Miami-Dade asks for right to remove FTX name from Heat arena

The FTX collapse has no shortage of ties to the sports world. A number of athletes — Tampa Bay Buccaneers quarterback Tom Brady, Golden State Warriors guard Stephen Curry, tennis player Naomi Osaka and Heat forward Udonis Haslem among them — were named as defendants last week in a class-action lawsuit against FTX. The suit argues that their celebrity status made them culpable for promoting the firm’s failed business model.

FTX entered into a number of other sports-related deals, including with Mercedes for Formula One racing and a sponsorship deal with Major League Baseball — whose umpires wore the company’s logo this past season. Mercedes has already taken the FTX logo off its race cars.

The building in Miami had been called FTX Arena since June 2021, and a 19-year, $135 million sponsorship agreement between FTX and the county was just getting started. FTX's next payment due to the county is $5.5 million on Jan. 1.

The Heat were to receive $2 million annually as part of the deal.

FTX was the third-largest cryptocurrency exchange, though it ended up with billions of dollars worth of losses before seeking bankruptcy protection. The Bahamas-based company and its founder, Sam Bankman-Fried, are under investigation by state and federal authorities for allegedly investing depositors' funds in ventures without their approval.

___

More AP NBA: https://apnews.com/hub/NBA and https://twitter.com/AP_Sports

Tim Reynolds, The Associated Press

FTX spent £250m on property in Bahamas: Founder accused of running crypto exchange as his 'personal fiefdom'

By HUGO DUNCAN FOR THE DAILY MAIL

PUBLISHED: 22 November 2022

Stricken crypto exchange FTX was run as a ‘personal fiefdom’ of founder Sam Bankman-Fried and spent £250million on property in the Bahamas, a court heard yesterday.

At a bankruptcy hearing in Delaware following the collapse of the £27billion company this month, a lawyer for FTX said the property empire was largely made up of homes and holiday houses for senior staff.

The revelations came just hours after Reuters reported that FTX, senior executives and Bankman-Fried’s parents bought at least 19 properties worth £100million in the Bahamas in the past two years alone.

Personal fiefdom: FTX founder Sam Bankman-Fried, 30, (pictured) is at the centre of one of the most stunning financial failures in history

FTX, one of the world’s largest crypto exchanges where users buy and sell digital currencies, imploded this month.

It has left an estimated 1m creditors facing losses of billions of pounds – with its 50 biggest customers owed more than £52million on average. Some 8pc of FTX users were based in the UK, suggesting 80,000 Britons have lost out.

‘We have witnessed one of the most abrupt and difficult collapses in the history of corporate America,’ James Bromley, a partner at law firm Sullivan & Cromwell, told the court.

He said the bankruptcy proceedings ‘allowed everyone for the first time to see under the covers and recognise the emperor had no clothes’.

The scandal is a humiliation for Bankman-Fried – the 30-year-old one-time crypto star known by his initials SBF now at the centre of one of the most stunning financial failures in history.

Yesterday

MIAMI (AP) — Miami-Dade County has asked a federal bankruptcy court for immediate permission to end its naming rights deal with FTX and strip that brand off the arena where the NBA's Miami Heat play.

Miami-Dade asks for right to remove FTX name from Heat arena© Provided by The Canadian Press

In a motion filed Tuesday, the county — which owns the arena and negotiated the naming rights deal with FTX — said continuing to refer to the building as FTX Arena will only add to the “enduring hardships” brought on by the collapse of the cryptocurrency exchange.

“It does not appear that the Debtor will suffer harm from a termination of the Naming Rights Agreement," the county wrote in its motion. “On the other hand, Miami-Dade County continues to supply valuable marquee naming rights and other benefits to the Debtor, to the detriment of the County’s ability to seek a new naming partner for the Arena."

A hearing is set for mid-December. For now, FTX signage remains on the building and its name has not been changed.

Tuesday's motion was hardly unexpected. FTX filed for bankruptcy on Nov. 11, and the county and the Heat began the process of terminating their relationship with the company that same day.

MIAMI (AP) — Miami-Dade County has asked a federal bankruptcy court for immediate permission to end its naming rights deal with FTX and strip that brand off the arena where the NBA's Miami Heat play.

Miami-Dade asks for right to remove FTX name from Heat arena© Provided by The Canadian Press

In a motion filed Tuesday, the county — which owns the arena and negotiated the naming rights deal with FTX — said continuing to refer to the building as FTX Arena will only add to the “enduring hardships” brought on by the collapse of the cryptocurrency exchange.

“It does not appear that the Debtor will suffer harm from a termination of the Naming Rights Agreement," the county wrote in its motion. “On the other hand, Miami-Dade County continues to supply valuable marquee naming rights and other benefits to the Debtor, to the detriment of the County’s ability to seek a new naming partner for the Arena."

A hearing is set for mid-December. For now, FTX signage remains on the building and its name has not been changed.

Tuesday's motion was hardly unexpected. FTX filed for bankruptcy on Nov. 11, and the county and the Heat began the process of terminating their relationship with the company that same day.

Related video: Miami Fines FTX $16.5M for Cancelling Arena SponsorshipDuration 6:03 View on Watch

The FTX collapse has no shortage of ties to the sports world. A number of athletes — Tampa Bay Buccaneers quarterback Tom Brady, Golden State Warriors guard Stephen Curry, tennis player Naomi Osaka and Heat forward Udonis Haslem among them — were named as defendants last week in a class-action lawsuit against FTX. The suit argues that their celebrity status made them culpable for promoting the firm’s failed business model.

FTX entered into a number of other sports-related deals, including with Mercedes for Formula One racing and a sponsorship deal with Major League Baseball — whose umpires wore the company’s logo this past season. Mercedes has already taken the FTX logo off its race cars.

The building in Miami had been called FTX Arena since June 2021, and a 19-year, $135 million sponsorship agreement between FTX and the county was just getting started. FTX's next payment due to the county is $5.5 million on Jan. 1.

The Heat were to receive $2 million annually as part of the deal.

FTX was the third-largest cryptocurrency exchange, though it ended up with billions of dollars worth of losses before seeking bankruptcy protection. The Bahamas-based company and its founder, Sam Bankman-Fried, are under investigation by state and federal authorities for allegedly investing depositors' funds in ventures without their approval.

___

More AP NBA: https://apnews.com/hub/NBA and https://twitter.com/AP_Sports

Tim Reynolds, The Associated Press

FTX spent £250m on property in Bahamas: Founder accused of running crypto exchange as his 'personal fiefdom'

By HUGO DUNCAN FOR THE DAILY MAIL

PUBLISHED: 22 November 2022

Stricken crypto exchange FTX was run as a ‘personal fiefdom’ of founder Sam Bankman-Fried and spent £250million on property in the Bahamas, a court heard yesterday.

At a bankruptcy hearing in Delaware following the collapse of the £27billion company this month, a lawyer for FTX said the property empire was largely made up of homes and holiday houses for senior staff.

The revelations came just hours after Reuters reported that FTX, senior executives and Bankman-Fried’s parents bought at least 19 properties worth £100million in the Bahamas in the past two years alone.

Personal fiefdom: FTX founder Sam Bankman-Fried, 30, (pictured) is at the centre of one of the most stunning financial failures in history

FTX, one of the world’s largest crypto exchanges where users buy and sell digital currencies, imploded this month.

It has left an estimated 1m creditors facing losses of billions of pounds – with its 50 biggest customers owed more than £52million on average. Some 8pc of FTX users were based in the UK, suggesting 80,000 Britons have lost out.

‘We have witnessed one of the most abrupt and difficult collapses in the history of corporate America,’ James Bromley, a partner at law firm Sullivan & Cromwell, told the court.

He said the bankruptcy proceedings ‘allowed everyone for the first time to see under the covers and recognise the emperor had no clothes’.

The scandal is a humiliation for Bankman-Fried – the 30-year-old one-time crypto star known by his initials SBF now at the centre of one of the most stunning financial failures in history.

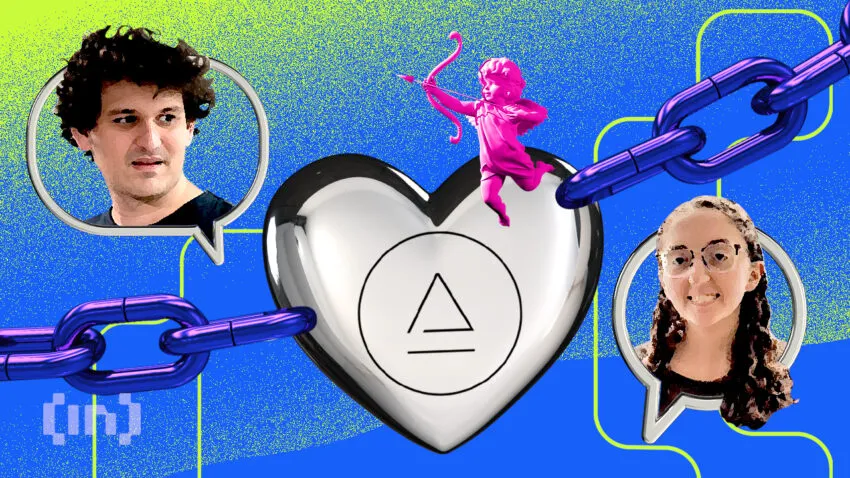

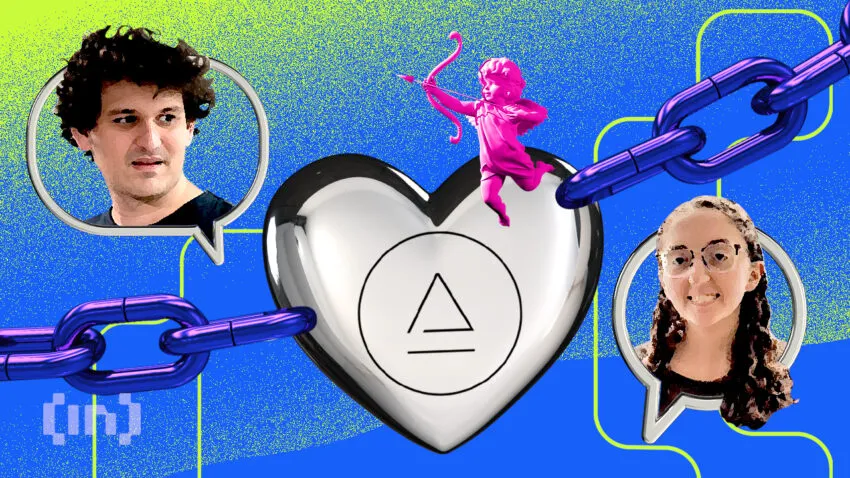

A Bizarre Fairy Tale: The Story Behind Sam Bankman-Fried and Caroline Ellison

By Jeffrey Gogo 23 November 2022,

Updated by Kyle Baird23 November 2022,

In BriefThe SBF-Ellison love affair raises psychological questions on how this might have fed into the collapse of FTX.

Bankman-Fried and Ellison may have set out to commit crime using charity as a cover.

Crypto swingman Sam Bankman-Fried (SBF) presided over the FTX exchange at the time of its collapse, allegedly sinking $32 billion in user funds. While the contours of the fall are yet to settle, FTX’s catastrophic collapse has set off massive contagion in the crypto ecosystem.

Spotlight has now extended from SBF to Ellison, who authorized risky bets with customer funds as co-CEO of FTX’s sister firm, Alameda. Bankman-Fried and Ellison had much more in common than prodigious MIT nerdery.

SBF recently confessed to a boardroom romance with Ellison in the New York Times, saying they were no longer together. A Tumblr post by Ellison, while potentially sarcastic, says her experience of polyamory convinced her “everyone should have a ranking of their partners.”

She believes that “people should know where they fall on the ranking, and there should be vicious power struggles for the higher ranks.”

FTX: Voyeuristic geniuses addicted to power

The perspective took a voyeuristic turn in a CoinDesk report. It claimed that SBF and Ellison, along with 10 roommates, were intimately involved. But more importantly, it raises psychological questions on how all this fed into the collapse of FTX.

“Psychologically, motivations behind committing a crime such as financial fraud varies and we need to dissect the unfolding situation from a systemic perspective,” psychologist Nadja Bester told BeInCrypto.

She continued:

“Since Bankman-Fried and Ellison are both from educated, higher-income childhood homes, one might consider that the wilful actions leading to the downfall of FTX and Alameda were likely less about financial need than the addictively powerful chance to opportunistically beat the system.”

It’s “a system that positioned them as powerful creationary players due to the scale and influence of their companies’ industry involvement,” added Bester. She is currently writing a book about the psychological drivers operating within the web3 industry.

The idea of a convertible boardroom with risk-driven and mutually intimate executives gels uncannily with Ellison’s view of fiercely competitive polyamory.

A quiet polymath daughter of MIT economics professors, Caroline Ellison became immersed in conventional learning early enough to be bored by the time she got to college.

She dabbled in fringe ethics of the evolutionary sort. This ensured that her corner would not be entirely deserted after her fall from grace. Far-right micro-bloggers who buy into Ellison’s race science and imperialism posts from college have emerged as her overnight loyalists.

According to a recent Forbes report, “some of her defenders, who call her ‘Queen Caroline,’ are followers of Curtis Yarvin, a neoreactionary political theorist and far right darling.” They think Ellison was the ‘fall person.’

In addition, they claim that former co-CEO Sam Trabucco, who they derisively call ‘Sam Tabasco,’ is “behind Alameda’s implosion.”

Updated by Kyle Baird23 November 2022,

In BriefThe SBF-Ellison love affair raises psychological questions on how this might have fed into the collapse of FTX.

A psychologist argues the fall of FTX was not about money but the "addictively powerful chance to beat the system."

Bankman-Fried and Ellison may have set out to commit crime using charity as a cover.

Crypto swingman Sam Bankman-Fried (SBF) presided over the FTX exchange at the time of its collapse, allegedly sinking $32 billion in user funds. While the contours of the fall are yet to settle, FTX’s catastrophic collapse has set off massive contagion in the crypto ecosystem.

Spotlight has now extended from SBF to Ellison, who authorized risky bets with customer funds as co-CEO of FTX’s sister firm, Alameda. Bankman-Fried and Ellison had much more in common than prodigious MIT nerdery.

SBF recently confessed to a boardroom romance with Ellison in the New York Times, saying they were no longer together. A Tumblr post by Ellison, while potentially sarcastic, says her experience of polyamory convinced her “everyone should have a ranking of their partners.”

She believes that “people should know where they fall on the ranking, and there should be vicious power struggles for the higher ranks.”

FTX: Voyeuristic geniuses addicted to power

The perspective took a voyeuristic turn in a CoinDesk report. It claimed that SBF and Ellison, along with 10 roommates, were intimately involved. But more importantly, it raises psychological questions on how all this fed into the collapse of FTX.

“Psychologically, motivations behind committing a crime such as financial fraud varies and we need to dissect the unfolding situation from a systemic perspective,” psychologist Nadja Bester told BeInCrypto.

She continued:

“Since Bankman-Fried and Ellison are both from educated, higher-income childhood homes, one might consider that the wilful actions leading to the downfall of FTX and Alameda were likely less about financial need than the addictively powerful chance to opportunistically beat the system.”

It’s “a system that positioned them as powerful creationary players due to the scale and influence of their companies’ industry involvement,” added Bester. She is currently writing a book about the psychological drivers operating within the web3 industry.

The idea of a convertible boardroom with risk-driven and mutually intimate executives gels uncannily with Ellison’s view of fiercely competitive polyamory.

A quiet polymath daughter of MIT economics professors, Caroline Ellison became immersed in conventional learning early enough to be bored by the time she got to college.

She dabbled in fringe ethics of the evolutionary sort. This ensured that her corner would not be entirely deserted after her fall from grace. Far-right micro-bloggers who buy into Ellison’s race science and imperialism posts from college have emerged as her overnight loyalists.

According to a recent Forbes report, “some of her defenders, who call her ‘Queen Caroline,’ are followers of Curtis Yarvin, a neoreactionary political theorist and far right darling.” They think Ellison was the ‘fall person.’

In addition, they claim that former co-CEO Sam Trabucco, who they derisively call ‘Sam Tabasco,’ is “behind Alameda’s implosion.”

Organized crime behind effective altruism

Bester also commented that Bankman-Fried and Ellison might have set out to commit crimes using charity as a cover.

“If we consider historical examples of dangerous couples – whether violent or large-scale corporate crime – a clear pathological thread runs through relationships that negatively impact the safeguarding of local or international communities,” she explained.

“While the FTX fall-out has been touted by some as the result of an inexperienced executive team, architecting a crime of this magnitude is far more indicative of organized than disorganized criminal profiles.”

Bester, also co-founder of engage-to-earn investing platform AdLunam, said, “leveraging the philosophy of effective altruism as a Trojan horse to conceal their industry-crippling misdealings is but one such example.”

Continuing, Bester said:

“With limited insight into the respective CEOs’ inner mental and psychological workings, we can only speculate which deviations have led to the callous predatory behaviour with which Bankman Fried and Ellison [acted].”

In the unsigned college-era Tumblr blog, WorldOptimization, Caroline Ellison said, “the sexual revolution was a mistake.” Her opinion is that “women are better suited to being homemakers and rearing children than doing careers.”

She also believes that there are “scientifically proven (and therefore apolitical) genetic differences between groups of humans.”

Ellison was well on her way to fulfilling her top “cute boy thing” of “controlling most major world governments.” Her on-and-off boyfriend SBF has ranked second on the financiers of the Democrats’ campaign in the last election.

Ellison’s affinity for risk may have become a tendency after her meeting with SBF when she was a Jane Street. The two immediately bonded around their mutual love of a George Soros-like philosophy called effective altruism.

“Over coffee in California, Sam Bankman-Fried…pitched her about joining Alameda, a new digital currency hedge fund he was working on that would exploit the differences in pricing for Bitcoin in different countries,” Forbes reports. “The exchange would help him toward his goal of ‘earning to give’ billions to charity.”

This is one of the pioneer philosophers of effective altruism. It preaches the gospel of using data to amass wealth for good, claims Will MacAskill.

MacAskill joined the Future Fund philanthropic arm of FTX but resigned last week.

Lover-gamblers

Recent events have put a wet blanket around lover-gamblers Ellison and SBF’s claim of effective altruism.

“Their whole goal was to maximize wealth,” a former Alameda employee told Forbes. “They never lived in a world where they weren’t risking a lot.”

And yet, Bankman-Fried has confessed to New York Times that he used the philosophy as a cover for speculative accumulation. His former girlfriend, Ellison, sarcastically renamed her blog “Fake Charity Nerd Girl.”

Bester also commented that Bankman-Fried and Ellison might have set out to commit crimes using charity as a cover.

“If we consider historical examples of dangerous couples – whether violent or large-scale corporate crime – a clear pathological thread runs through relationships that negatively impact the safeguarding of local or international communities,” she explained.

“While the FTX fall-out has been touted by some as the result of an inexperienced executive team, architecting a crime of this magnitude is far more indicative of organized than disorganized criminal profiles.”

Bester, also co-founder of engage-to-earn investing platform AdLunam, said, “leveraging the philosophy of effective altruism as a Trojan horse to conceal their industry-crippling misdealings is but one such example.”

Continuing, Bester said:

“With limited insight into the respective CEOs’ inner mental and psychological workings, we can only speculate which deviations have led to the callous predatory behaviour with which Bankman Fried and Ellison [acted].”

In the unsigned college-era Tumblr blog, WorldOptimization, Caroline Ellison said, “the sexual revolution was a mistake.” Her opinion is that “women are better suited to being homemakers and rearing children than doing careers.”

She also believes that there are “scientifically proven (and therefore apolitical) genetic differences between groups of humans.”

Ellison was well on her way to fulfilling her top “cute boy thing” of “controlling most major world governments.” Her on-and-off boyfriend SBF has ranked second on the financiers of the Democrats’ campaign in the last election.

Ellison’s affinity for risk may have become a tendency after her meeting with SBF when she was a Jane Street. The two immediately bonded around their mutual love of a George Soros-like philosophy called effective altruism.

“Over coffee in California, Sam Bankman-Fried…pitched her about joining Alameda, a new digital currency hedge fund he was working on that would exploit the differences in pricing for Bitcoin in different countries,” Forbes reports. “The exchange would help him toward his goal of ‘earning to give’ billions to charity.”

This is one of the pioneer philosophers of effective altruism. It preaches the gospel of using data to amass wealth for good, claims Will MacAskill.

MacAskill joined the Future Fund philanthropic arm of FTX but resigned last week.

Lover-gamblers

Recent events have put a wet blanket around lover-gamblers Ellison and SBF’s claim of effective altruism.

“Their whole goal was to maximize wealth,” a former Alameda employee told Forbes. “They never lived in a world where they weren’t risking a lot.”

And yet, Bankman-Fried has confessed to New York Times that he used the philosophy as a cover for speculative accumulation. His former girlfriend, Ellison, sarcastically renamed her blog “Fake Charity Nerd Girl.”

Former FTX CEO Sam Bankman-Fried

The demise of FTX has been a huge setback for the crypto market. Even more so that it never fully recovered from the Terra collapse in May. There’s no way of measuring the extent of the damage. Is it possible that, in the future, crypto investors will prefer not to use crypto exchanges for keeping their assets?

“The possibility of this happening [has been] temporarily increased due to the FTX fallout,” Robert Quartly-Janeiro, chief strategy officer of crypto exchange Bitrue, told BeInCrypto.

He continued:

“More broadly, [this is] unlikely as crypto exchanges are the primary gateway through which investors get to enter the digital currency ecosystem. Investors with larger portfolios are likely to embrace more of self custody than hot wallet storages that crypto exchanges offer. Retail holders are more poised to keep assets on exchanges in the long run.”

Nadja Bester said the FTX debacle was a turning point in web3. It signaled that “the business world is in dire need of trustless tech rather than corruptible leaders who, at any given moment, could make the most disastrous of decisions for personal gain, at the expense of millions or even billions of people.”

The demise of FTX has been a huge setback for the crypto market. Even more so that it never fully recovered from the Terra collapse in May. There’s no way of measuring the extent of the damage. Is it possible that, in the future, crypto investors will prefer not to use crypto exchanges for keeping their assets?

“The possibility of this happening [has been] temporarily increased due to the FTX fallout,” Robert Quartly-Janeiro, chief strategy officer of crypto exchange Bitrue, told BeInCrypto.

He continued:

“More broadly, [this is] unlikely as crypto exchanges are the primary gateway through which investors get to enter the digital currency ecosystem. Investors with larger portfolios are likely to embrace more of self custody than hot wallet storages that crypto exchanges offer. Retail holders are more poised to keep assets on exchanges in the long run.”

Nadja Bester said the FTX debacle was a turning point in web3. It signaled that “the business world is in dire need of trustless tech rather than corruptible leaders who, at any given moment, could make the most disastrous of decisions for personal gain, at the expense of millions or even billions of people.”

the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.

No comments:

Post a Comment