By Hollie Silverman and Andy Rose, CNN

Updated Sun April 18, 2021

Minnesota National Guard on alert amid tensions over police shooting of Daunte Wright, looming Chauvin trial verdict 00:53

(CNN)Minnesota's governor expressed regret Saturday after the alleged mistreatment of journalists covering demonstrations in Brooklyn Center by law enforcement, as attorneys representing news organizations released a letter calling out several examples throughout the week -- including the arrest of a CNN producer.

During an hour-long phone conference with law enforcement officials and an attorney representing media outlets -- including CNN -- Minnesota Gov. Tim Walz said he was embarrassed about the treatment of reporters after police ordered the crowd to disperse, according to a participant in the meeting.

"A free press is foundational to our democracy. Reporters worked tirelessly during this tumultuous year to keep Minnesotans informed. I convened a meeting today with media and law enforcement to determine a better path forward to protect the journalists covering civil unrest," the governor said on Twitter Saturday.

At least 100 people arrested on tense sixth night of protests as Daunte Wright's loved ones mourn for his son

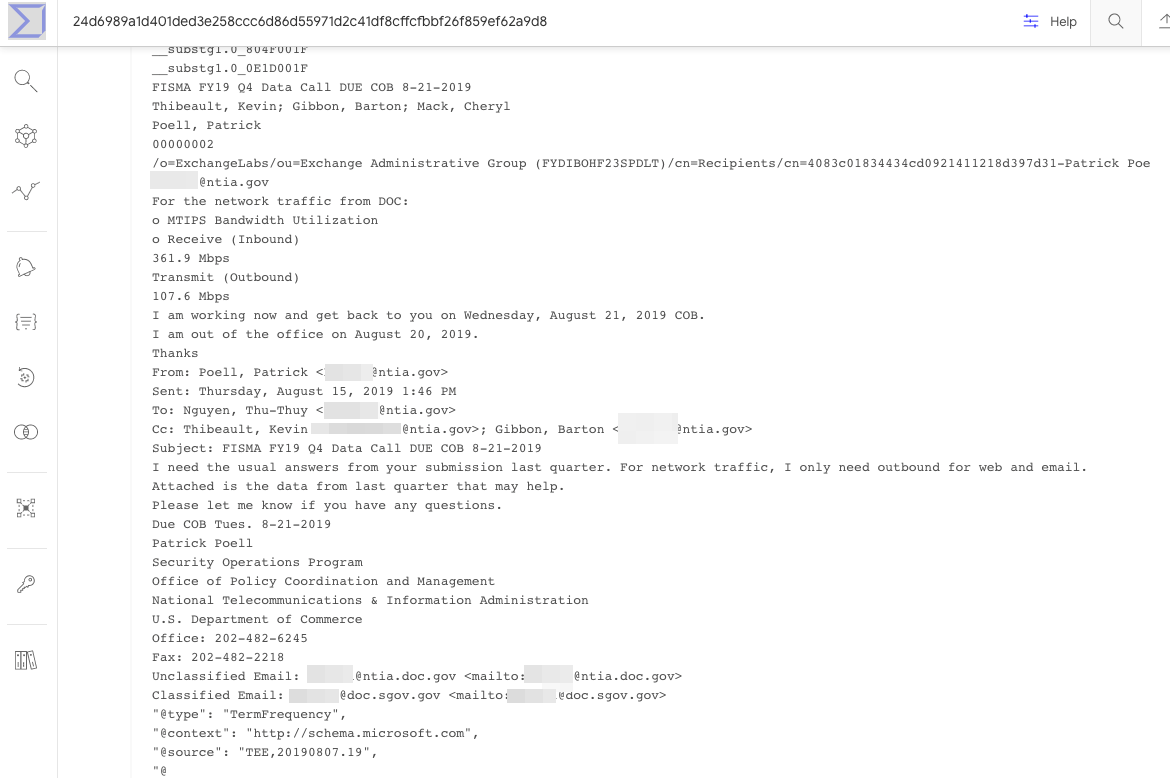

Attorney Leita Walker, writing on behalf of more than two dozen journalism and media outlets, sent a letter to Gov. Walz and public safety officials after the meeting. The letter alleges multiple instances of journalists being harassed, assaulted, or arrested by law enforcement officers while covering protests in Minnesota.

CNN producer Carolyn Sung was grabbed by her backpack and thrown to the ground by state troopers while trying to comply with a dispersal order, the letter said.

Her hands were zip-tied behind her back, she did not resist and repeatedly identified herself as a journalist working for CNN while showing her credentials, according to the letter. The male security agent hired to work with her was also detained but then released after he showed his credentials.

A trooper yelled at Sung, "Do you speak English?" despite her identifying herself several times as a journalist and telling the troopers that the zip-ties on her wrists were too tight. Sung was transported to Hennepin County Jail in a prisoner-transport bus where she was processed, the letter said.

"She was patted down and searched by a female officer who put her hands down Sung's pants and in her bra, fingerprinted, electronically body-scanned, and ordered to strip and put on an orange uniform before attorneys working on her behalf were able to locate her and secure her release, a process that took more than two hours," the letter said.

Law enforcement officers pepper spray freelance photographer Tim Evans (L) as he identifies himself a working journalist outside the Brooklyn Center police station on April 16.

In another instance, several media members, including one from the New York Times, were assaulted by police officers, according to the letter. The officers surrounded their car, banging on windows and doors with wooden sticks before dragging the driver out and arresting them. Officers allegedly hit the New York Times journalist repeatedly and tried to break his camera, the letter said.

The letter includes a photo of an unidentified law enforcement officer spraying chemical agents on journalists, clearly identifiable by their equipment and clothing.

In a press release after Saturday's meeting, the Minnesota State Patrol acknowledged that, in accordance with a federal judge's order, a dispersal order does not apply to members of the media covering the protest.

"MSP is prohibited from seizing equipment from or ordering someone to stop recording or observing who we know or have reason to know is a member of the media," the statement says.

The State Patrol also says it is instructing troopers not to threaten to arrest members of the media unless they are suspected of committing a crime.

CNN's Travis Caldwell contributed to this report.

Good Morning Britain correspondent shares dramatic moment crew was detained by police in Minnesota

Kim Novak Saturday 17 Apr 2021

Good Morning Britain’s US correspondent Noel Phillips has revealed he and the TV crew he was with were detained by police during the protests in Minnesota. Protests have been ongoing in Brooklyn Center for six days following the shooting of Daunte Wright by police around 10 miles from where George Floyd died last year.

Wright, 20, was fatally shot by police officer Kim Potter – who has been charged with second-degree manslaughter – after she claimed to mistake her gun for a Taser.

Phillips, who has been covering the protests, shared dramatic footage of the moment he and the crew were detained but later released by police. He wrote alongside the clips: ‘Sixth day of protests in #Minnesota. This is the moment our crew were detained but later released.’ In the video clip, police can be heard instructing them: ‘Get down! Put your hands up. Take a knee.’

Phillps’s legs can just be seen in the clip as he kneels down, before the clip cuts to show protestors milling around with sounds that appear to be gunshots heard in the background.

Police in riot gear can also be seen standing by groups of protesters as lights from their vehicles flash in the background.

The current protests come after similar scenes last year following the death of George Floyd after a police officer knelt on his neck for nine minutes during his arrest.

The death of Wright also sparked protests outside the police department in Minnesota, with demonstrators throwing rocks and water bottles at cops, with Minnesota National Guard members and State Patrol troopers using tear gas and rubber bullets to control the crowd.