 2019, accounting for more than 31% of global supply.

“It will take another decade for Jansen to have significant production,” Ken Seitz, chief executive of Nutrien Potash said in a statement.

Nutrien expects global demand to grow by 2-3% per year until close to 2030. The company is also seen as an ideal partner to dilute BHP’s risk and development costs. BHP says it is open to but not in need of a partner, while Nutrien has said that any tie-up with BHP is not its focus.

Global potash demand by 2030 is likely to be more than sufficient to absorb additional supply from Jansen, said Morningstar analyst Seth Goldstein, as farmers in Asia use more of the crop nutrient.

“Potash has one of the best demand outlooks of any fertiliser out there,” Goldstein said.

This month Washington imposed sanctions on Belaruskali OAO, one of Belarus’ largest state-owned enterprises and among the world’s biggest producers of potash. Belarus Potash Company (BPC), the exporting arm Belaruskali, warned the move would lead to global potash price increases.

Jansen is expected to create 3,500 jobs annually during construction and employ 600 permanent operating staff.

Premier Scott Moe said the mine is the largest private economic investment in the province’s history.

(By Nia Williams; Editing by Marguerita Choy)

No comments:

Post a Comment