Niall McGee and Matthew McClearn -- The Globe and Mail | September 20, 2023

Cigar Lake uranium mine (Image: Cameco)

With its one-time pariah commodity back in vogue, one of Canada’s biggest mining companies is reaching valuations not seen in more than 15 years.

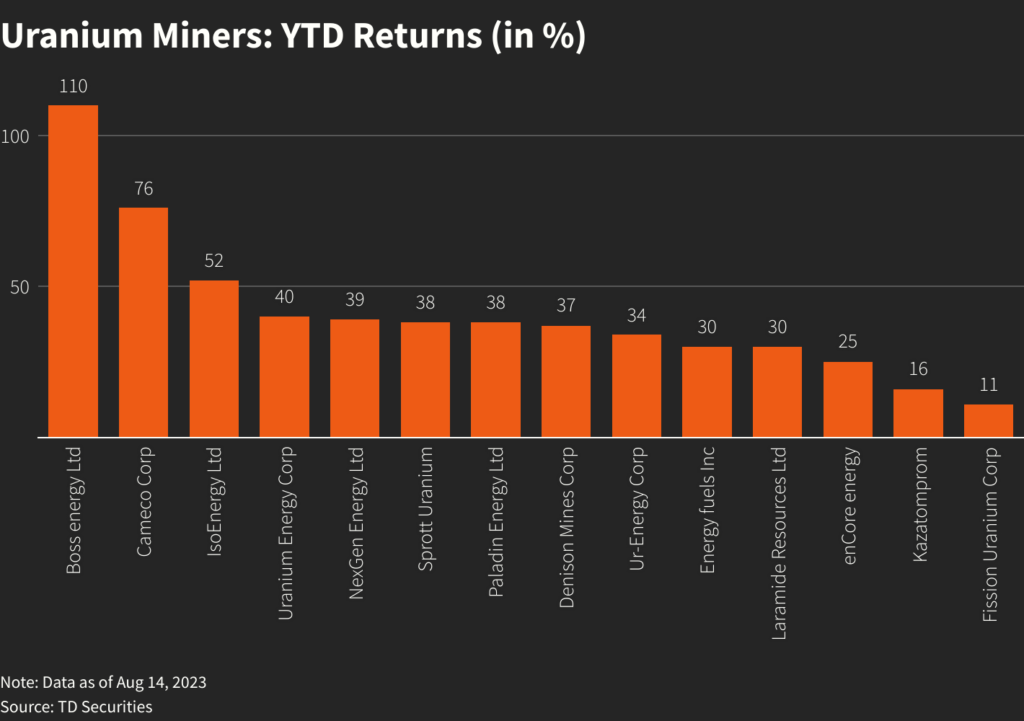

Cameco Corp. (TSX: CCO) is benefiting from a resurgence in uranium, as nuclear power is increasingly embraced by countries looking for ways to cut carbon emissions and supply concerns arise.

On Monday, the company’s shares closed at C$54.54 on the Toronto Stock Exchange, about C$5 below their all-time high in 2007.

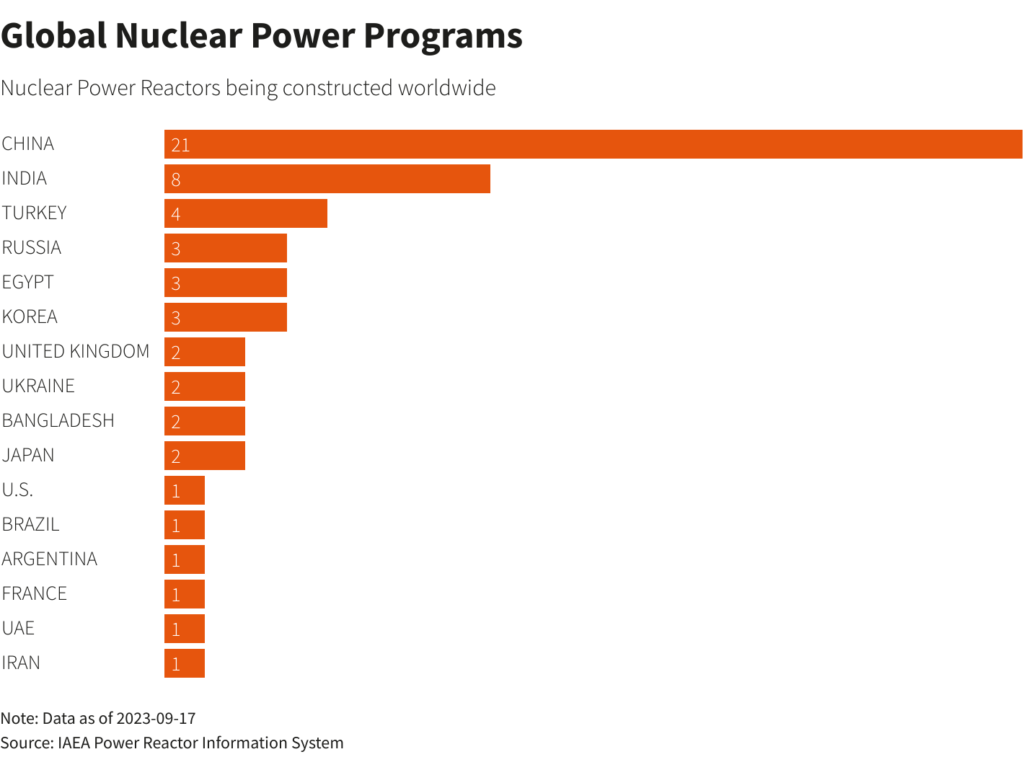

In recent years, the world’s attention has turned to cutting carbon emissions to fight climate change. One of nuclear’s chief selling points is that it generates no CO2 emissions, leading some observers to predict a surge in construction of new power plants, including small modular reactors (SMRs), which are billed as cheaper and easier to build than their larger cousins.

Raymond James analyst Brian MacArthur wrote in a note to clients Thursday that he expects demand for uranium to grow further as nuclear is increasingly embraced as a “green” power source.

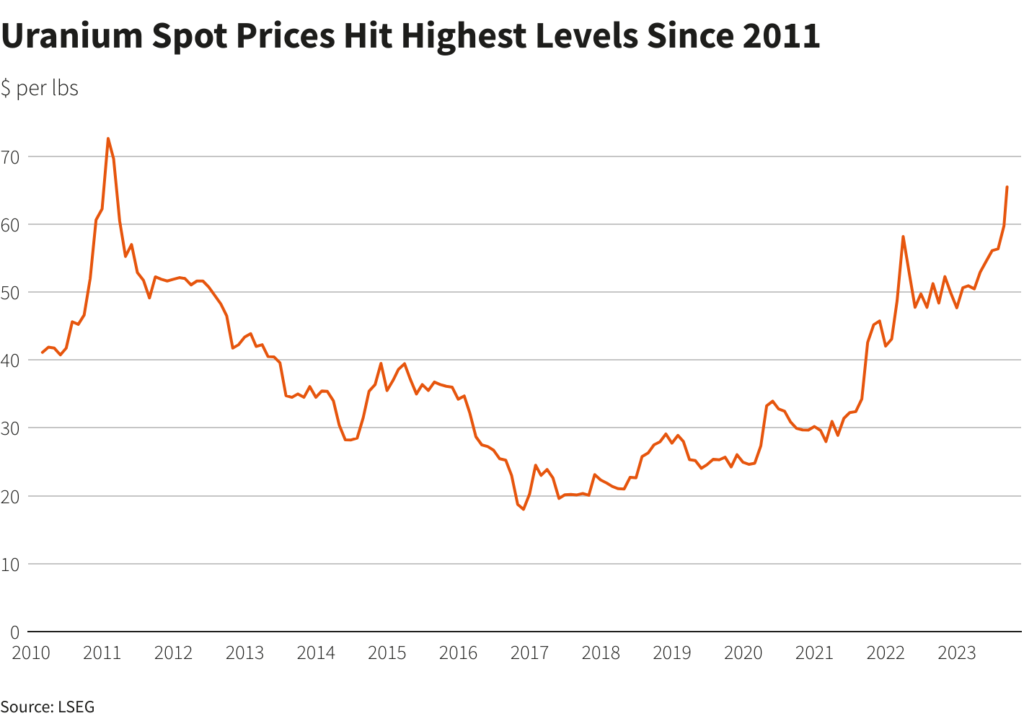

Uranium’s revival follows a protracted slump triggered by the 2011 meltdown of the Fukushima power plant in Japan after an earthquake and tsunami. Many nuclear power projects were cancelled after the accident, which prompted Germany to phase out nuclear power entirely.

The war in Ukraine has upended the global market for nuclear fuels. In April, the governments of Canada, France, Japan, the U.S. and Britain announced they would collaborate on establishing new supply chains that cut Russia, traditionally a major player, out of the picture.

The war also severely curtailed supplies of Russian natural gas to Europe. Nuclear has been floated as an alternative or at least a stopgap until renewables such as solar and wind become more widely adopted.

Meanwhile, Saskatoon-based Cameco, one of the world’s biggest suppliers of uranium, has run into production problems. The company recently cut its production forecast for the year by 8 per cent, to 30.3 million pounds, owing to operational issues at both its Cigar Lake mine and Key Lake mill, which services the McArthur River mine.

“The recent production shortfall from Cameco further highlights the growing security of supply risk in uranium at a time when the demand outlook is stronger,” Mr. MacArthur wrote.

“Uncertainty about where nuclear fuel supplies will come from continues to drive long-term contracting with evidence that the broader uranium market is moving toward replacement rate contracting for the first time in over a decade.”

Analysts are also bracing for a possible impact from the coup in Niger in July. Chris Drew, an analyst with Jefferies, wrote in a note to clients that the continuing political uncertainty in that country could delay Global Atomic Corp.’s Dasa project, which is expected to bring 4.5 million pounds of new production online in 2025.

The world’s nuclear reactor fleet, which is fuelled predominantly by mined uranium processed at conversion and enrichment plants, has been in steady decline for decades.

According to the World Nuclear Association, as of June, 437 reactors were operating around the world with a combined 391 gigawatts of generation capacity. They meet about 10 per cent of global electricity demand, down from a peak of 17.5 per cent in the mid-1990s. Despite a frenetic pace of reactor construction in China, over the past two decades more reactors have closed down than have started up, according to Mycle Schneider Consulting’s latest review of the industry.

Lately, however, several countries with large reactor fleets (notably France, Japan and Russia) have moved to extend the operating lives of plants that were poised for retirement.

In Canada, Ontario Power Generation is more than halfway through a refurbishment of its four-reactor Darlington station in Clarington, Ont. Bruce Power is also overhauling its Bruce station on the eastern shore of Lake Huron and restarted a refurbished reactor this month.

A year ago, the Ontario government instructed OPG to explore the feasibility of refurbishing four of the eight reactors at its aging Pickering station, with the aim of extending their operating lives by 30 years. (The plant is scheduled to be retired in 2026.) This summer, Hydro-Québec revealed it was considering refurbishing its Gentilly-2 station on the south shore of the St. Lawrence River, which ceased operation in 2012.

“Upwards of 140 reactors could be subject to extended operation in the period to 2040, driven by economics, emission reduction targets, as well as security of supply,” the World Nuclear Association stated in a report published this month that examined the nuclear fuel market.

The report concluded that “intense development” of new uranium projects will be needed throughout this decade to avoid future supply disruptions.

“There is no doubt that sufficient uranium resources exist to meet future needs,” it noted. “However, producers have been waiting for the market to rebalance in order to start investing in new capacity and bringing idled and shutdown projects back into production.”

Despite roughly tripling in price over the past five years to trade at about $65.50 a pound, uranium remains far below the all-time high of approximately $140 reached in 2007.

Although it is increasingly pitched as a clean energy source, worries persist over the challenges of the long-term storage of radioactive waste and the possibility of another accident at a power plant.

Uranium primed to extend rally on resurgent nuclear power, say analysts

Reuters | September 20, 2023

Uranium prices are likely to extend a blistering rally and end the year more than 50% higher as mounting worries over climate change accelerate a global shift to cleaner sources of energy including nuclear power, analysts said.

Uranium spot prices are expected to climb to $75-$80 a pound by end-December, in a fitting finish to a year that has seen the metal rally about 36% to-date.

At current levels of around $66.25 a pound, prices are the highest since the 2011 Fukushima disaster. They had peaked at $140 a pound in 2007.

“The market has been slowly building higher prices as mining costs rise and nuclear generators look to build stocks to guard against increasingly risky supply-side issues,” said SP Angel mining analyst John Meyer.

“We see prices rising year-on-year for next 10-20 years or till the world finds another source for large scale un-interruptible base load power with a low carbon footprint.”

Demand from nuclear reactors was projected at 65,650 tonnes of elemental uranium (tU) this year, with the World Nuclear Association forecasting it to climb 28% by 2030 and nearly double by 2040 to 130,000 tU.

A push to improve energy security, particularly after Russia’s invasion of Ukraine upended the global oil markets, has also stoked demand, while supplies remain constrained due to under-investment in new production, transportation risks from geopolitical uncertainties and monopoly of state-owned entities.

Meanwhile, utilities are racing to stock up and term contract volume so far this year exceeds 118 million pounds, the highest in over a decade, according to market research firm and consultancy UxC.

For 2023, UxC projects a 66 million pound deficit with 436 operable reactors globally requiring about 195 million pounds.

As a result, spot uranium and uranium miners have been among the top-performing commodity and mining equities groups this year, outperforming the S&P 500 Index’s gains.

The Global X Uranium Exchange Traded Fund has also jumped over 31% this year.

“There’ll be an eventual easing but certainly not before year-end… uranium should have a good run up ahead,” said Liberum mining equity analyst Ben Davis.

(By Mrinalika Roy; Editing by Arpan Varghese and Sriraj Kalluvila)

No comments:

Post a Comment