IT'S INDUCED BY THE FED CHEERED ON BY WALL STREET

Jennifer Schonberger

·Senior Reporter

Fri, December 23, 2022

White House chief economist Jared Bernstein told Yahoo Finance this week he’s optimistic the U.S. economy can keep growing next year, and remains encouraged by signs inflation is coming down.

“A recession is not inevitable,” Bernstein said from his office in the Old Executive Office Building, overlooking the North Lawn of the White House. “I think there are reasons to be optimistic that the path to a steady and stable transition is plausible and credible.”

Bernstein noted recent data support a likely path where the economy transitions to growth that is below last year’s levels but is still positive, while employment growth slows, in part through diminished vacancies though there are still strong job gains. This outlines, broadly, the "soft landing" scenario so much talked about by Federal Reserve watchers and Wall Street.

“You take the help wanted signs out of the window, not the workers out of the shop and that helps to take some pressure off nominal wage growth,” he said.

Bernstein suggested that the Federal Reserve’s forecast for economic growth is consistent with the model he sees for below-trend GDP.

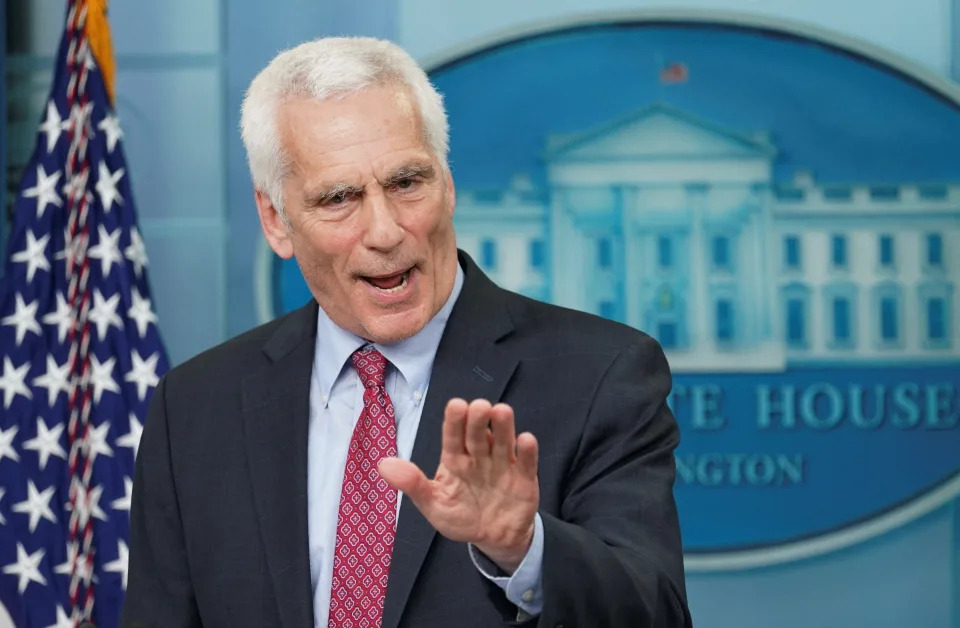

White House Council of Economic Advisers member Jared Bernstein speaks during a press briefing at the White House in Washington, U.S., April 1, 2022. REUTERS/Kevin Lamarque

Economic growth should slow, in Bernstein's view, which helps close the gap between labor demand and supply, helping to slow nominal wage growth, in turn leading to slower price growth.

The Fed last week said it sees GDP growth clocking in at just 0.5% next year before as inflation slows to 3.1%.

“The key goal is to maintain the progress we've made thus far, particularly in the job market, while reducing inflationary pressures,” said Bernstein.

The unemployment rate, in the Fed's outline, is expected to rise to 4.6% by the end of next year, up from 3.7% as of November.

Bernstein said President Biden’s biggest economic priorities for next year include implementing key economic legislative packages passed this year: the infrastructure plan, the Inflation Reduction Act, and the CHIPS Act, which seeks to boost the manufacturing of semiconductors in the U.S.

“Not only do we think that the economy can absorb what we're trying to do here and stay on the forecasted inflation path,” Bernstein said, "but we actually think that with some of the headwinds in this economy, including the Fed’s hiking cycle and other demand issues, these measures will provide some helpful tailwinds to working Americans.”

'I hope that the peak is behind us.'

Bernstein told Yahoo Finance he feels good about the slowdown in inflation, pointing to the two-point percentage point drop in headline inflation on the consumer price index seen in recent months, from from 9.1% in June to 7.1% as of November.

Paraphrasing President Biden, Bernstein said: “I hope that the peak is behind us.”

Jennifer Schonberger

·Senior Reporter

Fri, December 23, 2022

White House chief economist Jared Bernstein told Yahoo Finance this week he’s optimistic the U.S. economy can keep growing next year, and remains encouraged by signs inflation is coming down.

“A recession is not inevitable,” Bernstein said from his office in the Old Executive Office Building, overlooking the North Lawn of the White House. “I think there are reasons to be optimistic that the path to a steady and stable transition is plausible and credible.”

Bernstein noted recent data support a likely path where the economy transitions to growth that is below last year’s levels but is still positive, while employment growth slows, in part through diminished vacancies though there are still strong job gains. This outlines, broadly, the "soft landing" scenario so much talked about by Federal Reserve watchers and Wall Street.

“You take the help wanted signs out of the window, not the workers out of the shop and that helps to take some pressure off nominal wage growth,” he said.

Bernstein suggested that the Federal Reserve’s forecast for economic growth is consistent with the model he sees for below-trend GDP.

White House Council of Economic Advisers member Jared Bernstein speaks during a press briefing at the White House in Washington, U.S., April 1, 2022. REUTERS/Kevin Lamarque

Economic growth should slow, in Bernstein's view, which helps close the gap between labor demand and supply, helping to slow nominal wage growth, in turn leading to slower price growth.

The Fed last week said it sees GDP growth clocking in at just 0.5% next year before as inflation slows to 3.1%.

“The key goal is to maintain the progress we've made thus far, particularly in the job market, while reducing inflationary pressures,” said Bernstein.

The unemployment rate, in the Fed's outline, is expected to rise to 4.6% by the end of next year, up from 3.7% as of November.

Bernstein said President Biden’s biggest economic priorities for next year include implementing key economic legislative packages passed this year: the infrastructure plan, the Inflation Reduction Act, and the CHIPS Act, which seeks to boost the manufacturing of semiconductors in the U.S.

“Not only do we think that the economy can absorb what we're trying to do here and stay on the forecasted inflation path,” Bernstein said, "but we actually think that with some of the headwinds in this economy, including the Fed’s hiking cycle and other demand issues, these measures will provide some helpful tailwinds to working Americans.”

'I hope that the peak is behind us.'

Bernstein told Yahoo Finance he feels good about the slowdown in inflation, pointing to the two-point percentage point drop in headline inflation on the consumer price index seen in recent months, from from 9.1% in June to 7.1% as of November.

Paraphrasing President Biden, Bernstein said: “I hope that the peak is behind us.”

Bernstein added the caveat: “I'm pretty cautious about calling any kind of global peak [in inflation]. We've seen head fakes before. That said, there are reasons why we're confident that we've seen some positive momentum.”

He said it’s possible the drop in prices could stick because of the slowdown in core goods inflation, thanks to the unsnarling of supply chains and the faster pace with which goods are getting shipped to shelves.

Bernstein added that by the second half of next year, the drop in rents and housing prices will start showing up in inflation data, helping put downward pressure on price increases. From there, Bernstein said he's looking for continued softening in the job market to ease wage pressure eventually and bring down inflation.

When it comes to inflation and Congress' relationship with the Fed, Bernstein said he thinks it's important fiscal policy complement monetary policy.

“This is not a good time to fight the Fed,” he said.

SURE IT IS

INCREASE TAXES NOT INTEREST RATES!!!

No comments:

Post a Comment