, Bloomberg News

Exxon Mobil Corp. was suspended from the Climate Leadership Council, a pro-carbon tax group backed by conservation groups and some of the world’s biggest corporations.

The move comes just weeks after an Exxon lobbyist was secretly recorded by Greenpeace saying that the oil giant only voiced support for a carbon tax because it knew such a policy would be almost impossible to implement. Exxon was one of the CLC’s founding members when it was formed in 2017; other participants include BP Plc, Goldman Sachs Group Inc., and Microsoft Corp..

“After careful consideration, we have decided to suspend ExxonMobil’s membership in both the Council and Americans for Carbon Dividends, our advocacy arm,” CLC Chief Executive Officer Greg Bertelsen said in a statement on Friday.

Exxon CEO Darren Woods apologized for the lobbyist’s comments at the end of June, saying they “in no way represent the company’s position” and reiterated support for a carbon tax. The oil explorer already was under intense investor pressure to bolster emission-reduction efforts after an activist investor won a key boardroom battle that replaced a quarter of directors.

“CLC’s decision is disappointing and counterproductive,” Exxon spokesman Casey Norton said in an email. “It will in no way deter our efforts to advance carbon pricing that we believe is a critical policy requirement to tackle climate change.”

Momentum for a carbon tax is gaining support as a way of combating climate change. Advocates say it would incentivize companies and consumers to pollute less. The American Petroleum Institute, the powerful oil-industry trade group that counts Exxon among its members, endorsed such a policy earlier this year.

But a tax that could increase the costs of driving, flying and importing is likely to face stiff resistance from some quarters. The Climate Leadership Council advocates that any proceeds should be directly returned to taxpayers through “carbon dividends.” It also wants simpler carbon regulations and similar fees charged on foreign imports to create a level playing field.

The World Resources Institute, also a founding member of the CLC, welcomed Exxon’s removal.

All companies should “re-examine their lobbying, political spending and participation in trade associations to ensure their actions are fully aligned with their public statements on climate change,” the WRI said in a statement.

Exxon will mull “more aggressive objectives” on emissions, Woods said last month, citing input from its new directors. The company is considering a target to zero out carbon emissions from its own operations, the Wall Street Journal reported Thursday.

ONE OF THE CLASSIC BLUNDERS

Exxon’s “net zero” climate goal misses the

point

REUTERS/BRENDAN MCDERMID/FILE PHOTOExxon CEO Darren Woods previously called climate commitments a "beauty competition." Now it seems he wants a turn on the runway.

By Tim McDonnell

Climate reporter

Published August 6, 2021

Even among major oil companies, ExxonMobil has been reluctant to take the climate change crisis seriously.

A July 21 analysis by the World Benchmarking Alliance, a group of sustainability-oriented nonprofits and financial institutions, gave Exxon a score of 5.2 out of 100 in how well its corporate strategy is aligned with the Paris Agreement goal to limit warming to 1.5 degrees Celsius above pre-industrial levels (Chevron, its closest peer, scored a 6.4).

In March, CEO Darren Woods dismissed other oil companies’ emissions-reduction commitments as a “beauty competition,” in defending his decision in December 2020 to set goals only to moderately reduce emissions per unit of oil and gas produced, and not to aim for net zero emissions as rivals like BP and Shell have done.

Now, it seems, Woods wants a turn on the runway. The Wall Street Journal reported on Aug. 5 that the company is considering setting a net zero goal for 2050. If it does, that would be a major victory for the climate activist shareholders that shook up the company’s board in May. But the details suggest that Exxon’s commitment would only be skin-deep.

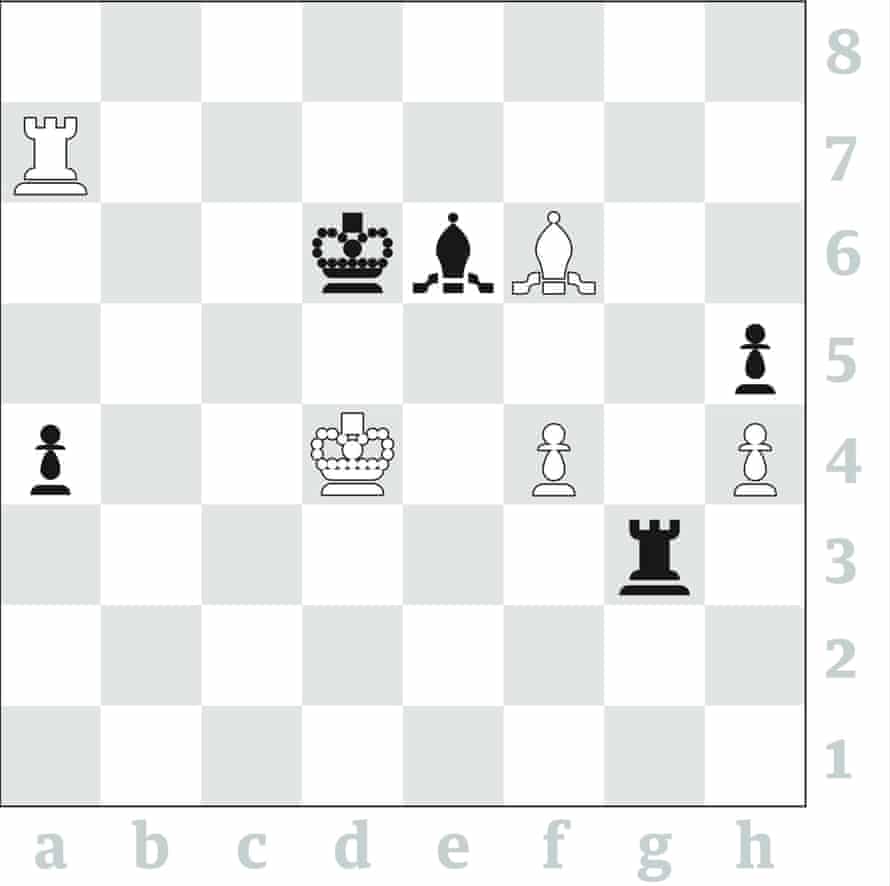

Companies need to focus on their Scope 3 emissions

Corporate emissions are tallied in three categories. Scope 1 covers emissions from the company’s direct operations, like gas burned to run the motor in an oil pump or company car. Scope 2 covers emissions from purchased energy—the electricity in Exxon’s offices, for example. Scope 3 covers emissions that come from a company’s suppliers and from its customers as they make use of the company’s product.

For an oil and gas company, scope 1 and 2 are negligible compared to scope 3: obviously, the vast majority of Exxon’s carbon footprint occurs when its customers burn its products in cars and airplanes and power plants. Exxon has disclosed its scope 1 and 2 emissions for a decade, but only disclosed its scope 3 emissions for the first time in April. And according to the Journal, the new net zero goal will only apply to scopes 1 and 2.

At the moment, Exxon’s main strategy for addressing scope 3 emissions is a new division it set up in February to commercialize carbon capture systems, which would allow major industrial consumers of gas to lower their scope 1 emissions, which, if the gas came from Exxon, are the same as Exxon’s scope 3. Woods has also said that Exxon may eventually sell carbon offset credits it generates through carbon capture activities—essentially running the company’s carbon pollution business in reverse, which could in theory draw down its scope 3 emissions.

Ultimately, the only way for Exxon to eliminate its scope 3 emissions is to stop producing oil and gas. That’s the direction some of its European peers are headed, as they look to become titans of renewable energy. Until Exxon gets on board, it will never be the climate beauty queen.

The vast majority of the income that Maria Luisa Suarez has earned over her lifetime has been paid by the hour and unregistered, resulting in paltry pension contributions [Photo courtesy of Maria Luisa Suarez]

The vast majority of the income that Maria Luisa Suarez has earned over her lifetime has been paid by the hour and unregistered, resulting in paltry pension contributions [Photo courtesy of Maria Luisa Suarez]