The Alternative is Sinking Russian Tankers

In essence, the US is protecting Russian oil exports and allowing Russia to fund the war thereby.

By Steven Kopits

April 19, 2024,

A strike on a Russian tanker would also panic the White House, prompting a swift and desperately needed restructuring of the Price Cap. Ukraine will not win the war without it.

![]()

Attacking Russian tankers is, of course, a politically risky option. A very risky option. On the other hand, certain defeat at the hands of the Russians is a much higher price to pay. If push comes to shove, the Ukrainians need to shove. Marjorie Taylor Greene and the MAGA Republicans need to decide if they want to own $6 unleaded as the Ukraine vote reaches the House floor.

Oil Prices

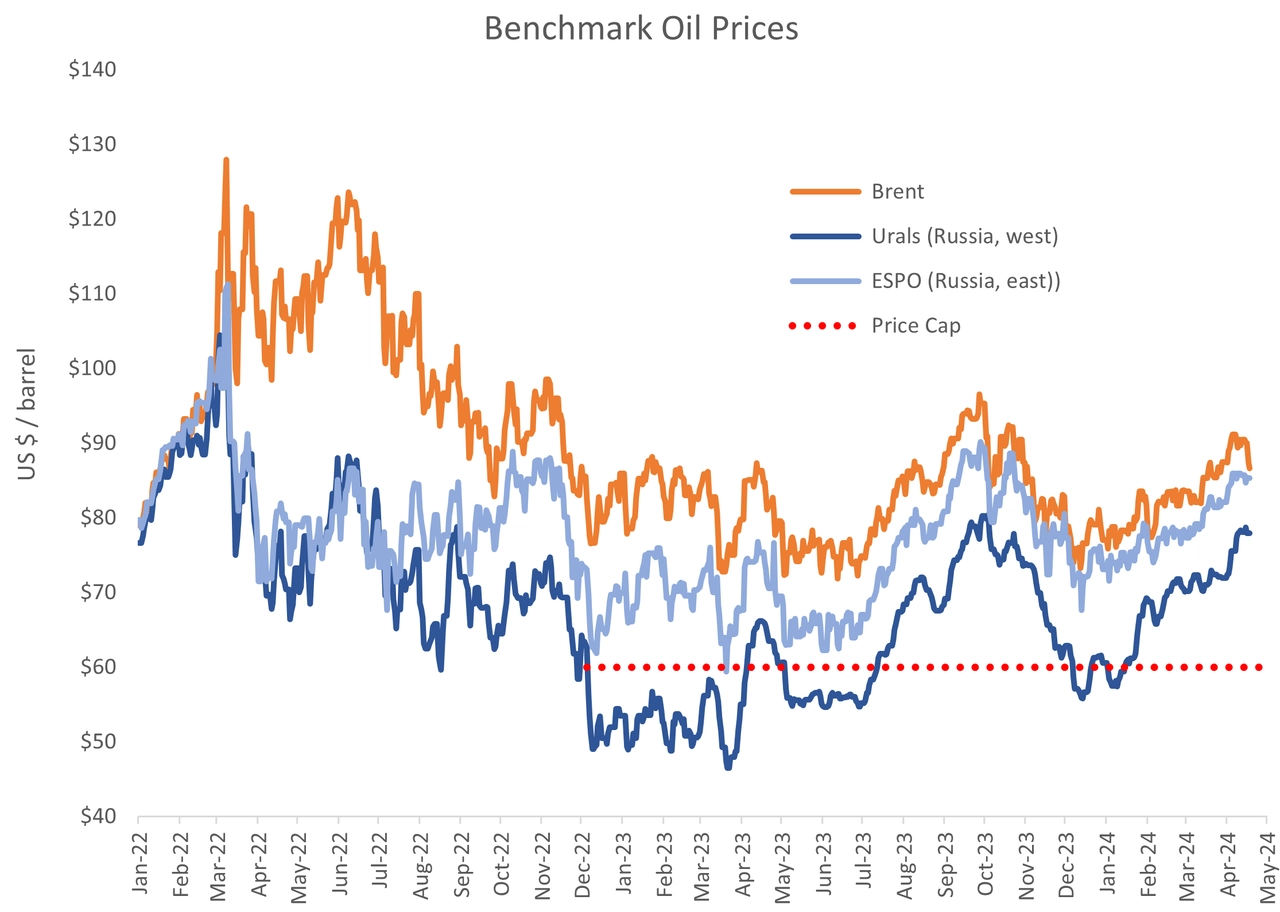

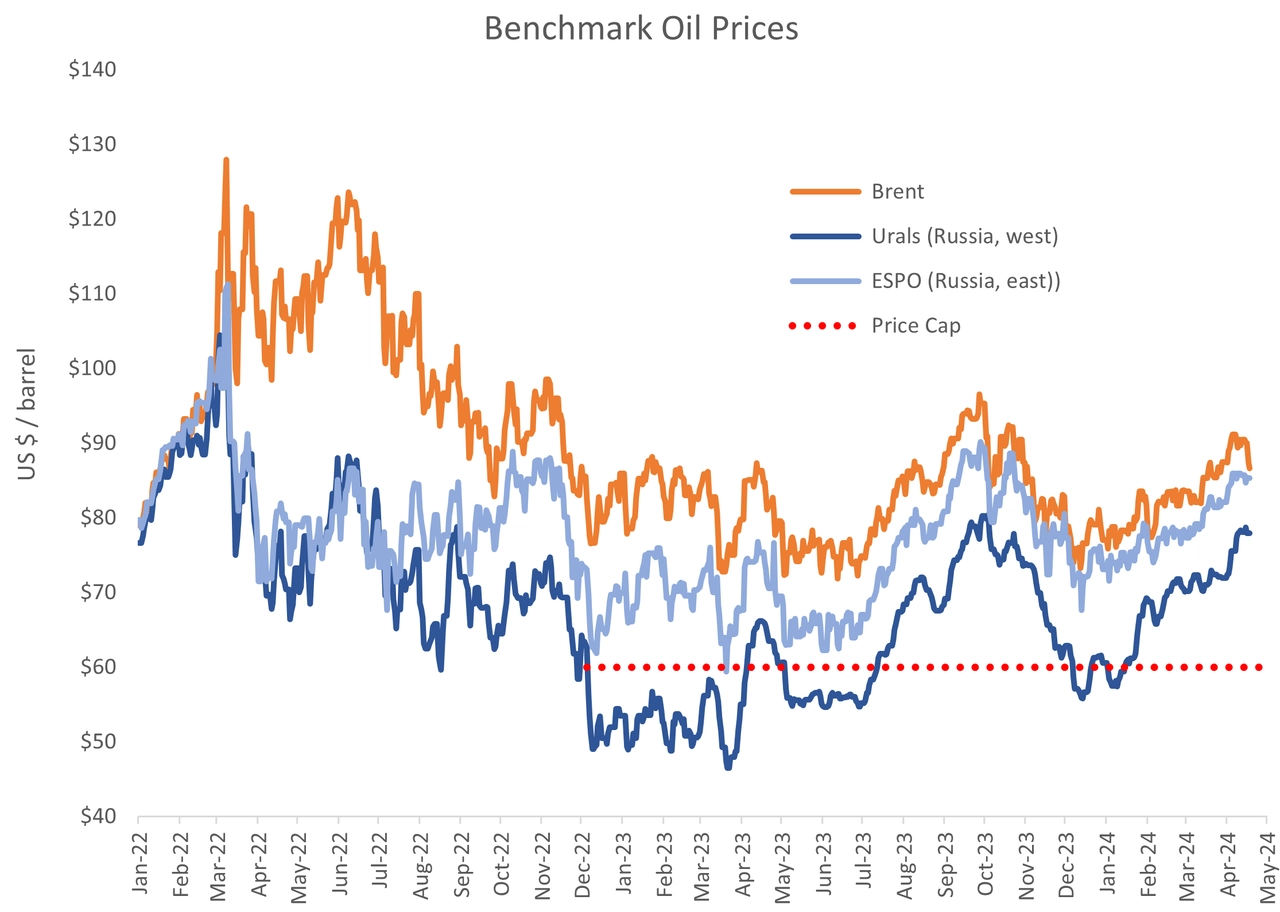

Brent crested $90 last week, but is trading down a bit, $87 at writing. Nevertheless, copper prices continue to surge. Thus, either copper has to retrace, or Brent might be expected to rise to $96 / barrel.

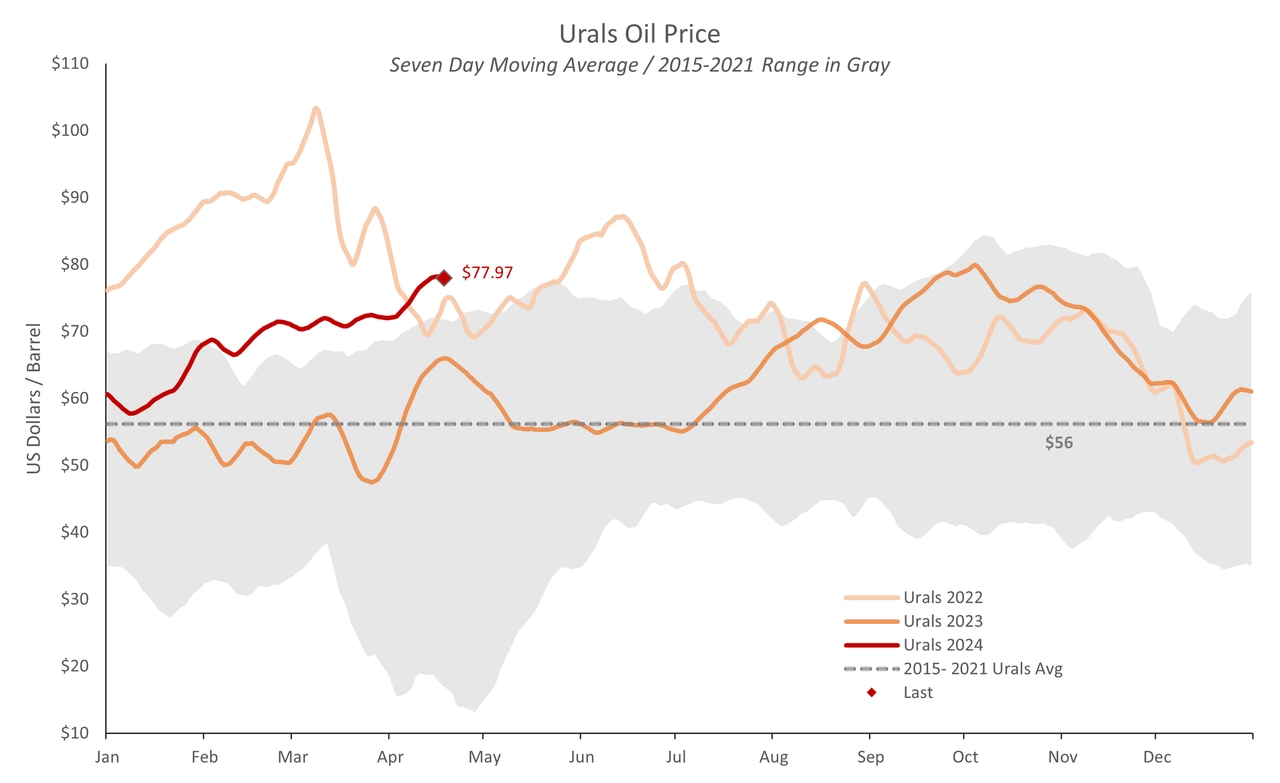

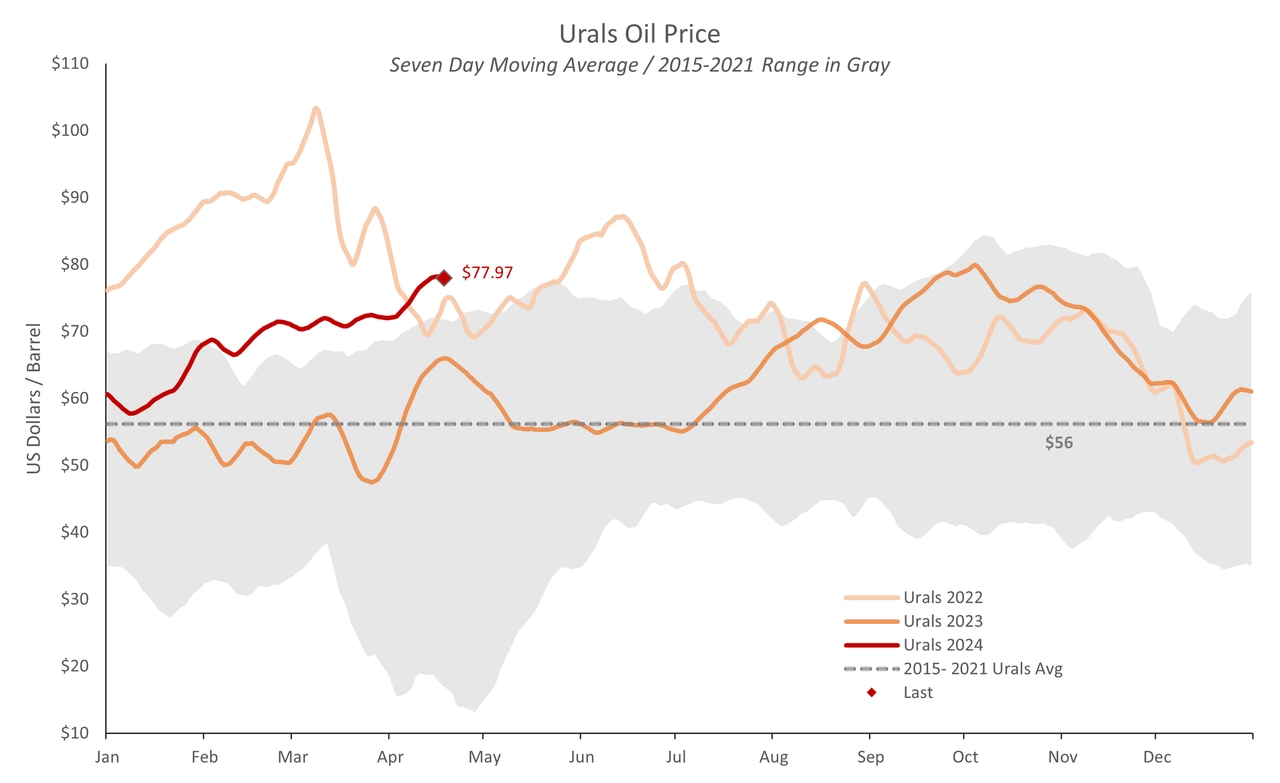

Urals has closed up, much as expected, to $78 / barrel, $18 / barrel above the Price Cap.

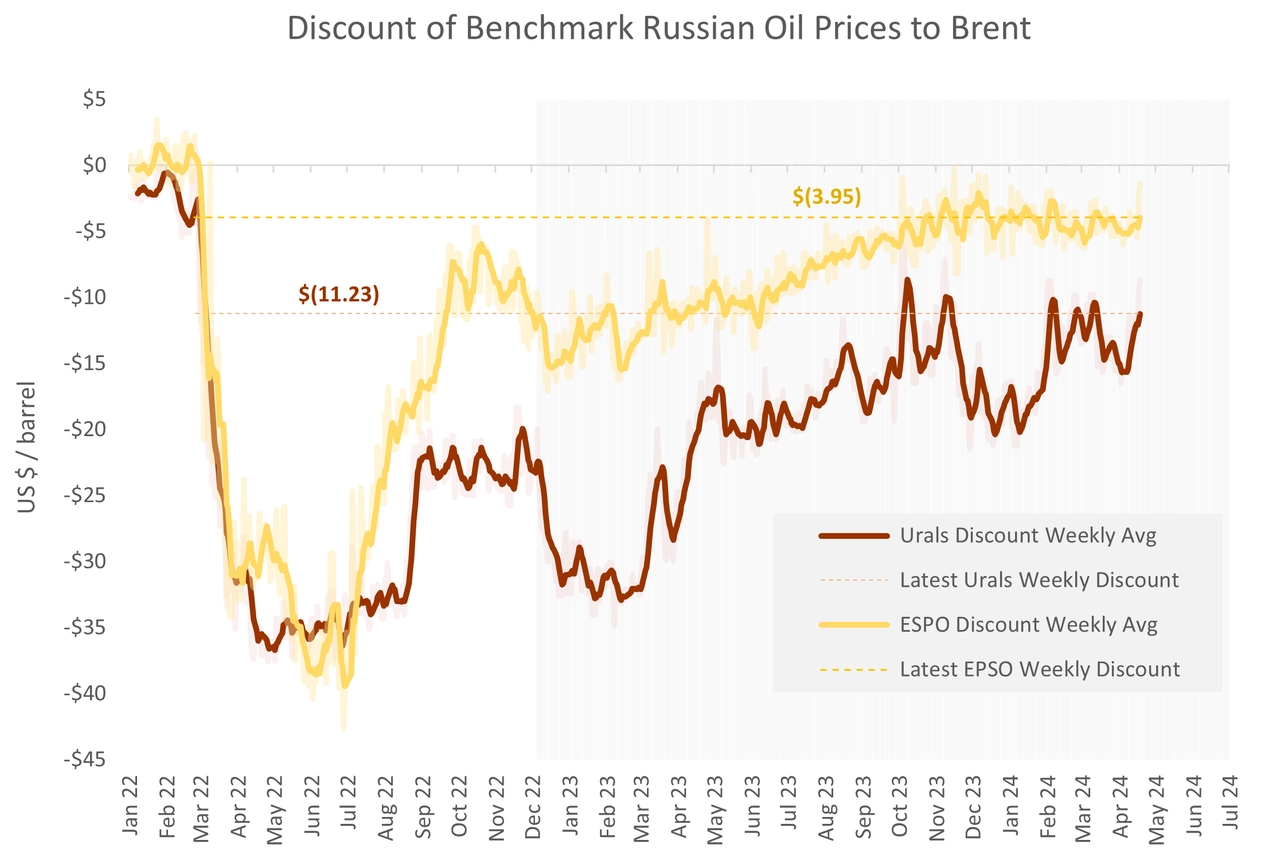

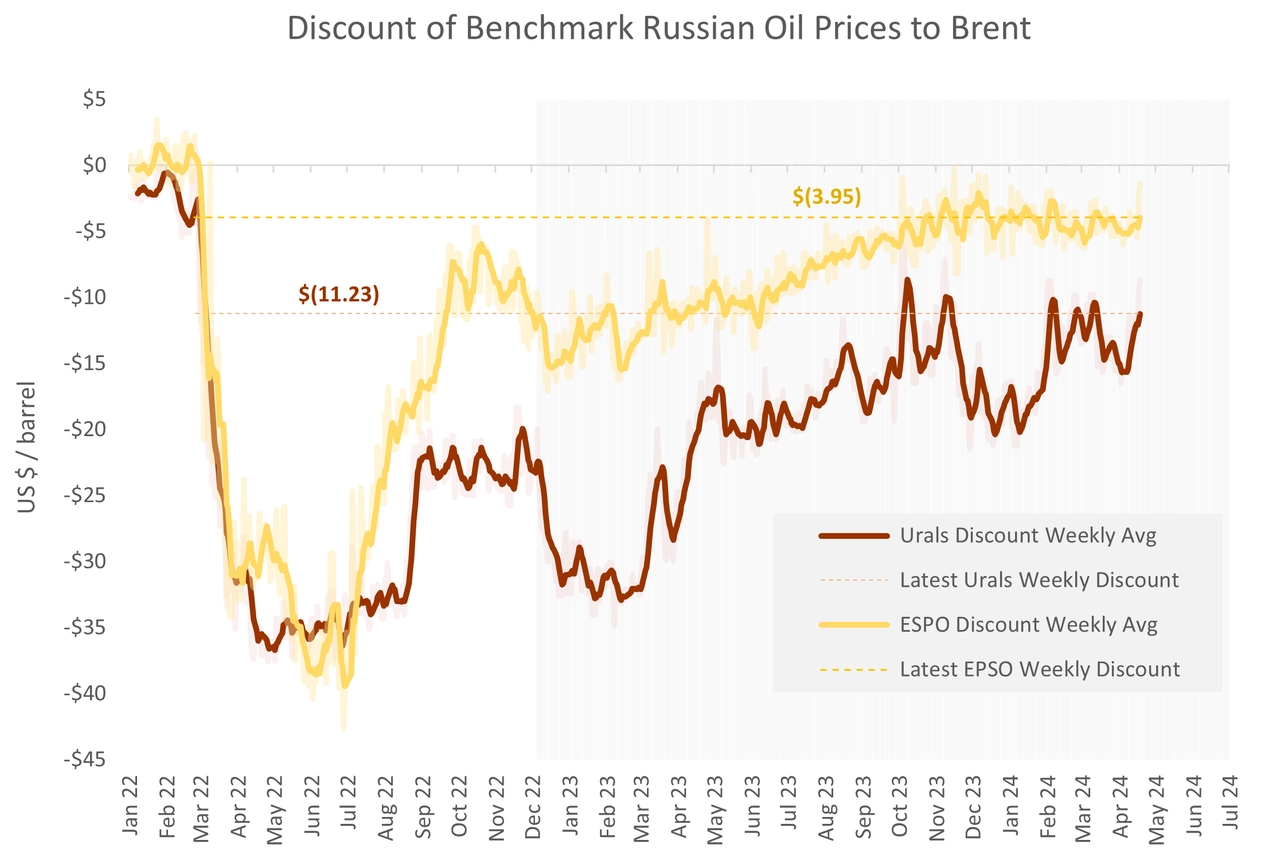

The Urals discount, the difference between Russia's western crude oil export price and Brent, has compressed to around $11 / barrel, again, much as expected.

Urals is now at the highest level for this date in at least nine years.

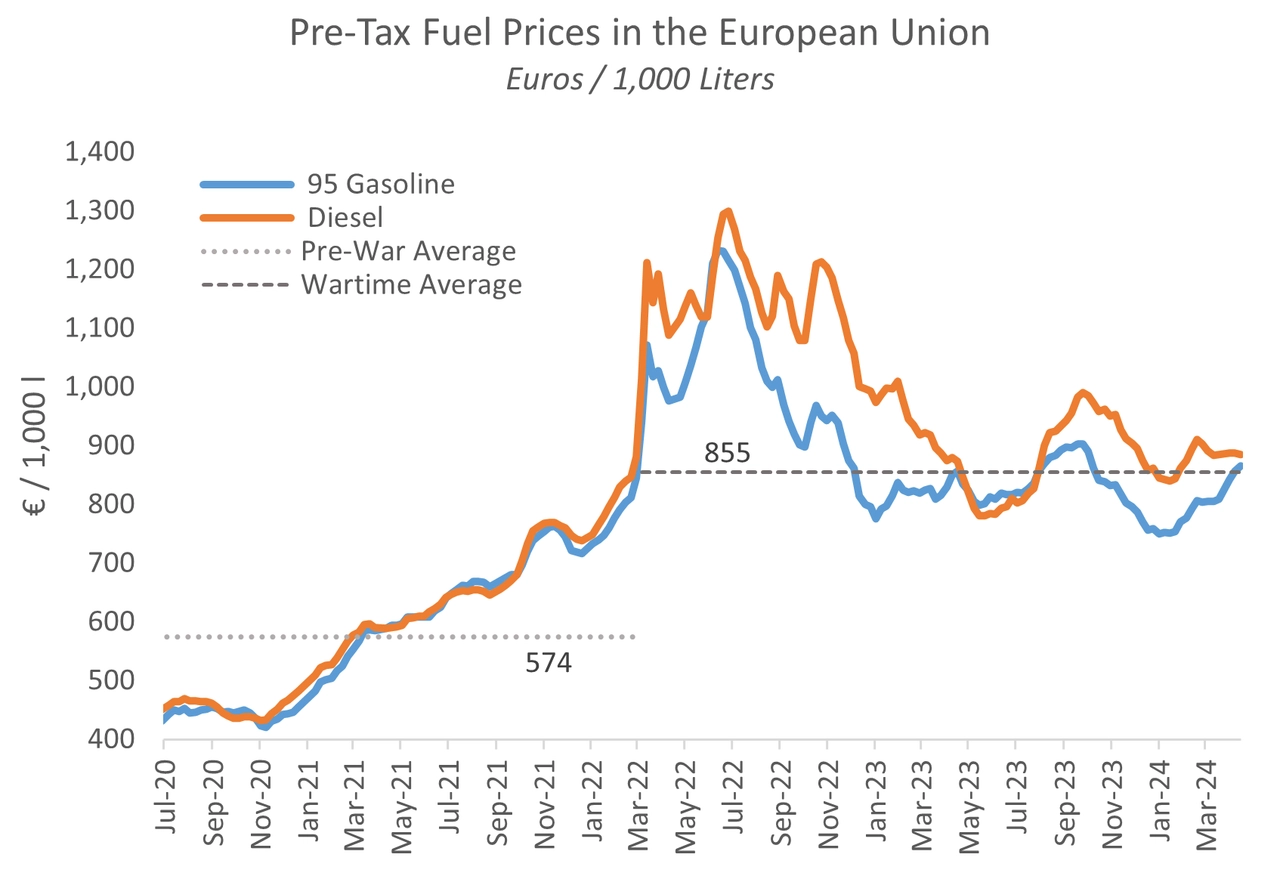

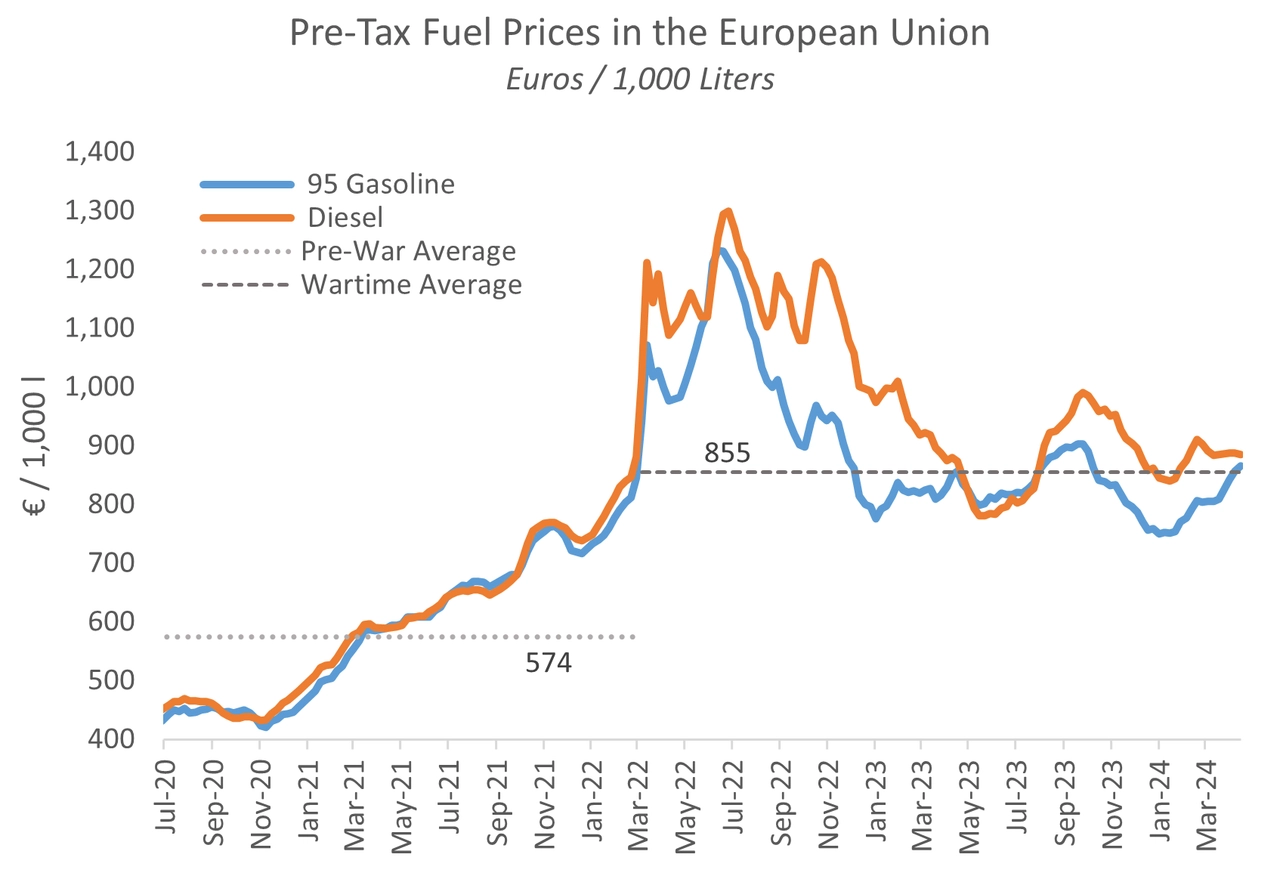

Despite US fretting, European gasoline and diesel prices do not appear materially affected by Ukraine's attacks on Russian refineries.

Overall, oil prices are developing much as expected and against Ukraine's interest. The easiest, though high risk, way to motivate a desperately needed and vastly overdue restructuring of the Price Cap would be an attack on an oil tanker carrying Russian crude in the Black Sea. If the House fails to fund Ukraine and the White House declines to revisit the Price Cap, it might come down to that.

Steven Kopits heads Princeton Policy Advisors. A strategic management consultant and investment banker, he writes frequently on policy topics for a variety of publications, including Foreign Policy and The National Interest, and is a regular contributor to CNBC and The Hill.

In essence, the US is protecting Russian oil exports and allowing Russia to fund the war thereby.

By Steven Kopits

April 19, 2024,

This pool photograph taken and distributed on September 11, 2023 by Sputnik agency shows the Zvezda shipbuilding complex before the naming ceremony of the Arctic tanker-gas carrier "Alexey Kosygin" and the tanker-shuttle "Valentin Pikul", in Primorsky Krai region.

(Photo by Vladimir SMIRNOV / POOL / AFP)

It's been a wild week. Over the weekend, Iran unleashed a barrage of missiles on Israel; the world awaits the response. President Trump is in the dock, in a criminal trial he looks set to lose. Speaker Johnson finally appears ready to introduce various funding bills for Ukraine, Israel and Taiwan, even as the Clown Show tries to take him down. And meanwhile, the US Secretary of Defense, Lloyd Austin, admonished Ukraine to observe proprieties and not make waves as the country fights for its life. The US appreciates that the situation may be desperate, but for goodness sake, please do it quietly! Those attacks on Russia refineries could increase fuel prices and inconvenience all of us.

Ukraine has been facing the twin challenges of an excessively timid Biden administration and a wildly dysfunctional Republican conference in the House. Barring a vote to fund Ukraine this weekend -- and even with it at some point -- Ukraine may be compelled to try to restrict Russian oil exports through the Black Sea. A combination of Russian, western and other tankers export almost $10 billion of Russian crude from the Black Sea every month. That equals the entirety of Russia's defense budget. The oil continues to flow only because the US and western Europe so desire. In essence, the US is protecting Russian oil exports and allowing Russia to fund the war thereby.

Ending this trade would materially degrade Russia's ability to conduct the war. It would also raise oil prices comfortably to $150, and perhaps as high as $200, per barrel. This would push Europe into a steep recession and would similarly punish US consumers. Indeed, US drivers would lose $60 bn / month in added gasoline and diesel costs, with the price of regular gasoline reaching perhaps $6 / gallon ($8 in California). US government support of $60 bn for Ukraine for the entire year would look like peanuts by comparison.

Should that happen, Kyiv would be in a position to shift the blame firmly onto the MAGA Republicans in Congress. Does Marjorie Taylor Greene prefer $6 gasoline to supporting Ukraine? Kyiv can put her to the test.

It's been a wild week. Over the weekend, Iran unleashed a barrage of missiles on Israel; the world awaits the response. President Trump is in the dock, in a criminal trial he looks set to lose. Speaker Johnson finally appears ready to introduce various funding bills for Ukraine, Israel and Taiwan, even as the Clown Show tries to take him down. And meanwhile, the US Secretary of Defense, Lloyd Austin, admonished Ukraine to observe proprieties and not make waves as the country fights for its life. The US appreciates that the situation may be desperate, but for goodness sake, please do it quietly! Those attacks on Russia refineries could increase fuel prices and inconvenience all of us.

Ukraine has been facing the twin challenges of an excessively timid Biden administration and a wildly dysfunctional Republican conference in the House. Barring a vote to fund Ukraine this weekend -- and even with it at some point -- Ukraine may be compelled to try to restrict Russian oil exports through the Black Sea. A combination of Russian, western and other tankers export almost $10 billion of Russian crude from the Black Sea every month. That equals the entirety of Russia's defense budget. The oil continues to flow only because the US and western Europe so desire. In essence, the US is protecting Russian oil exports and allowing Russia to fund the war thereby.

Ending this trade would materially degrade Russia's ability to conduct the war. It would also raise oil prices comfortably to $150, and perhaps as high as $200, per barrel. This would push Europe into a steep recession and would similarly punish US consumers. Indeed, US drivers would lose $60 bn / month in added gasoline and diesel costs, with the price of regular gasoline reaching perhaps $6 / gallon ($8 in California). US government support of $60 bn for Ukraine for the entire year would look like peanuts by comparison.

Should that happen, Kyiv would be in a position to shift the blame firmly onto the MAGA Republicans in Congress. Does Marjorie Taylor Greene prefer $6 gasoline to supporting Ukraine? Kyiv can put her to the test.

A strike on a Russian tanker would also panic the White House, prompting a swift and desperately needed restructuring of the Price Cap. Ukraine will not win the war without it.

Attacking Russian tankers is, of course, a politically risky option. A very risky option. On the other hand, certain defeat at the hands of the Russians is a much higher price to pay. If push comes to shove, the Ukrainians need to shove. Marjorie Taylor Greene and the MAGA Republicans need to decide if they want to own $6 unleaded as the Ukraine vote reaches the House floor.

Oil Prices

Brent crested $90 last week, but is trading down a bit, $87 at writing. Nevertheless, copper prices continue to surge. Thus, either copper has to retrace, or Brent might be expected to rise to $96 / barrel.

Urals has closed up, much as expected, to $78 / barrel, $18 / barrel above the Price Cap.

The Urals discount, the difference between Russia's western crude oil export price and Brent, has compressed to around $11 / barrel, again, much as expected.

Urals is now at the highest level for this date in at least nine years.

Despite US fretting, European gasoline and diesel prices do not appear materially affected by Ukraine's attacks on Russian refineries.

Overall, oil prices are developing much as expected and against Ukraine's interest. The easiest, though high risk, way to motivate a desperately needed and vastly overdue restructuring of the Price Cap would be an attack on an oil tanker carrying Russian crude in the Black Sea. If the House fails to fund Ukraine and the White House declines to revisit the Price Cap, it might come down to that.

Steven Kopits heads Princeton Policy Advisors. A strategic management consultant and investment banker, he writes frequently on policy topics for a variety of publications, including Foreign Policy and The National Interest, and is a regular contributor to CNBC and The Hill.

No comments:

Post a Comment