GOOD NEWS

Frik Els | December 26, 2024 |

CAPITALI$M IS OVERPRODUCTION

While electric vehicle sales growth has certainly slowed down from the torrid pace of the last few years, the global passenger EV market, including plug-in and conventional hybrids, should easily top 20 million units this year.

In combined battery capacity deployed – a better indicator of battery materials demand than unit sales alone – the electric car market has expanded by a healthy 24% so far this year.

In total, 674.6 GWh of fresh battery power hit the globe’s roads from January through August, according to data from Toronto-based EV supply chain research firm Adamas Intelligence.

While electric vehicle sales growth has certainly slowed down from the torrid pace of the last few years, the global passenger EV market, including plug-in and conventional hybrids, should easily top 20 million units this year.

In combined battery capacity deployed – a better indicator of battery materials demand than unit sales alone – the electric car market has expanded by a healthy 24% so far this year.

In total, 674.6 GWh of fresh battery power hit the globe’s roads from January through August, according to data from Toronto-based EV supply chain research firm Adamas Intelligence.

Hybrid approach

The rapid electrification of the global car parc comes despite a noticeable swing towards hybrid vehicles, which have inherently smaller batteries and therefore contained metal.

The combined battery capacity of plug-in hybrid vehicles steered onto roads globally for the first time this year is up 71% versus a more sedate pace for full electric passenger vehicles of 17%. At the same time the sales-weighted average battery capacity of plug-ins (PHEVs) is also rising, up 12% this year to 23kWh, more than a third of the average full electric vehicle.

A subset of the PHEV, the extended range EV or EREV where the combustion engine only acts as a charger for the battery, are even bigger users of installed metal. EREVs on average have 39kWh of battery capacity, more than most sub-compact and small cars.

EREV battery capacity and sales have more than doubled in 2024 and were it not for the PHEV market, the many news headlines saying the EV market is in a deep slump, may have carried more weight.

Law of averages

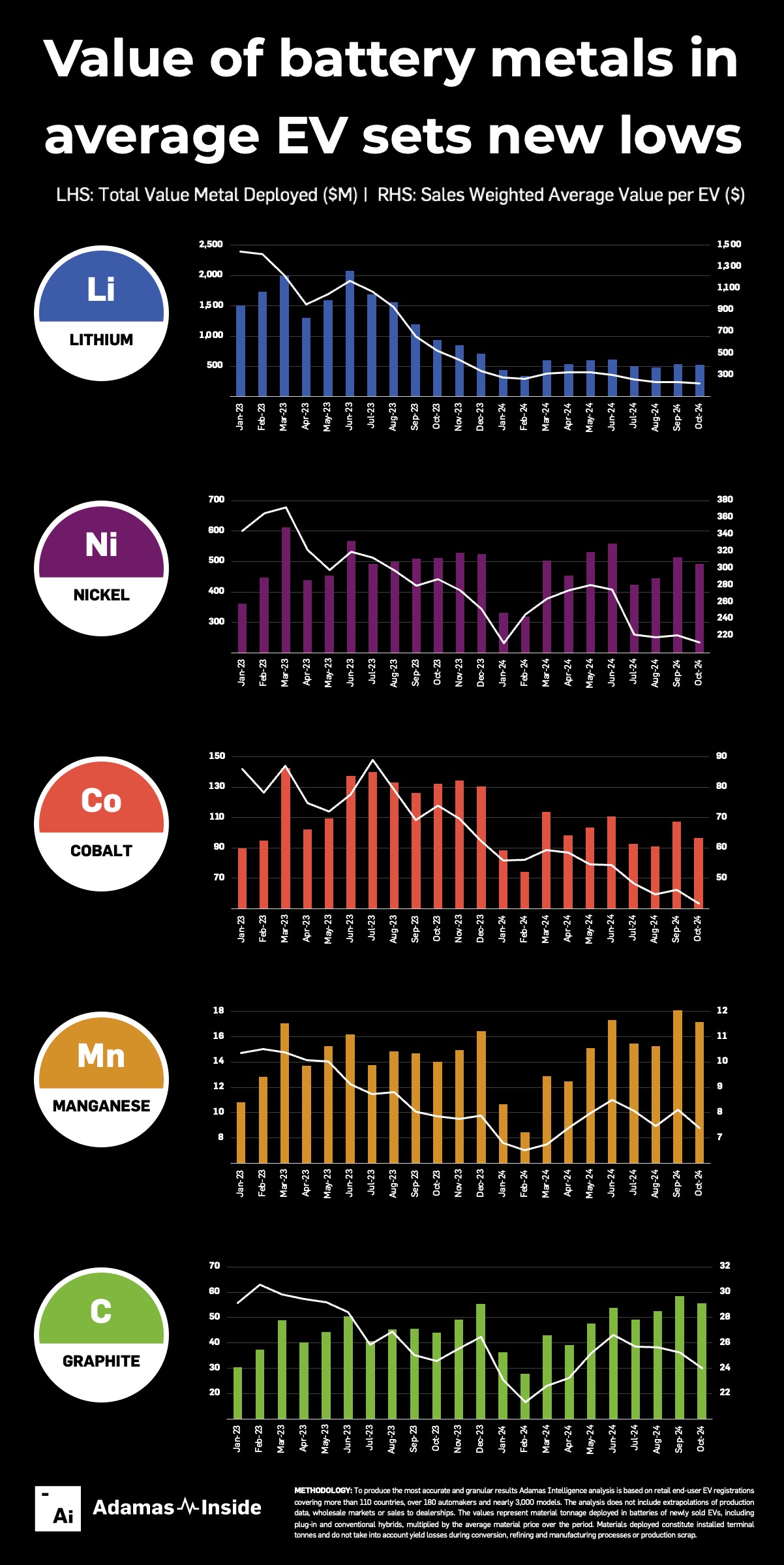

For miners supplying the EV battery industry, the news remain negative however: The latest data tracking sales, battery capacity and chemistry in over 110 countries paired with monthly prices show the weighted average monthly dollar value of the lithium, nickel, cobalt, manganese and graphite contained in the batteries of the average EV is continuing its downward path.

As natural and synthetic graphite, lithium carbonate and hydroxide, and nickel, cobalt and manganese sulphate prices decline further, the raw materials bill for the average EV is now down to $510 compared to $918 in October 2023 and a monthly peak of more than $1,900 at the beginning of last year, according to Adamas Intelligence analysis.

The downtrend is led by lithium where the value per EV for the first ten months of the year is down 74% compared to the same period last year to $276. In October, the latest month with detailed data, the value of installed lithium set a new low of $212. In January of 2023 that figure was $1,444 per average EV.

Cobalt, at just under $42 is 34% below the value reached in October 2023. After a strong start to the year, manganese has now also succumbed to weakness in the battery raw material space, averaging just over $7 per EV battery.

For anode material, graphite loadings and values have held mostly steady at just under $26 per average EV, but the average for 2024 so far is 13% below that of 2023.

Iron phosphate vs nickel

The value of nickel in the average EV battery is down 25% as LFP battery chemistries continue to take global market share. LFP batteries represented 44% of the global total in terms of capacity deployed in GWh in October despite slow build out of LFP battery factories outside China.

That compares to a 33% share during the same month last year, more than offsetting the long-running trend towards high-nickel cathodes, and the growing popularity of NCM batteries for PHEVs where the energy density of nickel-based cathodes makes more sense given the weight of these vehicles.

For a fuller analysis of the battery metals market check out the December issue of the Northern Miner print and digital editions.

* Frik Els is Editor at Large for MINING.COM and Head of Adamas Inside, providing news and analysis based on Adamas Intelligence data.

No comments:

Post a Comment