Reuters | October 23, 2023 |

(The opinions expressed here are those of the author Andy Home, a columnist for Reuters)

China is upping the critical minerals stakes by curbing exports of graphite, a key raw material in electric vehicle batteries.

The West can’t say it wasn’t warned.

When China announced restrictions on exports of gallium and germanium in July, former Vice Commerce Minister Wei Jianguo was quoted in the China Daily as saying it was “just the start” if the West continued to target China’s high-technology sector.

Restricting the flow of two metals used in the manufacture of silicon chips was “a well-thought-out heavy punch” in reaction to the U.S. Chips Act, Wei said.

The Biden administration has since tightened restrictions on the flow of advanced artificial intelligence chips to China, announcing on Friday a new raft of measures aimed at closing previous loopholes.

China is responding in kind, this time taking aim at the West’s electric vehicle (EV) ambitions.

There is much potential for further escalation in this unfolding critical minerals battle between China and the West.

Critical input

Graphite has slipped under the radar in the broader critical raw materials debate. China’s control of other battery inputs such as cobalt, nickel and lithium has grabbed the headlines.

Those are all used to make the battery cathode. It won’t work, however, without an anode, which is invariably made of graphite.

Indeed, graphite is the largest EV battery component by weight, typically accounting for between 50 and 100 kg.

China is the dominant player in the global supply of both natural graphite and synthetic graphite, which has been taking an increasing share of the market.

The country accounts for around two-thirds of all natural graphite production and, according to consultancy Benchmark Minerals, supplies around 98% of the world’s synthetic graphite anodes.

The West’s dependency on Chinese supply has seen graphite recently join the likes of cobalt and rare earths on the U.S. Department of Energy’s list of super-critical raw materials.

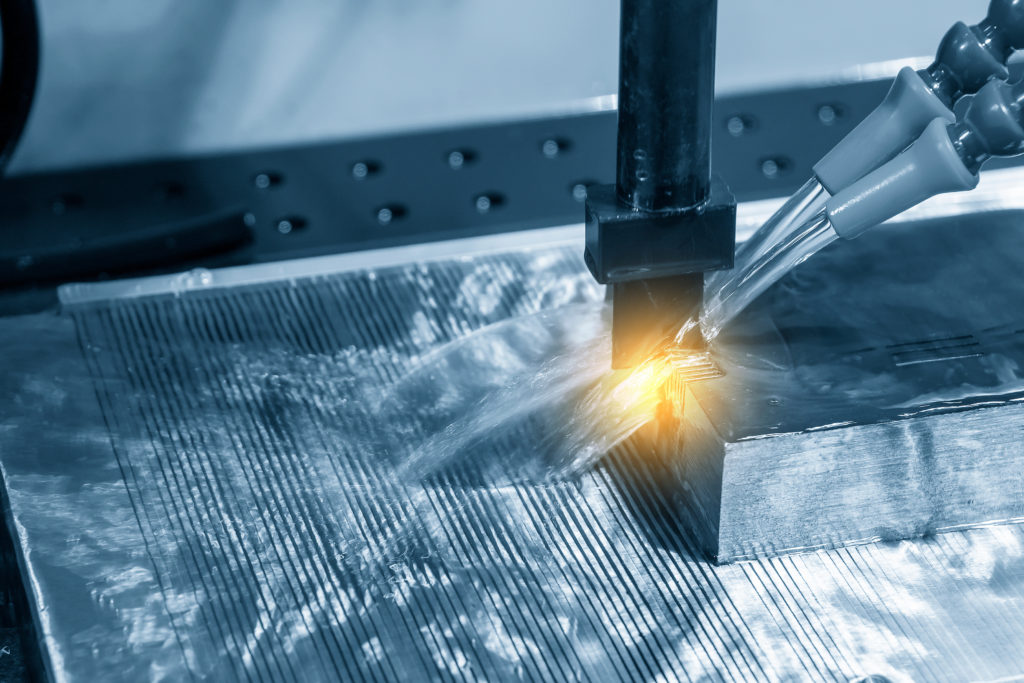

The machining mold and die by EDM graphite electrode.

The U.S. and its metals allies are investing in non-Chinese supply.

The Department of Defense awarded $37m in July to Graphite One to accelerate a feasibility study on its Graphite Creek project in Alaska, thought to be one of the largest 10 identified deposits in the country.

Australia has used its A$2 billion Critical Minerals Facility to lend A$185 million to Renascor Resources’ Siviour graphite project and A$40m to EcoGraf Ltd’s battery anode plant.

However, none will be in operation by the start of December, when China’s export restrictions come into place.

Squeezing supply

The big question is how tightly China will squeeze the graphite export pipeline.

It’s worth noting the ban is not on all forms of graphite. The new measures, which prohibit any exports without a licence, cover high-purity synthetic graphite and natural flake graphite, including spherical and expanded forms.

Previous restrictions on lower-grade graphite exports destined for the steel and lubricants sectors have been rescinded.

The curbs are clearly targeted at the EV battery sector but which parts?

If gallium and germanium are anything to go by, expect a flurry of export activity in the run-up to the Dec. 1 deadline and then a collapse in activity.

Some Chinese companies have received their licences and many more applications are under review but the process has essentially halted exports of both metals for the time being. Prices of both have unsurprisingly increased.

The world’s graphite supply chain could well be in for a similar short-term shock.

Jaw-jaw or war?

Western governments are still evaluating their response, waiting like the rest of us to see how China’s graphite volumes play out in the coming months.

One potential avenue would be challenge the export curbs at the World Trade Organization (WTO), an option the Japanese government is already evaluating.

This was a tactic successfully used when China cut off exports of rare earths in 2010. A joint complaint by the U.S., the European Union and Japan was upheld in 2014 and China was forced to back down.

Indeed, the Obama administration launched multiple complaints against China at the WTO and won all of them other than the last, which challenged the country over its subsidised aluminium industry.

The Trump administration, by contrast, was outright hostile to the WTO and preferred unilateral trade action such as the Section 232 tariffs on imports of steel and aluminium.

The Biden administration has so far been equally dismissive. When the WTO last year upheld China’s complaint about the Section 232 tariffs, Assistant Trade Representative Adam Hodge rejected the finding as “flawed” and said “these WTO panel reports only reinforce the need to fundamentally reform the WTO dispute settlement system.”

While the European Union and Japan might prefer to use the old world order trade dispute system, the U.S. quite evidently won’t be leading the way.

Rather, the more likely response will be to double down on the country’s already heavy investment in building out a domestic critical mineral supply chain and working with allied countries to source what it cannot produce itself.

With no sign of any let-up in the campaign to cut off the flow of high-end chips to China, the risk of further heavy counter punches in the metals sector looks high.

If gallium and germanium were, to quote China’s Wei, “just the start”, graphite is unlikely to mark the end of this escalating global tit-for-tat.

(Editing by David Evans)

No comments:

Post a Comment