Seren Morris,Lowenna Waters,Nuray Bulbul and William Mata

Tue, 7 February 2023

BP has announced that its annual profits more than doubled to £23 billion in 2022 following Russia’s invasion of Ukraine.

It follows Shell last week reporting a £32.2 billion profit, the largest in its 115-year history — also attributed to a rise in gas prices following Russia’s invasion.

In announcing its profit on Tuesday, BP said that it had cut its pledge to lower emissions and is now expected to double down on the production of gas and oil.

The announcement triggered new calls for a windfall tax to be placed on energy giants to fund support for households struggling during the cost of living crisis.

But what is a windfall tax? Here’s everything you need to know.

What is a windfall tax?

A windfall tax is a one-off tax that the Government imposes on a company or a group of companies when they benefit from something that happened outside their control.

Energy companies are benefiting from the increased demand for energy following the Covid-19 pandemic and Russia’s invasion of Ukraine.

Who is calling for a windfall tax on oil and gas companies?

Ed Miliband, the shadow secretary of state for climate change and net zero, said: “As the British people face an energy price hike of 40 per cent in April, Rishi Sunak is letting the fossil-fuel companies making bumper profits off the hook with his refusal to do a proper windfall tax. Labour would stop the energy price cap going up in April.”

Last year, he said: “Another day, another oil and gas company making billions in profits, and yet another day when the Government shamefully refuses to act with a windfall tax to bring down bills.”

Richard Burgon, Labour MP for Leeds East, posted on Twitter: “Shell just reported record profits of £32,000,000,000. Such outrageous profits are why your bills are so high.

“We need to hike the Windfall Tax so North Sea oil and gas giants don’t make a single penny in excess profits off the back of higher energy bills for ordinary people.”

Another Labour MP, Nadia Whittome, who represents Nottingham East, said: “Not everyone is suffering from a cost-of-living crisis. In 2022, Shell made £32,200,000,000 in profit — by far the most in its entire history. Time to end this profiteering from misery. Instead of another bill hike, we need a proper windfall tax.”

Philip Evans, Greenpeace UK’s oil and gas campaigner, last year called for a windfall tax. “By using a big chunk of the bloated profits that Shell, BP, and others are raking in, to make homes warmer, more energy efficient, and kitted out with heat pumps, the Government could start to really tackle the climate and cost of living crises simultaneously,” he said.

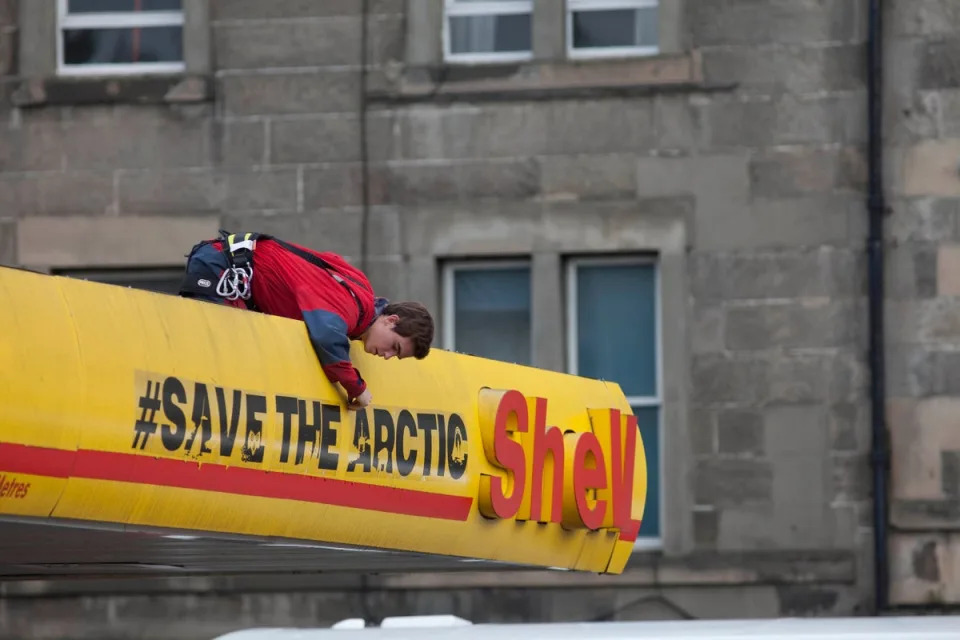

Protesters shut 40 of Shell’s London garages

AN6019028Handout photo issu.jpg:

AN6019030Handout photo issu.jpg:

AN6019020Handout photo issu.jpg:

AN6019019Handout photo issu.jpg:

AN6019015Handout photo issu.jpg:

AN6019011Handout photo issu.jpg:

What has the Government said about a windfall tax?

Chancellor Jeremy Hunt revealed in the Autumn Budget that he would be increasing the windfall tax paid by energy companies.

“I have no objection to windfall taxes if they are genuinely about windfall profits caused by unexpected increases in energy prices,” he said.

“But any such tax should be temporary, not deter investment, and recognise the cyclical nature of energy businesses.”

Mr Hunt said that from January 1 until March 2028, the Government would increase the Energy Profits Levy from 25 per cent to 35 per cent.

Furthermore, the Government will introduce a temporary 45 per cent levy on electricity generators. Mr Hunt said that increasing these taxes would raise £14 billion next year.

No comments:

Post a Comment