US so-called “Reciprocal” Tariffs Set to Take Effect, Triggering Widespread Opposition, Market Uncertainty

The new US administration is set to announce its reciprocal tariffs on Wednesday local time, prompting widespread concern and opposition over the uncertainty they could unleash, according to media reports.

As the date approaches, global financial markets including the US stock market have experienced a rollercoaster ride as investors’ anxiety continues to worsen.

Asia-Pacific markets were mixed on Wednesday. Japan’s benchmark Nikkei 225 edged up 0.28 percent higher to close at 35,725.87, and the broader Topix index closed down by 0.43 percent at 2,650.29. Meanwhile, South Korea’s Kospi slipped 0.62 percent to close at 2,505.86 while the Kosdaq declined 0.95 percent to close at 684.85.

As for European markets, the benchmark STOXX 600 was trading down as of press time.

US stocks dropped Wednesday as Wall Street braced for the expected rollout of the US tariffs. The Dow Jones Industrial Average lost 333 points, or 0.8 percent. The S&P 500 slid 1 percent, and the Nasdaq Composite pulled back by 1.5 percent, CNBC reported.

It followed a volatile session on Monday as investors awaited clarity on US President Donald Trump’s tariff rollout. The S&P 500 and the Nasdaq Composite posted on Monday their worst quarterly performances since 2022, as uncertainty around the Trump administration’s economic agenda roiled US equity markets in the first quarter of 2025. For the quarter, the S&P 500 slumped 4.6 percent, while the Nasdaq Composite plummeted 10.5 percent, Reuters reported.

In the bond market, the yield on the 10-year Treasury fell to 4.16 percent from 4.23 percent late Monday and from roughly 4.80 percent in January, the AP reported.

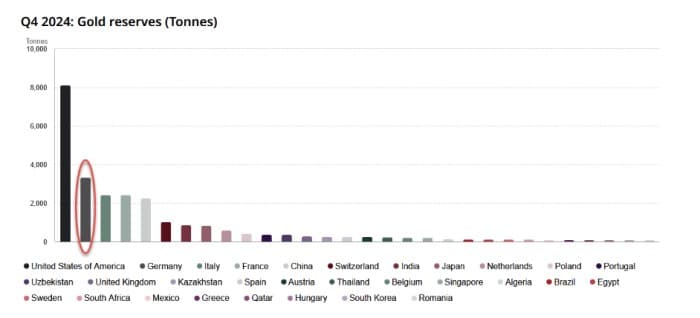

Gold prices on Monday surged above $3,100 per ounce for the first time as concerns around the US tariffs and the potential economic fallout, combined with geopolitical worries, drove a fresh wave of investments into the safe-haven asset. Spot gold prices hit a record high of $3,106.50 per ounce, according to a separate Reuters report.

Growing backlash

The tariff plan has also drawn widespread opposition from the US’ trading partners, with officials from various countries speaking out to safeguard their interests while potentially retaliating if necessary.

Canadian Prime Minister Mark Carney pledged to fight unjustified trade actions, protect Canadian workers and businesses and build Canada’s economy, including through increased trade between Canada and Mexico as he spoke with Mexican President Claudia Sheinbaum on Tuesday.

“With challenging times ahead, Prime Minister Carney and President Sheinbaum emphasized the importance of safeguarding North American competitiveness while respecting the sovereignty of each nation,” Carney’s office said in a statement.

Other economies have also threatened countermeasures.

The EU has “a strong plan to retaliate if necessary,” European Commission (EC) President Ursula von der Leyen said on March 20 in a speech, according to the speech released by the EC on Tuesday.

“Our objective is a negotiated solution. But of course, if need be, we will protect our interests, our people and our companies,” von der Leyen said.

The sweeping tariff measures adopted by the US will not work because they are built on a flawed assumption and “completely mistaken” diagnosis on its economy, and it wrongly blames global trade for domestic struggles, which will only lead to negative consequences, Pascal Lamy, former Director General of the World Trade Organization (WTO) told the Global Times in an exclusive interview.

Sharp tariff hikes can indeed disrupt global value and supply chains, adversely affecting other nations while simultaneously impacting the US itself, Gao Lingyun, an expert at the Chinese Academy of Social Sciences, told the Global Times on Wednesday.

Experts warned that the tariffs will backfire, disrupting global supply and industrial chains and saddling US businesses and consumers with higher costs.

Lamy cautioned that the US itself stands to suffer most. “If the US triggers a trade war, it will primarily hurt the US economy by raising prices, driving inflation and likely pushing up interest rates,” Lamy said, adding that this fallout could also trigger pushback from US financial markets and the general public.

Gao noted that after tariff hikes, domestic US producers often raise prices, leaving consumer welfare unimproved.

According to Gao, studies indicate that 25 percent tariffs could raise consumer costs by $5,000 to $10,000, exacerbating uncertainty for both the US and global economies. The price of a typical car could rise by between $5,000 to $10,000 “out of the gates” due to the new tariffs, according to a March 31 estimate from Wedbush Securities analyst Dan Ives, CBS News reported.

Gao pointed to recent market volatility, low consumer confidence and rising recession risks as evidence.

Goldman Sachs said in a report released on Sunday US local time “We now see a 12-month recession probability of 35 percent [in the US]. The upgrade from our previous 20 percent estimate reflects our lower growth baseline, the sharp recent deterioration in household and business confidence, and statements from White House officials indicating greater willingness to tolerate near-term economic weakness in pursuit of their policies.”

Tariffs are a double-edged sword. On the one hand, they can suppress imports of foreign products into the US. On the other hand, tariffs do not offer as many advantages for the development of the US as Washington might imagine, Liu Weidong, a research fellow at the Institute of American Studies at the Chinese Academy of Social Sciences, told the Global Times on Wednesday.

Tariffs fuel inflation and stifle innovation among local firms. Moreover, due to potential retaliation from other countries, US exports can also be affected, and the impacts of tariffs on the US would be mostly negative, Liu said.

However, former WTO chief Lamy downplayed the tariffs’ potential to reshape global trade, noting that the US accounts for just 15 percent of world imports. “The rest of the international trading system – 85 percent of global imports, involving trade between countries like China, India, Mexico, and Canada – can remain largely unaffected,” he said.

As for China, Liu said that as the detailed measures have not been disclosed, the specific impacts remain uncertain, though it will likely target specific sectors.

Regarding China’s response, Liu said that the country is well-prepared, with ample technological, industrial and strategic reserves.

Chinese authorities, including the Foreign Ministry and the Commerce Ministry, have stated multiple times that trade and tariff wars have no winners and the unilateral imposition of tariffs by the US undermines the multilateral trading system, as well as disrupting normal international trade order.

China-US trade ties are based on reciprocal interactions. Cooperation will bring about mutual benefit and win-win, and China will definitely take countermeasures in response to arbitrary pressure, Chinese Foreign Ministry spokesperson Mao Ning said on March 12.

.jpg)