February 17, 2026

By Craig Eyermann

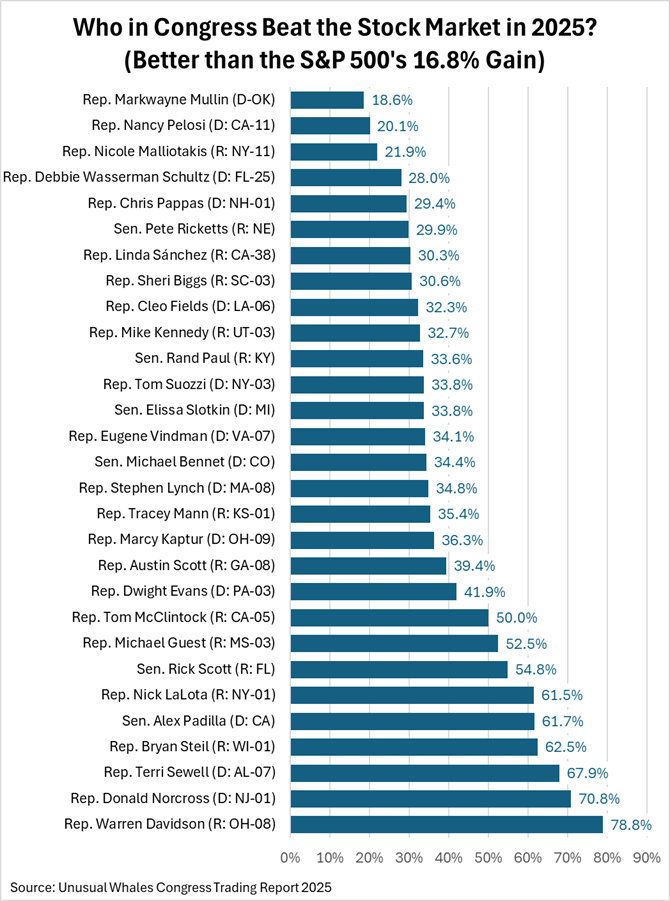

2025 was a good year for the stock market. Americans who invested in a broad market index like the Standard and Poor 500 did really well. But not as well as 29 members of the U.S. Congress who beat the market in 2025.

Beating the market is not easy and beating an index like the S&P 500 in 2025 means getting gains of more than 16.8%. Unusual Whales compiled a report on the members of Congress whose investments beat that return in 2025. I compiled the chart below from the report to focus on the 29 members of Congress whose investment portfolios grew by more than 16.8% last year.

The list is almost evenly split between Democrats and Republicans. There are 15 Democrats and 14 Republicans, indicating a lack of adequate rules governing members of Congress’s trading activities. It’s like an equal-opportunity exercise in insider trading, in which members of Congress have an edge because they know which laws and regulations are in the works that could materially affect their investments.

More than a few members of Congress had trades in 2025 with very questionable timing.

The reigning queen of questionable trading is former House Speaker Nancy Pelosi (D: CA-11), who has truly made bank throughout her long congressional career. In November 2025, the New York Times reported on her lifetime achievement:

Before first taking Congressional office in 1987, the then-47-year-old freshman and her hubby, venture capitalist Paul Pelosi, reported between $610,000 and $785,000 in stocks in their portfolio, according to a copy of her “hand delivered” 1987 financial disclosure form.

They held a dozen stocks, including CitiBank, and in many companies no longer publicly traded.

That portfolio has soared to $133.7 million today, according to the latest estimates from Quiver Quantitative.

That represents an eye-watering profit of 16,930%—compared to 2,300% for the Dow Jones over those years.

Even with the power of compound interest, the windfall represents a staggering 14.5% average annual return—beating out the S&P 500, NASDAQ and Dow Jones performances over those years, around 7% to 9%.

Most professional money managers are unable to beat the major stock market indices for more than a few years. Repeatedly beating them over decades is a very rare achievement. Or would be without an insider’s edge.

Pelosi has announced she is retiring from Congress at the end of 2026. Will this be the year she really cashes in because it’s her last chance to exploit her inside edge?This article was published by the Independent Institute

Craig Eyermann

Craig Eyermann is a Research Fellow at the Independent Institute. He is also the creator of MyGovCost.org: Government Cost Calculator. He received his M.S. in mechanical engineering from New Mexico State University and M.B.A. from the University of Phoenix, having received a B.S. in both mechanical and aerospace engineering from the Missouri University of Science and Technology.

.jpg)

No comments:

Post a Comment