As shipping moves to align with the IMO's ambitious Net Zero Framework, ammonia has emerged as a leading zero-carbon fuel candidate.

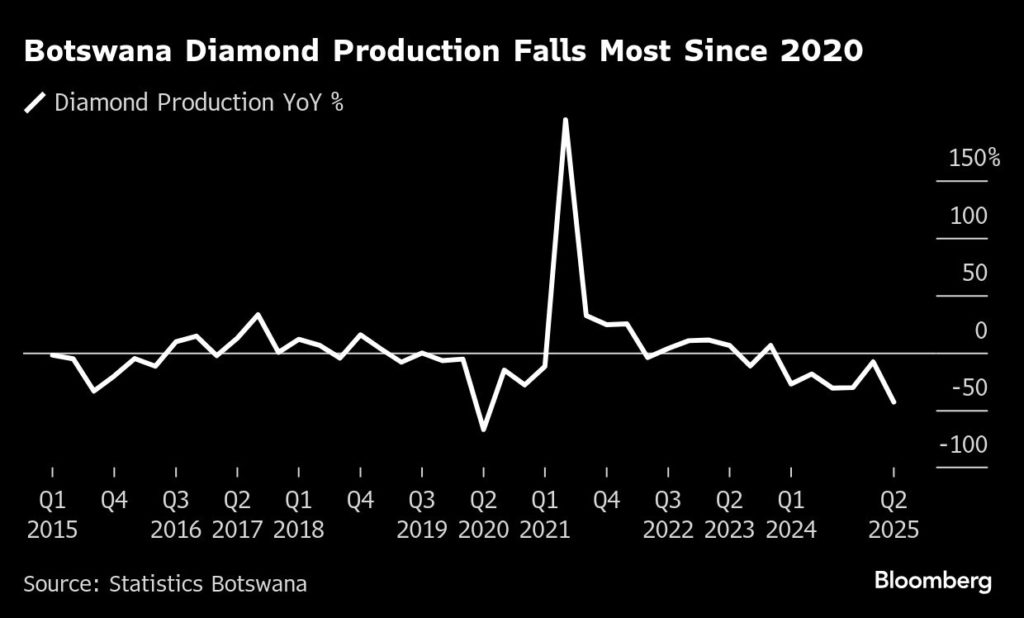

With more clarity emerging from upcoming MEPC meetings, nearly 400 ammonia-capable vessels have now entered global orderbooks. Major regulatory drivers, such as FuelEU Maritime and regional carbon taxation frameworks, further reinforce ammonia's potential advantages, yet actual consumption of sustainable marine fuels remains minimal.

Market sentiment remains cautiously optimistic. Classification societies and regulators are racing to establish safety and operational standards, and pilot infrastructure projects are gaining momentum. Singapore, the world's largest bunkering hub, is actively preparing ammonia bunkering guidelines as the industry edges toward practical adoption.

To assess ammonia's real prospects, we spoke with two Singapore-based industry leaders at the heart of ammonia's maritime development.

BUILDING THE SUPPLY CHAIN

Ashish Anilan now leads Itochu Corporation's global ammonia bunkering business from Singapore. Itochu, a major Japanese trading company, established Clean Ammonia Bunkering Shipping (CABS) to develop a global ammonia bunkering infrastructure.

Anilan frames the industry's commitment to ammonia as a decisive step forward: "What excites me most is the fact that the maritime industry is 'walking the talk' when it comes to climate change. The IMO's Net Zero Framework is the first in the world to combine mandatory emissions limits and greenhouse gas targets."

He acknowledges that maritime decarbonization is not straightforward. "Maritime decarbonization is a complex web of interdependencies influenced by multiple stakeholders," he explains. "So is the decision on fuel choice and bunker port.”

He adds that multiple fuels will coexist: "The fuel race didn't have a common starting point, and there won't be a single winner. LNG had the true first-mover advantage, while methanol has secured a significant market share, and biofuels provide immediate carbon reduction. Ammonia offers unique benefits for lengthy, heavy-duty voyages with zero direct carbon emissions. We can already see it in the bulk and container vessel segments. Harbor crafts have also started ammonia-based trials.”

Anilan points to ammonia's long history of safety and infrastructure challenges. "Ammonia has been transported as maritime cargo for decades,” he notes, “and its safety is well established for shore-based terminals and industries. Knowledge and safety gaps exist, however, in the bunkering interface and fuel-related systems of the receiving vessels, specifically in bunkering procedures, emergency response protocols, and crew competency.”

The regulatory groundwork is already in motion. “Most class societies have published guidelines for ammonia bunkering and using ammonia as a marine fuel," Anilan states. "Singapore is preparing guidelines for port-specific ammonia bunkering, which will coexist with LNG and methanol bunkering guidelines.”

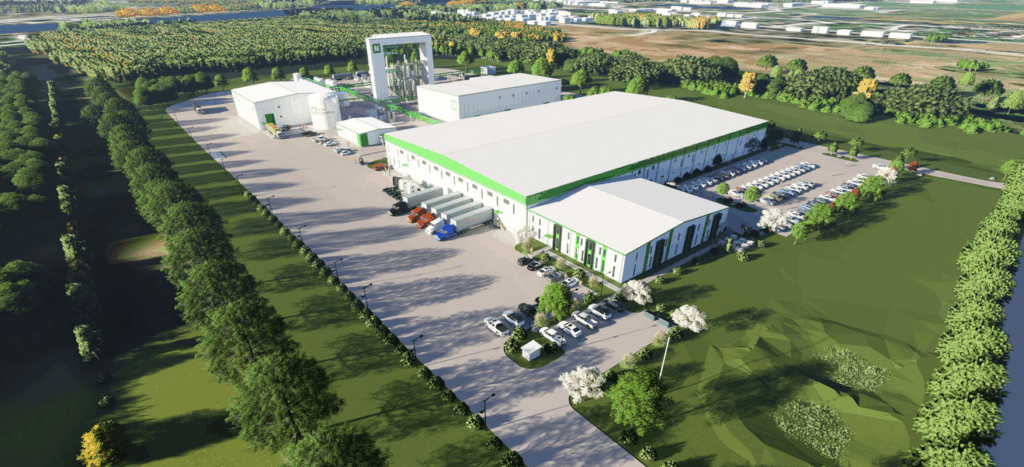

Itochu recently took a significant step forward by signing a contract to build the world's first ammonia bunker vessel with Sasaki Shipbuilding. "Finalizing the Ammonia Bunkering Vessel design, especially for the ammonia transfer systems, and creating rigorous crew training programs will remain top priorities," Anilan says. "Lessons learned from these activities will support the development of clear regulatory frameworks for ammonia bunkering in Singapore and other strategic locations such as Algeciras and the Suez Canal.”

Collaboration will determine success.

“Itochu has been promoting its integrated project to develop ammonia-fueled ships and establish a global ammonia supply chain in collaboration with partners,” he notes. “Projects like the Green Ammonia Initiative from Aceh (GAIA), in partnership with PT Pupuk Indonesia and Toyo Engineering Corporation as part of the Global South Future-Oriented Co-Creation Project, are expected to provide a stable supply of low-carbon ammonia for Itochu's marine bunkering business.”

Ultimately, Anilan frames inclusive adoption as the real challenge.

“More than half of the world fleet in the orderbook is capable of using alternative fuels," he concludes. "However, consumption of sustainable marine fuels remains negligible. The real challenge is not developing alternative fuels but empowering every marine operator to use them in a just manner so that they become the co-creators of the transition, not just forced recipients of the change."

REALITY CHECKS

Jon Løken, Commercial Director Asia-Pacific at Siglar Carbon, provides emissions intelligence and strategic guidance to shipping stakeholders. He offers a measured assessment of ammonia's near-term viability.

"As a dual-fuel combustion fuel, ammonia has minimal potential,” he states. "Even though we have seen a surge in vessels on order that are ammonia-ready, I doubt many of them will ever be operated with ammonia as fuel.”

He sees greater promise for ammonia in the long run: “I believe fuel cells have major potential as a source of hydrogen for vessels with fuel cell technology. However, fuel cells are still mostly in the pilot stage."

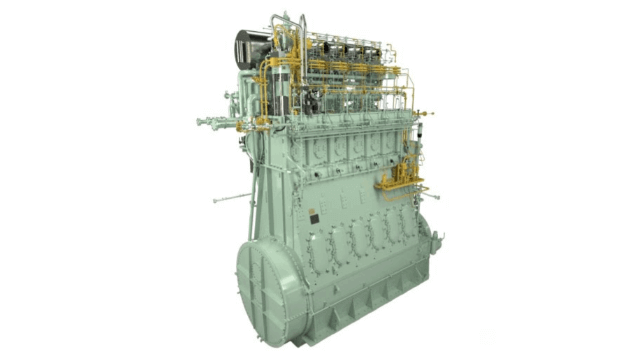

Løken highlights the cautious optimism reflected in the market. "Only a handful of ammonia dual-fuel ships are in operation,” he says. “However, the surge in orders for newbuilds suggests that the market is quickly gaining confidence in ammonia as a fuel option. But certainly, it's lagging behind methanol as an alternative fuel option. In general, we're seeing that dual-fuel engines are becoming a normal choice for newbuilds.”

Emissions and fuel characteristics remain a hurdle.

"Fossil-based or grey ammonia is quite comparable to conventional fuels in terms of emissions," he explains. "But as we know, we have some challenges with it. Low-energy density means increased fuel use; a heavier-laden ship burns more fuel. In addition, test results suggest that the NOx emissions when combusting ammonia are something we need to watch and combat.

"Additionally, there are near-term regulatory and market limitations. “At the moment, Fuel EU and the IMO framework make ammonia a less-than-viable option for at least the next five years,” Løken says. “As production of low-carbon ammonia is scaling, we may see it used as a partial fuel in certain restrictive areas such as ports or highly taxed Emission Control Areas."

He adds that other fuels may dominate the near-term: “It seems other options will probably overshadow ammonia as a near-term option. This is particularly true for tramping vessels, as ammonia availability is scarce. For larger line operators who are hedging options, it may well feature as a smaller mix in the medium-term window.”

Accurate emissions data is now essential. “Accurate and frequent data collection from the ships is essential to understand performance fully,” cautions Løken. “For the foreseeable future, the frameworks favor calculations over actually measuring emissions, so we're making assumptions with our standard models that may well have flaws when it comes to methane slip, NOx, and other GHG emissions."

He concludes by explaining how the market is adapting: “Charterers have a new tool with carbon taxation. Traditionally, fuel has just been a cost, but now it's a commodity itself. A voyage with the right option gives tradeable value. "Brokers and charterers, he adds, are actively developing strategies and hedging positions as shipping transitions toward lower-carbon fuels and tighter regulations.

FUTURE ADOPTION?

As ammonia infrastructure matures and early projects come online, adoption will hinge on operational readiness, robust regulation, transparent data, and market alignment. The next five years, guided by collaborative initiatives and MEPC outcomes, will determine whether ammonia moves from promise to a permanent role in shipping's zero-carbon future. – MarEx

Sean Holt is a frequent contributor to The Maritime Executive.

The opinions expressed herein are the author's and not necessarily those of The Maritime Executive.

.jpg)