Donald Trump has made billions from the Nasdaq debut of crypto startup World Liberty Financial. With his sons in charge and favorable policies in play, critics see a troubling mix of presidential power and personal gain.

US President Donald Trump and his family are pocketing billions from cryptocurrency ventures since his return to the White House, capitalizing on a loosely regulated market he has actively shaped.

From meme coins to stablecoins, digital currencies designed to stay at a fixed value, the financial windfall is estimated at over $5 billion (€4.25 billion) on paper, sparking accusations of unprecedented profiteering by a sitting president.

Two companies drive the Trump family's crypto profits: World Liberty Financial (WLF), a decentralized finance platform that lets users with $WLFI tokens help shape the platform’s lending rules, and American Bitcoin Corp. (ABTC), a Nasdaq-listed bitcoin mining company.

WLF has earned millions from $WLFI token sales tied to Trump’s name, while ABTC, backed by his sons, holds significant bitcoin assets and saw its stock jump 110% on its debut, before settling 16.5% higher than the opening price of $6.90.

Reuters news agency reported that a Trump business entity owns 60% of WLF and is entitled to 75% of revenue from coin sales.

Concerns over influence and access

Critics believe the Republican president’s dual role as crypto beneficiary and policymaker undermines public trust and blurs the line between governance and self-enrichment.

Ross Delston, an independent American attorney and expert witness, thinks the crypto ventures could offer unscrupulous actors the chance to buy influence with Trump just by investing in his digital coins.

"This is a new avenue to allow the President to get money from anyone, including foreign individuals and states that would be prohibited by US [election] campaign laws, or someone convicted of a crime or under investigation," Delston told DW.

Although Trump and his sons are barred from selling their own tokens in WLF for now, they are almost certain to profit big in the medium term. The White House insists, however, that there are no conflicts of interest.

How Trump has changed on crypto

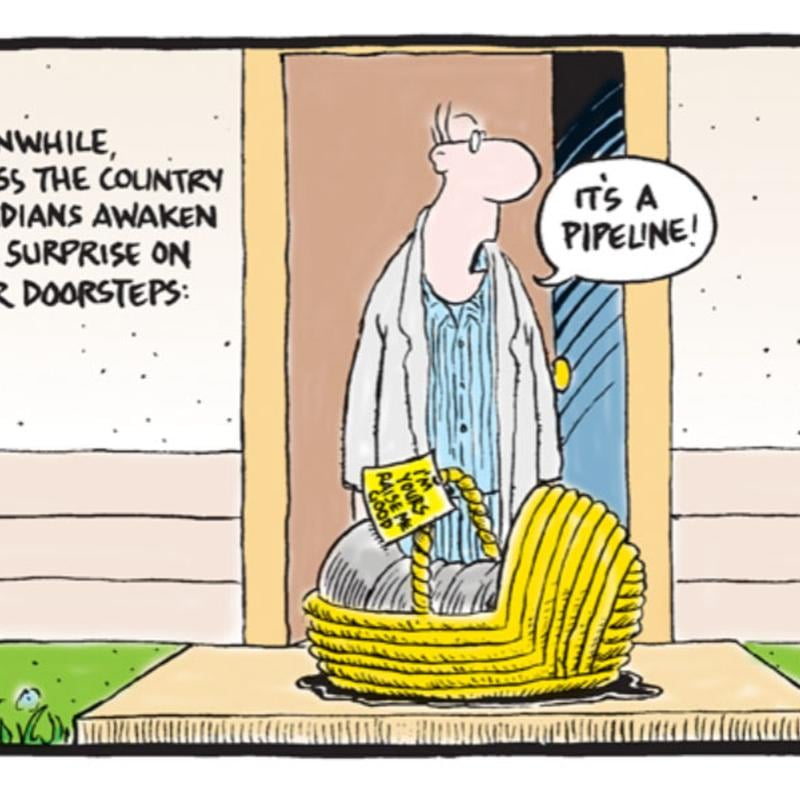

Trump's favorable policies toward crypto after his return to office have come as a surprise to some after he called digital currencies like bitcoin a "scam" and a threat to the dollar during his first term. Now he wants to make the United States the crypto capital of the world.

Before returning to the White House, Trump nominated longtime crypto advocate Paul Atkins to lead the Securities and Exchange Commission (SEC), the US financial markets regulator. He was confirmed in the position in April.

One of Trump's first Executive Orders, signed in January, banned any US agency from creating or promoting a central bank digital currency (CBDC), a government-issued crypto version of the dollar.

In March, he established a Strategic Bitcoin Reserve, funded by cryptocurrencies seized by US authorities, and a Digital Asset Stockpile of other currencies. These assets are now treated as national reserves.

This summer, Trump signed the Genius Act, the first federal framework for stablecoins.

Lavish dinners and political perks

The embrace of crypto has extended beyond policy into high-profile social events, most notably the White House-hosted dinners for digital asset moguls. These gatherings, often featuring lavish menus and exclusive access to the president, have drawn scrutiny for blending political power with private financial interests.

One standout event was the May 2025 Crypto Kings dinner at Trump National Golf Club in Virginia, where the top holders of Trump’s meme coin, $TRUMP, were invited after collectively spending $148 million.

The top 25 investors received private access to the president, while the four largest holders were gifted luxury Trump Tourbillon watches. Justin Sun, a China-born crypto billionaire and adviser to World Liberty Financial, was the top guest, spending $18.5 million.

Critics argue that such events serve less as forums for innovation and more as showcases for influence-peddling, where proximity to the presidency appears to be a perk of investment.

"This is maybe just one more step that this administration has taken of combining public office with private gain," Richard Briffault, a professor at Columbia Law School, told DW. "This includes making regulatory decisions, but also using the prestige of the White House and the presidency to advance the Trump family's fortunes."

How US regulators are handling crypto

US federal regulators have taken a markedly hands-off approach to crypto oversight, largely due to a sweeping executive order issued in January that dismantled many of the Biden-era guardrails and replaced them with a framework designed to promote innovation and accelerate adoption of cryptocurrencies.

Washington has removed some confusing rules about how crypto companies should report their finances, which made it hard for businesses to show crypto assets on their balance sheets or work with banks. By rolling them back, the administration is making it easier for crypto firms to operate and grow.

Before, the SEC was very strict, especially under its former leader, Gary Gensler. It launched many investigations and lawsuits against crypto firms. Those actions have mostly stopped under Trump 2.0.

While Biden’s approach was more about caution and control, Trump's was described by one industry insider as "crypto capitalism on steroids." While the crypto sector is now booming, the latest US policies are raising serious questions about ethics, transparency, and long-term stability.

Purge of officials sparks alarm

Concerns over political loyalty within federal agencies have also intensified, with critics pointing to a growing pattern of dismissals targeting career officials seen as out of sync with the Trump administration’s agenda.

They include Federal Reserve Governor Lisa Cook, CDC Director Susan Monarez, railroad regulator Robert Primus and, most notably, Erika McEntarfer, the head of the Bureau of Labor Statistics.

"The administration has had no compunctions about firing people, including ordinary civil servants who are just doing their jobs, if they are politically out of step with the administration," said Briffault. "There's no greater signal than the firing of the head of the Bureau of Labour Statistics. If they're willing to do that, they're willing to fire anybody."

This climate of fear and retaliation has made regulators increasingly cautious about challenging Trump’s crypto ventures, even when ethical concerns arise.

US lawmakers are now pushing Congress to bring back stronger oversight and tighten control over the latest crypto policies. They're calling for clearer rules on digital currencies, more transparency from companies like WLF, and limits on officials who hold crypto themselves. Critics warn the current setup benefits insiders and puts everyday users at risk.

"The most likely outcome is a huge increase in criminal prosecutions, regulatory enforcement actions, as well as economic dislocation following in the wake of this presidency," warned Delston.

Edited by: Uwe Hessler