Fire breaks out at Indonesia nickel hub, three injured

A fire broke out on Sunday at a facility in Indonesia’s Morowali Industrial Park (IMIP), the country’s largest nickel processing facility, which injured three workers, an official said.

The fire affected a scrubber tower at one of IMIP’s tenants, IMIP spokesperson Dedy Kurniawan said in a text message, adding that it may have been caused by sparks from welding activities.

“Three employees suffered minor injuries. The investigation (on the cause of the fire) is still ongoing,” Dedy said.

Operations at IMIP were running normally as the incident affected the premises of only one tenant which was under construction.

Indonesia is the world’s largest producer of nickel, but its processing industry often experiences fire incidents, including a fatal blaze in December 2023.

(By Fransiska Nangoy; Editing by Bernadette Baum)

Column: Turbulent markets fuel LME’s recovery from nickel crisis

Crisis? What crisis? It’s hard to believe that just over three years ago the London Metal Exchange (LME) was teetering on the brink of a death spiral after its nickel contract blew up.

Yet as the global metals industry descends on London for the annual LME Week festivities starting on Monday, the 148-year-old exchange, owned by Hong Kong Exchanges and Clearing, appears in robust good health.

Trading volumes are up, with nickel itself back to pre-crisis activity levels. New LME warehouses have opened for business in the Saudi Arabian port of Jeddah and Hong Kong.

Even the exchange’s open-outcry trading ring continues to defy expectations of inevitable demise with US broker Clear Street joining the hallowed red-leather circle.

The tumultuous events of March 2022 still cast a long shadow in the form of the exchange’s ongoing reform program and tougher enforcement policies.

But the LME is being buoyed by turbulence in physical metal supply chains, not least this year’s special guest in London – Doctor Copper.

Must do better

The Financial Conduct Authority (FCA) drew a line under the nickel crisis earlier this year with a hefty fine on the LME, reduced for co-operating with the UK regulator, and a detailed, at times scathing, analysis of what went wrong.

Were it a school report, it would have ended with the words “must do better”.

The exchange, to be fair, has been trying, pushing through a market restructuring program in the face of predictable hostility from many of its members.

After much pushing and shoving, the LME will go ahead and introduce block trade thresholds to direct more liquidity to its electronic platform. But it’s had to concede greater latitude for inter-office trading on the front part of the curve to appease its industrial base.

An attempt to extend block-trade rules into the over-the-counter (OTC) segment of the market was dropped after strong resistance from both members and futures industry associations.

The LME’s response is a hike in the fee charged for “lookalike” contracts, a popular instrument in the OTC market.

Likely less controversial is the exchange’s proposal to shift its options contracts from inter-office to electronic trading.

The London metals options market is underdeveloped relative to peer exchanges.

The Shanghai Futures Exchange (ShFE) only introduced options trading in 2018 but now has liquid contracts across the full spectrum of its metals suite, including even the new aluminum alloy contract. US exchange CME, meanwhile, has expanded its copper options offering with weekly contracts.

The LME’s timeline for going electronic is extended but the ambition gets a vote of confidence from Dutch options trader Optiver, which has just become a non-clearing member.

More muscle

The LME, no doubt under the watchful eye of the FCA, has toughened up its handling of over-size positions by extending its lending rules beyond the cash date to the nearest monthly prompt.

The rules require an entity with a dominant long position to lend at a capped rate, diluting the potential for a market corner.

When it announced the change in June, the LME revealed it had already “at times” directed “market participants to take a number of actions to reduce large on-exchange positions relative to prevailing stock levels.”

The new lending rules were presented as a response to low exchange stocks, particularly those of aluminum and copper, markets in which physical supply chains have been distorted by sanctions on Russian metal and the US tariff trade respectively.

However, they also come against the backdrop of a rolling squeeze that has gripped the aluminum contract since May. Even the FCA wants to know why Swiss trader Mercuria is holding so much metal.

That particular stand-off notwithstanding, it’s clear that the exchange is taking a more active and robust role in trying to manage its unruly markets.

Thank you Mr. President

Rising volumes are good news for LME executive and membership alike. Average daily volumes jumped by 18% last year and were up another 3% in the first nine months of this year.

The LME will naturally present this as an endorsement of its reform campaign but the exchange has also reaped the reward of turmoil in physical metal supply chains.

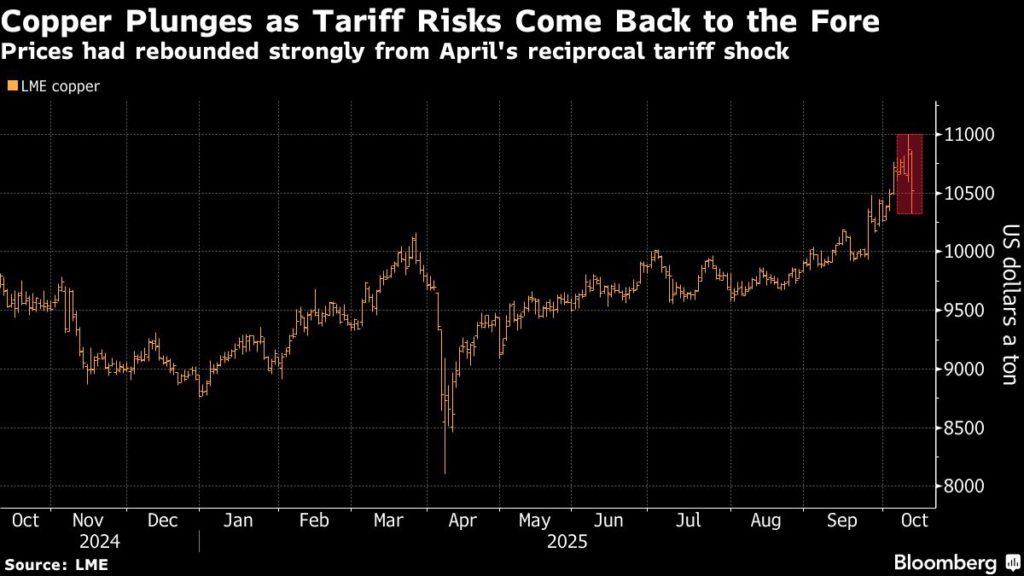

US President Donald Trump’s threat, subsequently deferred, to impose an import duty on refined copper triggered a tectonic shift of global inventory to the United States.

This turned out to be good news for the LME with its international and industrial user base and less good news for the more fund-driven CME contract. LME copper futures and options volumes rose by 2.4% year-on-year through September, while CME activity contracted by 39% over the same period.

Meanwhile, oversupply in the lead and nickel markets has washed into the LME warehouses, lifting exchange stocks to multi-year highs and boosting financing activity on the LME contracts.

Even the LME’s long-dormant cobalt contract has got a new lease of life, notching up record activity on the back of 1,755 tons of metal making its way into the LME warehouse system.

But the special guest at this year’s LME Week will be Doctor Copper, who’s had a topsy-turvy time so far in 2025 but is back in full bull mode.

The LME 3-month copper price this week hit the $11,000 per metric ton level, moving it within striking distance of its all-time peak of $11,104.50, set in May 2024.

When Doctor Copper’s in that sort of mood, it probably means it’s going to be a proper LME Week party. Let’s just hope it’s not too bad a hangover.

(The opinions expressed here are those of the author, Andy Home, a columnist for Reuters.)

(Editing by Susan Fenton)