AUSTRALIA

Fortescue approves $750 million investment for three green projectsReuters | November 20, 2023

Credit: Fortescue Future Industries

Australia’s Fortescue on Tuesday approved an estimated total investment of about $750 million over the next three years for two green energy projects and one green steel project as the iron ore miner seeks to become a top-tier clean energy producer.

Fortescue approved investments in the US hydrogen hub in Phoenix, Arizona; the Gladstone 50 megawatt green hydrogen project in Queensland, Australia; and the Christmas Creek green iron trial commercial plant in Western Australia.

About $550 million will be used for developing an electrolyser and liquefaction facility in Phoenix, where first production of liquid green hydrogen is targeted for 2026.

The world’s fourth-largest iron ore maker, which is expanding into production of hydrogen from renewable resources under its Fortescue Energy unit, said it had also decided to fast-track projects in Brazil, Kenya and Norway.

Fortescue is intensifying its push into the US markets.

In the past few days, it has announced plans to set up an advanced manufacturing centre in Michigan and an office in New York, Fortescue Capital, to attract more investment to its green energy companies.

Under a plan to ramp up its green energy business, Fortescue said in August it would stop allocating 10% of its net profit to that unit. Instead, projects and investments would compete for capital allocation, with additional flows from outside investors.

Fortescue expects to hold stakes of 25% to 50% in projects with outside investors.

More details are expected to be unveiled at Fortescue’s annual shareholder meeting later on Tuesday.

(By Himanshi Akhand; Editing by Subhranshu Sahu and Richard Chang)

Credit: Fortescue Future Industries

Australia’s Fortescue on Tuesday approved an estimated total investment of about $750 million over the next three years for two green energy projects and one green steel project as the iron ore miner seeks to become a top-tier clean energy producer.

Fortescue approved investments in the US hydrogen hub in Phoenix, Arizona; the Gladstone 50 megawatt green hydrogen project in Queensland, Australia; and the Christmas Creek green iron trial commercial plant in Western Australia.

About $550 million will be used for developing an electrolyser and liquefaction facility in Phoenix, where first production of liquid green hydrogen is targeted for 2026.

The world’s fourth-largest iron ore maker, which is expanding into production of hydrogen from renewable resources under its Fortescue Energy unit, said it had also decided to fast-track projects in Brazil, Kenya and Norway.

Fortescue is intensifying its push into the US markets.

In the past few days, it has announced plans to set up an advanced manufacturing centre in Michigan and an office in New York, Fortescue Capital, to attract more investment to its green energy companies.

Under a plan to ramp up its green energy business, Fortescue said in August it would stop allocating 10% of its net profit to that unit. Instead, projects and investments would compete for capital allocation, with additional flows from outside investors.

Fortescue expects to hold stakes of 25% to 50% in projects with outside investors.

More details are expected to be unveiled at Fortescue’s annual shareholder meeting later on Tuesday.

(By Himanshi Akhand; Editing by Subhranshu Sahu and Richard Chang)

Fortescue sets up investment platform to fund green energy projects

Reuters | November 16, 2023 |

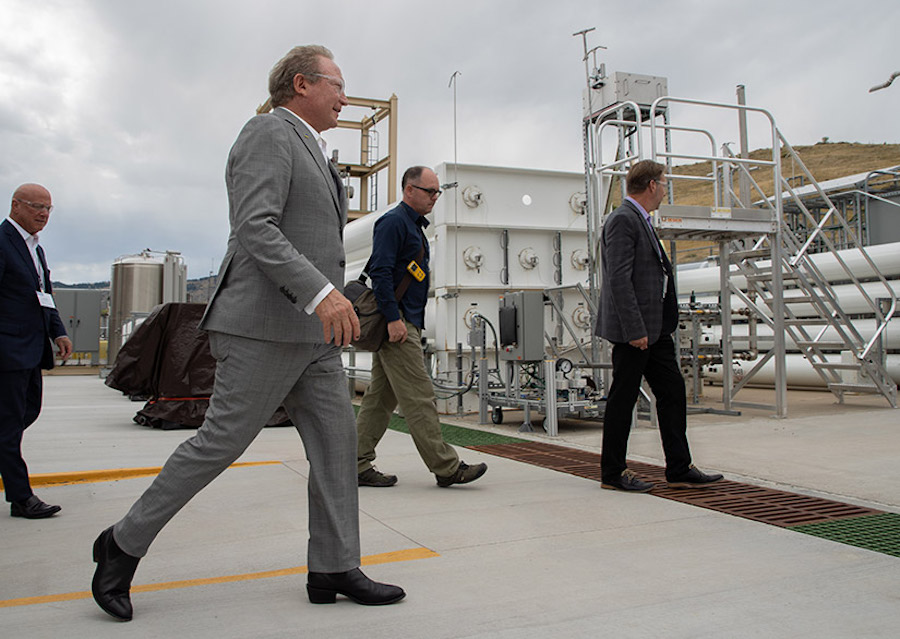

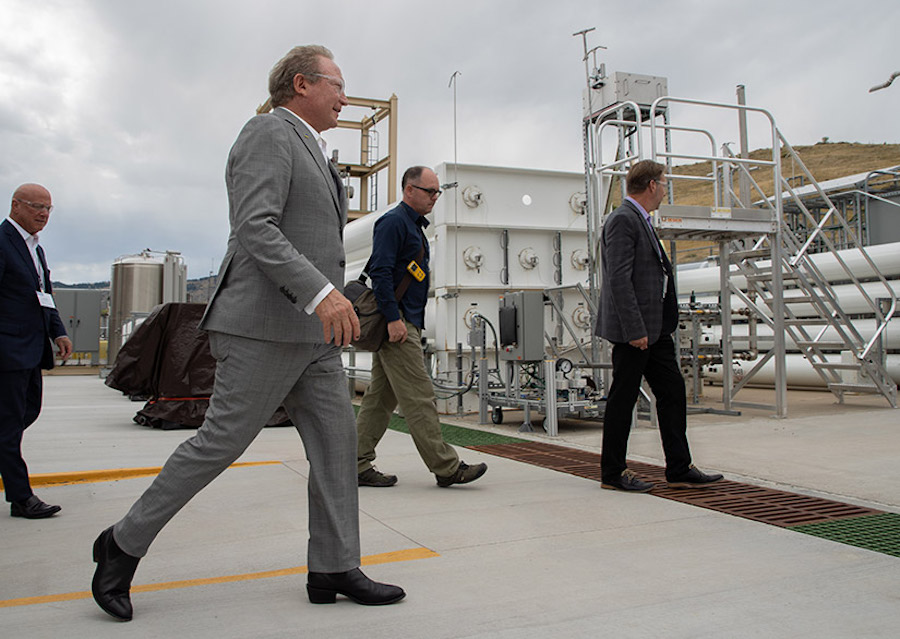

Andrew Forrest, chairman of Fortescue Future Industries. tours the outdoor Hydrogen Fueling Station and Bioreactor at the National Renewable Energy Laboratory. (Image by Joe DelNero, courtesy of NREL).

Australia’s Fortescue said on Thursday it has launched a new investment platform to attract more investment in its green energy projects as the miner pivots towards establishing itself as a major global supplier of green energy.

New York-based Fortescue Capital will be led by Robert Tichio and act as a fiduciary for third-party capital to complement the company’s finance teams in its energy and metals division, Fortescue said.

“Fortescue is taking its global pipeline of green hydrogen and green ammonia projects to final investment decision and in doing so, has communicated our intention and desire to bring additional equity investors onboard,” Fortescue Energy CEO Mark Hutchinson said.

The funding model for projects will differ based on the project and Fortescue expects to hold stakes of between 25% and 50% stake in projects with outside investors, the company said.

Fortescue, in recent years, has significantly stepped up its investment in renewable projects to cash in on the global transition towards green energy and decarbonization, but that has led to an exodus of high-level management and raised investor concerns.

Tichio joins Fortescue after over 17 years at Riverstone Holdings, a New York-based private equity firm. He will be joined by a leadership team with backgrounds across sustainable infrastructure, climate technology, energy and private markets.

(By Roshan Thomas; Editing by Subhranshu Sahu and Savio D’Souza)

Reuters | November 16, 2023 |

Andrew Forrest, chairman of Fortescue Future Industries. tours the outdoor Hydrogen Fueling Station and Bioreactor at the National Renewable Energy Laboratory. (Image by Joe DelNero, courtesy of NREL).

Australia’s Fortescue said on Thursday it has launched a new investment platform to attract more investment in its green energy projects as the miner pivots towards establishing itself as a major global supplier of green energy.

New York-based Fortescue Capital will be led by Robert Tichio and act as a fiduciary for third-party capital to complement the company’s finance teams in its energy and metals division, Fortescue said.

“Fortescue is taking its global pipeline of green hydrogen and green ammonia projects to final investment decision and in doing so, has communicated our intention and desire to bring additional equity investors onboard,” Fortescue Energy CEO Mark Hutchinson said.

The funding model for projects will differ based on the project and Fortescue expects to hold stakes of between 25% and 50% stake in projects with outside investors, the company said.

Fortescue, in recent years, has significantly stepped up its investment in renewable projects to cash in on the global transition towards green energy and decarbonization, but that has led to an exodus of high-level management and raised investor concerns.

Tichio joins Fortescue after over 17 years at Riverstone Holdings, a New York-based private equity firm. He will be joined by a leadership team with backgrounds across sustainable infrastructure, climate technology, energy and private markets.

(By Roshan Thomas; Editing by Subhranshu Sahu and Savio D’Souza)

No comments:

Post a Comment